Choosing between paying down debt and investing can be like trying to solve a riddle.

If you've ever tried to work out the answer, you've probably run into some version of this advice: Compare the interest rate on your debt with the return you expect to earn on your investments, and put the money toward the option with the higher percentage figure.

While that advice might make sense in theory, it isn't exactly easy to put into practice. Plus, even seasoned experts find it difficult to forecast precise return rates, so it hardly seems sound to base your decision on a single number plucked out of thin air.

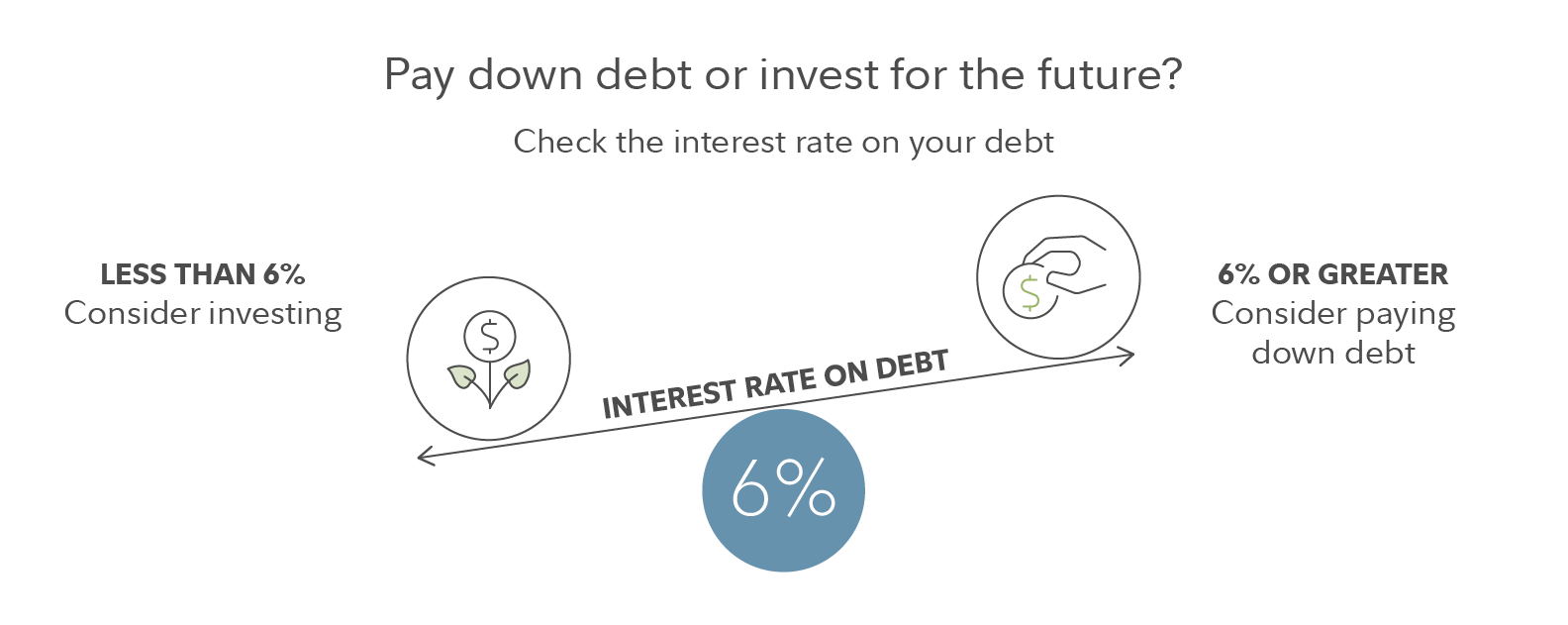

The rule of 6%

So we crunched the numbers to come up with a clearer formula (more on our methodology below). Our conclusion? For many people, it generally makes sense to first pay down any debt with an interest rate of 6% or greater. This assumes you have at least 10 years before retirement, that you're investing in a balanced portfolio with about a 50% allocation to stocks, and that you're investing in a tax-advantaged account, such as a 401(k) or IRA.

If the interest rate on your debt is less than 6% (and again, based on our set of assumptions), it likely makes more sense to invest those extra dollars instead. That's because at lower interest rates, there's a greater chance your long-term investing returns will beat the bang for your buck you'd get by paying your debt off faster.

How to adjust

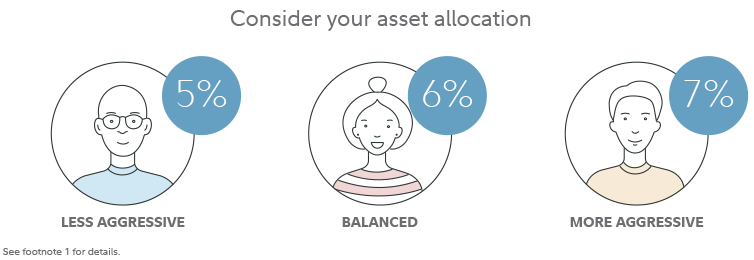

Although 6% is the number to remember if you have a balanced asset allocation, you can consider a higher (or lower) threshold if you invest more (or less) aggressively. Here's what the critical number looks like at different levels of aggressiveness, in each case considering a 35-year-old investing for retirement in a tax-advantaged account.1

Why does the relevant figure change with your asset allocation? A less aggressive investment mix, meaning one with a lower allocation to stocks, may be expected to result in slightly lower returns (on average) over the long run. And with slightly lower expected returns on investing, paying down debt comes out ahead even at slightly lower interest rates.

The reverse goes for a more aggressive asset allocation. A greater allocation to stocks may result in higher expected returns on your investments, which means investing may come out ahead over the long term even if your debt has a slightly higher interest rate.

When to consider our guideline

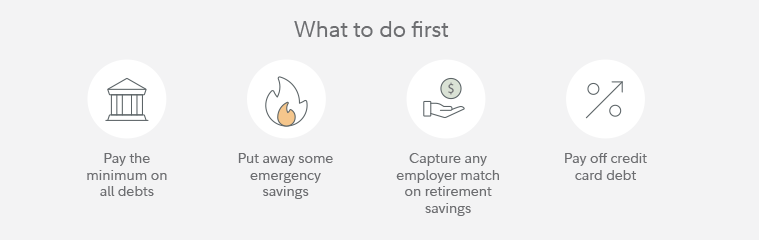

While the rule of 6% is easy to remember, there's some fine print to understand before you try putting it into action. Namely, you should make sure you're checking off a few other boxes on your financial to-do list first, before you even get to the question of paying off debt or investing.

Why do these other tasks take priority? Paying your minimums, socking away a cash buffer for emergencies, and digging out of any credit card debt are crucial to establishing basic financial security (plus protecting your credit score), so that your finances could survive any unexpected curveballs life might throw your way. And an employer match is essentially "free money," which you should generally try to capture in full.

In sum, consider the rule when deciding between investing unmatched dollars toward retirement or paying down debt. (And if you have more than one debt at or above the relevant interest rate, work first at eliminating your highest-rate debt, then move on to your next-highest, and so on.)

More on our methodology2

Most people prefer a sure thing to a risky bet, so we incorporated an additional margin of safety into our methodology. In essence, our guideline assumes that you would only choose investing (the riskier bet) if it has at least a 70% chance of beating the more certain return you would earn by paying down debt (based on our estimates of what likely future investing returns will look like).

Put another way, if our methodology2 suggests that you should invest, that doesn't mean we're 100% sure that investing will come out ahead. But we believe the return potential you'd get from investing should beat any return you'd get from paying down debt about 70% of the time.

Need some help sorting through your financial priorities? Consider connecting with a financial professional, or learn more about how to balance paying off debt with saving.