Lithium charged into news headlines on reports that the US government would seek a 10% equity stake in Vancouver, Canada-based Lithium Americas (

Here’s how investors might dig into the minerals and rare-earths investment theme.

Government stakes ratchet up minerals race

The Lithium Americas’ deal followed the US government taking a stake in rare-earths miner MP Materials (

The US government’s no-cost warrants stake in Lithium Americas was part of renegotiations for a more than $2 billion loan from the Department of Energy for the lithium miner. The deal centers around its Thacker Pass lithium mine project within the extinct McDermitt Caldera supervolcano in Nevada, which also includes purchase guarantees by General Motors (

Reuters reports that the first phase of the Thacker Pass project, which is set to kick off in 2028, projects to produce 40,000 metric tons of lithium carbonate. That would produce enough byproduct to help construct 800,000 electric vehicles. By comparison, Albemarle’s (

Governments and international companies have been racing to secure rights to lithium and other key minerals that are critical components for electronics, vehicles, wind turbines, and a range of other products. Given that a significant amount of the US supply chain is dependent upon Chinese mineral imports—a US Geological Survey indicated that 70% of US rare-earth imports were supplied by China in recent years—the US has moved aggressively to secure more domestic control of certain mineral resources.

Lithium is among those minerals that have become particularly sought after, largely because of how critical a component it is to battery technology. Other common components of a battery, which can include graphite, aluminum, nickel, and copper, tend to be more readily obtained. While lithium is not a rare-earth metal, it’s not as easily procured as other battery components.

For that reason, some companies that utilize batteries in their supply chain have been investing heavily in battery production—including lithium procurement and refining. For instance, Tesla (

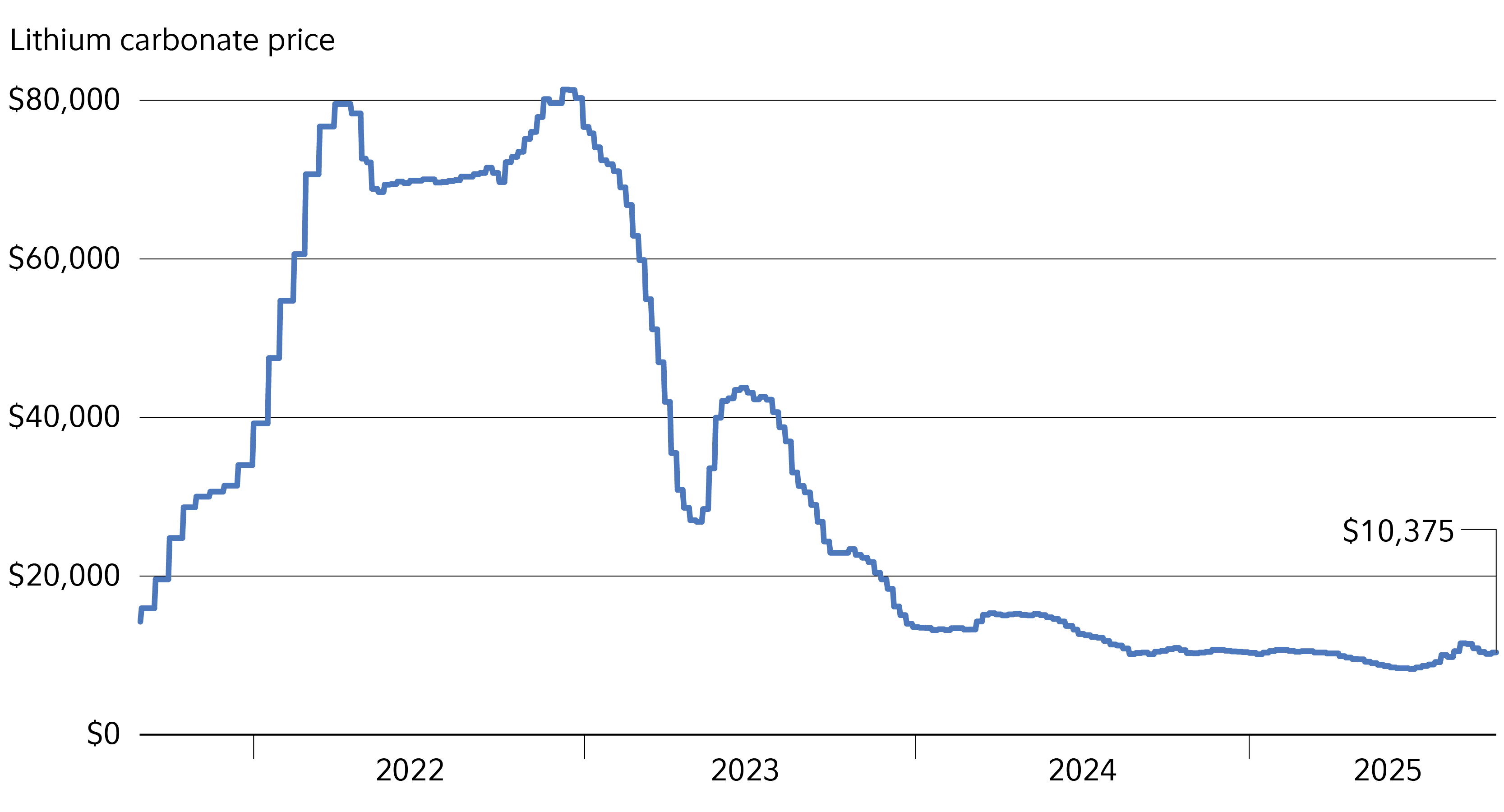

Lithium prices had been volatile, as the market responded to supply and demand imbalances, export restrictions out of China, and other factors.

One facet of the strategy by the US government has been to create a price floor for certain resources, with the primary purpose of enabling industry to invest for the long term in building out big mining projects for key minerals. For example, in the MP deal, the government set a floor of $110 per kilogram for neodymium-praseodymium oxide, which is a core input in rare-earth magnets.

Lithium stocks

The largest purely lithium miners by market cap are Chinese miners Ganfeng Lithium (

Other companies who are not pure-play lithium miners, but do have lithium-mining operations include mining conglomerate Rio Tinto (