Although stocks have experienced healthy gains through the first half of the year, it wasn’t an easy ride for investors. The S&P 500 Index dipped 19% in early April on news of global tariffs. But that move proved short-lived: Markets staged a turnaround and hit new all-time highs by June. “What investors saw in April was a typical market reaction to uncertainty,” explains Naveen Malwal, institutional portfolio manager with Strategic Advisers, LLC, the investment manager for many of Fidelity’s managed accounts. “The initial tariff announcements were a surprise in terms of levels and range of countries affected, which led to a lot of questions for investors on the outlook for corporate profit growth.”

While news about tariffs has become more muted in recent weeks, questions remain. Will higher costs from tariffs trickle down to consumers, pushing inflation back into the forefront of the conversation? Was slowing growth in the recent jobs report an indication that the economic tide may be turning? Given today’s relatively high stock valuations, should investors consider scaling back on equities?

“Markets don’t like uncertainty and surprises. In April, investors didn’t know what tariffs might look like, or what they might mean. But now, many of those uncertainties may already be priced into the market,” says Malwal. “That said, I wouldn’t be surprised to see more choppiness for the remainder of this year. What we have seen recently in the client portfolios that our team manages is that a focus on diversification offered some resilience to volatility, as well as the opportunity to take advantage of rebounds by staying invested.”

Malwal points to 3 themes that investors may want to consider as they assess their investment strategy for late 2025 and into 2026.

The potential for higher inflation

As the picture has become clearer on tariffs, it now seems likely that the US will keep some level of tariffs in place, says Malwal, though the exact amount also seems likely to shift over time. Tariffs have historically often led to higher prices for certain consumer goods. Based on this, Fidelity’s Asset Allocation Research Team (AART) recently revised its headline inflation estimate to 4%, which would represent an increase from recent levels around 2.7%.

“This is another example of something that is potentially priced into the market today,” says Malwal. “While this level of inflation may be a challenge for consumers, I also don’t believe we’re looking at a situation like we had in 2022, when inflation stayed above 5% for several years.”

Stable but modest economic growth

Adding to many investors’ uncertainties have been some mixed-picture signals from the economy. In the first quarter of 2025, gross domestic product (GDP) slightly shrank, then grew again in the second quarter, while second quarter job gains were revised below initial estimates.

Other key metrics, however, such as corporate profits, consumer spending, and bank lending, point to continued economic strength, says Malwal. He notes that while unemployment has ticked up modestly, it’s still very low by historical standards. “At Strategic Advisers, we are watching many economic factors very closely as we manage client portfolios,” he says. “The job market has shown some signs of cooling, but unemployment is still low and relatively stable. This may support continued economic expansion. But the pace of growth may be more modest if tariffs wind up driving up consumer prices.”

Managing risk

“Diversification has been very beneficial this year,” says Malwal. For example, in the first half of 2025, a hypothetical diversified portfolio made up of 42% US stocks, 18% international stocks, 35% bonds, and the rest cash equivalents would have outperformed a portfolio solely made up of US stocks.1 That hypothetical diversified portfolio would have also offered reduced volatility during the April sell-off, falling just 6.5% compared to a nearly 16% drop for US stocks.

Malwal also points to several strategies Strategic Advisers has been using to help manage risk in client portfolios.

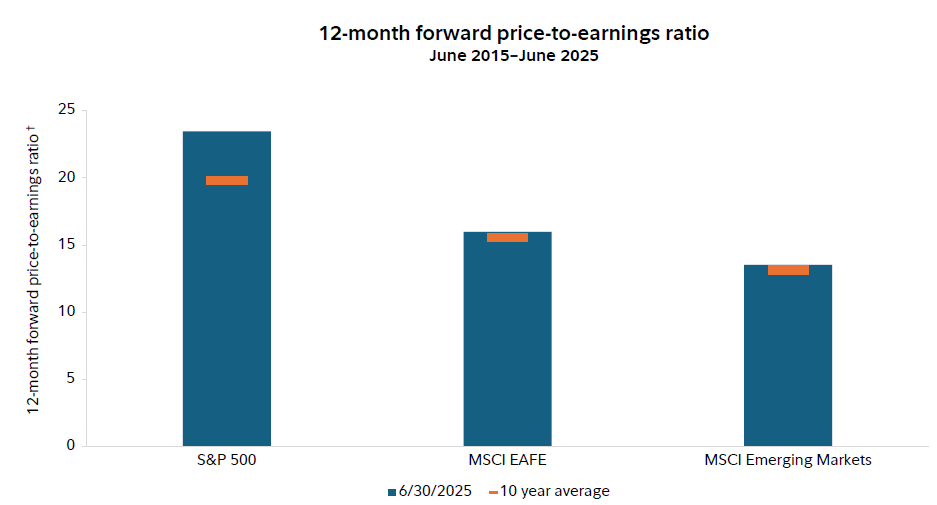

Continued international exposure. Last year, Strategic Advisers started seeing signs of improving outlook overseas and began to lean more toward international stocks. “We saw that valuations for international equities were more favorable than for US stocks. Historically, lower price-to-earnings valuations have often led to higher returns,” says Malwal. Year to date through June 30, 2025, non-US stocks returned more than 18% while US stocks returned about 6%.2 Since international valuations still look favorable compared to US stocks, Strategic Advisers has generally maintained this allocation this year, says Malwal, only recently adding back some US stock exposure given the greater certainty around the impact of tariffs.

Watching valuations. Some investors may feel nervous about high valuations on US stocks. “Historically, the stock market has still experienced gains starting from high valuations,” says Malwal. “Those returns have been more modest compared to periods with lower valuations. Yet even those more modest returns have typically outpaced the returns on bonds and short-term investments. And we believe having exposure to both US and international stocks may deliver smoother investment returns than investing in just US stocks.”

Maintaining inflation protection. With the potential for inflation to tick up again, the team at Strategic Advisers has kept asset classes that have historically provided a buffer against inflation in diversified client portfolios, such as commodities, REITS, alternatives, and Treasury Inflation-Protected Securities (TIPS). “During the April decline in stocks, every one of those diversifiers performed better than US stocks,” Malwal notes.

Holding bonds for stability. While no one can predict with certainty the actions of the Federal Reserve, it is widely expected that they may further lower interest rates later this year. Fidelity's bond managers believe that a combination of high current yields and interest rates that are expected to gradually fall later this year is creating an attractive total return opportunity for bond investors in the months ahead. “In the meantime, relatively high interest rates are providing bond investors with income and a potential boost to future returns,” says Malwal.

The bottom line: Stay invested

Volatility can create emotional struggles for investors, acknowledges Malwal. But it’s worth keeping in mind that by late July the S&P 500 had rebounded to a new all-time high following the sell-off in early April. “Someone who went to cash earlier this year would unfortunately have missed out on that strong recovery,” Malwal notes. If you struggle to stay invested in times of volatility, you may want to consider getting help from a professional, who can help you keep perspective, avoid rash decisions, and create a portfolio that seeks to balance growth potential while managing risk. Says Malwal: “Our goal is to give our clients more confidence to stay invested and stick with their plan, especially during times of high uncertainty.”