Taking control of your finances isn’t just about cutting down on expenses and increasing your savings. It’s also about opening yourself up to more options. With the right financial foundation, you have more freedom to make choices, take risks, and move forward with confidence.

Whether you're just starting out, navigating a life change, or planning for retirement, these 5 key steps can help you stay on track for your goals—on your terms.

1. Make a plan

Creating a financial plan starts with naming your goals. If you haven’t identified your goals and set up steps to help you achieve them, then you won’t have a plan to return to if you start to go off track.

There’s no one-size-fits-all approach to planning, but the great thing is a plan can grow and flex with you as your needs change. In your 20s, your goal may be paying off student loans and starting to save. In your 30s and 40s, saving for a home or boosting retirement contributions might take center stage. Nearing retirement? It may be time to shift from saving to thinking about creating a plan to turn your savings into an income stream.

Planning can feel overwhelming at the start, but naming a goal can help the path become clearer. Breaking down big goals into bite-sized steps can make them feel more achievable. To help with this, consider asking yourself:

- What’s the goal? Examples include paying down debt, saving for short-term goals like a wedding or a down payment, and saving for retirement.

- What’s your savings number? How much money do you need to meet your goal?

- What’s your timeline? Knowing when you’ll need the money can help you come up with a savings schedule.

- How will you achieve it? Consider allocating a certain amount of each paycheck toward the goal.

Not sure whether to prioritize paying down debt or saving and investing for another goal? Find balance with our step-by-step guide.

2. Boost your savings

Once your goals are defined and your plan is set in motion, it’s time to supercharge your savings. Automation can be a game-changer. Consider your workplace retirement plan: Contributions are deducted before your paycheck hits your account, making it one of the most effective automated savings tools. You can apply this principle to other goals too. By setting up automatic transfers to savings or debt repayment accounts, you “pay yourself first” and reduce the temptation to spend that money elsewhere. This strategy also helps you stay consistent, even when the market fluctuates or life gets busy.

Investing is another way to help your money work harder for you. Strategic investing, aligned with your goals and timeline, can potentially help you reach milestones faster than parking those savings in cash. There are options for every type of investor including hands-off accounts, where an investment manager chooses and manages your investments for you and hands-on accounts, where you choose and manage your own investments. You can set up recurring investments and take advantage of automation for your investment accounts too.

Ready to learn more? Take a quick quiz to figure out which account might be right for you.

3. Diversify your assets

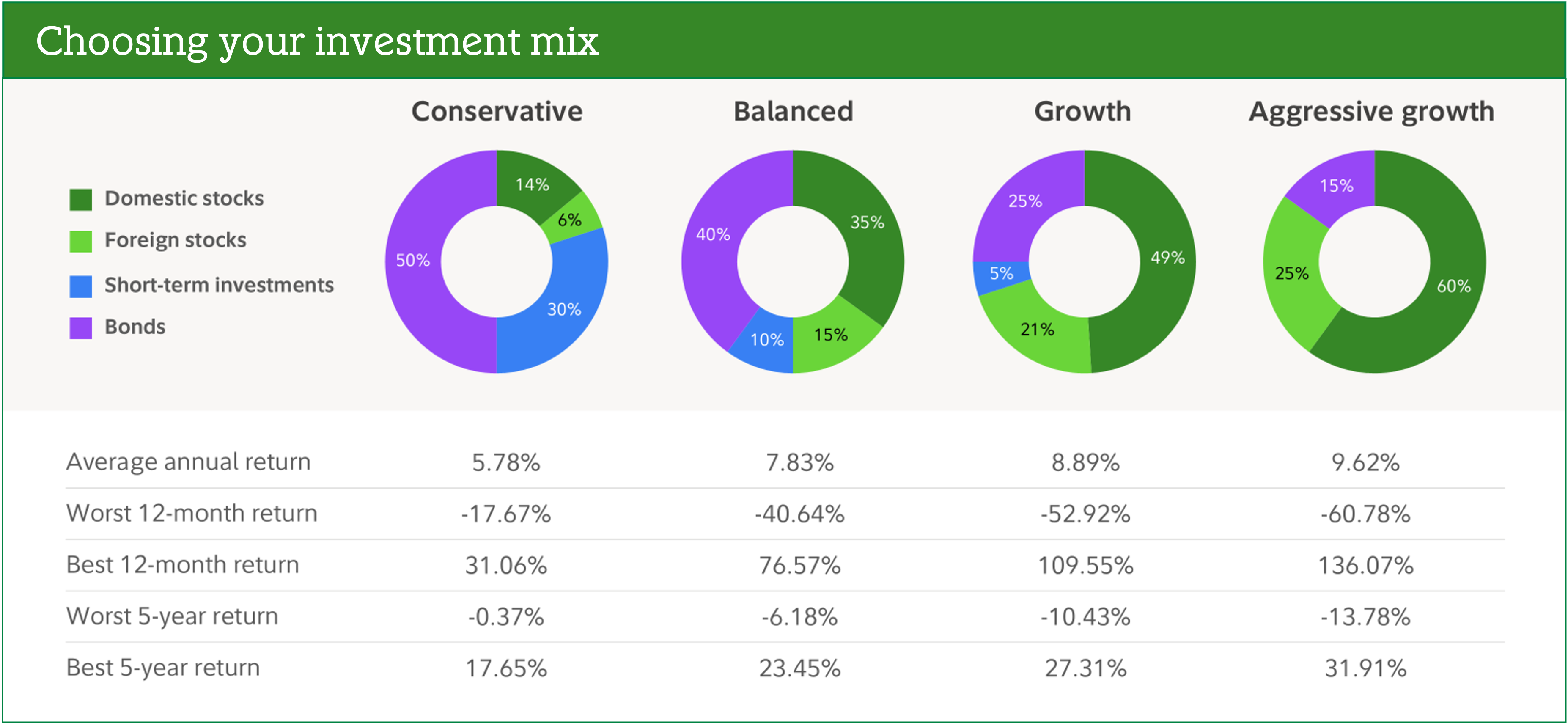

Diversification is an important part of smart investing. It means spreading your money across different investment types, which can help you manage risk according to your goals. Whether you're conservative or aggressive in your approach, choosing the right investment mix—also known as asset allocation—is key.

It’s possible that you could have a very different asset allocation for a goal that is a few years away compared to one that is still decades away. As an example, someone saving for a short-term goal might choose a more conservative mix, while longer-term goals like retirement may benefit from a more aggressive strategy. Everyone’s situation is their own, and we all have our preferences. You want to balance risk and reward in a way that feels good for your timeline and comfort level.

If you’re looking to do more, another strategy to consider is asset location, which is a way to help you manage the tax liability of building your wealth. This where you place investments in accounts that offer the most tax advantages. Asset location can be complicated, but a financial professional can help you figure out if it’s worth exploring.

4. Have a pivot plan

Life can be unpredictable. Whether it’s a job loss, inheritance, divorce, or early retirement, having a plan for curveballs helps you stay resilient. Planning for change doesn’t mean expecting the worst—it means being ready for anything.

It can be easier to do this if you take the time to imagine and plan for the pivots life could bring: the good, the not-so-good, and everything in between.

You can plan for different scenarios by asking yourself how you might feel if one of these pivots happened. How prepared would you feel if you lost your job? Or if you received an inheritance you weren’t expecting? Then you’ll want to come up with a savings number that will help you feel more comfortable no matter what happens.

Start by building emergency savings with 3–6 months (or more, depending on what helps you feel secure) of essential expenses in an account that is liquid and easily accessible, such as a high-yield savings account. Then, consider additional savings for specific scenarios. If you’re thinking about turning a side hustle into a full-time gig, what amount of cushion would help make taking that leap more comfortable?

Insurance and estate planning are also part of a solid pivot strategy. Reviewing your coverage and updating your documents can help to ensure you’re protected no matter what life throws your way.

5. Hold yourself accountable

Accountability is how you turn your plan into progress. Start by scheduling regular check-ins with yourself. And if you have a planning partner, include them too! Treat these money dates like important meetings—because they are. Your financial future deserves care and attention. Review your goals, track your progress, and adjust as needed.

You’ll also want to consider building up your financial support system. Surround yourself with professionals—a financial pro, tax accountant, and/or an estate lawyer—who can guide you and help you stay focused on your future. There’s financial help available to everyone, no matter where you are in your career or savings journey, so take advantage of this support.

But don’t stop there. Share your goals with trusted friends or family members who can cheer you on and give you a nudge when you need it. And most importantly, don’t forget to celebrate your wins. Whether you paid off a credit card or hit a savings milestone, acknowledging your progress can help you feel accomplished and keep that momentum going.

The bottom line

Mastering your money isn’t about perfection—it’s about taking small steps that keep you moving forward. So take that next best step. Reflect, plan, automate, invest, and pivot when you need to. Your money should work as hard as you do—and with the right strategy, it can.