Goal

To profit from an expected short-term price rise in a stock or market index.

Explanation

In return for paying a premium, the buyer of a call gets the right (not the obligation) to buy the underlying instrument at the strike price at any time until the expiration date. Speculators who buy calls hope that the price of the call will rise as the price of the underlying rises. Since stock options in the U.S. typically cover 100 shares, the call buyer in the example below pays $3.30 per share ($330 plus commissions) for the right to buy 100 shares of XYZ stock at $100 per share until the expiration date (usually the third Friday of the month). However, speculators typically do not want to own the underlying shares, so calls are usually sold before the expiration date.

Example of long call - speculative

Buy 1 XYZ 100 Call at 3.30

Maximum profit

The potential profit is unlimited, because the price of the underlying can rise indefinitely.

Maximum risk

Risk is limited to the premium paid plus commissions, and a loss of this amount is realized if the call is held to expiration and expires worthless.

Breakeven stock price at expiration

Strike price plus premium paid.

In this example: 100.00 + 3.30 = 103.30

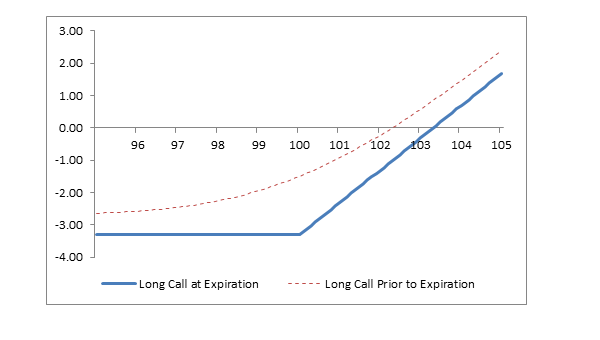

Profit/Loss diagram and table: Long 100 Call @ 3.30

| Stock Price at Expiration | 100 Call Value at Expiration | 100 Call Purchase Price | Profit/(Loss) at Expiration |

|---|---|---|---|

| 108 | 8.00 | (3.30) | +4.70 |

| 107 | 7.00 | (3.30) | +3.70 |

| 106 | 6.00 | (3.30) | +2.70 |

| 105 | 5.00 | (3.30) | +1.70 |

| 104 | 4.00 | (3.30) | +0.70 |

| 103 | 3.00 | (3.30) | (0.30) |

| 102 | 2.00 | (3.30) | (1.30) |

| 101 | 1.00 | (3.30) | (2.30) |

| 100 | 0 | (3.30) | (3.30) |

| 99 | 0 | (3.30) | (3.30) |

| 98 | 0 | (3.30) | (3.30) |

| 97 | 0 | (3.30) | (3.30) |

Appropriate market forecast

Buying a call to speculate requires a 2-part bullish forecast. The forecast must predict (1) that the stock price will rise so the call increases in price and (2) that the stock price rise will occur before expiration.

Strategy discussion

Buying a call to speculate on a predicted stock price rise involves limited risk and two decisions. The maximum risk is the cost of the call plus commissions, but the realized loss can be smaller if the call is sold prior to expiration. The first decision is when to buy a call, because calls decline in price when the stock price remains constant or declines. The second decision is when to sell, because unrealized gains can disappear if the stock price reverses course and declines. Many investors who buy calls to speculate have a target price for the stock or for the call, and they sell the call when the target is reached or when, in their estimation, the target price will not be reached.

Impact of stock price change

Call prices, generally, do not change dollar-for-dollar with changes in the price of the underlying stock. Rather, calls change in price based on their "delta." At-the-money calls typically have deltas of approximately .50, so a $1 rise or fall in stock price causes an at-the-money call to rise or fall by 50 cents. In-the-money calls tend to have deltas greater than .50, but not greater than 1.00. Out-of-the-money calls tend to have deltas less than .50, but not less than zero.

Impact of change in volatility

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. As a result, long call positions benefit from rising volatility and are hurt by decreasing volatility.

Impact of time

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion. Long calls are hurt by passing time if other factors remain constant.

Risk of early assignment

The owner of a call has control over when a call is exercised, so there is no risk of early assignment.

Potential position created at expiration

If a call is exercised, then stock is purchased at the strike price of the call. If there is no offsetting short stock position, then a long stock position is created. Furthermore, calls are automatically exercised at expiration if they are one cent ($0.01) in the money. Therefore, if a speculator wants to avoid having a long stock position when a call is in the money, the call must be sold prior to expiration.

Other considerations

When calls are purchased to speculate, it is assumed that the investor does not want to own the underlying stock. In many cases, in fact, there is not sufficient cash in the account to pay for the stock, even in a margin account. Therefore, it is generally necessary for speculators to monitor a long call position and to sell the call if the target price is reached or if the call is in the money as expiration approaches.