Public markets are shrinking, and more investors are turning to alternative investments to expand their investable universe.

For decades, private market alternative investments—which are types of alternative investments that include private equity, private credit, and private real assets—have only been available to institutions or investors through a financial advisor. But new private asset opportunities have now made them accessible for eligible investors.

Let’s explore these types of alternative investments.

What are private market alternative assets?

The term “alternative investment” generally applies to different types of investments that are distinct from traditional ones (such as stocks, bonds, and cash/cash-like instruments). Like other alternative investments, private market alternative assets may provide enhanced long-term capital appreciation, higher income and/or total returns, and diversification.

Whereas public market investments are those that are accessible to the general public to be bought and sold on regulated exchanges (where you can easily transact via your brokerage account or financial advisor), private market investments do not trade on public exchanges. Private market alternatives generally include investments in 3 major asset classes: private equity, private credit, and private real assets.

Private equity. Private equity funds generally seek to provide enhanced long-term capital gains by investing in private, non-traded companies. Unlike investors in publicly traded companies, private equity investors are typically required to stay invested (i.e., they can’t withdraw funds without incurring a penalty) for relatively longer periods of time. This can mean waiting several years before you can access your investment money.

Buyout, growth equity, and venture capital funds represent examples of private equity investments. Most private equity activity is in the form of buyout, which is the acquisition of majority stakes or full ownership positions in companies. Other private equity investments may reflect lesser ownership stakes, but involve important governance and management rights. Private equity investments can occur at any time during a company’s life cycle—from startups to established revenue-generating companies.

Venture capital is a form of private equity that typically involves acquiring a minority stake in startup companies with high growth potential. Growth equity often involves a significant equity interest with governance/management rights in more mature companies with the potential for accelerating earnings growth. With these rights to effect change at a company, the private equity fund manager works actively to add value by growing sales, making strategic acquisitions, and increasing operating efficiencies—which is distinct from the role of a traditional public equity fund manager. Generalist private equity typically reflects investments in a variety of categories. A growing proportion of the market, secondary investments involve the buying and selling of existing interests in private equity funds.

Private credit. Like private equity, private credit generally refers to investments that are originated or negotiated privately and are not traded on public markets. Private credit investments seek to provide relatively higher income and/or total returns relative to many other traditional investments by investing in privately negotiated loans, bonds, or other debt instruments below investment grade (i.e., bonds that may be at higher risk of not being able to make scheduled payments to investors). Some strategies in private credit include direct lending, distressed debt, collateralized loan obligations, mezzanine debt, and opportunistic credit.

Direct lending enables investors to lend money directly to private companies. The borrowers are typically small and mid-sized private companies, while the lenders may be institutions or asset management firms. Other subsets of private credit include distressed debt, which refers to debt issued by companies that have defaulted, are undergoing bankruptcy, or are facing other near-term business complications. Also in the private credit category are securitized assets, such as collateralized loan obligations, whereby various types of loans—generally lower-rated but senior secured corporate loans—are bundled together and sold to investors in different tranches. Mezzanine debt is another subset of private credit that falls between senior debt and equity in the capital structure. Mezzanine debt often contains embedded equity warrants that may be converted to equity ownership under specified circumstances. Opportunistic credit encompasses a range of fixed income investments that may include private investments, structured securities, or public corporate debt.

Private real assets. Private real assets span a range of assets that seek to maximize total returns, provide diversification, and/or generate income through exposure to physical assets. Private real asset strategies include private real estate investments, private real estate debt, commodities, infrastructure, collectibles, and fine art.

Private real estate investments involve ownership stakes in commercial properties or land in a variety of sectors, such as office buildings, retail, industrial, and multi-unit housing. Returns are generally driven by capital appreciation, and these strategies tend to be more suitable for investors with a higher tolerance for risk. Private real estate can be accessed via equity and credit markets. Private real estate debt strategies offer exposure to loans on such properties. Private real estate equity strategies fall within 4 main categories that reflect their risk and return characteristics:

- Core. Well-leased buildings in sought-after markets.

- Core plus. Quality properties in desirable locations where modest capital improvements or increased occupancy can enhance total return.

- Value-add. Less desirable properties that require capital improvement or have low occupancy and thus have higher risk/return profiles.

- Opportunistic. Challenged properties that may be vacant or very early in the development phase.

Commodities are also classified within real assets and include basic goods, raw materials, and natural resources. These may include agricultural products like corn and soy, precious metals like gold and silver, oil, and natural gas. Infrastructure represents physical assets that enable transportation, storage, and communication. These include bridges, marine ports, pipelines, data centers, and cell towers.

Why you might consider investing in private market alternatives

Diversification is among the key benefits of considering private alternatives. Indeed, diversification across asset classes (in addition to diversification within asset classes) has been demonstrated to provide the potential for superior risk-adjusted returns.

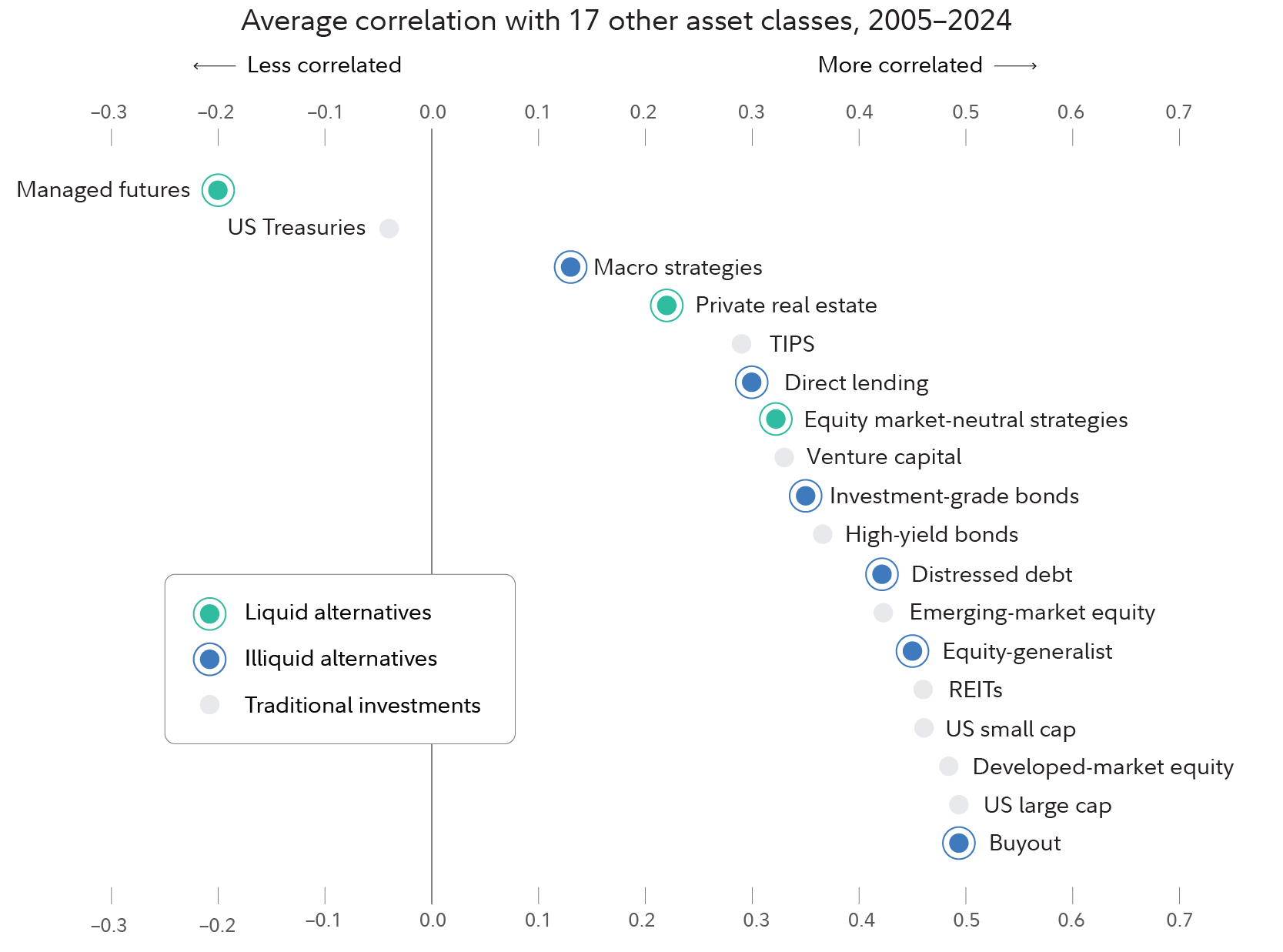

Alternatives can provide returns that differ from traditional investments. Diversification potential among private market alternatives can be seen in the lower correlations that many of these types of investments have exhibited historically with traditional investments (and with each other). Correlation refers to how assets perform relative to one another (with lower correlations providing more diversification benefits). Of course, it’s worth noting that some alternatives have shorter track records than traditional investments—particularly relatively new alternative categories like digital assets—so there is not as much data to assess.

Recent data shows that correlations for alternatives, including private alternative asset classes highlighted in blue in the chart below, are generally low with each other and with traditional investments.

Another possible benefit of private market alternatives is their potentially enhanced returns or income. If one of your main investing objectives is to grow your investments, research on alternatives has shown they can help enhance returns or generate income.

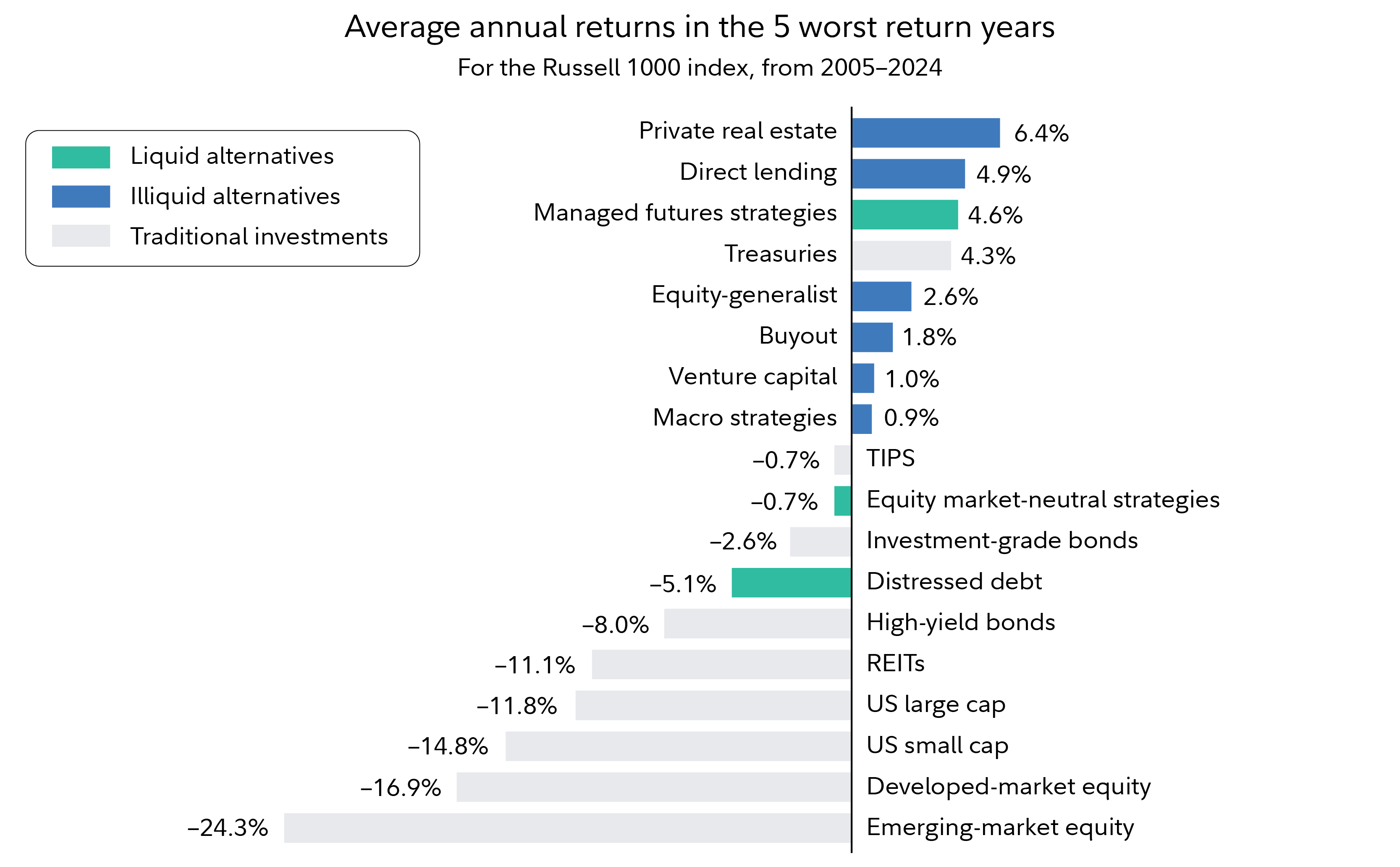

Certain strategies may also help generate higher yields versus traditional asset classes, as they can benefit from regular interest payments from directly originated loans. The chart below highlights annualized returns for alternative and traditional asset classes. Over the period studied, private equity outperformed all other traditional and alternative asset categories.

Additionally, private market alternatives can lower the overall volatility of your investment mix through greater diversification and may help manage the risk of your overall investment mix. The chart also shows how some private market alternatives have generally outperformed traditional investments when the Russell 1000 has had its worst performance.

Finally, several structural market trends may support consideration of private market alternatives. For example, companies are staying private longer, creating more opportunities in private markets. Also, there is growing accessibility for private market alternatives through innovative structures (e.g., interval funds, non-traded REITs, and semi-liquid vehicles).

Who should consider investing in private alternatives?

Private market alternatives have some common risk factors and other considerations. They are unique investments that could have varying liquidity limitations compared with traditional investments, feature fee structures that differ from traditional investments, have differing tax reporting features (such as Schedule K-1s, which arrive later than other types of tax forms and can make filing income taxes more complex), need more complex monitoring, and require relatively high investment minimums. Consequently, private market alternatives may not be right for everyone.

For those that private market alternatives might be suitable for, there are considerations to take into account. When investing in private market alternatives at Fidelity, for example, investors are currently required to meet the eligibility criteria for a Qualified Purchaser (e.g., an individual who owns at least $5 million in investments individually or held jointly with a spouse), along with other suitability requirements.

There are also liquidity considerations. Liquidity refers to how easily you can sell an investment. Alternative investments offer a range of liquidity.

Private market alternatives are often accessed via illiquid or intermittently liquid vehicles, which may limit the ability to take withdrawals from your investment but can also offer the potential for higher returns. Liquidity, or lack thereof, can come in the form of lock-up periods (a timeframe when the investment cannot be sold, often for a period of many years).

Some types of alternative investments offer intermittent liquidity, allowing you to redeem shares during specific time periods or at the fund manager's discretion, sometimes referred to as "tender windows" or "repurchase offers." This is all to say that, in addition to the potentially higher degree of risk associated with private market alternatives relative to traditional investments, in exchange for tying up your investment for longer periods of time, illiquid alternatives typically offer the potential for higher returns. This is referred to as the "illiquidity premium.”

Ways to invest in private market alternatives

Investing in private market alternatives requires due diligence and careful consideration. Eligible investors can schedule an appointment with a brokerage consultant to discuss private alternatives. If you're working with a Fidelity professional, please contact your advisor to discuss your options.