When people imagine retirement, they hope to save enough money to last them 30 years or more without income from work. But creating a retirement income plan that can last decades is essentially an exercise in planning for the unknown, including the uncertainties of how long you will live and what your market returns may be.

Research from the Retirement Income Institute (RII), a nonprofit research group based in Washington, DC, shows that uncertainty about whether retirement savings will last can cause many retirees to underspend, particularly those whose portfolios consist primarily of securities. One third of people in RII’s research say they may only spend their portfolio's earnings because they fear they will run out of money. Spending too cautiously may prevent retirees from fully enjoying the lifestyle their finances could actually support, for example by foregoing things like travel or eating out, according to the research.1

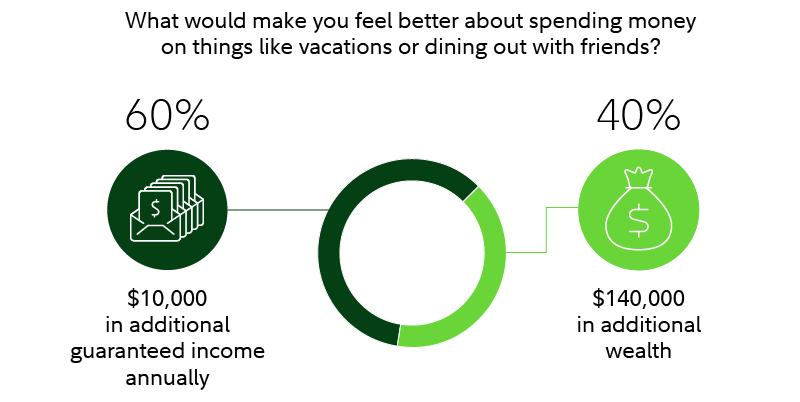

But the same research suggests a solution: Retirees may feel more confident affording expenses if they know they have guaranteed income. Sixty percent of those surveyed said they would have more peace of mind in spending on expenses if given $10,000 in additional guaranteed income annually, as opposed to having the equivalent $140,000 in additional wealth.2 In other words, people may be more comfortable taking withdrawals from their portfolio to cover entertainment, hobbies, and other discretionary purchases if they could know with certainty that their essential needs are covered through a guaranteed income source such as an annuity. This aligns with Fidelity’s view that having predictable income to cover essential daily expenses can help boost confidence that retirement savings will last.

“Retirees may feel far more comfortable spending from guaranteed income than they do from savings,” says Michael Finke, professor and chair of economic security for the American College of Financial Services, and an author of the RII research. “They often feel uncomfortable spending from money in their IRA.”

That may be a particular concern because most new retirees rely on defined contribution plans rather than pensions, Finke adds, and as a result aren’t spending as much as they could, especially early on in retirement.

Ways to build more guaranteed lifetime income

The guaranteed lifetime income portion of someone’s retirement savings portfolio can be critical to meeting essential expenses once their work paycheck is gone. Typical sources of dependable income include pensions and Social Security. But only 15% of current private sector workers have access to pensions,3 and the average Social Security benefit is $1,976 a month,4 which is often not enough to cover essential expenses for most people.5

One way to increase predictable income, according to Finke’s research, is to delay taking Social Security. For every year you delay your claim past your full retirement age (67 for most people), you get an 8% increase in your benefit. That could be at least a 24% higher monthly benefit if you delay claiming until age 70.

Another underutilized way to create guaranteed income in retirement, Finke says, is to transfer some of the usual market and longevity risk associated with an investment portfolio to an insurance company. This can be done by converting a portion of their retirement savings to a fixed income annuity. Annuities are often compared to private pensions because they can provide dependable income for life.6 By converting a portion of retirement savings to an income annuity, Finke’s research suggests retirees might have the confidence to spend up to twice as much as they would from investment wealth.7

Find out more about income annuities in Viewpoints: How income annuities work

“If the goal of retirement savings is to live a better lifestyle, then most retirees could spend more by shifting savings into income through the use of an annuity,” Finke says, adding that annuities may also give retirees the “psychological license,” or permission, to spend their savings in retirement.

How income annuities could help with spending

At its most basic level, an annuity is a contract between you and an insurance company. The contract can shift certain risks—such as longevity or market volatility—away from you and onto the insurance company. This depends on the type of annuity and any guarantees it may include.

While there are many different types of annuities that can help build income either prior to or in retirement, a fixed income annuity can provide guaranteed income in exchange for a lump sum investment. Payments can be either for a set period of time or for life. Income annuities can also come with optional features, such as a cost-of-living adjustment (COLA) to combat inflation, or a cash-refund guarantee to your beneficiaries in the event that you die prematurely.

Someone approaching retirement could purchase an income annuity to supplement the portion of their income devoted to essential expenses, for example, if they’ve identified a gap that other sources of dependable income such as Social Security or a pension may not cover. By providing a baseline for these expenses, an income annuity could potentially allow them to spend more freely from the part of their portfolio devoted to nonessential expenses.

Keep in mind that fixed income annuity contracts are generally irrevocable after a “free look” period, meaning your money can’t be refunded.

Good to know: There are other types of annuities that can help you develop a diversified income plan. In all cases, since an income annuity's guarantees are subject to the claims-paying ability of the issuing insurance company, it is important to do your research and choose an annuity issued by a financially strong insurance company.

You can find out more about annuities in Viewpoints: Understanding annuities

It’s a good idea to consider consulting with a financial professional who can discuss the pros and cons of the different types of annuities. That way they can help you design a plan that includes guaranteed income tailored to your needs, potentially giving you the confidence to enjoy the retirement you’ve worked so hard to achieve.