In real estate, it's location, location, location. In investing, the same bit of wisdom also has a place. Where you put your investments—meaning the type of account you choose—can make a major difference in how much you can earn, after tax, over time. That's because different investments are subject to different tax rules, and different types of accounts have different tax treatment. Sorting your investments into different accounts—a strategy often called asset location—has the potential to help lower your overall tax bill.

Should you use your brokerage account for the real estate investment trust (REIT) fund you are investing in, or would it be better in your tax-deferred annuity? What about the growth stocks you have been eyeing or the municipal bonds you are laddering toward retirement income—should those go into a Roth account or into your taxable account?

"You can't control market returns, and you can't control tax law, but you can control how you use accounts that offer tax advantages—and good decisions about their use can add significantly to your bottom line," says Brad Koval, director of financial solutions at Fidelity Investments. While tax treatment is important, investors should start with a strategy for the mix of investments they will own. That asset allocation strategy should be based on goals, financial situation, risk tolerance, and investment horizon. Once your asset allocation is in place, asset location may be worth considering, in an attempt to help improve after-tax returns.

Know the 3 main types of investing accounts

Many investors have several different types of accounts that can be aligned with specific investing goals. Some are subject to taxes every year, while others have tax advantages. Here are the 3 main investment account categories:

- Taxable accounts such as traditional brokerage accounts hold securities (stocks, bonds, mutual funds, ETFs) that are taxed when you earn dividends or interest, or you realize capital gains by selling investments that went up in value.

- Tax-deferred accounts like traditional 401(k)s, 403(b)s, annuities, and IRAs allow payment of taxes to be delayed until money is withdrawn, when all or a portion of it is taxed as ordinary income.

- Tax-exempt accounts like Roth IRAs, Roth 401(k)s, and Roth 403(b)s, require contributions to be made with after-tax dollars and do not provide a tax deduction up front, but they allow the investor to avoid further taxation (as long as the rules are followed). Fully tax-exempt accounts such as health savings accounts (HSAs), allow you to make pretax or deductible contributions, earnings, or withdrawals, if used for qualified health expenses.1

Remember, for each of these accounts, any tax advantages that investors may receive are limited by each account's contribution limit.

Asset location in action

Let's look at a hypothetical example. Say Adrian, age 40, is thinking about diversifying his portfolio by investing $250,000 in a taxable bond fund. For this example, we will assume Adrian pays a 35.8% marginal income tax rate on net investment income and the bond fund is assumed to earn a 6% rate of return each year—before taxes. (Actual rates of return may vary.)

In what account should he hold the investment? The answer matters, and can mean the difference between paying taxes annually and deferring them until withdrawal.

Suppose Adrian has 2 accounts with sufficient assets to choose between, to hold the investment: one is his taxable brokerage account, where any interest earned on the investment will be taxed annually; the other is a Roth IRA. If Adrian chooses to hold the investment in the Roth IRA, the hypothetical return on his investment, after taxes, could be nearly $290,000 greater than it would be in the taxable account when he begins withdrawals 20 years later at age 60, assuming his tax rate remains the same. If he owes capital gains taxes on the assets in the taxable account, the benefit could be even greater.

Tax deferral has the potential to make a big difference for investors—especially when matched with investments that may be subject to high tax rates, as interest on taxable bonds can be.

Tip: Some high-income investors, who have already taken full advantage of tax deferral through workplace plans like 401(k)s and/or IRAs, may look to obtain additional tax deferral. They may benefit from the use of low-cost deferred variable annuities, which can bring a variety of benefits, and facilitating asset location is one of them. However, there are also tradeoffs and restrictions to think about, so consult with an investment or tax professional before purchasing.

Read Viewpoints on Fidelity.com: Create future retirement income

Can you benefit from an active asset location strategy?

There are 4 main criteria that tend to indicate whether an asset location strategy may be a smart move for you. The more of these criteria that apply to your situation, the greater the potential advantage in seeking enhanced after-tax returns.

- You currently pay a high marginal income tax rate: The higher the marginal income tax rate you currently pay, the bigger the potential benefits of asset location. Remember, as you earn more money, you may move into higher tax brackets. Since withdrawals from tax-deferred accounts are taxed at your marginal income tax rate, your higher income can increase the taxes that you’ll pay on distributions.

- You expect to pay a lower marginal income tax rate in the future: If you expect your marginal income tax rate to be lower in the future than it is now, active asset location may allow you not only to defer your taxes but to reduce them as well. Note that it is very common for investors to see their marginal income tax rate fall following retirement, and if you have assets with a time horizon into retirement, this may well be the case for you.

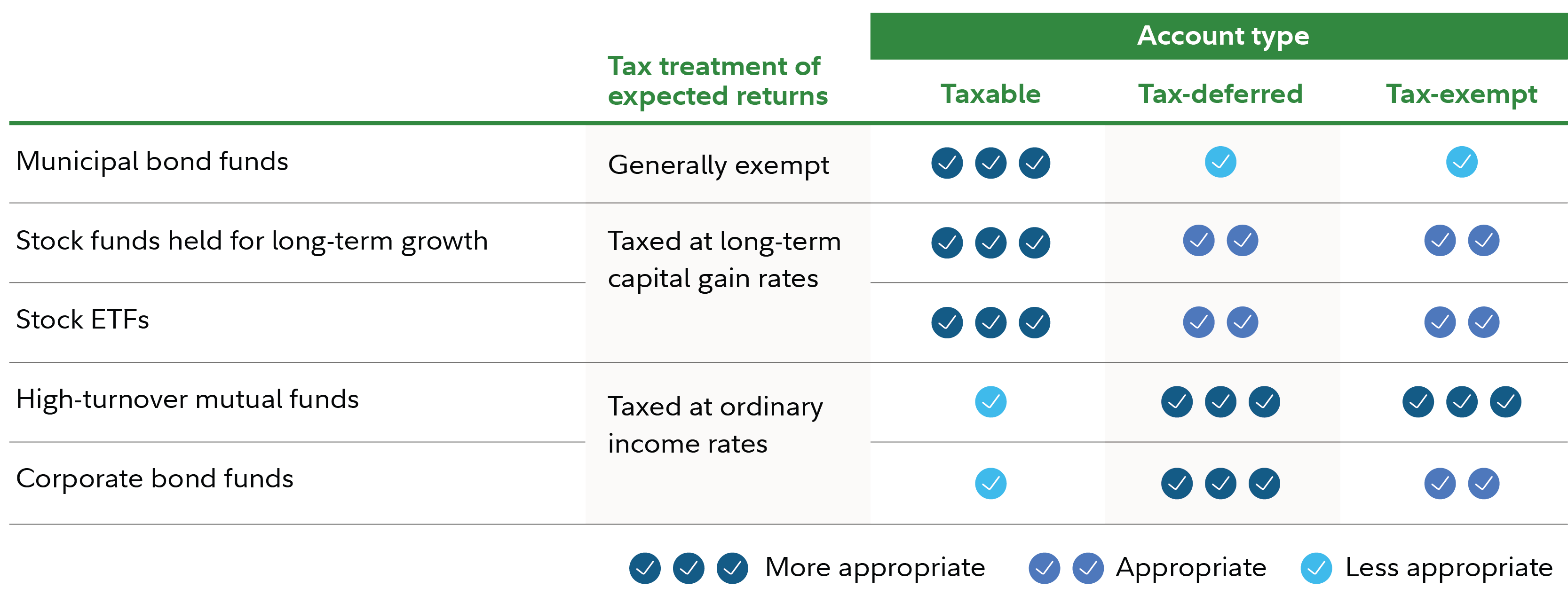

- You have significant assets in tax-inefficient investments held in taxable accounts: The more tax-inefficient investments, such as taxable bonds and taxable bond funds, you're currently holding in taxable accounts (see chart), the greater the potential to take advantage of asset location.

- You are investing for the long term: Asset location strategies generally take time to work. While small tax benefits may be realized year over year, sizable benefits may be realized by allowing potential tax savings to compound. If relocating assets in a taxable account, you may incur initial tax costs when implementing an asset location strategy and it may take time for the benefits to outweigh the costs.

Rate your investments on a tax-advantaged scale

If you are in a position to benefit from an asset location strategy, you have to choose which assets to assign to your tax-advantaged accounts and which to leave in your taxable accounts.

In general, the following are higher on the tax-advantaged scale if bought and held for longer than 1 year:2

- Individual stocks are, as a general rule, relatively tax-advantaged.

- Equity index mutual funds and ETFs are generally quite tax-advantaged.

- Tax-managed equity funds (that is, equity funds that name tax management as an explicit goal) tend to be highly tax-advantaged.

In general, these are lower on the tax-advantaged scale:

- Bonds and bond funds (with the exception of municipal bonds and funds, and US Savings Bonds) are generally highly tax-disadvantaged, because they generate interest payments that are taxed at relatively high ordinary income rates. Potentially higher returning types of bond investments, such as US high yield and emerging markets bond funds, are the most tax-disadvantaged.

- Actively managed stock funds with high turnover rates are less tax-advantaged because they tend to have high rates of capital gain distributions. They sometimes even distribute short-term capital gains, which are taxed at the higher ordinary income tax rates.

Locate investments where they may help enhance after-tax returns

So, which investments do you put where to help enhance after-tax returns? Each person will have to find the right approach for their particular situation. But generally, depending on your overall asset allocation, you may want to consider putting the most tax-advantaged investments in taxable accounts and the least in tax-deferred accounts like a traditional IRA, 401(k), or a deferred annuity, or a tax-exempt account such as a Roth IRA (see chart).

To get going, consider first checking to see whether you've already taken full advantage of a 401(k) plan, small business retirement plan, IRA, or other qualified retirement accounts that may be available to you. To implement asset location, you need a variety of accounts with different tax treatments. Focus first on taking advantage of tax benefits available to you. Once you hit contribution limits or shift contributions to account types with different tax treatment, asset location can be used to further enhance after-tax returns.

"Investors should start out with a solid plan for their asset allocation, but within that framework, having a good strategy for where you keep your investments can be important," says Koval. "By putting certain less tax-advantaged investments in a tax-deferred or tax-exempt account, you can potentially save a significant amount of money on taxes, which may help you improve your bottom line as an investor."

Remember, the process of developing an asset location strategy is complicated, so consider working with a financial professional who can assist you with asset location as well as working with you to develop a solid financial plan to help you reach your financial goals.