Stacking the tax benefits of certain accounts can help supercharge your strategy. Health savings accounts (HSAs), 401(k)s, and IRAs are more than just savings accounts—they can help reduce taxable income and allow your money to potentially grow tax-deferred or even tax-free. Used together, they may help you keep more of what you earn to prepare for future expenses.

One of the biggest future expenses? Health care. Fidelity estimates that a 65-year-old retiring in 2025 may need about $172,500 in after-tax savings for medical expenses alone.1 Here’s how to make the most of every tax advantage available—and why HSAs may deserve a bigger role than you might think.

1. The basics of each account

Health savings accounts (HSAs) offer unmatched tax benefits—contributions are tax-deductible (or made pre-tax through an employer), any potential earnings grow tax-free, and withdrawals are tax-free when used for qualified medical expenses.2 There’s just one catch: You must be enrolled in an HSA-eligible health plan to contribute.

Read Fidelity Viewpoints: HSA contribution limits and eligibility rules for 2025 and 2026

Note: If you withdraw money from an HSA for non-qualified medical expenses before age 65, you may owe a 20% penalty on the amount withdrawn and income taxes.

401(k)s and other workplace plans help you save for retirement—typically with high contribution limits, pre-tax or Roth contributions, potential employer matches, and tax-deferred growth potential.

IRAs offer flexibility outside of work. Traditional IRAs may be tax-deductible, while Roth IRAs allow tax-free withdrawals in retirement provided certain conditions are met.3

Traditional IRA deductions and Roth IRA contributions phase out at higher incomes—be sure to check IRS guidelines each year before contributing. Learn more about income phaseouts and limits: IRA contribution limits

2. How HSAs complement retirement accounts

All 3 account types—HSAs, 401(k)s, and IRAs—help reduce taxes and allow your money to potentially grow over time without incurring taxes while assets remain in the account. But HSAs may offer additional advantages:

- HSA contributions through payroll aren’t subject to Social Security and Medicare taxes.

- HSAs, like Roth IRAs, have no required minimum distributions (RMDs).

- You can take advantage of the tax benefits and use the account right away. Money in an HSA can be used tax-free for qualified medical expenses at any age.

Think of a 401(k) and IRA as the foundation for retirement security. An HSA offers flexibility to cover qualified medical expenses without dipping into your retirement accounts.

3. The tax-advantage stacking strategy

There may not be one right order for everyone. Your financial situation, health insurance, eligibility to contribute to an HSA, and the availability of workplace retirement plans are key determinants for the way you might order contributions.

This practical framework may help you prioritize tax benefits based on eligibility and goals:

- Save enough to cover qualified medical expenses for the year in your HSA.

If you’re eligible to contribute to an HSA, starting there can be a tax-efficient move—thanks to its triple-tax advantage2 and potential payroll tax savings.

Covering current qualified medical expenses with pre-tax HSA dollars means you avoid paying those costs with after-tax dollars. Even if you don’t invest the HSA yet, you’re already helping to reduce your tax bill. An added benefit: Some employers contribute to your HSA on your behalf.

- Contribute enough to get your full employer match, if offered, to your 401(k).

Employer matches are essentially like free money—avoid leaving it on the table if possible. Plus, employer contributions aren’t taxed when you receive them and can potentially grow tax-deferred and help power any compounding.

- Maximize contributions to your HSA and keep enough cash available for annual qualified medical expenses.

Once you’ve set aside enough for this year’s qualified medical expenses, consider investing any remaining balance in your HSA for long-term growth potential. Read Fidelity Viewpoints: How much cash should you keep in your HSA?

- Pay qualified medical expenses out of pocket, if you are able to, letting your invested HSA balance potentially grow for the future.

You can save receipts and reimburse yourself with HSA funds later—even years down the road. If you have a Fidelity HSA or an employer-sponsored health benefits plan administered by Fidelity, you can store receipts in the Fidelity Health® app.

At age 65 and beyond, you can use HSA funds on anything, not just qualified medical expenses, avoid the 20% penalty, and simply pay ordinary income taxes on the withdrawal.

Once enrolled in Medicare, you can’t contribute to an HSA—but you can still spend tax-free on qualified medical expenses.

Read Fidelity Viewpoints: 5 ways HSAs can help with your retirement

- Maximize contributions to your retirement accounts.

This includes both workplace plans and IRAs. Each has rules that can affect how you prioritize contributions.

Workplace plans like 401(k)s and 403(b)s

Eligibility

To participate, you must meet your employer’s plan rules. These may include:

- Minimum age requirements (commonly age 18 or 21, depending on the plan).

- A waiting or service period before you can enroll.

- Specific enrollment windows set by the employer or plan administrator.

Contribution rules

You can defer part of each paycheck into your plan up to IRS limits. Employers may also:

- Allow both traditional (pre-tax) and Roth (after-tax) contributions.

- Limit the percentage of pay you can contribute per period.

- Offer employer matching and/or profit-sharing contributions.

- Set vesting schedules for employer contributions.

Tax treatment

- Traditional (pre-tax) contributions may reduce taxable income today.

- Roth contributions can provide the opportunity for tax-free withdrawals in retirement, as long as a few requirements are met.3

Contribution limits

- 401(k)/403(b) contribution limits: Annual IRS limits apply; catch-up and super catch-up available at qualifying ages.

Special considerations

- Employer matching contributions vary widely and may follow their own vesting schedule.

- RMD rules differ for traditional and Roth employer accounts, depending on the year and plan structure. Read Fidelity Viewpoints: Making sense of RMDs

- Plan rules may restrict Roth availability or cap salary deferral percentages.

Individual retirement accounts (IRAs)

Eligibility

You (or your spouse, if filing jointly) must have earned income to contribute. Beyond that:

- Traditional IRA: Anyone with earned income can contribute, but deductibility depends on income and workplace plan coverage.4

- Roth IRA: Eligibility depends entirely on your modified adjusted gross income (MAGI), with contributions phasing out at higher income levels.5

Contribution rules

- You may contribute to a traditional IRA, a Roth IRA, or both—within the combined IRS annual limit.

Tax treatment

- Traditional IRA: Contributions may be deductible; earnings grow tax-deferred; withdrawals are taxed as ordinary income.

- Roth IRA: Contributions are after tax; earnings and withdrawals may be tax-free if requirements are met.3

Contribution limits (2026)

- IRA contribution limits: The IRS sets combined annual limits; catch-up contributions begin at age 50.

Special considerations

- Roth IRAs have no RMDs.

- Traditional IRAs require RMDs at age 73–75, depending on birth year.

- If income is too high for Roth contributions, nondeductible traditional IRA contributions may be an option.

Read Fidelity Viewpoints: Do you earn too much for a Roth IRA?

4.Contribution limits that can stack

If you’re eligible to contribute, you could save the following amounts on a tax-advantaged basis in 2026:

- Health savings account (HSA)

Up to $8,750 for family coverage. A $1,000 catch-up contribution can be made beginning at age 55 and older. If both spouses are age 55 and older, each may make a separate $1,000 catch-up contribution to their own HSA. You cannot contribute while enrolled in Medicare; however, existing HSA funds may still be used tax-free for qualified medical expenses.

- Workplace savings plan (e.g., 401(k))

Up to $24,500. An $8,000 catch-up contribution can be made beginning at age 50. “Super catch-up” contributions of $11,250 can be made between ages 60–63, in place of regular catch-up amounts, subject to plan rules.

- Traditional IRA / Roth IRA

Up to $7,500. A $1,100 catch-up contribution can be made beginning at age 50. Traditional IRA deductions and Roth IRA contributions phase out at higher income levels—check IRS rules annually.

Why this matters: These limits show the ceiling of tax-advantaged contributions available across accounts. Eligibility varies (e.g., HSA-eligible health plan required for HSA contributions), and actual choices depend on your situation.

5. A long-term example

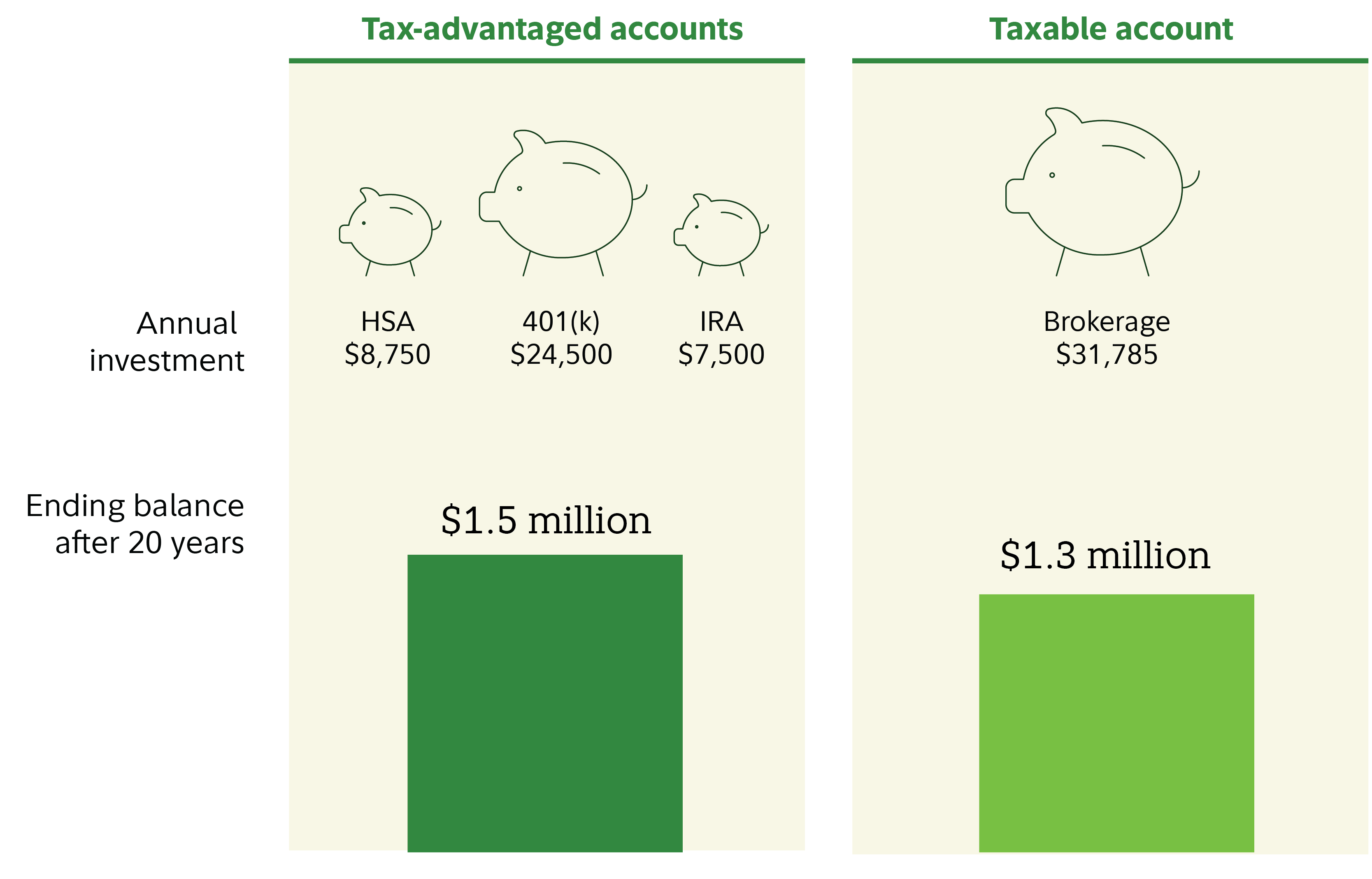

If you’re eligible to contribute the maximum to all 3 account types, the tax benefits can add up. Here’s a hypothetical illustration based on 2026 limits and a 20-year horizon:

Annual contributions assumed:

- HSA: $8,750

- 401(k) + IRA combined: $32,000

- Taxable account: $31,785 (after-tax equivalent of $40,750 gross at a 22% marginal tax rate)

Growth assumption: 7% annually, contributions made at year-end.

After 20 years:

- Tax-advantaged accounts combined: $1,512,405

- Taxable account (after 15% capital gains tax): $1,312,256

Why the difference?

Tax-advantaged accounts allow contributions to reduce current taxable income and any growth is tax-deferred or tax-free. In this example, the taxable account invests fewer dollars each year because contributions are made with after-tax money. Over time, that difference can compound.

This hypothetical illustration compares the value of making maximum contributions to tax-advantaged accounts versus investing the same gross amount in a taxable account over a 20-year horizon. It assumes the individual meets IRS eligibility requirements for tax-deductible IRA contributions and is enrolled in an HSA-eligible health plan for family coverage. Eligibility for tax-deductible IRA contributions depends on income, whether you or your spouse are covered by a workplace retirement plan, and IRS rules, which can change over time.

Assumptions: Annual contributions of $8,750 to an HSA, $32,000 to a workplace plan and IRA combined, and $31,785 to a taxable account (after applying a 22% marginal tax rate to $40,750 gross contributions). Contributions are made at year-end for 20 years. Hypothetical pretax annual return is 7% (not guaranteed). Taxable account assumes a 15% long-term capital gains tax upon liquidation and no interim taxes. Tax-advantaged accounts assume HSA withdrawals are for qualified medical expenses (tax-free). All accounts are liquidated at the end of the projection.

Important limitations:

- This example does not account for state or local taxes, fees, expenses, inflation, interim taxable distributions, or tax-loss harvesting.

- Investment losses could reduce or eliminate the relative advantage of tax deferral.

- Lower tax rates or tax-efficient strategies could make the taxable scenario more favorable.

- A taxable account offers liquidity without penalties. By contrast, non-qualified HSA withdrawals before age 65 incur a 20% penalty plus ordinary income tax; at age 65 and after, non-qualified withdrawals are taxed as ordinary income. Early distributions from retirement accounts may be subject to taxes and a potential 10% penalty unless an exception applies.

- Investors may realize capital gains or losses in any year they sell securities in a taxable account; this example does not take into account capital loss carryforwards or other tax strategies that could reduce taxes in a taxable account.

- The earnings on distributions from a tax-deferred account are subject to federal income taxes and may be subject to a 10% penalty.

This example is for illustrative purposes only and does not represent the performance of any security. Consider your current and anticipated investment horizon when making an investment decision, as the illustration may not reflect this. The assumed rate of return used in this example is not guaranteed. Investments that have potential for a 7% annual rate of return also come with risk of loss.

Putting it all together

HSAs, 401(k)s, and IRAs aren’t rivals—they’re teammates. When used together, they can help you stretch your savings, manage taxes, and prepare for everyday expenses and long-term goals.

If you’re eligible for an HSA, its triple-tax advantage can make it a powerful complement to your retirement accounts. Workplace plans and IRAs add flexibility and higher contribution limits, helping you build a foundation for retirement security.

Here's the key takeaway: Understand your options, know the rules, and consider how these accounts can work together to help you keep more of what you earn and meet your goals.