Thanks to its potential to grow savings over time, the idea of compound interest is what motivates many people to start investing. Here's how compound interest works—and how you can take advantage of it.

What is compound interest?

Compound interest is when interest you earn in a savings or investment account earns interest of its own. (So meta.) In other words, you earn interest on both your initial balance—called the principal—and the interest that's added to the balance over time. That's in contrast to simple interest, or when interest payments are based on the principal. Any accumulated interest does not impact future interest payments.

How does compound interest work?

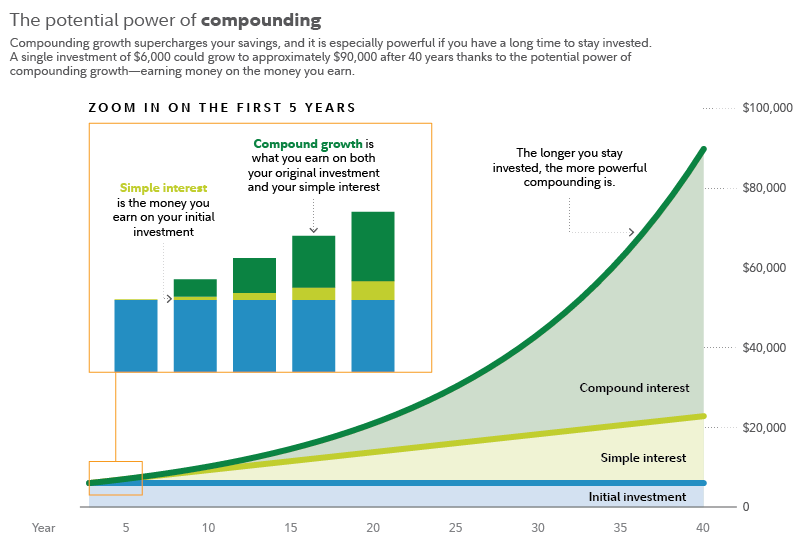

Compound interest takes advantage of previous gains to grow your money more. Need an example? Let's compare the returns on a $6,000 investment that earned simple interest vs. compound interest, assuming each earns a hypothetical 7% rate of return.

In year 1, you'd have identical balances: a $420 increase for a total of $6,420. A year later, simple interest would yield $6,840 ($6,000 + $420 + $420), the compound-interest balance is slightly higher at $6,869.40 ($6,420 + 7% returns, or $449.40).

As illustrated in the chart below, over time the difference between simple and compound interest becomes significant. After 10 years, a $6,000 investment earning simple interest would be worth $10,200. The same investment earning compound interest would total about $11,800. And after 30 years, the difference is almost $30,000: about $45,700 for your compound-interest investment vs. just $18,600 for your simple-interest investment.

How to calculate compound interest

Final amount = Principal x [1 + (the interest rate / number of times it's applied per time period)]^(number of times it's applied per time period x the number of time periods that have passed)

Simple interest formula

Final amount = Principal x (1 + the interest rate x the number of time periods)

Compound interest and your finances

Why is it important to understand how compound interest works? Because compound interest doesn't only have the potential to add to your balances—in certain circumstances, it can work against you. That's because compound interest also often applies to interest added to credit card balances, which can make it harder to pay back. Aim to pay off high-interest debt as fast as you can to avoid having to pay back a lot more than you originally borrowed.

An important note: The frequency that the interest you either earn on your savings and investments or pay on your credit card balance matters. For simplicity, in the example above, we assume compounding only happens once each year. In real life, interest might compound daily, weekly, monthly, quarterly, biannually, or annually. The more often it compounds, the greater compounding's impact.

How can investors receive compounding returns?

Anytime you invest money in the stock market, you're giving it a chance to benefit from compounding. Keep these tips in mind to make the most of compound interest.

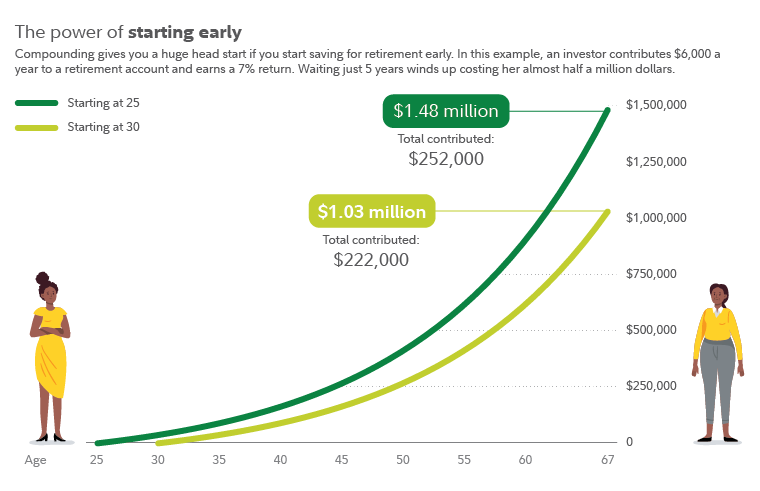

Invest early You might've heard the saying: "It's not timing the market. It's time in the market." That's because time fuels the potential power of compounding. In the example above, the stark difference between simple and compound interest didn't play out immediately. Check out another example that illustrates what can happen for retirement savers who start investing early vs. those who wait.

Here's the difference just 5 years can make when it comes to saving for retirement. Two hypothetical savers invest $6,000 at the beginning of each year starting at either age 25 or 30. Each continues until they are 67 and earns an average 7% return. When the saver who started at 25 retires, her account balance is almost $1.5 million. The saver who started at 30? Hers is just over $1 million, or about $450,000 less, despite only investing $30,000 less than the early saver.

Of course, not everyone is able to start investing at 25 or has $6,000 a year ($500 a month) to set aside for their retirement. But this example shows how time can amplify investment compounding: Our early saver managed to grow her savings by nearly 500%. That said, over 37 years, even the later saver saw her investment increase nearly 400%. The lesson? Start investing as soon as you can, even if it's a small amount.

Invest often Investing regularly is one of the best habits you can build for financial success. Consider the difference between the total amount our hypothetical retirement saver who started at 25 might end up with if she had stopped after 10 years and never contributed another dollar.

Her account balance would be around $773,000. Considering she'd only invested $60,000 of her own money, that's not a bad return on investment. But it's also drastically less than if she'd invested consistently.

Regular contributions have another potential: helping to decrease your risk. In our examples so far, we've relied on a hypothetical 7% average annual rate of return. This is a conservative value based on historical average annual returns of the S&P 500—a common benchmark for overall stock market performance—which has averaged close to 10% annual returns over the last 100 years. But the market doesn't move in a straight, upward line. Instead, there are peaks and valleys like bear markets, where stock values fall more than 20% from recent highs. Luckily, the stock market has recovered from every downturn it's experienced in history. But there's no guarantee that it will or that you won't lose any money.

To combat this risk, many investors turn to dollar-cost averaging, a strategy that has you invest smaller amounts regularly rather than waiting to invest a large lump sum. (You likely already use dollar-cost averaging if you're saving for retirement through a workplace plan like a 401(k) or 403(b).)

Because you buy the same dollar value of an investment, no matter if prices are low or high, you buy more shares when prices are down and fewer when they're up. This helps you avoid investing a lot right before prices drop or too little before they rise. In addition to helping minimize your risk, dollar-cost averaging may lead you to pay less per share on average over time.

But remember: Dollar cost averaging does not assure a profit or protect against loss in declining markets. For the strategy to be effective, you must continue to purchase shares in both market ups and downs.

Diversify The average return of the S&P 500 is based on the average returns of 500 of the largest public companies in the US, adjusted based on each company's market capitalization. The S&P 500's wide-ranging holdings help provide the kind of diversification that many investors aim for to decrease their risk.

While individual stocks may see short-term, or even longer-term, returns that trump the broader stock market's (as represented by S&P 500), they also carry much more concentrated risk. The overall stock market has never zeroed out, but individual companies have.

By investing in a wide range of companies, you decrease the risk you'll wind up with a losing hand. And if individual stocks you buy do stumble and fall, hopefully others will rise to help balance it out.

But remember: The goal of diversification is not necessarily to boost performance—it won't ensure gains or guarantee against losses. Diversification does, however, have the potential to improve returns for whatever level of risk you're aiming to take on.

You can, of course, buy individual stocks yourself. But putting in the time, effort, and research it takes to pick them thoughtfully can be challenging. That's where mutual funds, index funds, exchanged-traded funds (ETFs), and target-date funds come in. With funds, professionals do the research for you, either by conducting due diligence themselves or by simply aiming to duplicate the performance of a major market index, like the S&P 500. In either case, they provide a diversified portfolio of many investments that offer the chance of benefitting from compounding returns.