Looking to reduce the volatility of your portfolio and the stress that comes with it?

In today’s interest rate environment, rebalancing a portion of your stock portfolio to bonds with medium-term maturities, around 5 years, may provide growth potential with less volatility and stress. Michael Scarsciotti is head of the investment specialists at Fidelity Capital Markets, and he believes that intermediate-maturity bond funds may be offering their most compelling opportunity in decades.

How much stock do you really need?

Because of the strong performance of stocks in recent months, the opportunity in intermediate-maturity bonds may be easy to overlook. But that could be a mistake because when any of the asset classes in a portfolio performs particularly strongly, the portfolio can become unbalanced and it may no longer match your personal tolerance for risk, such as the risk that volatility could return to the stock market.

David DeBiase who co-manages Fidelity® Intermediate Bond Fund (

Other experienced bond managers agree. Jerome Schneider is head of Short-term Portfolio Management and Funding at PIMCO. He says, “For the first time in a generation, higher real yields and active management are creating attractive opportunities in intermediate-maturity fixed income with interest rate exposures of 5 years or shorter."

For busy self-directed investors, rebalancing some of their assets from stocks to an intermediate-maturity bond strategy could reduce complexity, cost, and stress.

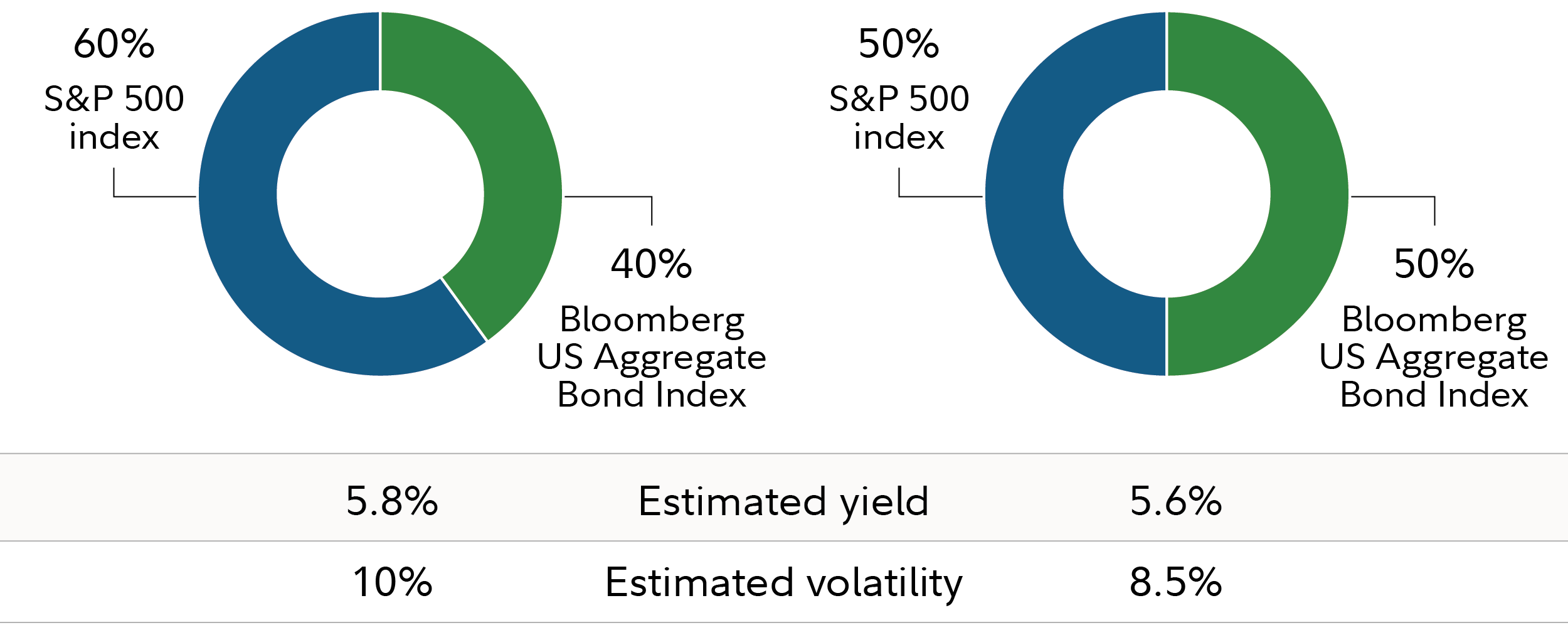

For example, suppose that due to market movements a portfolio with a targeted allocation of 50/50 stocks and bonds has shifted to a 60/40 mix. Rebalancing back to the intended mix could reduce potential volatility with only a small impact to the portfolio's estimated yield.

Source: PIMCO, Bloomberg. As of July 31, 2025. MSTAR Active Core-Plus Model's risk exposures are based on the Morningstar Active Intermediate Core-Plus Category.

Yield refers to the Yield to Worst (YTW), which is the estimated lowest potential yield that can be received on a bond without the issuer actually defaulting. For equities, yield refers to the trailing 12-month earnings yield plus the 5-year breakeven inflation rate.

Volatility refers to the estimated, annualized standard deviation of the returns. Standard deviation is a measure of dispersion in returns with respect to their mean. We estimate the volatility by computing historical factor returns that underlie each asset class proxy from 1997 through the present date. We then draw a set of 12 monthly returns within the dataset to produce an annual return number. This process is repeated 25,000 times to have a return series with 25,000 annualized returns. The standard deviation of these annual returns is used to model the volatility for each strategy.

The purpose of the target asset mixes is to show how target asset mixes may be created with different risk and return characteristics to help meet a participant's goals. You should choose your own investments based on your particular objectives and situation. Remember, you may change how your account is invested. Be sure to review your decisions periodically to make sure they are still consistent with your goals. You should also consider any investments you may have outside the plan when making your investment choices.

Why go medium?

DeBiase says that medium-maturity bonds are solid building blocks for a bond portfolio that can deliver total returns that may be high enough to let some investors reduce their exposure to stocks, if doing so is consistent with their financial goals. Schneider agrees, saying, “I believe bonds with maturities of around 5 years are a sweet spot because they’re somewhat insulated from the volatility you might see in both shorter and longer maturities.”

If the Federal Reserve proceeds with further anticipated interest rate cuts, yields of the shortest-maturity bonds could fall quickly. That's what happened in September 2024, when the Fed lowered rates and the yield on the shortest-maturity Treasurys quickly dipped below 5%, where they had been for more than a year. Meanwhile, prices of long-maturity bonds have seen volatility in part because some traders and investors are becoming more reluctant to lock up money further into what they see as a future in which the US government may eventually have to take difficult steps to manage its debt.

Whipping inflation now

The ability of well-chosen bonds to lower volatility in a portfolio is not a secret, but some may believe that lower volatility comes at the price of returns that are too low to keep ahead of inflation.

Sean Walker is an institutional portfolio manager on Fidelity’s fixed income investment team. He says that a properly constructed intermediate-maturity bond strategy could help protect your purchasing power and reduce the amount of your portfolio that you need to expose to the volatility of the stock market to stay ahead of inflation. “Instead of relying entirely on stocks, I would suggest constructing a bond portfolio with a yield to maturity of around 5%.”

Active management may also be able to provide additional opportunities for returns from price appreciation of the holdings, potentially pushing the total return higher, to perhaps 6%, according to Walker. For example, that means if you could earn 6%, you would still be 3% ahead of a higher-than-expected 3% inflation rate.

That may be especially attractive to retirees who are looking to fund a 4% annual withdrawal rate from their portfolios while also preserving the value of their portfolios’ principal.

Understand the trade-offs

It’s always true that in investing there is “no free lunch.” That means any decision you make—or refuse to make—can have consequences that you may not want. For example, you can shift your mix of assets by selling stocks and using the money to buy bonds and reduce the volatility of your portfolio. But in the process, you will also reduce the ability of your portfolio to benefit from the long-term higher growth potential of stocks.

As with any investment, you also need to “know what you own” when you consider adding intermediate-maturity bonds. It’s not enough to merely pick the medium-maturity bonds or intermediate bond funds with the highest current yields. Higher yields may come with higher risks of default and higher price volatility, so adding those to your portfolio is probably not going to give you less stress than you had with stocks. Whether you are looking at bond funds or have enough money to invest and want to build a diversified portfolio of individual bonds, Fidelity’s digital tools and fixed income specialists can help you choose an appropriate balance between attractive yields and credit quality.

How to research intermediate-maturity bond strategies

If you want to add intermediate-term bonds to your portfolio, you can choose from self-managed portfolios of individual bonds and CDs, mutual funds, and ETFs managed by experts from across the investment management industry.

Fidelity also has a number of tools to help investors research mutual funds and ETFs including the Mutual Fund Evaluator and ETF screener on Fidelity.com, and the PIMCO ETF landing page on Fidelity.com.