Whether you plan to spend your retirement traveling the world, playing with your grandkids, or turning your side hustle into a new venture, you want to make sure your savings will last your lifetime. For many women, paying for retirement will look different than it might have in the past. That’s because these days, fewer retirees have access to a pension. And when you add in things like market ups and downs, inflation, and the gender savings gap, there’s a lot to think about when planning.

Women need to plan differently for retirement for a number of reasons, including a longer lifespan: Women tend to live 5 years longer than men.2 And while a longer life can mean more time to do what you love, it also means your savings need to last longer to cover both necessities and nice-to-haves as you grow older. Health care is one of these necessities and is often one of the biggest expenses women need to plan for in their later years. In fact, a 65-year-old retiring in 2025 can expect to spend an average of $172,500 in health care and medical expenses.3 And due to longevity, the average is $180,000 for women.4 It’s a lot to plan for but knowing you can access guaranteed income can help.

What is guaranteed income?

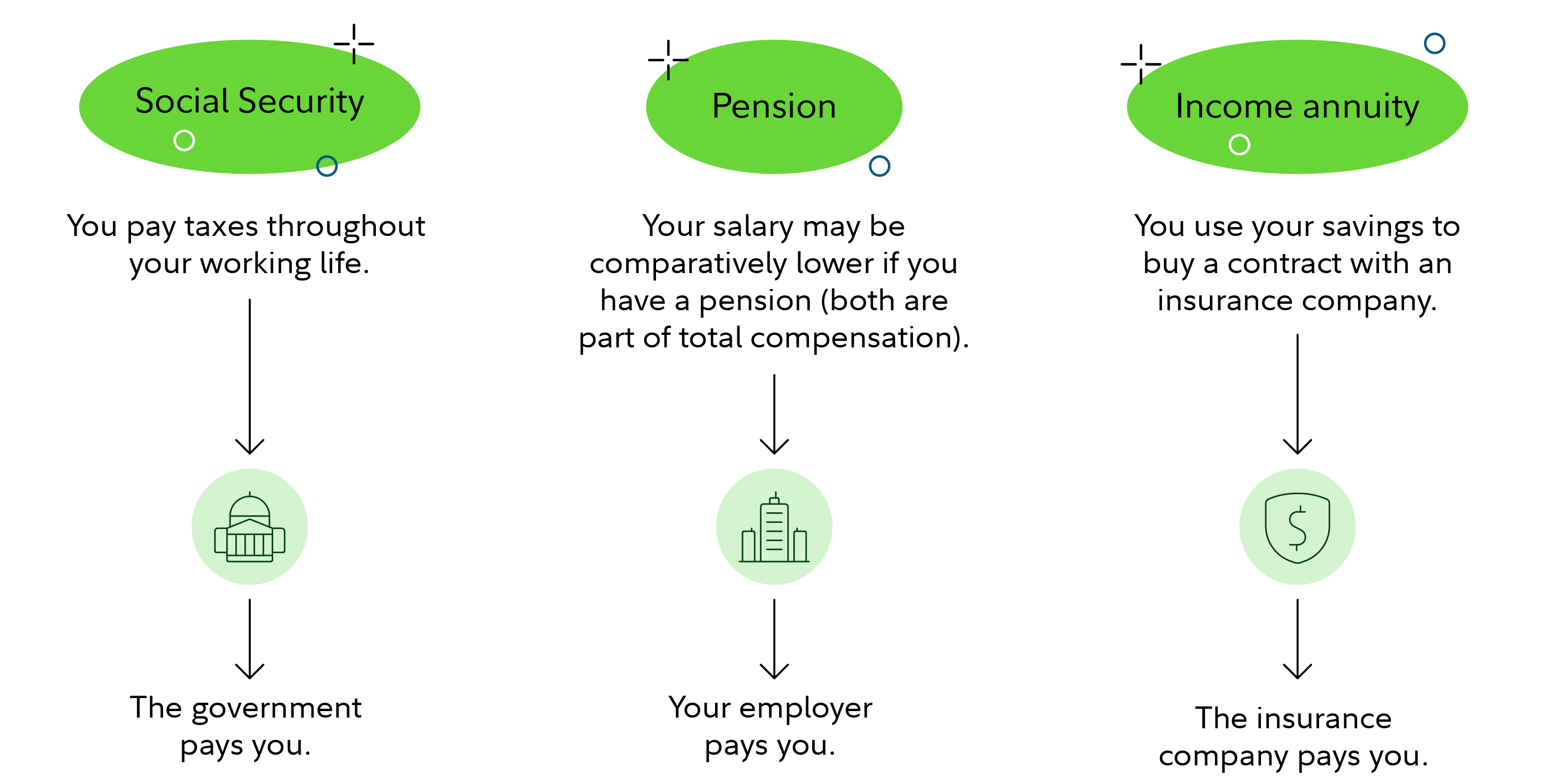

Simply put, guaranteed income is a predictable source of cash flow, like Social Security, a pension, and some annuities.5 It can help create a monthly income stream for the rest of your life, no matter how long you live. You’ll want to have one or more sources of predictable income to help pay for everyday, nonnegotiable expenses in retirement.

How guaranteed income can fit into your retirement income plan

As you approach retirement, it can be a big mindset change to go from saving to spending, but that’s why financial professionals are here to help. Guaranteed income can help play a key role in a retirement income plan and help ease that mindset shift.

"I ask clients about things that might derail their plan and we talk about how they would feel, how it would affect their spending. Creating a strategy that includes guaranteed income can help protect your retirement income."

—Gina Gillespie, Vice President, Financial Consultant

In the years leading up to retirement, you want to think about what your monthly expenses will look like. Doing that will help you come up with your retirement income plan, or recreating something similar to the paycheck you’ve had during your working years. A good guideline is to plan for 55% to 80% of your pre-retirement income annually.6

Everyone’s situation is different, but you can think about your spending in 2 separate categories:

- Essential expenses: The nonnegotiables for everyday life, like housing costs, food, utilities, taxes, and health care.

- Non-essential expenses: What you do for fun, be it travel, shopping, or other hobbies.

Once you have a sense of these expenses, you can think about what income sources will cover them. It’s helpful to have predictable sources of income for those essential expenses, so you always know that your nonnegotiables are covered. That’s where guaranteed income sources, including some types of annuities, come in.

An income annuity can help cover those essential expenses in retirement

There are many different types of annuities for different goals. An income annuity turns your investment into guaranteed income—either for life or for a set number of years—so you get a fixed payment no matter what the market does. It’s a contract with an insurance company that shifts some of the risk away from you and onto the insurance company. You take advantage of this by either making a lump sum payment into the contract or a series of payments, and you can receive income either now or in the future.

“Say you're in your 60s or retiring soon. An income annuity could help you cover your essential expenses with a guaranteed income stream.”

—Stefne Lynch, Vice President, Annuity Product Management & Client Engagement, Fidelity Insurance Agency

To help make up a portion of that theoretical retirement paycheck, an income annuity can provide a consistent income stream. Say your essential expenses total $4,000 a month, your Social Security will cover $2,500, and you expect no pension. An income annuity could help make up all or a portion of the $1,500 difference and help add to your confidence in your plan. Keep in mind that since women generally live longer than men, they typically receive less from an equal-sized income annuity purchase. This means that you may need to spend more as a woman to cover the same spending gap, but the tradeoff is income for a potentially longer lifespan.

How much you’re paid depends on different factors

A common question about income annuities is: “What happens to the payments when I pass away?” The short answer is that it depends. Fixed lifetime income annuities come with different options that pay out different amounts of income, depending on how much, if any, income your beneficiary will receive when you pass.

Here are 3 common options for fixed lifetime income annuities:

- Life with a cash refund: You receive income payments for as long as you live. If you pass away before receiving payments that total your original investment, your beneficiary will receive the difference.

- Life with a guarantee period: This option also pays you for life. But if you pass away before your selected “guarantee period” ends, your beneficiaries will continue receiving payments until that period ends.

- Life only: This option gives you the highest income of the 3 listed here, but there’s a tradeoff: Payments stop when you pass away and nothing goes to your beneficiaries. It’s designed to maximize your lifetime income.

If you want to get a sense of what your monthly income could be with a fixed income annuity, we have a tool called the guaranteed income estimator that makes it easy. It compares the income generated by different types of annuities, so you can get a sense of which annuity, if any, might be a good fit for you.

Guaranteed income can be a way to seek security amidst uncertainty

43% of women say they aren’t sure how to handle future dips in the market.7 Creating a steady stream of income that doesn't come from market-based sources like bonds or stocks can help increase your confidence in your retirement income plan. It also may help you stay the course and tune out the noise when those market swings do happen.

Read our guide on what you should know about investing through volatility.

What you may want to keep in mind

Annuities aren’t typically a standalone solution, rather they can work alongside your other investments, savings, and retirement benefits to help create a plan that can be more predictable and less stressful. That said, there are things to consider before you purchase an annuity contract:

- Annuity guarantees are dependent on the ability of the insurance company to make payments. This is why it’s important to choose a company with a high credit rating.8

- Depending on the annuity you purchase, withdrawing funds early can have financial implications, including penalties, taxes, and surrender charges. You will also need to pay taxes on any earnings once you start receiving payments, which are taxed as ordinary income.

- Annuities have different fees depending on the product and type you choose. Make sure you understand how they work before deciding.

A financial professional can help you better understand your options

As you start to put together a plan, a financial professional can walk you through different annuity options and help explain how they work. That way, you can decide whether an income annuity might fit your unique needs.

Want to learn more about annuities? Check out a replay of our Women Talk Money discussion about decoding annuities.