The economic landscape in late 2025 has been buffeted by crosswinds. While the economy has continued to grow, tariff policies remain unsettled, inflation risks persist, and recent job reports have raised questions about the pace of future growth.

So far, the US economy has continued to expand and does not appear likely to tip imminently into recession. Gross domestic product (GDP) has continued to grow this year, despite some tariff-related volatility in the quarterly numbers. And corporations reported surprisingly strong profits in the most recent quarter—with analysts now expecting double-digit earnings growth for the S&P 500® Index this year.1

Still, key economic indicators like unemployment, manufacturing, and business and consumer confidence have remained mixed, and there is the potential for more policy changes ahead. So investors should prepare themselves for the possibility that uncertainty may persist. US stock valuations are already relatively high, which can make the market more susceptible to wobbles—meaning continued uncertainty could fuel continued volatility.

This ambiguous backdrop might make investors hesitant to stay the course. But as this year has already shown, markets have often continued to rise even against imperfect economic environments. For investors, the smartest moves right now might be not to abandon their plans, and instead to stay invested and rely on broad diversification for help in weathering any future storms of volatility.

A volatile start to the year—then a strong recovery

The second quarter of 2025 began with a sharp sell-off in US stocks, triggered by announcements of unexpectedly high tariffs. US stocks fell more than 19% from peak to trough—just shy of the 20% bear-market threshold—and measures of volatility spiked.

But the bear-scare proved short lived. The US announced pauses on many tariffs, opening the door to negotiations on trade policy, and the market staged a dramatic V-shaped recovery. Before the second quarter was out, the S&P had already made up all its lost ground and broken into new record-high territory.

While this market reaction might have been jarring for investors to experience, in many ways it showed typical market behavior—with investors taking time to absorb and process how new developments might impact the economy and corporate profits.

“Initially, so much was unknown about the tariffs, including how high they would be and how many countries would be affected,” says Naveen Malwal, institutional portfolio manager for Strategic Advisers, LLC, the investment manager for many of Fidelity’s managed accounts. “But since the lows in April, investors have had more time to think through the impacts on overall economic growth and specific companies’ profits. A sharp recovery like that can happen when investors retest their initial assumptions and wind up reaching better conclusions.”

The value of staying invested—and diversifying

This year’s dramatic market turns have vividly illustrated the importance of staying invested even when the news is changing rapidly. Investors who bailed out when the news looked the worst might have locked in the S&P 500’s 19% peak-to-trough decline. Investors who simply held on to US stocks would have done much better: As of September 15, the S&P 500 had generated year-to-date returns of 13.5% so far in 2025.

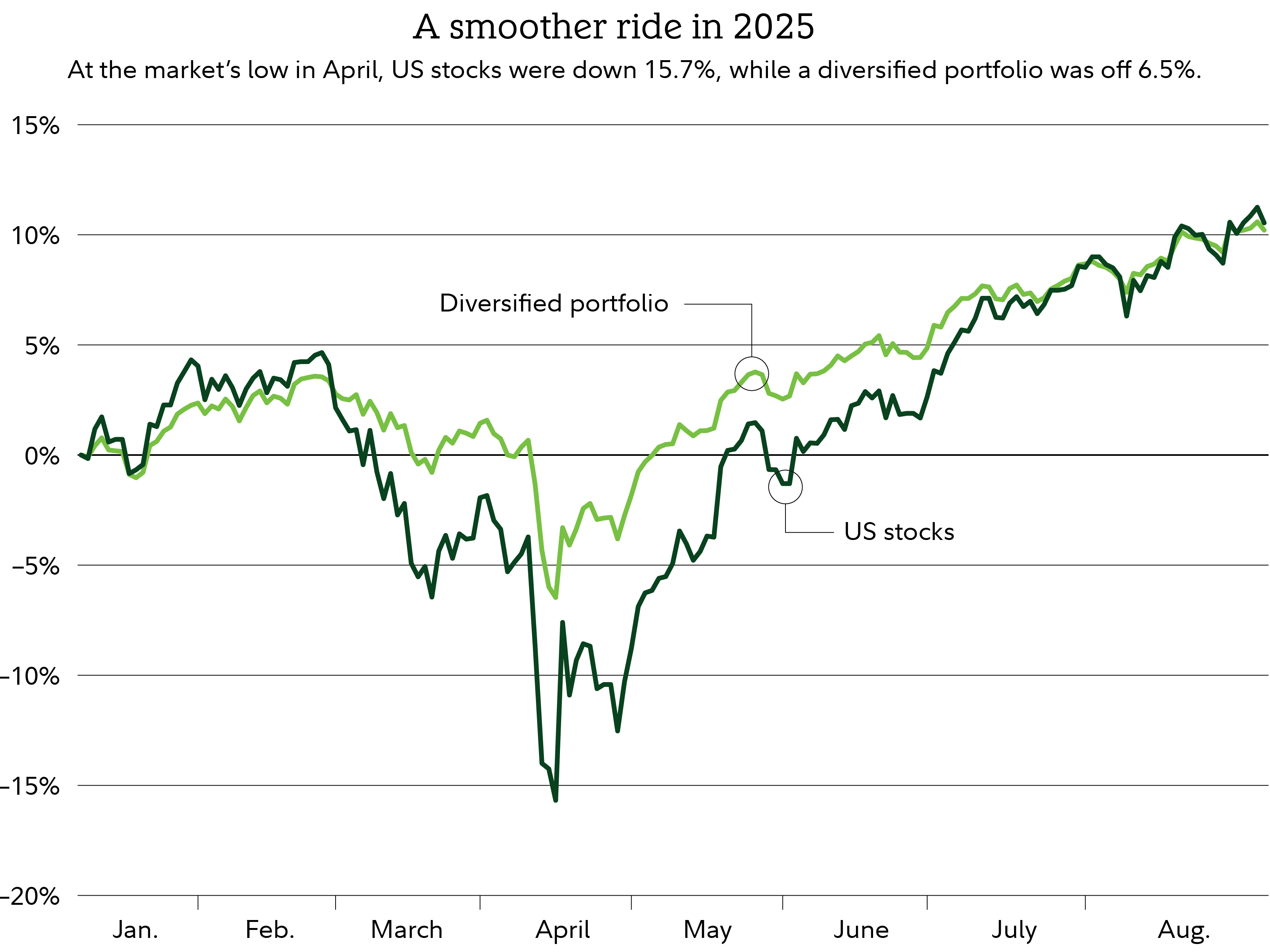

Yet well-diversified investors might have had a smoother journey to a similar result. A portfolio broadly diversified among US stocks, international stocks, long-term bonds, and short-term fixed income lost less than a US-stock-only portfolio, as of the April market lows—seeing a maximum year-to-date decline of 6.5% compared with a maximum decline of 15.7% for US stocks. Yet the diversified portfolio still generated total returns comparable to that of the US-stock-only portfolio, as the chart below shows, as of the end of August. Remember however, diversification and asset allocation do not ensure a profit or guarantee against loss.

“An investor with a mix of stocks and many other investments actually likely experienced much less volatility this year,” says Malwal. “And that’s the goal of diversification. It doesn’t always work. But most of the time, if the US stock market sells off, a diversified portfolio may benefit from resilience in other asset classes.”

The economic outlook: Ambiguous signals, but still expanding

The market’s recovery since April suggests that investors now expect economic activity and corporate profits to continue their upward march—slowing, perhaps, but not turning negative.

But key economic indicators continue to give mixed signals as to what may lie ahead. Take the job market. Data revisions last month showed that job gains in spring and summer were much lower than initially expected, suggesting a slowing job market. However, even after its recent slight rise, the US unemployment rate of 4.3% is still low by historical standards. For every indicator that seems to be flashing yellow (such as a contraction in the manufacturing sector), there seems to be another flashing green (such as an upturn in CEO confidence).

No end date to risks from inflation, policy uncertainty, and recession

Although investors may crave certainty and resolution to these economic worries, many are unlikely to resolve in the near term. “Many of these issues may not have an end date,” says Malwal.

Legal challenges and ongoing negotiations could keep tariff policy in flux well beyond the end of 2025. The impact on inflation, consumer spending, and economic growth of tariffs implemented thus far is still unfolding and not yet fully understood—and will continue to shift as policies continue to shift.

Yet as recent years have shown, the US economy often finds a way to muddle through, even amid profound uncertainties. For instance, the most recent US recession, in 2020, lasted only 2 months as the economy staged a better-than-expected rebound in the face of the extreme disruptions of the pandemic. (The corresponding bear market in US stocks that year was even shorter, lasting just 1 month.) More recently, investors widely expected the Fed’s aggressive interest-rate hikes in 2022 and 2023 to trigger a recession. But instead the economy has soldiered on—with no recession materializing in the more than 3 years since the start of those rate hikes.

What smart investors are doing now

It’s impossible for investors to know exactly what will happen next with the market, or how or when the economy’s mixed signals might resolve. In this environment, smart investors are focusing instead on what they know and strategies that have helped manage periods of uncertainty in the past.

First, they’re leaning into diversification, with exposure across asset classes and geographies. International stocks, including shares from both developed and emerging economies, have outperformed US stocks so far this year and could continue to do so, thanks to more attractive valuations, a softer dollar (which generally leads to higher returns on international stocks for US-based investors), and improving earnings growth. High-quality bonds have provided stability and income amid elevated interest rates. Certain historically inflation-hedging assets, such as commodities, REITs, and Treasury Inflation-Protected Securities (TIPS), helped buffer portfolios during the April sell-off and could offer further resilience against inflation uncertainty.

“Over the last year, Strategic Advisers has added to areas like commodities and TIPS to help portfolios stay resilient,” says Malwal. “These investments don’t always move in sync with stocks, which can help smooth out the ride.”

Smart investors are also sticking to their long-term plans, aligned with their goals and risk tolerance. While it can be challenging to stay invested when the news feels unsettling, history has shown time and again that selling during periods of uncertainty has led investors to miss out on long-term gains.

“There may be bumps here and there, but what I have found is that investors who stay invested, who maintain their risk level in alignment with their risk tolerance and their overall financial picture, have tended to experience strong results over the long run,” Malwal says.

Ready to take the next step?

Learn more about habits of successful investors and investing mistakes to avoid. If you’re concerned about economic uncertainty, read about how to recession-proof your life.

If you don’t yet have a plan, or could use guidance on the one you do have, learn more about how we can work together.