There is no shortage of bad information out there—and falling for some of it can cost you money. It could be other people who steer you in the wrong direction, or the things you tell yourself. Whatever the source, believing these myths could be hazardous to your financial health.

Get the truth behind these bits of financial misinformation.

Myth #1: It's not worth saving if I can only contribute a small amount.

In reality: If you start early, around age 25, saving 15% of your paycheck—including your employer’s match to your 401(k) if you have one—could help you save enough to maintain your current way of life in retirement. It sounds like a lot, but don’t lose your motivation if you can’t save that much. Don't be discouraged if you start later than age 25. Beginning to save right now and gradually increasing the amount you're able to put away can help you hit your goals.

Save as much as you can while still being able to pay for essentials like rent, bills, and groceries. Fidelity's budgeting guidelines may be able to help determine how much you can afford to save and spend.

- Consider allocating no more than 50% of take-home pay to essential expenses (including housing, debt repayment, and health care).

- Try to save 15% of pre-tax income (including employer contributions) for retirement.

- Prepare for the unexpected by saving 5% of take-home pay in short-term savings for unplanned expenses.

Myth #2: The stock market is too risky for my retirement money.

In reality: It’s true that money in a savings account is safe from the ups and downs of the stock market. However, it won't grow much either, given that interest rates on savings accounts are typically low. When it’s time to withdraw that money for retirement a few decades from now, your money won’t buy as much because of inflation. The stock market, however, has a long history of growth, making it an important component of your longer-term investment portfolio.

For instance, for a young person investing for retirement, a diversified investment strategy based on your time horizon, financial situation, and risk tolerance could provide the level of growth you need to achieve your goals.

There are a variety of ways to invest. Building a diversified portfolio based on your needs and the length of time you plan to be invested can be as complicated or as simple as you prefer. You can build your own diversified portfolio with mutual funds or exchange-traded funds—or even individual securities.

Even if you choose to manage your own investments, you may not be entirely on your own. 401(k) providers often offer example investment strategies that could give you ideas on how to build a diversified portfolio. You can invest in the funds in the model portfolio in the suggested proportions or you could use the models as a source of inspiration for your own investment ideas.

If you find investing daunting or don’t have the time to figure it out just yet, you might consider a managed account or a target-date fund for savings that are earmarked for retirement.

Myth #3: I’m young, so I don’t need to save for retirement now.

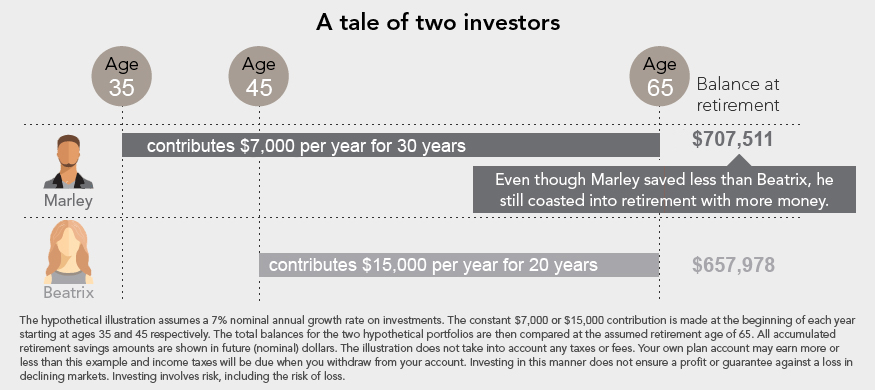

In reality: Retirement can feel very far away when you're young—but having all of those years to save can actually be incredibly powerful. That's because time and compounding are important factors in a retirement savings plan.

Compounding happens as you earn interest or dividends on your investments and reinvest those earnings. Because the value of your investments is then slightly higher, it can earn even more interest, which is then packed back into the investments, allowing it to grow even more.

Over time, the value can snowball because more dollars are available to benefit from potential capital appreciation. Time is the secret ingredient—if you aren’t able to start saving early in your career you may have to save a lot more in order to make up for the value of lost time.

You can start by contributing to your 401(k) or other workplace savings plan. If your employer matches your contributions, make sure you contribute to the match—otherwise you’re basically giving up free money. If you don’t have a workplace retirement account, consider opening an IRA to get started.

Read Viewpoints on Fidelity.com: Traditional or Roth account—2 tips to choose

Myth #4: There’s no way of knowing how much money I’ll need in retirement.

In reality: How much you’ll need depends entirely on your situation and what you plan to do when you leave the workplace.

Fidelity did the math and came up with some general guidelines. Aim to save at least 15% of your pre-tax income every year—including employer contributions. To see if you’re on track, use our savings factor: Aim to have saved at least 1x (times) your income at 30, 3x at 40, 7x at 55, and 10x at 67.* Everyone's situation is unique and you may find that you need to save more or less than this suggestion.

Read about all of Fidelity's retirement saving guidelines on Fidelity.com: Retirement roadmap

Don’t worry if you’re not always on track. Saving consistently, increasing your contributions when you’re able, and investing for growth in a diversified mix of investments could help you catch up over time.

Myth #5: All debt is bad.

In reality: It’s true that carrying a balance on your credit card or a high-interest loan can cost a lot—significantly more than the amount you initially borrowed. However, not all debt will hold you back. Certain types of debt, like mortgages and student loans, could help you move forward in life and achieve your personal goals.

Plus, the interest rates on mortgages and student loans are typically much lower than those on personal loans or credit cards, and the interest may be tax-deductible.

No matter what kind of debt you take on, make sure you shop around for the best rates and never borrow more than you can afford to pay back on time.

Myth #6: Credit cards should be avoided.

In reality: As long as you pay off your card balance in full each month to avoid interest, making purchases with credit can be worthwhile. Many credit cards offer a rewards program. If you make your everyday purchases with your card, you could quickly add up redeemable points for cash, travel, electronics, or to invest.

Also, demonstrating that you use credit responsibly can help increase your credit score, making it easier to buy a car or a home. It may even earn you a lower interest rate when you borrow in the future. It can be difficult to get out of credit card debt, but if you control your spending and pay the card off every month, it could pay off debt fast.