It’s time to set the record straight on health savings accounts (HSAs).

They’re one of the most powerful accounts for managing health care costs and planning for retirement—but also widely misunderstood. From eligibility to how the money can be used, myths and misconceptions still keep many people from taking full advantage.

HSAs are tax-advantaged savings accounts for people enrolled in high-deductible health plans. They offer a triple-tax benefit: You can contribute pre-tax (or tax-deductible, depending on your situation) dollars, pay no taxes on any earnings, and withdraw the money tax-free—now or in retirement—to pay for qualified medical expenses.1

To help clear up the confusion, here are 8 common HSA myths—and the facts that debunk them.

Myth 1: I’m too old to save in an HSA

Reality: It’s not about age—it’s about eligibility. If you’re enrolled in a high-deductible health plan (HDHP) and haven’t signed up for Medicare yet, you can contribute to a health savings account (HSA), no matter your age.

In fact, once you turn 55, you can make an extra $1,000 catch-up contribution each year. That’s a great way to help boost your savings as you approach retirement.

Even after you enroll in Medicare and can no longer contribute, the money in your HSA is still yours. You can continue spending it tax-free on qualified medical expenses—including Medicare premiums, copays, and long-term care costs, including premiums for qualified long-term care insurance policies up to applicable limits.

Bonus: After age 65, your HSA becomes even more flexible. You can use the money for nonmedical expenses without penalty—just like a traditional IRA. You’ll pay ordinary income tax on those withdrawals, but no additional fees. That makes an HSA a valuable, tax-advantaged tool for both health care and retirement planning.

Myth 2: HSA-eligible health plans are too expensive

Reality: While HSA-qualified high-deductible health plans (HDHPs) often come with higher deductibles, they typically have lower monthly premiums—which can lead to meaningful savings, especially for people who don’t use a lot of medical services.

In 2024, the average annual employee contribution toward premiums for single coverage in an HSA-qualified HDHP was $1,259, compared to $1,368 across all plan types.2

For family coverage, the average employee contribution towards premiums was $5,662, also lower than the overall average of $6,296.

Many employers also contribute to employees’ HSAs, helping offset out-of-pocket costs. But even if your employer doesn’t chip in—or if you tend to use more health care—HSAs can still offer long-term value. The triple-tax advantage (pre-tax or tax-deductible contributions, tax-free growth potential, and tax-free withdrawals for qualified expenses) can make these plans more cost effective over time, especially when paired with smart budgeting and saving strategies.

Myth 3: Medicare will cover all my health care costs in retirement

Reality: Medicare helps, but it doesn’t cover everything. Retirees still face out-of-pocket expenses like:

- Medicare premiums and deductibles

- Dental, vision, and hearing care

- Prescription drugs

- Long-term care

In fact, Fidelity estimates that a 65-year-old retiring in 2025 will need about $172,500 to cover health care costs throughout retirement.3 Despite the magnitude of these costs, most people don't even have this on their radar, with 17% taking no action whatsoever when it comes to planning for health care costs in retirement.4

An HSA can help bridge that gap. Money in an HSA can be used tax-free for qualified medical expenses—including Medicare premiums and out-of-pocket costs, as well as other services that Medicare may not cover at all. And after age 65, you can even use HSA funds for nonmedical expenses without penalty (though you’ll pay income tax, just like with a traditional IRA).

This flexibility makes HSAs a powerful tool not just for managing current health care costs, but also for strategic retirement planning.

Read Fidelity Viewpoints: 5 ways HSAs can help with your retirement

Myth 4: You can only open an HSA through your employer

Reality: While many people open HSAs through their workplace benefits, that’s not the only option. If you’re enrolled in an HSA-eligible high-deductible health plan (HDHP), you can open an HSA on your own through a bank, credit union, or financial institution.

This gives you more control and flexibility—especially if you’re self-employed, between jobs, or your employer doesn’t offer an HSA option.

And here’s something a lot of people don’t realize: Your HSA is yours to keep. It’s not tied to your employer, so the money stays with you even if you change jobs, switch health plans, or retire. That makes it a portable, long-term asset you can continue to use and grow over time.

You can open an HSA at Fidelity, with no fees or minimums,5 a wide range of investment options, and tools to help you plan for the future.

Myth 5: Money in an HSA must be spent by the end of the year

Reality: That’s a common mix-up—but it’s flexible spending accounts (FSAs) that have a “use-it-or-lose-it” rule. HSAs don’t work that way.

With an HSA, your money is yours to keep. There’s no deadline to spend it, and no risk of losing unspent money at the end of the year. Your account can continue to grow throughout your life—particularly if you invest the money.

This makes HSAs a powerful long-term savings tool. You can use the money now for qualified medical expenses, or leave it to seek tax-free growth and save it for future needs—even decades down the road.

That flexibility is what sets them apart from other savings options.

Still confused? Read Fidelity Smart Money: HSA vs. FSA: Which is right for you?

Myth 6: I can only have one HSA

Reality: You can have multiple HSAs, though it’s often simpler to consolidate them. If you’ve changed jobs or opened accounts with different providers, you can roll over or transfer the money into a single HSA to streamline management and potentially reduce fees.

But here’s where it gets interesting: You don’t have to choose just one.

If your employer offers an HSA and makes a contribution on your behalf, you can keep that account open to take advantage of your employer’s contribution. At the same time, you can open a separate individual HSA—for example, with a provider like Fidelity—if you're looking for a wide range of investment options, different fee structures, or more flexibility in how your money is managed. Plus, you can open an HSA at any time during the year, not just during annual enrollment.

You can also transfer or roll over money between HSAs, giving you the flexibility to optimize your savings strategy without losing access to your money.

In short: Your HSA is yours, and you have options. Use them to your advantage.

Myth 7: You can’t invest the money in your HSA

Reality: It’s easy to think of your HSA as a savings account for doctor’s visits and prescriptions—but it can be so much more. In fact, you may be able to invest that money and give it a chance to grow over time.

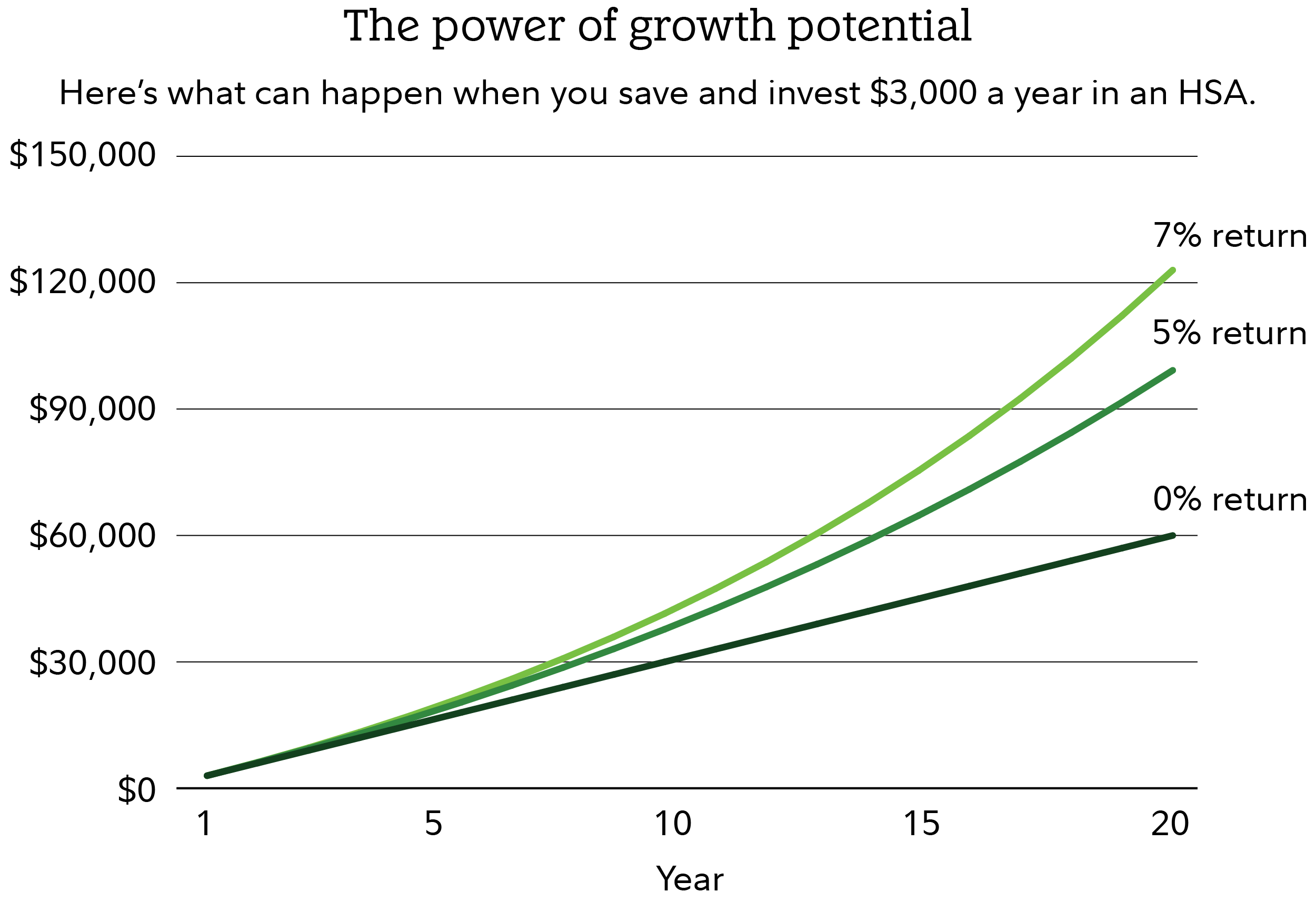

Instead of letting your HSA sit in cash, you could be putting it to work—just like you would with a 401(k) or IRA. And because HSAs come with a triple-tax advantage,1 any growth from investing is tax-free if it’s spent on qualified medical expenses.

If you’re not tapping into your HSA for everyday health costs, investing could be a smart move. And even if you do use your HSA regularly, investing can still make good sense. If you’re able to estimate how much you may spend on health care during the year, you can keep that amount in cash and invest the rest of your balance for the future.

Getting started doesn’t have to be complicated. Many providers offer easy-to-use tools and low barriers to entry. For example, Fidelity lets you start investing with as little as $1—no minimum balance required.

One more tip: If you do pay out of pocket for medical expenses now, you can reimburse yourself later—there’s no time limit. Just be sure to save your receipts.

Myth 8: An HSA is not a retirement account

Reality: Technically, that’s true—HSAs are designed to help with health care costs, not to replace a 401(k) or IRA. But that doesn’t mean they can’t be a powerful part of your retirement strategy. Unlike tax-advantaged retirement accounts, you can use money saved in your HSA potentially tax-free now or later in your life.

That makes HSAs one of the most flexible and tax-efficient tools available for retirement planning—especially considering the rising cost of health care in retirement.

Flexible, tax-advantaged savings for health care

HSAs offer a unique combination of flexibility, tax advantages, and long-term value. Don’t let myths keep you from making the most of this powerful financial tool. Whether you're just starting out or approaching retirement, an HSA can play a key role in your health care and retirement strategy.