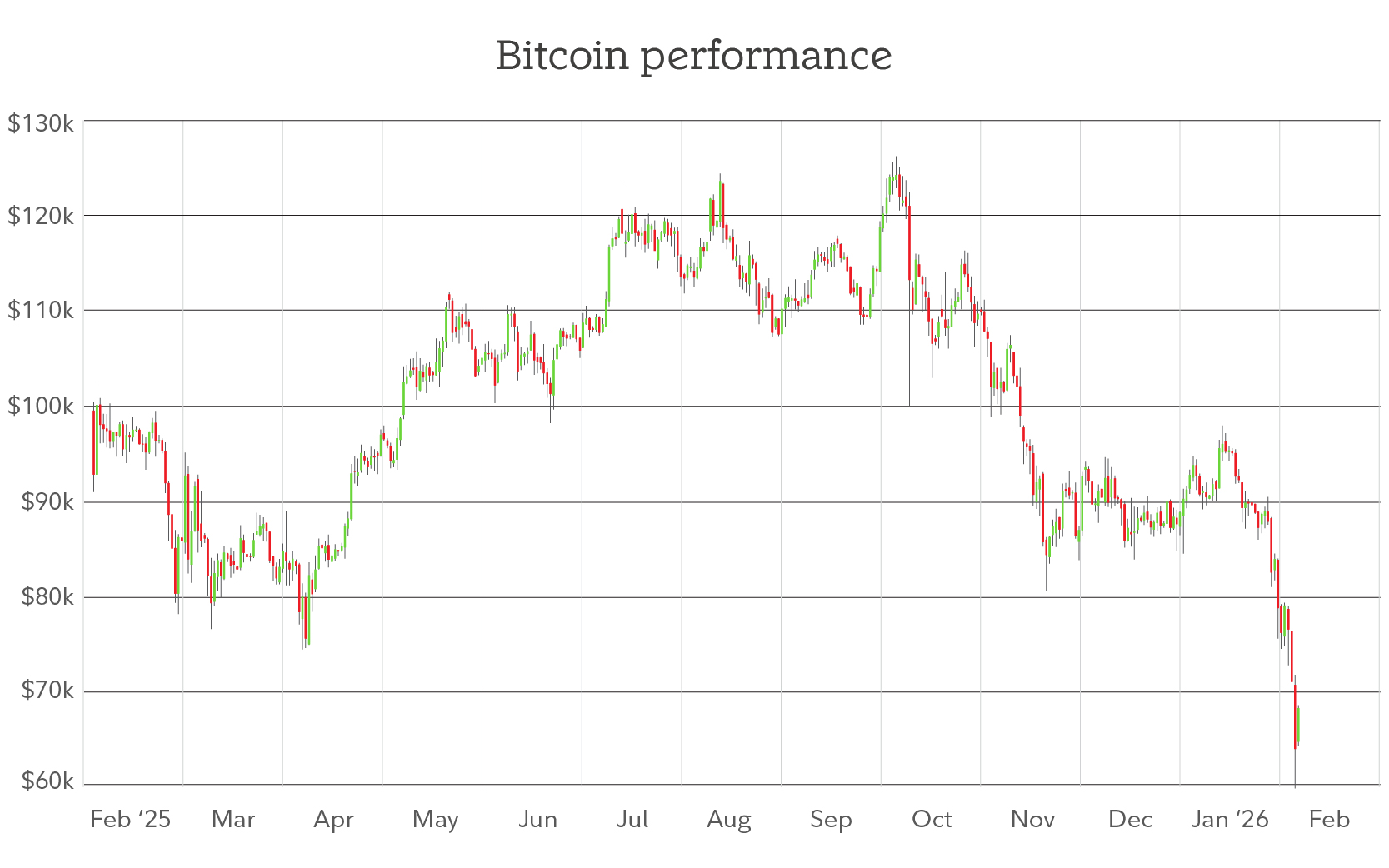

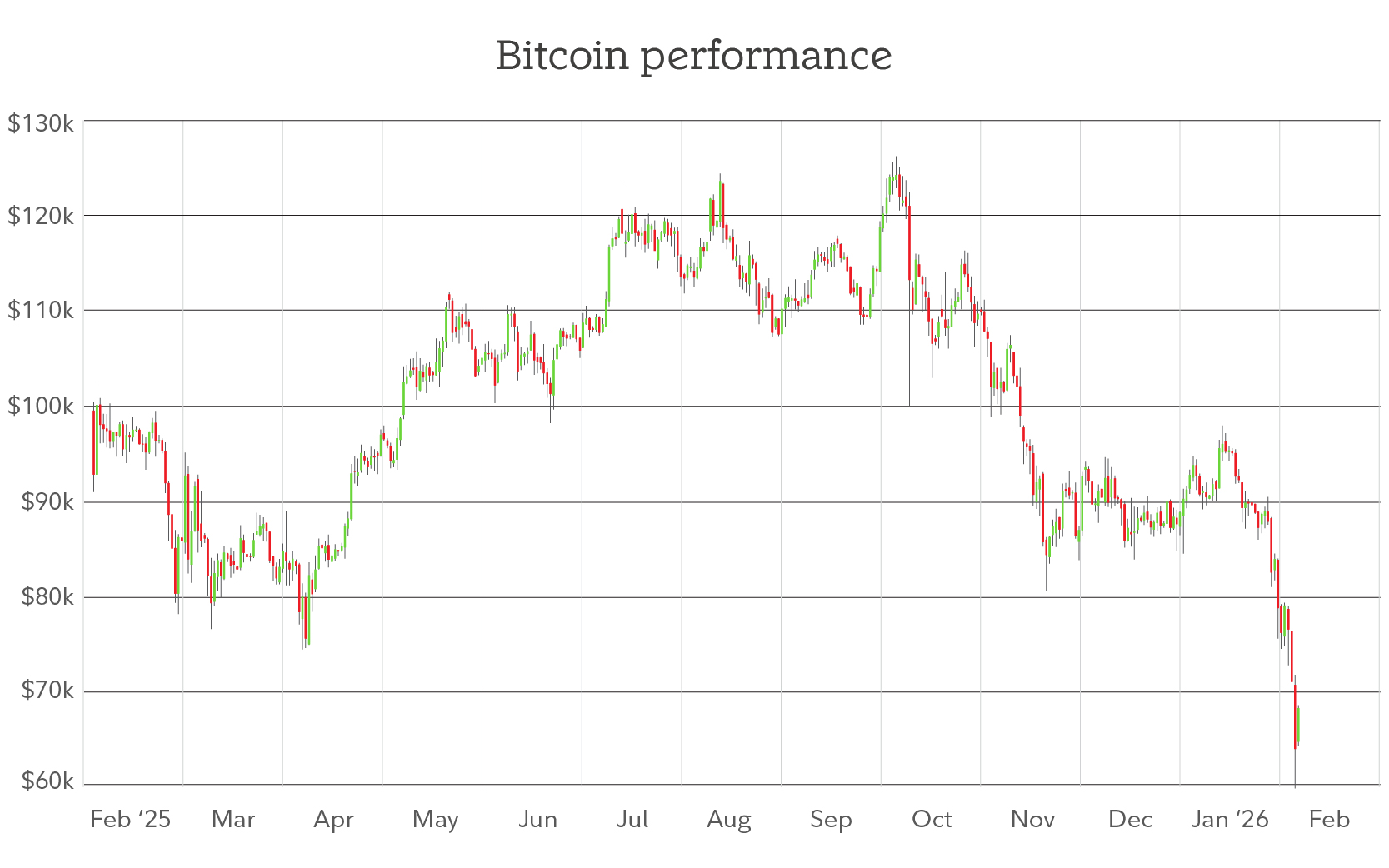

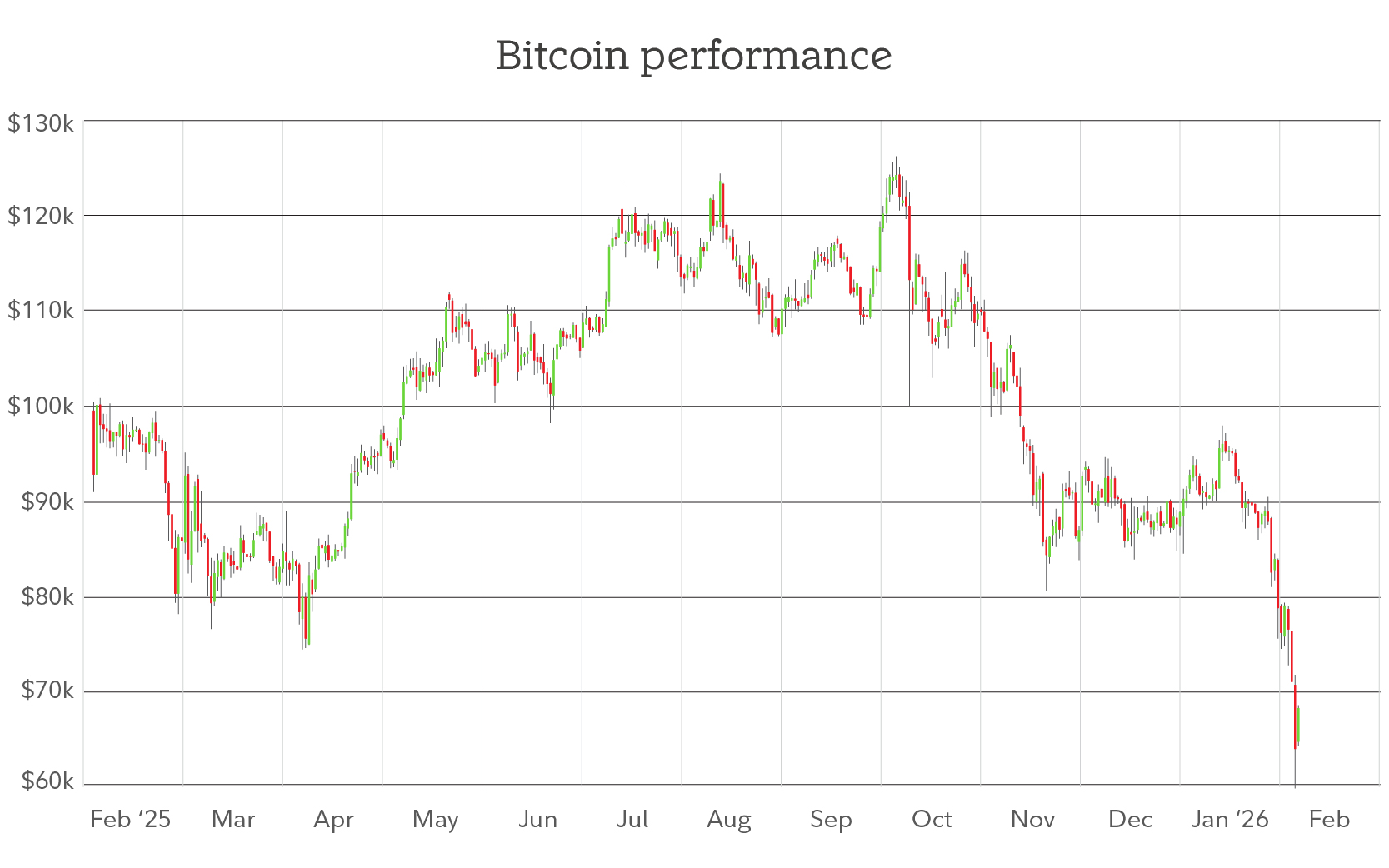

Chart of the week: Bitcoin sinks below $70,000

Past performance is no guarantee of future results.

Investing involves risk, including risk of total loss.

Crypto as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Crypto may also be more susceptible to market manipulation than securities. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Investors in crypto do not benefit from the same regulatory protections applicable to registered securities.

Neither FBS nor NFS offer a direct investment in crypto nor provide trading or custody services for such assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917