Changing or leaving a job can be an emotional time. You're probably excited about a new opportunity—and nervous too. And if you're retiring, the same can be said. As you say goodbye to your workplace, don’t forget about your 401(k), 403(b), or 457(b) plan with that employer. You have several options and it’s an important decision.

Because your 401(k) may be a big chunk of your retirement savings, it's important to weigh the pros and cons of your options and find the one that makes sense for you.

Here are 4 choices to consider.

1. Keep your 401(k) in your former employer's plan

Most companies—but not all—allow you to keep your retirement savings in their plans after you leave.

Some benefits:

- Your money has the chance to continue to grow tax-advantaged.

- You can take penalty-free withdrawals from a plan sponsored by your former employer if you left your job with them at age 55 or older.

- Many offer institutionally priced (i.e., lower-cost) or unique investment options.

- Federal law provides broad protection against creditors.

But:

- Depending on plan rules, if you have a low balance (less than $7,000), your account balance may be sent to you as a taxable distribution, rolled over to an IRA, or, if your account is eligible for Auto Portability, may be automatically rolled to your new 401(k). Rollovers performed by Auto Portability are not subjected to taxes and penalties, though there may be a small fee incurred.

- If you choose to keep the money in your former employer's plan, you won't be able to add any more money to the account, or, in most cases, take a 401(k) loan.

- Withdrawal options may be limited. For instance, you may not be able to take a partial withdrawal; you may have to take the entire balance.

- If you were born prior to 1960, once you reach age 73, you'll have to take annual required minimum distributions (RMDs). For those born in 1960 or later, RMDs will start at age 75.

2. Roll over the money into an IRA

A rollover IRA is a retirement account that allows you to roll money from your former employer-sponsored retirement plan into an IRA.

You can open the IRA with a financial institution. Make sure to research fees and expenses when choosing an IRA provider, though, as they can really vary.

Some benefits:

- Your pre-tax money has the chance to continue to grow tax-deferred.

- If you're under age 59½, you can withdraw money penalty-free if you meet one of the IRS' exceptions, including a qualifying first-time home purchase or higher education expenses.1

- You may be able to get a broader range of investment choices than is available in an employer's plan.

- Rolling over assets can be done by source type. This means you can roll over Roth assets independently to a Roth IRA.

But:

- Investment fees may be more expensive than in your 401(k).

- Once you reach age 73, unless you were born in or after 1960, you’ll have to take annual required minimum distributions (RMDs) from a traditional IRA every year, even if you're still working.

- Federal law offers more protection for money in 401(k) plans than in IRAs. However, some states offer certain creditor protection for IRAs too.

- If you hold appreciated company stock in your workplace savings account, consider the potential impact of net unrealized appreciation (NUA) before choosing between staying in the plan, taking the stock in kind, or rolling over the stock to an IRA or another employer's plan. Rolling over the stock into another tax-advantaged plan will eliminate any NUA.

Note: If you're self-employed, you may also be able to roll over an old plan into your own small business retirement plan, such as a SEP IRA. Learn more about self-employed rollover options

3. Roll over your 401(k) into a new employer's plan

Not all employers will accept a rollover from a previous employer’s plan, so check with your new employer before making any decisions.

Some benefits:

- Your money has the chance to continue to grow tax-advantaged.

- Consolidating your 401(k)s can make it easier to manage your retirement savings.

- Many plans offer lower-cost (institutionally priced) plan-specific investment options.

- Federal law provides broad protection against creditors. You may be allowed to defer RMDs even if you're still working after age 73.2

- You can take penalty-free withdrawals if you leave your job with the new employer at age 55 or older.

But:

- Make sure to understand your new plan rules.

- Consider the range of investment options available in the new plan.

- If you hold appreciated company stock in your workplace savings account, consider the potential impact of net unrealized appreciation (NUA) before choosing between staying in the plan, taking the stock in kind, or rolling over the stock to an IRA or another employer's plan. Rolling over the stock into another tax-advantaged plan will eliminate any NUA.

4. Cash out

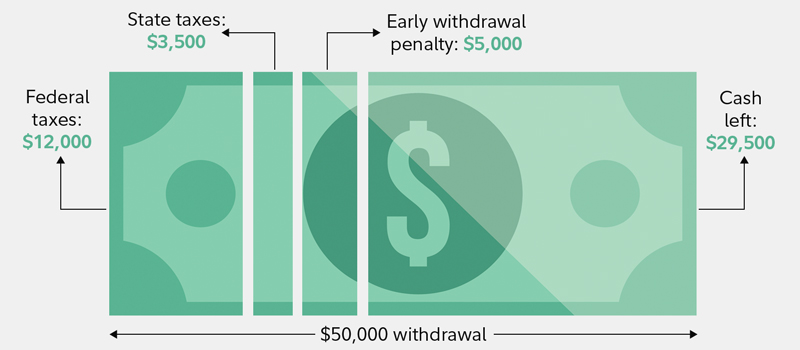

Taking the money out of retirement accounts altogether prior to retirement should be avoided unless the immediate need for cash is critical and you have no other options. The consequences vary depending on your age and tax situation. If you withdraw from your 401(k) before age 59½, the money will generally be subject to both ordinary income taxes and a potential 10% early withdrawal penalty. An early withdrawal penalty doesn't apply if you stopped working for your former employer in or after the year you reached age 55, but are not yet age 59½. This exception doesn’t apply to assets rolled over to an IRA or to 401(k)s.

A $50,000 cash out before age 59½ could cost $20,500 in penalties and taxes

If you are under age 59½ and absolutely must access the money, you may want to consider withdrawing only what you need until you can find other sources of cash. Obviously that's only possible if your former employer allows partial withdrawals—or if you roll the account into an IRA or another 401(k) and subsequently take a withdrawal.

How the rollover is done is important too

Whether you pick an IRA for your rollover or choose to go with your new employer's plan, consider a direct rollover—that’s when one financial institution sends a check directly to the other financial institution. The check would be made out to the new financial institution with instructions to roll the money into your IRA or 401(k).

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your plan administrator is required by the IRS to withhold 20% for taxes. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you'd have to come up with the 20% that was withheld and put it into your new account. As if that wouldn't be bad enough—you only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401(k) or IRA, and if you don't complete the transfer within the 60 days, the distribution is subject to taxes and a potential penalty.

If you're not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe taxes and a 10% penalty if you're under age 59½ (or under age 55 if separating from service in that year or later) because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401(k).

Make the best decision for you

When it comes to deciding what to do with an old 401(k), certain factors may be unique to your situation. That means the best choice will be different for everyone.

- If you decide to roll your funds into another retirement account, make sure the investment mix is aligned to your risk tolerance and time horizon.

- If you opt for an IRA specifically, your rollover money will sit in cash. This means you'll need to take an additional step in order to get invested.

- Remember that the rules among retirement plans vary, so it's important to find out the rules your former employer has as well as the rules at your new employer.

- Compare the fees and expenses associated with the accounts you're considering.

If you find it confusing or overwhelming, speak with a financial professional to help with the decision.