Investing involves risk, including risk of loss.

Images and screenshots are for illustrative purposes only.

1.

Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

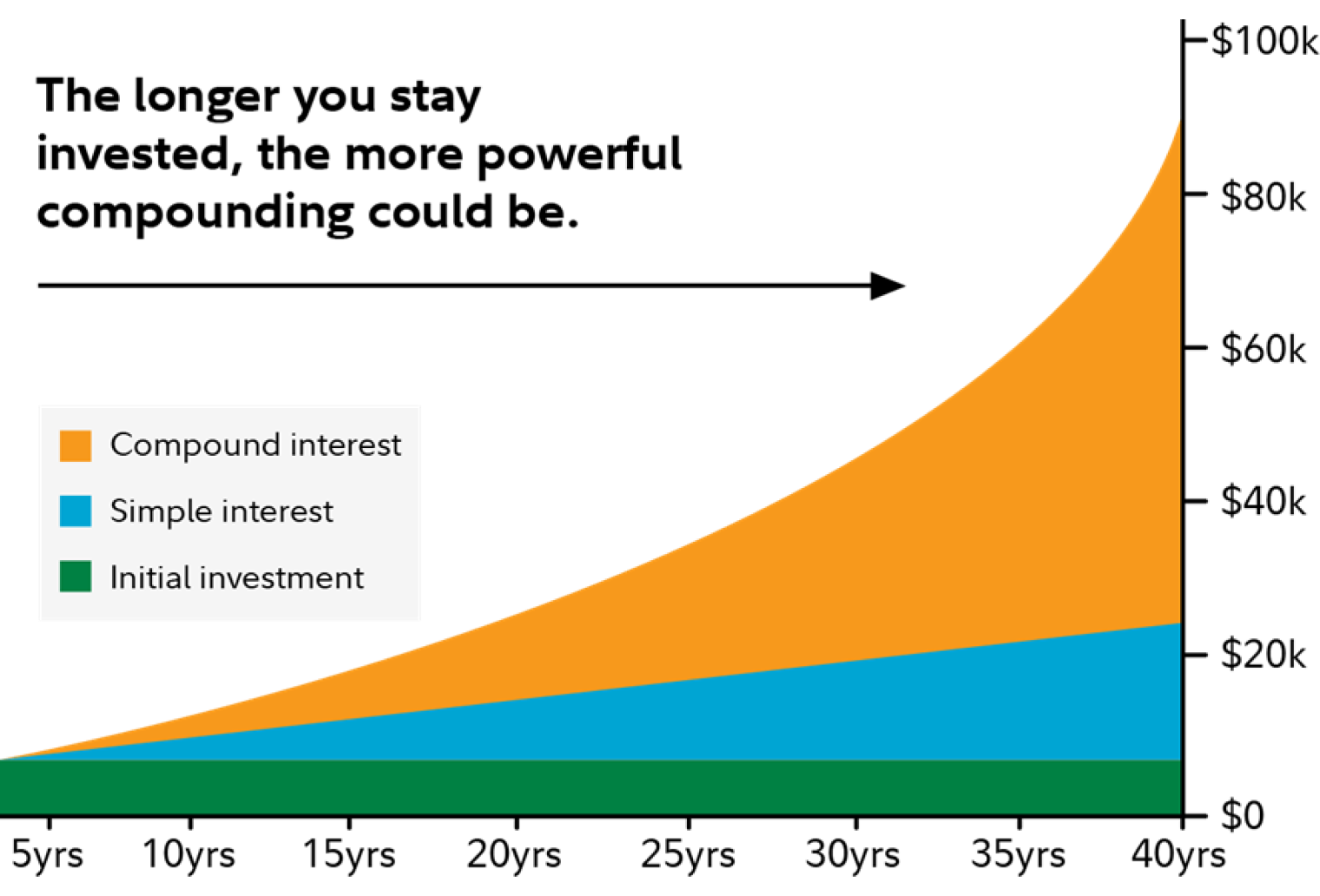

2. This hypothetical example assumes the following: (1) an initial $6,000 contribution and no additional contributions; (2) An annual rate of return of 7% that accrues as simple and compound interest. (3) The ending values do not reflect taxes, fees, inflation, or withdrawals. If they did, amounts would be lower. This example is for illustrative purposes only and does not represent the performance of any security. Consider your current and anticipated investment horizon when making an investment decision, as the illustration may not reflect this. The assumed rate of return used in this example is not guaranteed. Investments that have potential for 7% annual rate of return also come with risk of loss.

Simple interest is the money you earn on your initial investment

Compound interest is what you earn on both your initial investment and all of the previously accumulated interest

3.

Fidelity's Planning and Guidance center allows you to create and monitor multiple independent financial goals. While there is no fee to generate a plan, expenses charged by your investments and other fees associated with trading or transacting in your account would still apply. You are responsible for determining whether, and how, to implement any financial planning considerations presented, including asset allocation suggestions, and for paying applicable fees. Financial planning does not constitute an offer to sell, a solicitation of any offer to buy, or a recommendation of any security by Fidelity Investments or any third-party.

The information presented is intended to be educational, should not be considered a recommendation, and is not tailored to the investment needs of any specific investor. Before opening any account or making any investment decision, you should carefully consider a number of factors, including your needs, goals and comfort with risk

Apple, the Apple logo and iPhone, are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android is a trademark of Google Inc.

Fidelity and the Fidelity Investments logo are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917