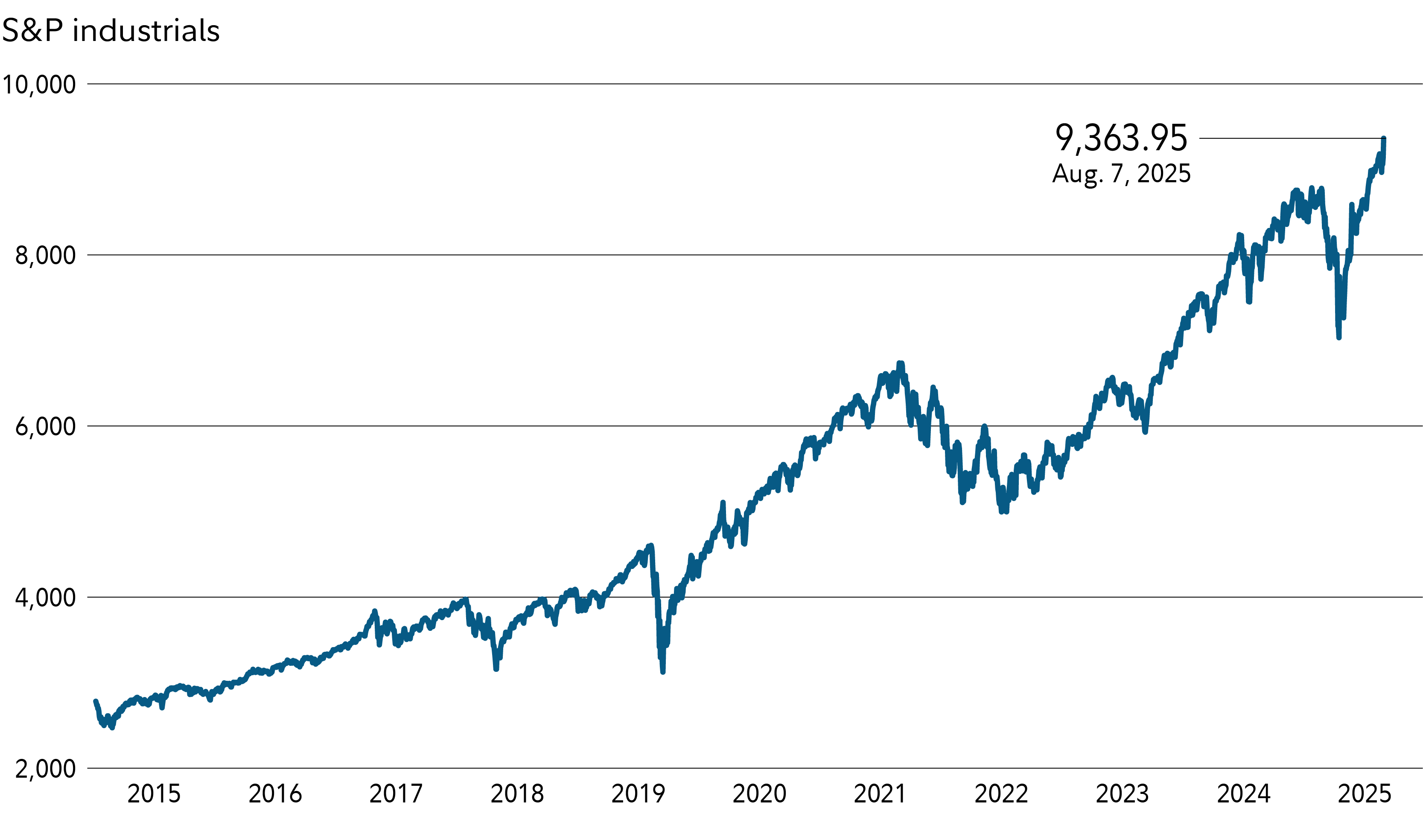

The industrials sector is on track to be the best-performing group among US stocks this year. If you’ve missed out on the industrials rally, there appears to be plenty of time—and opportunities—to get on board.

Industrial stocks in the fast lane

Industrials can be thought of as a backbone of an economy in many ways. These are companies that provide much of the infrastructure for the rest of the economy, including engineering, manufacturing, and transportation providers.

Aerospace and defense (which accounts for about one-quarter of the industrials sector and is up 32% year to date) has been responsible for much of this sector’s outperformance thus far this year. Construction and engineering companies (up 29% year to date) have also helped drive returns, due in large part to spillover benefits from artificial intelligence data center demand as well as reshoring initiatives.

Clayton Pfannenstiel, manager of the Fidelity® Select Industrials Portfolio (

For example, consider an AI data center. “In addition to semiconductor chips, building a data center requires industrial assets such as a reliable source of backup power, advanced climate-control systems, and substantial electrical equipment. Companies like GE Vernova (

Fund top holdings1

Top-10 holdings of the Fidelity® Select Industrials Portfolio (

- GE Aerospace (

) - 7.70% - GE Vernova (

) - 7.63% - Howmet Aerospace (

) - 6.02% - Boeing (

) - 4.20% - Parker-Hannifin (

) - 4.00% - Eaton (

) - 3.95% - Trane Technologies (

) - 3.93% - TransDigm (

) - 3.20% - Ingersoll Rand (

) - 3.10% - Deere (

) - 3.10%

(See the most recent fund information.)

Something that may not immediately come to mind here is the public sector, which might be an underappreciated component of the AI disruption journey. “For instance, AI is enabling police forces to substantially reduce the time police officers spend behind a desk writing incident reports,” Pfannenstiel says. “Furthermore, AI-enabled wearables offered by companies like Axon (

Factory automation is another segment that has boosted industrials. “An underlying factor for the headline-grabbing global trade deals is reshoring,” Pfannenstiel says. “Factory automation is enabling this possibility of shifting supply chains back home while managing costs discrepancies by geography.”

Fund top holdings1

Top-10 holdings of the Fidelity® Disruptive Automation ETF (

- Taiwan Semiconductor (

) - 6.28% - Deere (

) - 5.19% - NVIDIA (

) - 4.87% - Axon Enterprise (

) - 4.53% - Fidelity Securities Lending Cash Central Fund - 3.95%

- Palantir (

) - 3.46% - Teradyne (

) - 3.26% - Siemens (

) - 3.22% - PTC (

) - 2.77% - Emerson Electric (

) - 2.76%

(See the most recent fund information.)

Industrial stock considerations

Of course, not all segments within industrials are riding high. Air freight and airlines have underperformed the market, partly because of nagging worries that the economy could deteriorate and have an exponential impact upon these businesses. Even the leaders in the industrials sector thus far remain sensitive to any downturn in the economy. Additionally, high valuations across the market—including among some industrials—could limit some upside over the short term.

With that said, industrials have a lot of momentum right now. Despite concerns that a slowdown in government spending might impact this sector, along with some others, industrial companies appear to be navigating economic uncertainty. And a number of companies in this sector may be poised to capitalize on the biggest economic trends right now.