Investing in stocks, mutual funds, or ETFs can help generate potential returns in multiple ways. Two of the most common are dividends and capital gains. Knowing how these types of investment income work—and how you can receive them—can help you make better financial decisions that support your goals.

What are dividends?

Dividends are payments made by companies to their shareholders, typically from profits or retained earnings. These payments are a way for companies to share their financial success with investors. Dividends are most commonly issued in cash, but they can also be paid in the form of additional shares (stock dividends). Most companies that pay dividends send them out every few months (quarterly), but some pay them monthly or once a year.

The amount of the dividend is usually expressed on a per-share basis. For example, if a company declares a dividend of $0.50 per share and you own 200 shares, you would receive $100. Dividends are especially appealing to people who want steady income, like retirees. They can also be a sign that a company is financially healthy and stable.

What are capital gains?

Capital gains distributions occur when a mutual fund or ETF sells securities in its portfolio for more than their purchase price, generating a profit. For example, if the fund manager recently sold XYZ stock at $50 per share, after purchasing it earlier at $40 per share, they would have realized a $10 profit per share. These gains are passed on to investors and are categorized based on how long the fund held the investment before selling:

Short-term capital gains distributions result from the sale of assets held by the fund for one year or less. These are taxed at the investor’s ordinary income tax rate, which can be higher than long-term rates.

Long-term capital gains distributions come from assets held by the fund for more than one year. These are taxed at preferential rates—0%, 15%, or 20%, depending on the investor’s taxable income.

How are dividends and capital gains paid?

Dividends and capital gains are paid out by stocks and funds and are typically added directly to your investment account. For individual stocks and ETFs, dividends are usually paid quarterly. Capital gains distributions from mutual funds and ETFs are typically paid out annually. The exact timing varies by fund, so it’s important to check the fund’s distribution schedule.

You’ll receive a notification when a fund pays out these gains, and the payment will appear in your account on the “payment date.” These distributions are also reported on tax forms like the 1099-DIV, which you’ll use to file your taxes.

What is dividend and capital gain reinvesting?

Reinvesting means using your dividends and capital gains to automatically purchase more shares of the same investment. This is often done through a Dividend Reinvestment Plan (DRIP), which Fidelity offers at no additional cost.

Reinvesting has the potential to enhance your portfolio’s growth over time through the power of compounding. Each reinvested distribution increases your share count, which in turn increases the amount of future distributions. While reinvested distributions are still taxable in most taxable accounts, the process is seamless and helps maintain your investment strategy without requiring manual action. Fidelity lets you reinvest dividends and capital gains from one Fidelity mutual fund into another, if both funds are in the same account.

Deciding whether to take distributions in cash or reinvest them depends on your personal financial goals. If you're focused on long-term growth—like saving for retirement—reinvesting can help your money grow over time. On the other hand, if you're retired or need regular income, taking cash might be a better fit. You can also mix strategies, such as reinvesting dividends for some investments while taking capital gains in cash for other investments.

Are dividends reinvested by default at Fidelity?

At Fidelity, your account has default settings for how it handles money earned from your investments, such as dividends and capital gains. For stocks and ETFs, the default is to pay you in cash—this means the money goes directly into your account, and you can use it however you like. For mutual funds, the default is to reinvest that money automatically, buying more shares of the same fund to help grow your investment.

When you update your dividend and capital gains settings, they become your new default. There are 2 setting levels to keep in mind:

- Position-level settings only affect the investments you already own—they determine how those holdings handle dividends and capital gains. For example, if you change stock XYZ from reinvesting dividends to paying cash, only that investment will start paying you in cash—none of your other holdings will be affected.

- Account-level settings apply only to future purchases—new investments will follow these updated defaults automatically.

How to manage current dividends and capital gains at Fidelity

Most brokerages, including Fidelity, allow you to set up your dividend and capital gains distribution preferences online. These settings can usually be changed at any time, giving you flexibility as your financial situation evolves. Here's how to change your dividend and capital gain distribution settings for any investments that you currently hold:

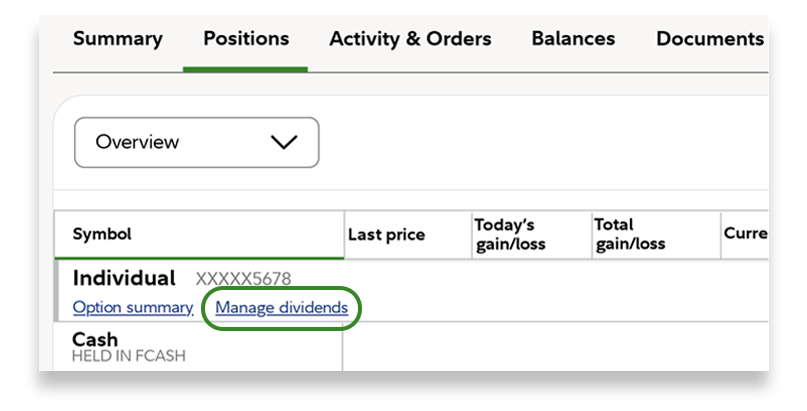

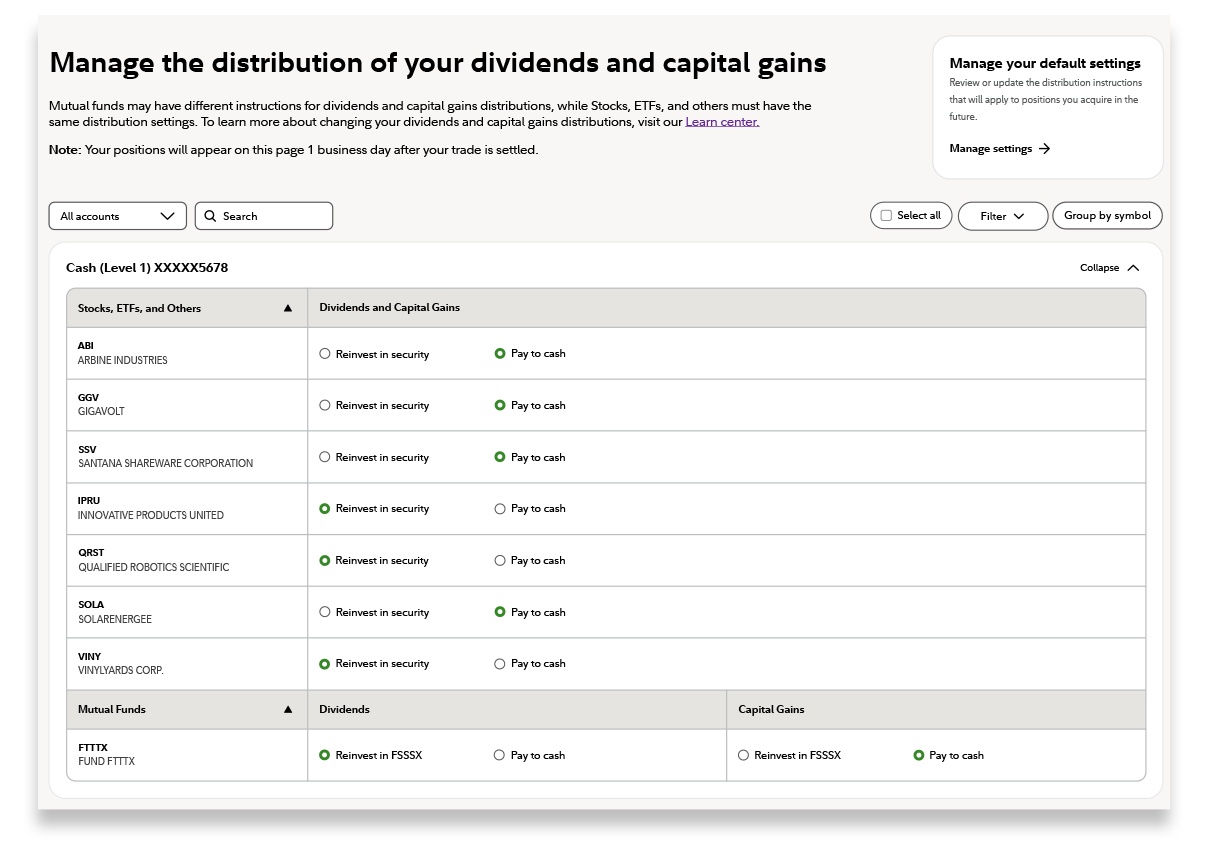

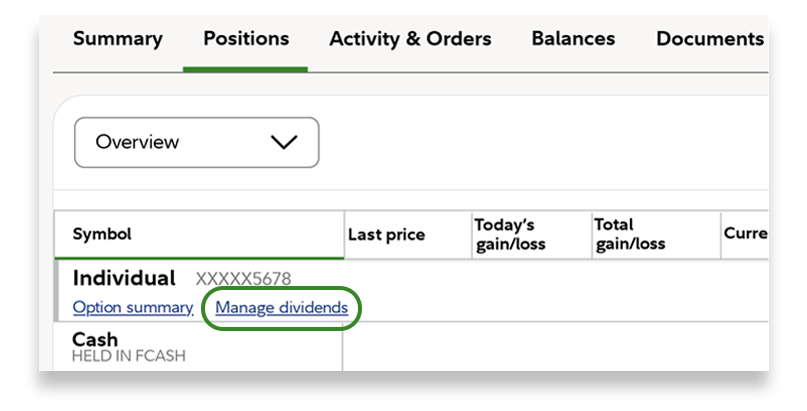

1. Log into your Fidelity brokerage account. From Positions, select Manage Dividends.

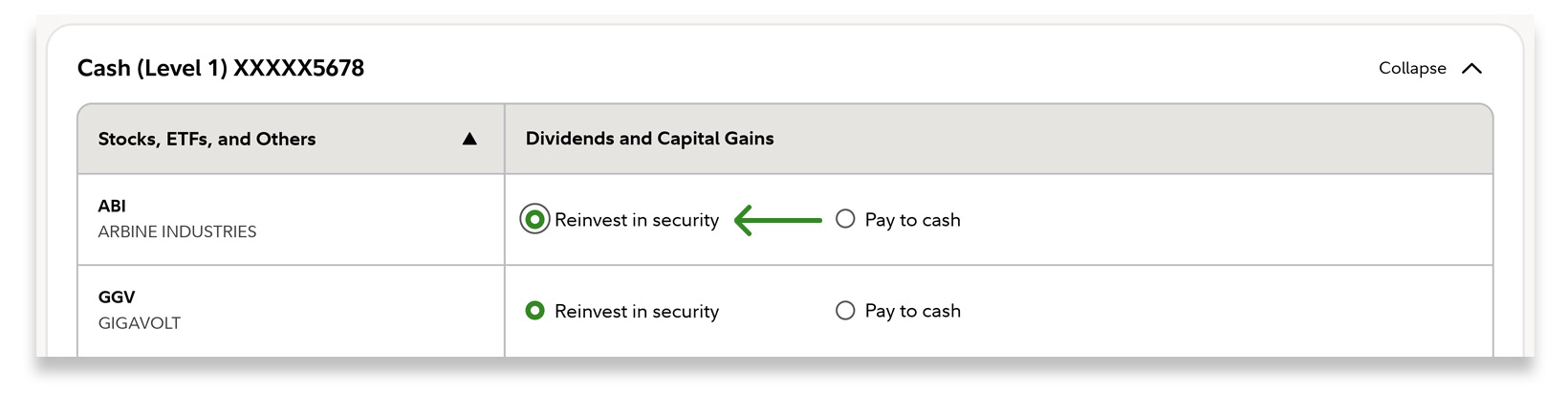

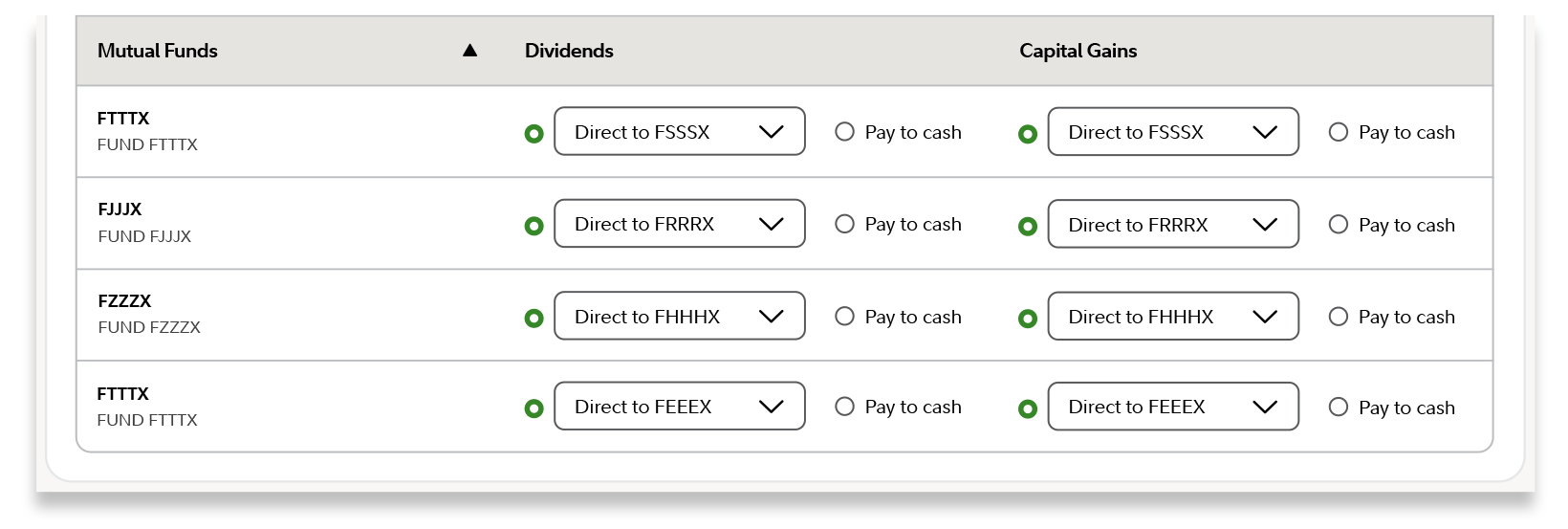

2. Review your current Dividends and Capital Gains distribution settings for stocks and funds.

3. Change your preference as needed. You can select investments individually or use the “Select all” feature to update all your investments at once.

4. Remember that Fidelity allows you to reinvest dividends and capital gains from one Fidelity mutual fund into another, as long as both funds are held within the same account.

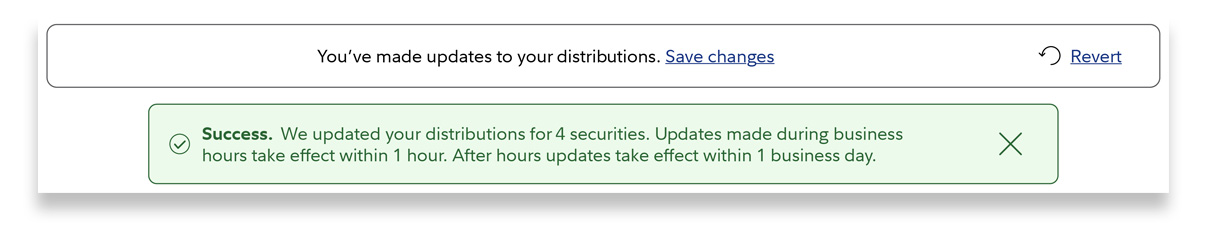

5. After you’ve reviewed and changed your preferences for your existing investments, select "Save changes."

How to manage future dividends and capital gains at Fidelity

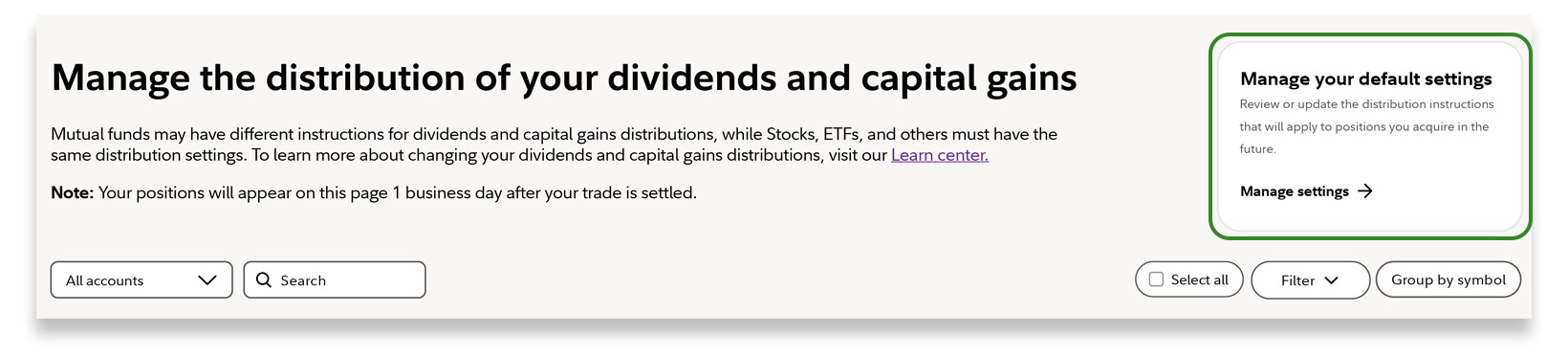

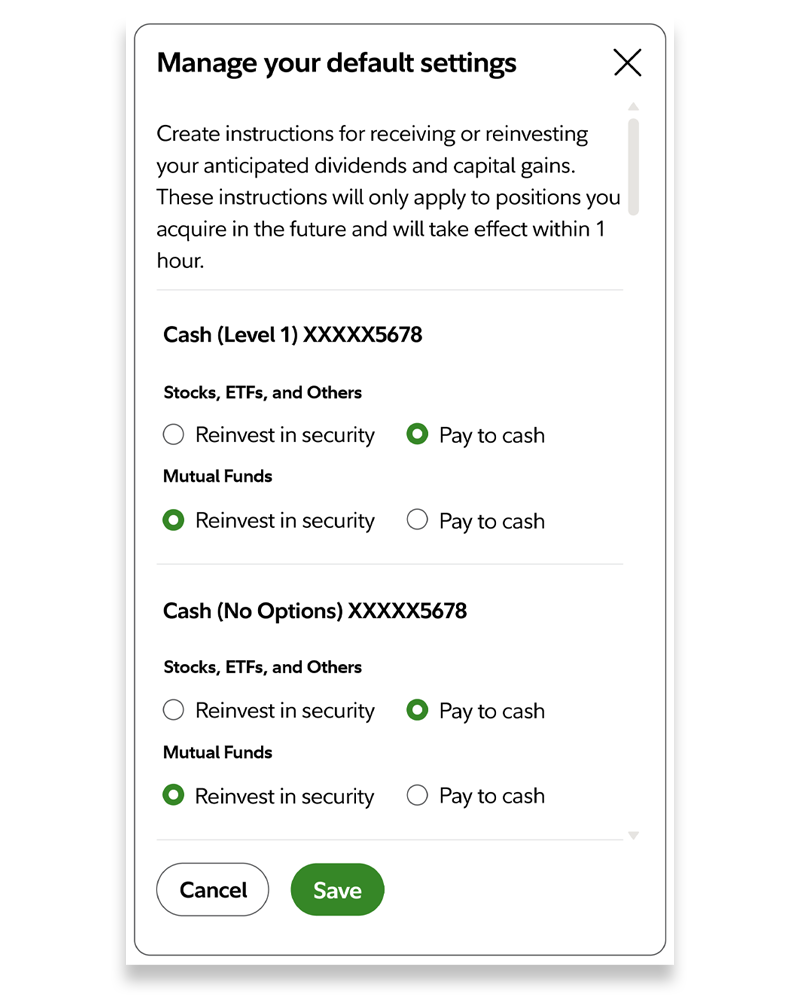

You may also want to proactively review and change the dividend and capital gains preferences for future investments. This allows you to create default instructions on how you want Fidelity to handle your various distributions. Follow these steps to manage and change your default settings:

1. Log into your Fidelity brokerage account. From Positions, select Manage Dividends.

2. Select Manage settings to update your accounts.

3. Select your default preference for reinvestment or cash across any and all your accounts. Select Save to lock in your changes.

Dividends and capital gains can be key components of total return. How you manage them can influence your portfolio’s growth, your tax bill, and your ability to meet financial goals. Whether your goal is to build wealth, generate income, or manage taxes, understanding your options empowers you to make informed decisions.