Investors may be wondering whether the S&P 500 Index® has more room to run, following a 30%-plus rally from market lows in April 2025, slowing jobs growth, and ongoing concerns about the future rates of inflation and economic growth.

Yet long-term investors might want to pause and review market trends in the big picture. US stocks have been in a long-term secular bull market—meaning, an extended period of above-average returns, which may span multiple phases of rallies and pullbacks—since recovering from the Global Financial Crisis. We analyzed the long-term secular bull market using multiple approaches. Market pullbacks are inevitable, but if history is any guide, the current cycle does not appear to be at an extreme. In fact, the S&P 500 could be years away from its generational peak.

Analyzing past secular bull cycles

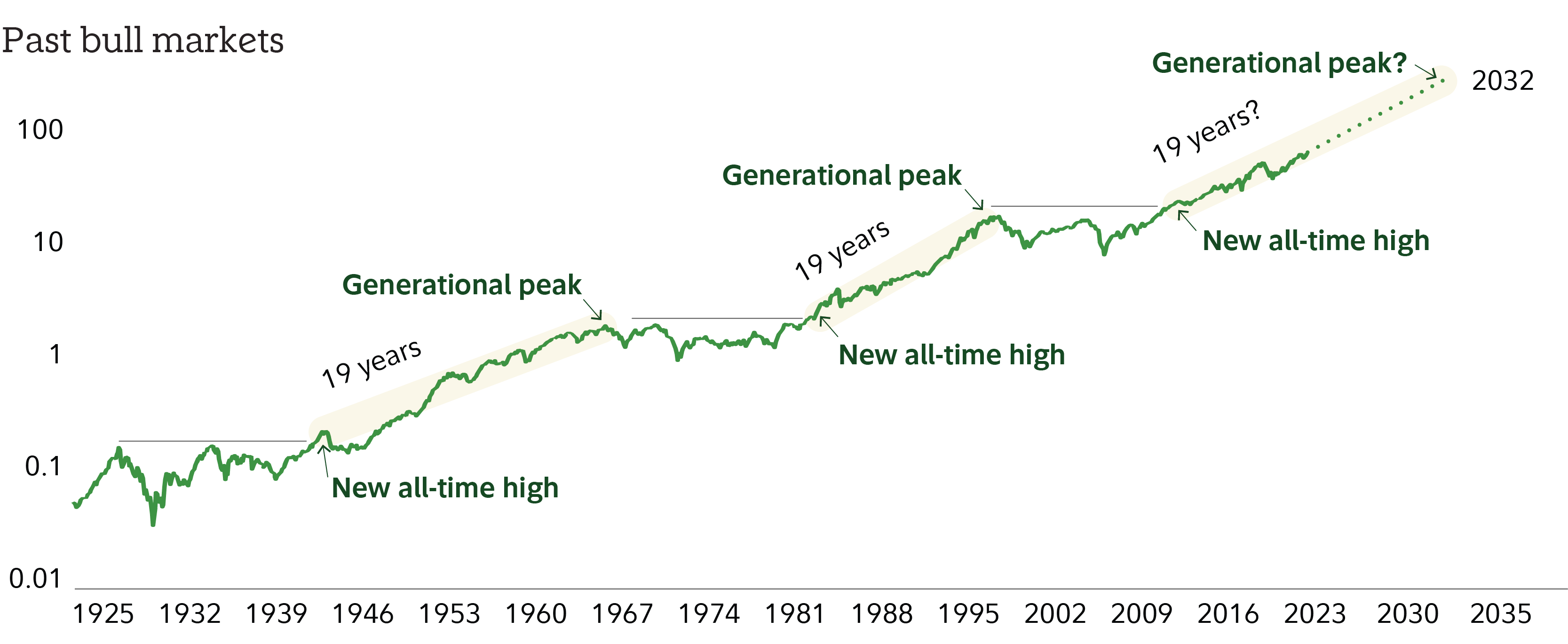

The chart, Past bull markets, shows the last 2 generational bull market cycles for the S&P 500, which slowly evolved from bear cycles to bull ones. In this analysis, we define the new bull cycle when the S&P 500 breaks out to a new all-time high from its bear stage, marked by the 2 multiyear consolidation patterns (mostly sideways price movement for the index).

If the current bull market were to match the average length of the previous postwar bulls (about 19 years), the S&P 500 index might go through a pullback in 2025 but continue to rise through 2032.

Note that this price-trend analysis does not rely on the type of fundamental research that uses cyclically adjusted price-to-earnings ratios and estimates of cumulative growth rates to create an index price target. It’s merely based on what we define as the generational stock market cycles since the Great Depression.

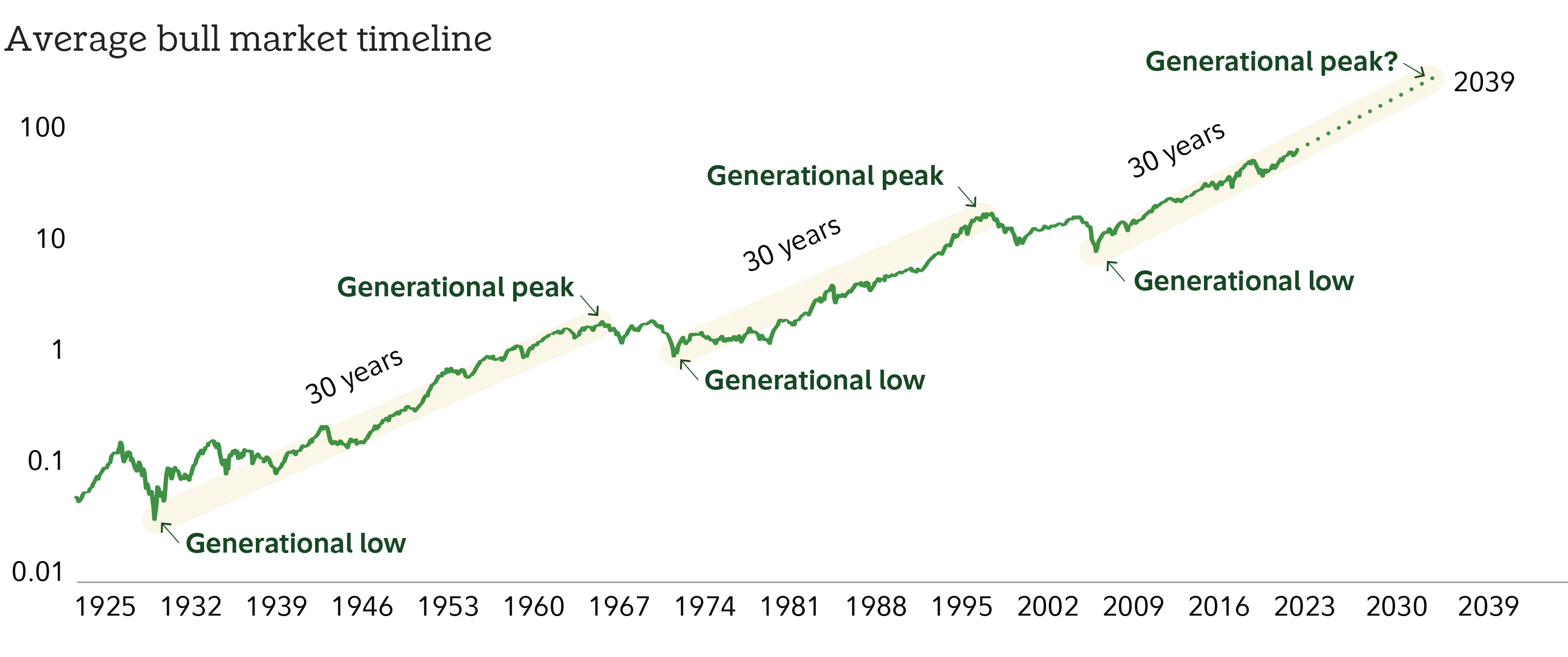

The chart, Average bull market timeline, shows the long-term trend from the “generational low” in the market from the trough price of the consolidation period to the generational peak, at which point consolidation begins again. By this measure, the past 2 secular bull trends lasted about 30 years, on average, from peak to trough.

If the current bull market were to rally for the same number of years as the average of the past 2 generational cycles, it might not peak until 2039. This analysis is not meant to be a target for how long the current bull cycle will last. Rather, based on multiple views, if the secular bull were to end tomorrow, it would be a far shorter run than the 2 previous cycles since the 1920s.

But are stocks overbought?

One related concern about the length of the current secular bull market is whether the rally for stocks is overbought following the rapid gains since April 2025.

The market is indeed overbought when looking at several short time frames used mostly by traders, but it is not egregiously extended on a longer-term basis, which we’d argue is the more important time frame for investors.

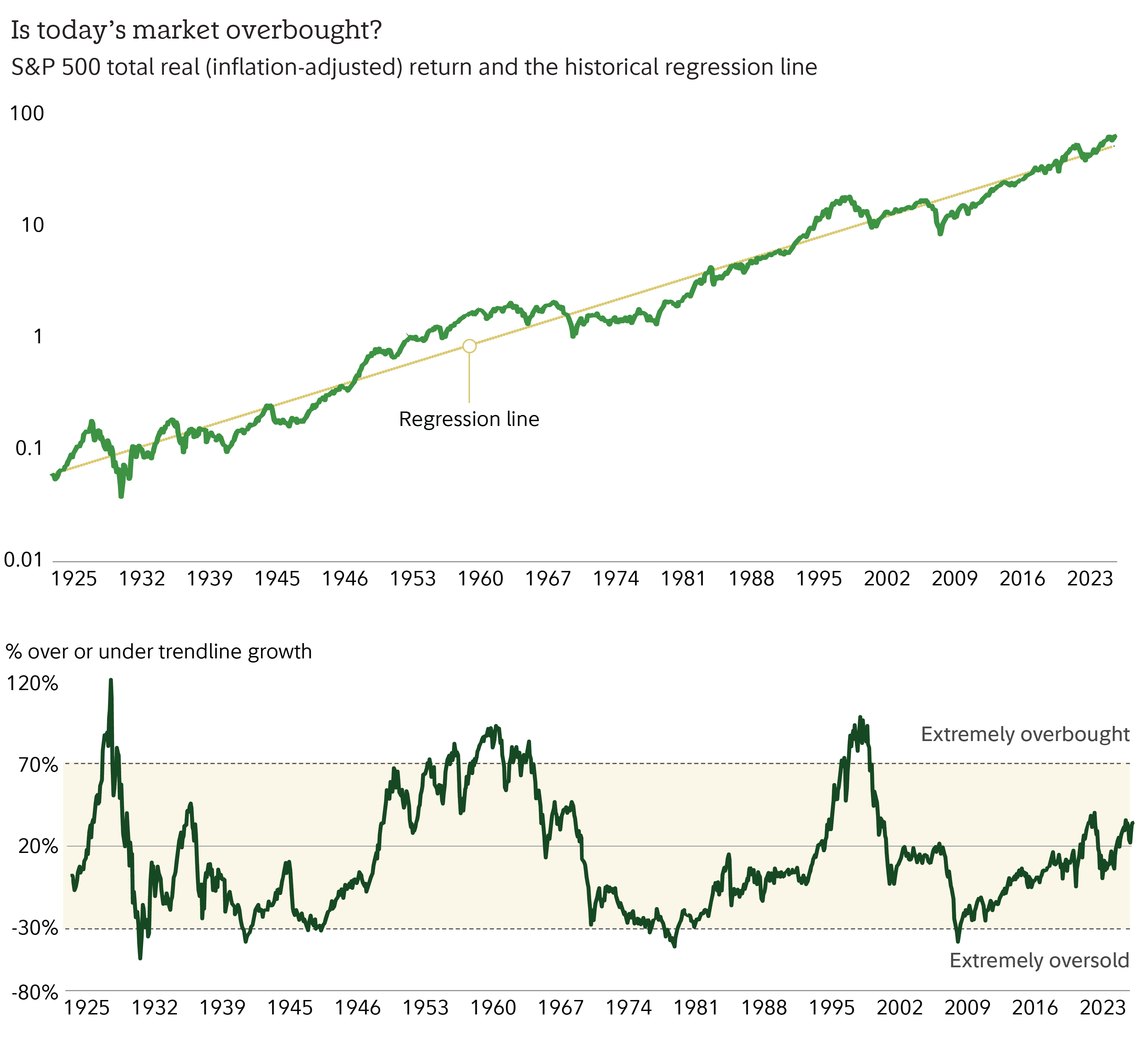

The chart, Is today’s market overbought? shows the real return (including dividends) for the S&P 500 going back to the early 1920s. The dotted rising line from left to right is a linear regression, which levels out the long-term trend by lowering the weights of extreme short-term price moves.

Using this visual cue, the long-term market is above the linear regression line, but not to the same degree as either the late 1990s or most of the mid-1950s through the early 1970s. The bottom chart reflects overbought and oversold market conditions based on the percentage of deviation of the S&P’s price from the dotted regression line. As of August 31, the S&P was about 28% overbought by this measure. This is not what we’d consider an extreme condition, which we define as 70% overbought or more.

What about large-cap growth?

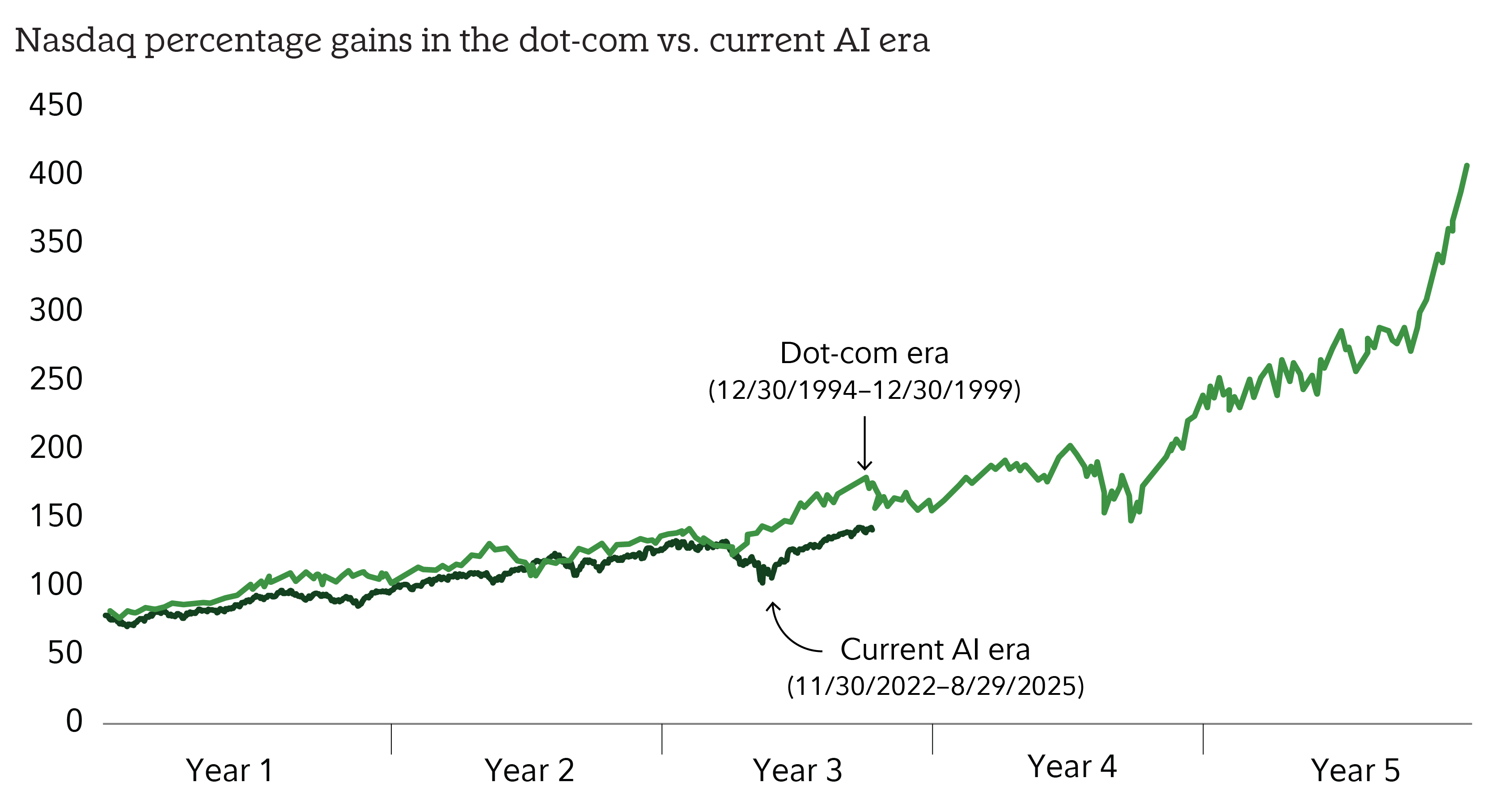

Finally, any long-term market analysis wouldn’t be complete without a historical comparison of growth-oriented stocks. The chart, Nasdaq percentage gains in the dot-com vs. current AI era shows the return of the Nasdaq Composite Index over 2 different cycles: the dot-com era (in green) and the current cycle, largely driven by artificial intelligence (AI) stocks (in black). The green line begins in December 1994, to correspond with the release of Netscape, the first web browser. The black line begins at the end of November 2022 to correspond with the release of ChatGPT.

If today’s largely AI-fueled run for the Nasdaq Composite were to match the length of the dot-com run since 1994, the Nasdaq might have several more years to run. More importantly, the magnitude of the current run has been modest compared with the index gains in the late 1990s, suggesting the current Nasdaq run does not appear to be at risk of a major downturn.

What could go right and wrong for investors

Pullbacks within a secular bull market are inevitable. Since 1950, we’ve seen a market decline of 20% or more once every 5 years, on average, and a drop of 15% or more once every 3 years, on average. Looking ahead, pullbacks within the current secular bull could be driven by big-picture concerns that include policy uncertainty, geopolitical turmoil, and potential growth challenges.

However, one major ongoing worry—the direction of policy interest rates—could swing in favor of stock investors. US Federal Reserve Chair Jerome Powell’s speech in Jackson Hole, Wyoming, in late August signaled the potential for lower rates ahead. The Fed initiated a 25-basis-point rate cut in September and signaled the potential for additional cuts into 2026, if needed. We believe that lower rates could support stock markets and a steeper yield curve.

As for valuations, the S&P 500 is indeed historically expensive. Near the end of August, it traded at 22x forward earnings (meaning, price divided by estimated earnings for the next 12 months), compared with an average of 17x over the past 30 years.

Is this historical average a fair comparison? Perhaps not. Financials and energy are now a smaller part of the S&P 500 than they had been, on average, over the past 3 decades. Each has tended to trade at lower-than-average valuations over this time frame. Conversely, information technology composes a larger percentage of the S&P 500 (34%) than it had over the past 30 years. Technology trades at a premium because of its above-average growth rates.

We believe valuation concerns could be largely extinguished with better-than-expected earnings over the next 12 months, driven by factors including stronger-than-anticipated technology adoption, including artificial intelligence. This could help organically reduce earnings multiples.

Conclusion

As always, the stock market exhibits downside and upside potential.

Remember that investors in the 2 past generational bull markets had to ride out multiple large pullbacks, growth and inflation concerns, headline risks, different interest-rate environments, geopolitical issues, and various policy changes to benefit from the entirety of those bull market runs.

The takeaway? The ride will be bumpy at times, but history has shown that long-term investors may do better by avoiding short-term distractions.