What’s an HSA?

Have you ever heard of a health savings account, or HSA? It’s an account you can open anytime that can help you save money on health care costs—and taxes. You can use it to pay for all sorts of qualified medical expenses, like copays, prescriptions, dental visits, contacts, eyeglasses, and even things like bandages and X-rays.

Here’s the best part: If your employer offers an HSA-eligible health plan, your contributions are pre-tax, similar to how a 401(k) works. If you don’t spend it all this year, you can roll it over and use it whenever you need to in the future, making an HSA another way to help save for retirement.

You can also invest the money in your HSA, which means it has the potential to grow over time. So not only are you saving for today’s medical expenses, but you’re also building a cushion for the future.

Now let’s break down the steps to open an HSA. Then, we’ll show you how to do it with Fidelity® so you can start putting your tax-deductible dollars to work.

6 steps to open an HSA

Follow these 6 steps when you’re ready to open a health savings account.

1. Check your eligibility

To be eligible, you must be enrolled in a health plan that qualifies—which usually means a high-deductible health plan. Not all health plans work with an HSA, so it’s a good idea to double-check yours. Once you determine that you’re covered by an eligible health plan, you can open an HSA any time during the year.

There are a couple of things that might make you ineligible, such as you’re not enrolled in a high-deductible health plan, or you’re enrolled in Medicare. If you’re unsure about your eligibility for an HSA, answer these 4 questions to find out.

- If you aren’t eligible for an HSA, don’t worry—your employer may offer a health care flexible spending account (FSA) instead, another way to set aside pre-tax dollars for medical expenses.

- And if you’re not HSA eligible now, you can research options and consider changing plans to be eligible during open enrollment.

2. Choose a provider that works best for you

- Start with your employer. Did you know that about 84% of employees covered by an HSA-eligible health plan receive an HSA contribution from their employers?1 Think of it as more money toward your health care. You won't get a tax deduction on what your employer contributes, but you’ll get extra money that has the potential to grow over time if it’s invested.

- It’s important to check out all your HSA options. Consider a Fidelity HSA—named the #1 HSA provider the last 6 years in a row.2

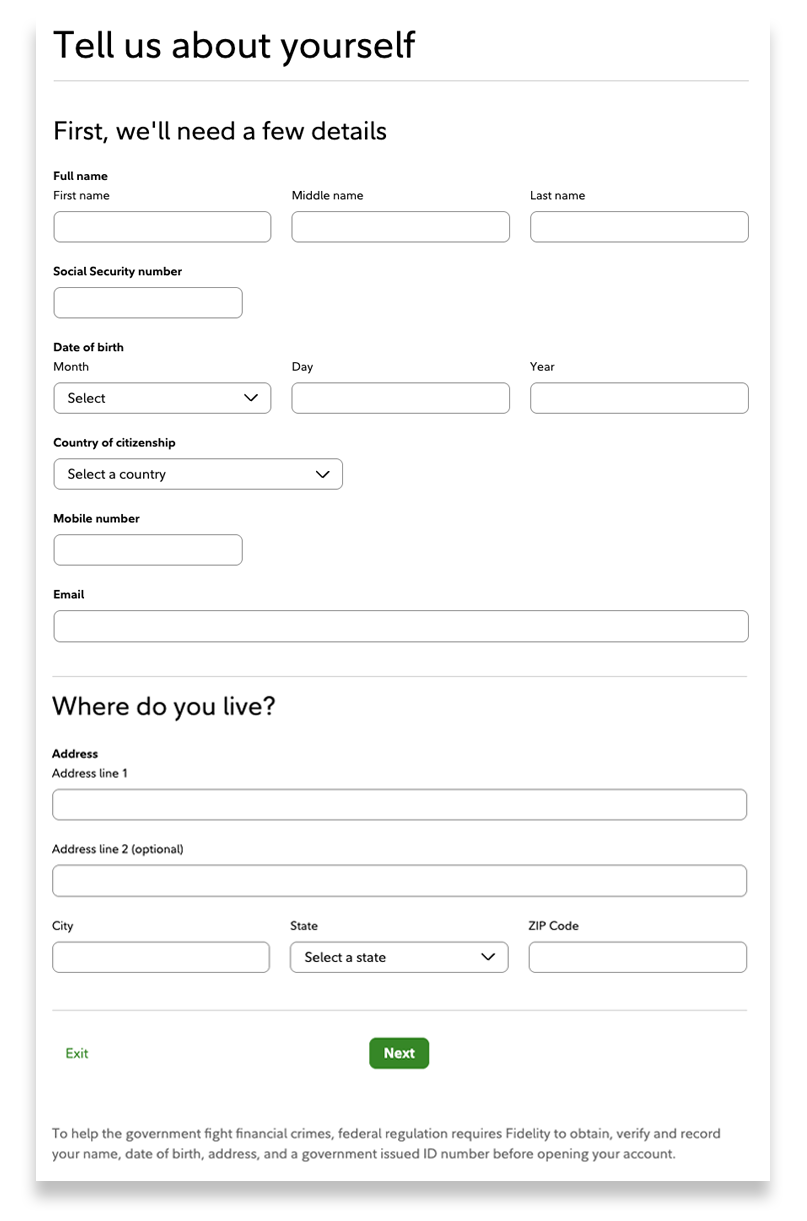

3. Gather your information and fill out the application

When you open an account, most require an application. Save time and make the process easier by having this information ready:

- Social Security number or tax ID

- Information for any beneficiaries (names, addresses, birthdates, and Social Security numbers)

- The investment or bank account details (routing and account numbers) to fund your HSA (not applicable if you’re opening an HSA through your employer)

- A government-issued ID (like a driver’s license or passport) may be needed to verify identity

This information helps confirm your identity and makes sure you’re eligible to open the account. Remember, you need to be enrolled in a high-deductible health care plan to be eligible.

4. Decide your cash target and know the contribution limits

Take time to jot down any expenses you think your HSA could cover. Then ask yourself: How do I feel about paying for health care right now vs. having an account to pull money from? The amount of cash you keep in your HSA should reflect not just what you expect to spend but also how comfortable you are handling unexpected health care costs when they happen. You may want to have enough cash (at a minimum) to cover your annual deductible. Check out these tips to help figure out the right cash target for you.

Be sure to keep up with the IRS annual contribution limits so you can make the most of your HSA. And, if you have more than one HSA, it’s good to know that the contribution limit is for all of them combined.

5. Choose what to invest

After you reach your cash target, it’s time to put that money to work. You’ll need to choose the investments you want, like stocks, ETFs, mutual funds, and more. If you’re not sure where to start, some providers offer an option for professional investment management, such as automated investing through a robo-advisor, so you don't need to do it on your own.

6. Set a check-in schedule

Life gets busy, so set a reminder to check in on your HSA every now and then. It’s also important to check if the annual contribution limits have changed and adjust your plan accordingly. You can also set up automatic contributions and investments to keep things simple and consistent.

How to open an HSA with Fidelity®

If you’ve decided that opening an HSA with Fidelity is the right move for you, here’s how to get started. If you're opening an HSA with your employer, refer to your benefits information you've received, and verify that you’re enrolled in an HSA-eligible plan.

1. Visit Fidelity.com.

2. Select Open an account.

3. Choose Health savings accounts (HSAs) and select Open an account.

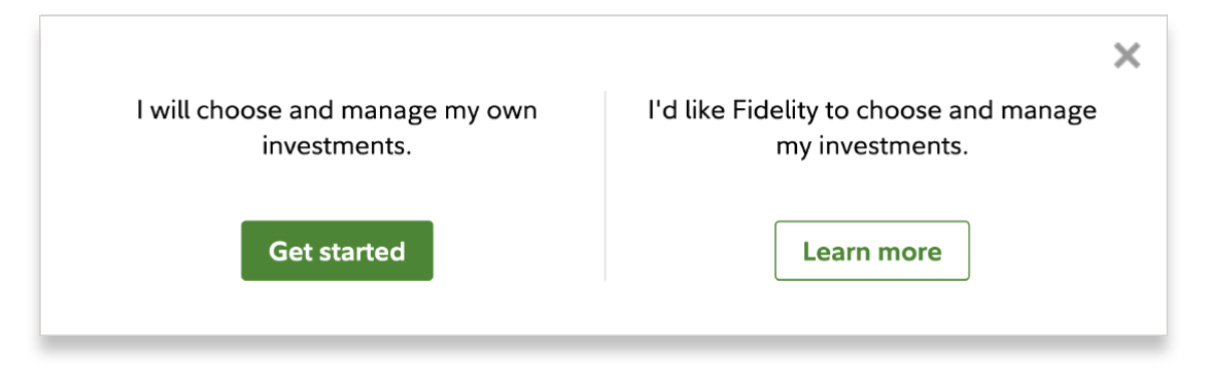

4. Decide whether you’d like to choose and manage investments or if you’d like Fidelity to do so.

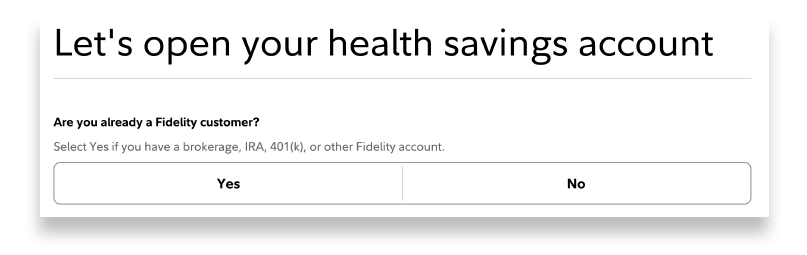

5. Answer Yes or No to the question about whether you’re already a Fidelity customer. Already a Fidelity customer? Just log in and skip ahead to step 8.

6. Fill in the required personal information.

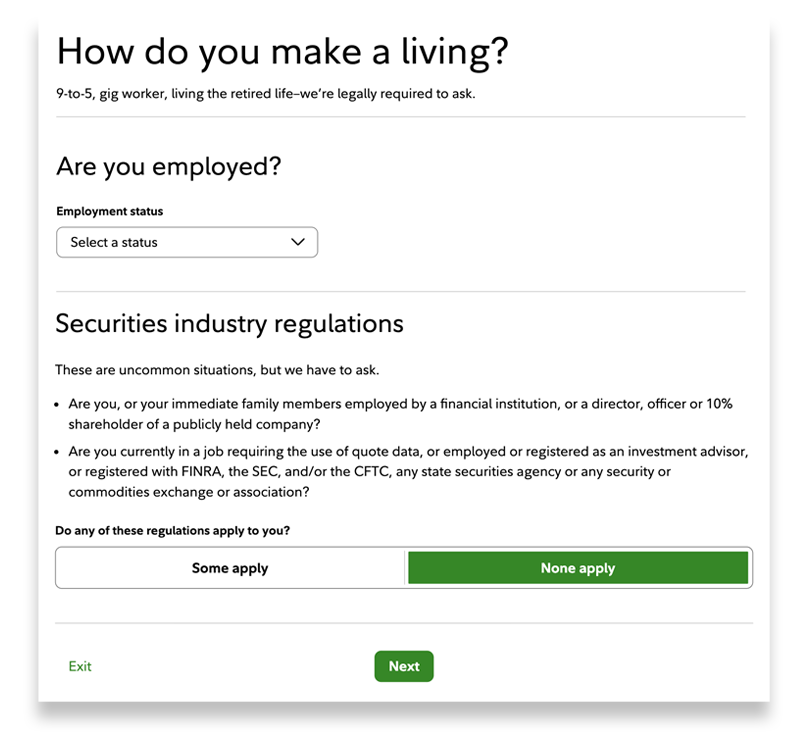

7. If you’re new, you’ll be asked for some employment information.

8. Review all your information to make sure it’s correct.

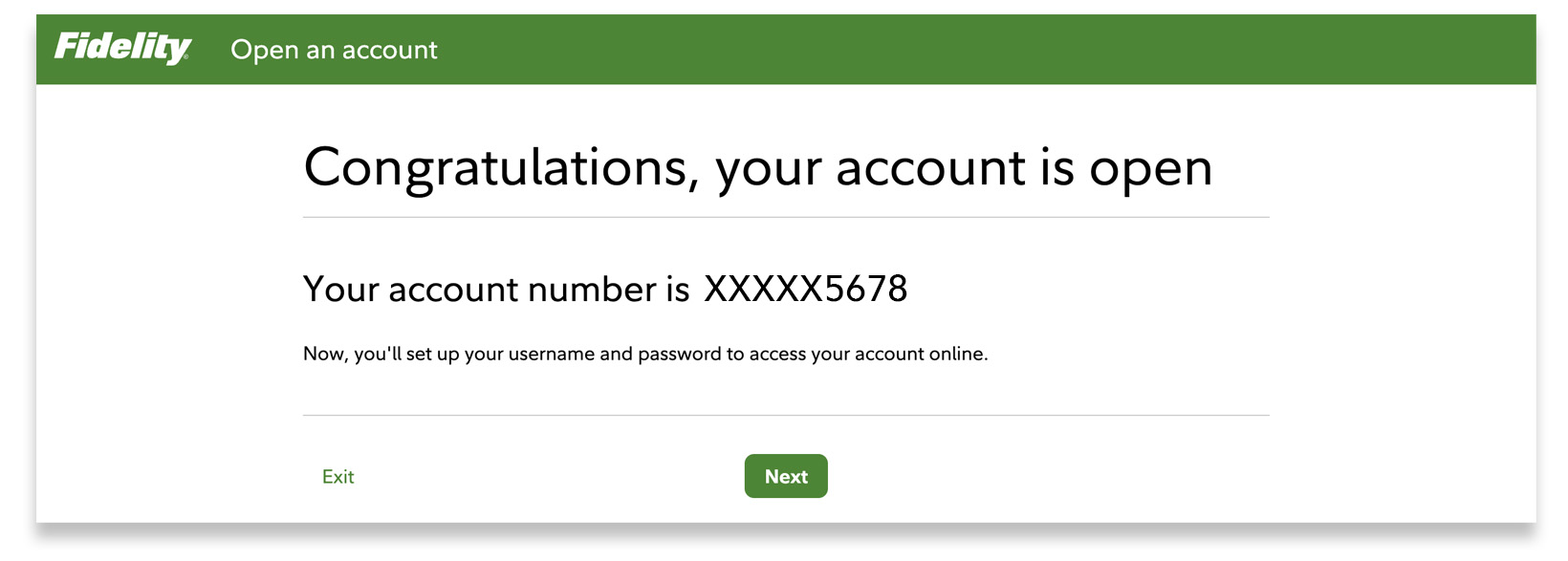

9. Select Open an account—and you’re all set!

What to do next after you’ve opened your HSA

Here are the next steps to take once your HSA is opened:

- Log in to your account

- Fund the account

- Determine your cash target

- Invest the money you’ve added

- Download the Fidelity Health® app to manage your HSA

If you have your HSA through your employer, a debit card will automatically be mailed to you after your account is open. If you open an HSA on your own, you can order a debit card on our website.

If you’re not sure what to invest in, you can always reach out to a financial pro for guidance or check out these investment funds that might be a good fit for your HSA.3

When you enroll in an HSA offered by your employer, the money is taken from your paycheck similar to 401(k) contributions. If you’re enrolling in an HSA on your own, you can set up recurring investments with Fidelity so your money gets invested on a regular schedule.

Remember, your HSA is your account, not your employer's. So if you leave a job, you keep all of the money you've saved up and can transfer into a new HSA or employer-sponsored HSA at your next job. You can even open an HSA if you're in an HSA-eligible health plan and your employer does not provide an HSA—or if they do but you prefer a third-party option. And if you’re not in an HSA-eligible health plan and can no longer contribute, the money is still yours to transfer or invest.