Chocolates get eaten and flowers wilt—but financial responsibility can be a lasting way to show someone you care. Put your wallet where your heart is with these financial acts of love.

1. Bare all—financially

Communication is key to building and maintaining a strong partnership, in finances and otherwise. Couples who say they communicate very well or exceptionally well are more likely to say that they expect to live comfortably in retirement, rate their financial health as excellent or very good, and say that money is not their greatest relationship challenge, a 2024 Fidelity study found.1 They also discuss their finances together at least monthly. Making financial decisions jointly can be a good way to keep the lines of communication open—including day-to-day spending and long-term planning.

Read Viewpoints on Fidelity.com: Tips for couples: Improving money talks

Whether you keep your money separate or combine finances, make sure that you both have a clear understanding of your combined money situation—and that you're both on the same page with goals and expectations. You may have very different ideas about debt, saving, and spending, but thinking about the goals you'll be able to achieve together may help you meet in the middle.

Being in a partnership comes with a few financial advantages over being single—especially if you have 2 incomes. But the first step is knowing how much money is coming in and going out, and setting up a spending and saving plan that works for both of you.

2. Lose your baggage

Having debt is sometimes unavoidable. Make a plan with your partner to knock out debt together, so you can save more money for the future or even spend more on fun stuff today.

After all, money that goes to paying interest on debt could be used in much more efficient ways—like saving for an emergency, for a down payment on a home, or for a big vacation. To make it more efficient, you may be able to separate debts into those you want to pay off more quickly versus those that you can continue paying the minimum on. Try comparing the interest rate on your debt to our 6% guideline. That can help you decide whether your next priority should be paying more than the minimum on your debts or saving for the future.

Read Viewpoints on Fidelity.com: How to balance debt, saving, and investing

3. Invest in your relationship

No matter where life takes you both, it will cost money—and probably more than you think.

Setting savings goals and going after them as a team can bring you closer together. For instance, are wedding bells a future possibility? Are you planning to buy a home or start a family? Even if it's just a future vacation together, figuring out the financial pieces is a big part of setting the wheels in motion to achieve your dreams and live the life together that you want.

Consider using Fidelity’s "50/15/5" spending and saving guidelines:

- Spend no more than 50% of your take-home pay on essentials—that includes housing costs, groceries, health care, transportation, and debt payments.

- Save at least 15% of your pretax income for retirement—that includes any match you may get from your employer.

- Save 5% of take-home pay for emergencies. Aim to accumulate at least enough to cover 3 to 6 months' worth of essential expenses. Then keep saving 5% of take-home pay for unexpected expenses. Saving 3 to 6 months’ worth of essential expenses can feel hard but don’t give up. Start by saving $1,000. That can give you a huge savings win to celebrate and a cash buffer in case of a rainy day. Then keep the savings momentum going until you reach the threshold you need to feel comfortable in that range of 3 to 6 months’ worth of essential expenses.

After you've met your essential expenses and saved for retirement and emergencies, you could use some of the leftover money to pursue your short-term goals.

Here's another tip: Make your saving automatic. You can schedule automatic transfers from your checking or cash management account to a savings or investment account. Arrange for the transfer to happen on the day you get paid, so that the money is out of sight as soon as you get it.

Read Viewpoints on Fidelity.com: 50/15/5: An easy trick for saving and spending

4. Plan to grow old together

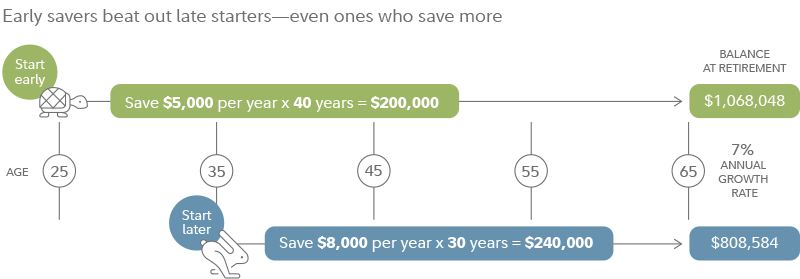

When you're young, the thought of saving money for the distant future can be daunting—are you really supposed to save money for something 40 years or more in the future? Yes! Believe it or not, setting aside money at a very young age is one of the best ways to help ensure that you have enough in retirement.

Read more on Fidelity.com: Compound interest

Time is one of the most important ingredients in your investing strategy, along with the amount you're able to save and your rate of return. Thanks to the magic of compounding, time is arguably one of the most powerful variables when it comes to investing. Compounding happens when earnings are reinvested and begin earning a return of their own. Over time, your investments have the potential to grow when any earnings are added in with the original principal—particularly if that growth is tax-deferred or tax-exempt when it’s in a qualified retirement account like a 401(k) or IRA.

If youth has already passed you by, don't worry! The next best time to start is right now. Sit down with your partner and talk about the kind of life you'd like to share when you're 70 years old. Then make a plan for how to get there.