After years of questioning crypto’s potential, Jamie Dimon recently announced that JPMorgan Chase (

This is one of the latest examples where fintech—which is short for financial technology—is encroaching on the territory of banks and other traditional financial services. And the implications for investors could be significant.

Fintech stocks

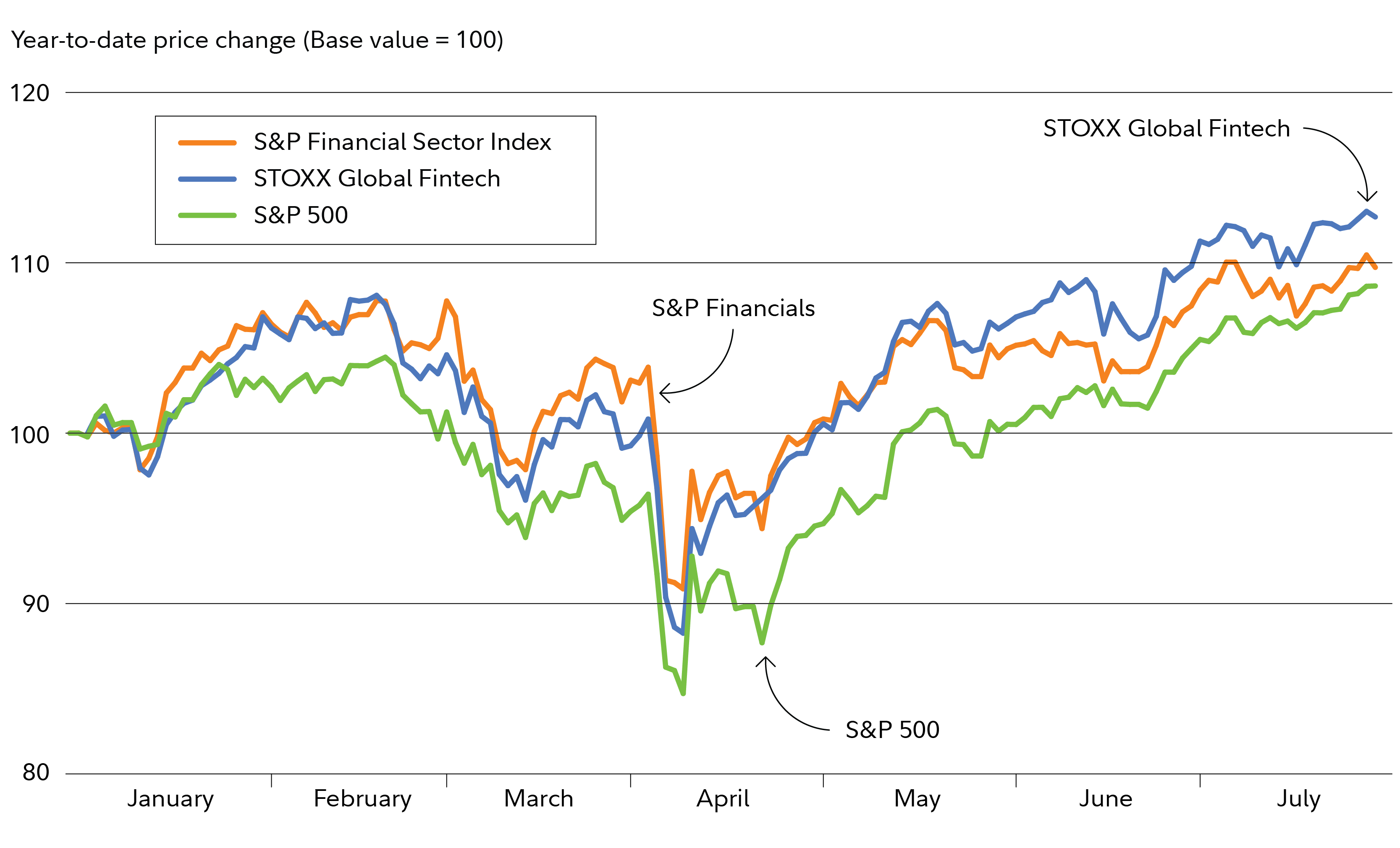

It’s been a big year for fintech thus far. The STOXX Global Fintech Index is up more than 13% year to date. That compares favorably to both the S&P 500 and the S&P Financials Sector Index.

Several fintechs that have debuted this year, including Circle (

“There’s a lot of momentum behind fintech, which is bringing modern functionality to the financial services space,” says Ruth Nagle, who manages the Fidelity® Select FinTech Portfolio (

FSVLX top holdings1

Top-10 holdings of the Fidelity® Select FinTech Fund (

- Intuit (

) – 14.08% - Visa (

) – 12.43% - Mastercard (

) – 11.86% - American Express (

) – 10.93% - Capital One Financial (

) – 8.53% - Shopify (

) – 5.07% - Adyen – 5.03%

- Fiserv (

) – 4.75% - Block (

) – 4.69% - Fidelity Natl Information (

) – 4.38%

(See the most recent fund information.)

If you aren’t familiar with the fintech industry, here are some examples of public fintech companies and a brief description of what they do:

- Adyen is a global payments platform supporting transactions through a unified cloud-based API.

- Chime is an online-only banking services provider.

- Circle issues USD Coin, the world’s second largest stablecoin (behind Tether’s USDT).

- eToro has become most well known for its “Copy” trading feature offering the ability to mimic the trades of popular investors on the platform.

- Marqeta (

) is a modern card issuing and transaction processing company allowing companies to instantly create and manage debit, credit, and prepaid cards. - Stone (

) integrates payment processing, digital banking, and software services for micro and small businesses in Brazil. - Wise (

) is a global network for money transfers that is relatively low cost, transparent, and offers multi-currency digital accounts.

Nagle highlights the growth of certain fintechs as illustrative of the potential disruptive power of the industry. “Take Marqeta, for example, which is a company with strong technology that supports card programs for buy-now, pay-later players, digital banks, and gig economy payroll,” Nagle notes. “It's total purchase volume grew 27% year over year in the first quarter of 2025 and is expanding even faster in Europe. Plus, Marqeta is powering a lot of fintech innovation.”

Pierre Sorel, portfolio manager for the Fidelity® Disruptive Finance ETF (

Sorel is also looking at fintechs that may be revolutionizing the investing space. “Consider eToro’s social investing strategy, which is helping this company grow share in active trading as well as managed asset management products through custom built allocations, built on a low-cost, efficient platform with fast innovation.”

FDFF top holdings1

Top-10 holdings of the Fidelity® Disruptive Finance ETF (

- Mastercard Inc. (

) – 6.09% - Visa (

) - 6.00% - Capital One Financial (

) – 5.69% - BlackRock (

) – 5.21% - Adyen – 4.96%

- AvidXchange (

) – 4.83% - Equifax (

) – 4.83% - Apollo Global Management (

) – 4.44% - Block (

) – 4.44% - DBS Group – 3.47%

(See the most recent fund information.)

Is fintech right for you?

Will these emerging fintech companies become established within the financial services world? If the likes of Jamie Dimon and other influential financial services figures are acknowledging their potential disruptive power, investors may want to take notice as well.

Of course, there are risks for fintech investors to consider. In addition to some of those associated with traditional financial services companies, such as interest-rate exposure and sensitivity to other economic factors, emerging disruptive technologies can have their own unique risks.

For instance, the digital payments industry is largely dependent on customers adopting and using their platforms. Additionally, the stablecoin and crypto industries are operating under an evolving regulatory regime—although several major pieces of crypto legislation have passed or are currently under consideration that might remove some of this uncertainty. There is also the potential for established financial companies to adopt fintech strategies or leverage their dominant positions. For example, Dimon’s JPMorgan made news recently by announcing it will charge for data requests by fintech middlemen like Plaid (

With that said, fintech has the potential to disrupt parts of the payment and money transfer, lending, personal finance, insurance, and real estate services industries. The rapid growth of fintech thus far suggests investors may want to consider exploring these relatively new waters.