When the headlines paint a worrisome picture, the economic outlook is uncertain, and markets are volatile, it’s understandable to want to play it safe with your portfolio. Or maybe you’re approaching retirement age and are beginning to think about how to make the money you’ve saved last long enough to maintain your desired lifestyle for your remaining years. Watching your account balance fluctuate with the market is hard enough when you’re still earning and retirement is decades away; it can be even harder when you need that money to pay for your day-to-day expenses.

While you may be tempted to pull back from the stock market and park your money in safer harbors, such as fixed income investments, or to pull it out of the market altogether and let your cash sit in a bank account, doing so won’t necessarily protect you from running out of assets. In fact, in some circumstances, adopting a more conservative portfolio allocation might actually increase the odds of having a shortfall late in retirement, leaving you without the assets you need precisely when you need them the most.

“People often think, ‘I’m retired, so I should be more conservative,’ rather than considering the practical realities of aging,” according to Riley Stallard, regional vice president, Planning Solutions at Fidelity Investments. “In the past, people’s retirements were relatively short, and because of that, the prospects of their portfolio recovering quickly enough to sustain their lifestyle after a market downturn were not very good. But that’s not necessarily the case today, for several reasons.”

Instead of making decisions based on what's going on in the markets, investors should base their choices on their personal circumstances: their long-term goals, their present financial situation, their time horizon, and, yes, their tolerance for risk. A closer look at these factors may show that short-term market volatility tends to have a limited effect on long-term objectives. Or it may reveal that a more aggressive asset allocation is necessary to help achieve your financial objectives, whatever they may be.

“As you age and approach retirement, your investment timeframe shortens—that’s one way to think about how you allocate your assets,” says Matt Bullard, regional vice president, Planning Solutions at Fidelity Investments. “But there’s more to consider. For instance, how much do you actually intend to use? You may discover that your necessary expenses are covered by retirement income sources such as pensions, Social Security, or annuities. If that’s the case, then it may not make sense to think about the assets that are left over in terms of your retirement timeframe. You may want to think about them in terms of your legacy. In that case, the timeframe gets much, much longer.”

While a more conservative allocation can certainly be a reasonable choice for many investors, it’s a decision that should be reached only after a thorough consideration of these factors—and not solely as a means of quelling anxieties about short-term economic and market performance. (There are other, more productive ways to handle those feelings: How to stay invested in volatile markets.)

Investments that are less exposed to market volatility can play an important role in your overall financial plan, especially for things like emergency savings or shorter-term spending needs. But allocating too much to asset classes such as cash or fixed income may be costly. That’s because despite the name, a conservative asset allocation is not entirely free of risk. Furthermore, these risks can be harder to detect and potentially more detrimental to your portfolio than you realize. Before you make any drastic changes, consider these 3 “hidden” risks that can present challenges for conservative investors.

Inflation

When is a dollar worth less than a dollar? It’s not a riddle—it’s a real question with an answer that may have consequences for your savings.

The answer is: The longer you hold onto it.

We’ve heard a lot about inflation over the last few years, and for good reason. In the years following the COVID-19 pandemic, inflation reached historic highs, and high inflation not only leads to higher prices for the goods and services you’ll need to spend money on, it can also reduce the purchasing power of the dollars you’re holding in your bank account. In short, a dollar in your bank account today may potentially be worth less—that is, won’t be able to buy as much—in the future.

“That’s a hidden cost of being in a conservative allocation,” says Bullard. “Because of inflation, your dollars may look stable, but in real terms, they’re shrinking.”

Even when inflation is at so-called “normal” levels (the Federal Reserve generally aims to keep inflation at around 2%), it’s subtly chipping away at your purchasing power. But because the number in your savings account or on the face of your dollar bill doesn’t budge, it’s easy to overlook that your uninvested cash is losing value over time, which can impact your overall financial plans.

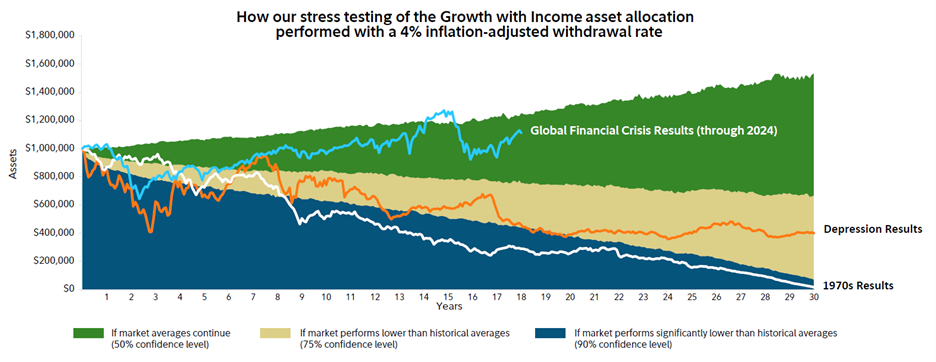

“Our research shows that the biggest risk to long-term sustainability may not be a short-term market event like the Great Depression or the Great Recession, but rather the type of high inflationary environment that we saw in the 1970s and ‘80s,” says Bullard.

Health care costs

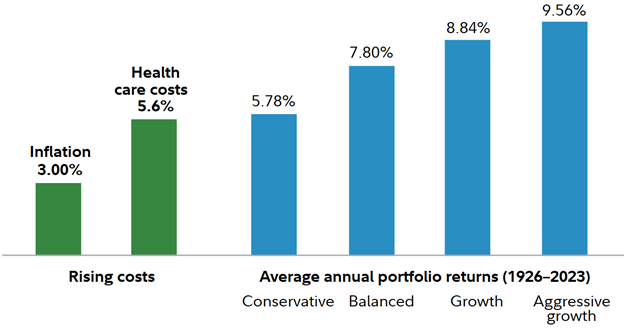

Benjamin Franklin once wrote that the only things certain in life were death and taxes, but if he were alive today, he’d likely want to add a third thing to his list: The cost of health care has historically shown an upward trend. In fact, according to the Centers for Medicare and Medicaid Services, a government agency, it’s projected that health care costs will rise by 5.6% annually through the year 2032. The average couple will likely need an estimated $345,000 to cover medical expenses in retirement, excluding long-term care.2

Like inflation, health care expenses can creep up on you. While it may be difficult to imagine now, it's possible that your health care needs may increase as you age, even if you don’t face a serious or chronic medical issue. So on top of health care getting more expensive in general, you are also likely to be spending more on it than you anticipate.

Longevity

The effects of inflation and health care expenses are both compounded by a third issue: Chances are, it’s possible that you may live longer than you expect. That’s great. But that means you’ll need to take steps to help ensure that your assets aren’t just stable but have enough growth potential to support you throughout your retirement.

This graph is for illustrative purposes only and does not represent actual or implied performance of any investment option. Data for health care costs is from the Centers for Medicare and Medicaid Services, National Health Expenditures Estimates 2023–2032. All indices are unmanaged, and it is not possible to invest directly in an index. Past performance is no guarantee of future results. Returns include the reinvestment of dividends and other earnings. Data source: Morningstar Inc., 2024 (1926–2023 ). Domestic stocks are represented by the S&P 500® index, bonds are represented by U.S. Intermediate Government Bond Index, and short-term assets are based on the 30-day U.S. Treasury bill. Foreign equities are represented by the MSCI Europe, Australasia, and Far East Index for the period from 1970 to the last calendar year. Foreign equities prior to 1970 are represented by the S&P 500 ® index. Inflation is represented by the Consumer Price Index. U.S. stock prices are more volatile than those of other securities. Government bonds and corporate bonds have more moderate short-term price fluctuation than stocks but provide lower potential long-term returns. U.S. Treasury bills maintain a stable value (if held to maturity), but returns are generally only slightly above the inflation rate. Asset allocation does not ensure a profit or protect against a loss.

“People are living longer, costs are rising, and medicine keeps improving,” says Stoddard. "It’s possible that you could live for a significant number of years in retirement—potentially even longer than you worked. The greatest risk to making your money last may not be the market; it may be that you’ve become conservative too prematurely, which could result in passing up the potential for compounding growth that could sustain you through the rest of your life.”

Understand the different types of risk

“It’s important to consider the pros and cons of different types of risk,” says Bullard. “There’s potential upside to the risk you are exposed to when you invest in the stock market. You may end up with more to leave to your kids and grandkids if you’re willing to endure a little volatility from time to time. But the risks you are exposed to when you choose a more conservative allocation have the potential to undermine your ability to reach your long-term retirement and wealth-transfer goals. Risk is a tool, and the ultimate question is: What type of risk is right for you?”

An asset allocation attuned to your personal needs and long-term goals, paired with a withdrawal and spending strategy that is conscious of the risks you face in retirement, can help to ensure that you enter your golden years with confidence. With the right plan in place, an investor could potentially shrug off the short-term volatility that might otherwise compel them to react emotionally and lead to the kind of knee-jerk decision that could potentially threaten their ability to sustain their assets over time.

Still, if this all seems easier said than done, it may be wise to consult with an experienced financial professional who can provide you with the context and coaching necessary to help find the appropriate asset mix for you so you can face these challenges head on. (Learn more: How an advisor can help you reach your retirement goals.)