Why open a custodial account (UGMA/UTMA)

A custodial account can be a great way to save on a child's behalf, or to give a financial gift. Otherwise known as an UGMA/UTMA account, there are no income or contribution limits—and no early-withdrawal penalties or restrictions on how the funds are used for the child. Basically, these are easy-to-open accounts used to invest in stocks, bonds, mutual funds, and more—all to give a child a better future.

Things to consider

- Great way to directly transfer wealth

- Transferred to the minor at a certain age (between 18 and 25, depending on the state)

- Friends and family can contribute

- A portion of earnings may be exempt from federal taxes

- Factored into financial aid eligibility

Why save and invest at Fidelity

Industry-leading value

$0 commissions for online stock trades—plus no account fees or minimums to invest.1

One-stop shop

Save for a child’s needs with our account and planning options.

Lessons for life

Teach a child money lessons to last a lifetime with our focus on education.

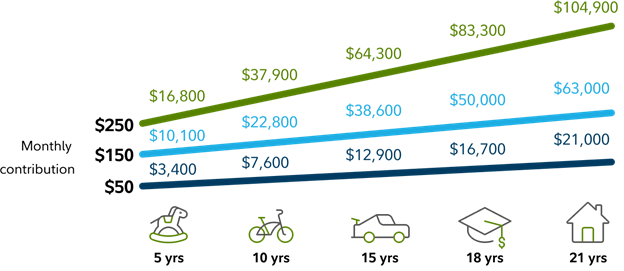

See hypothetically how saving a little over time can go a long way towards a child's future

Common questions on a custodial account

How can a custodial account be used to to help educate a child about saving and investing?

With a custodial account, you can explain that the money belongs to the child and that you, as the custodian, are saving and investing for them until they reach adulthood. By showing a child the investment mix, types of assets, and performance reports, you can educate them about investing until the account becomes theirs.

Who can contribute to a custodial account and are there limits?

Anyone can contribute to a custodial account—parents, grandparents, friends, other family—with no contribution limits, making them valuable gift opportunities for major milestones and celebrations. Individuals can contribute up to $19,000 free of gift tax in 2026 ($38,000 for a married couple). There's also no minimum to open an account, though certain investments may require a minimum initial investment.

Ready to get started?

Must-know facts about UGMA/UTMA accounts

Read our Viewpoints article to learn the ins and outs on how custodial accounts work.