Jeff and Alison Otto of Framingham, Massachusetts, knew picking a Medicare plan would take time and effort. So they talked to friends, family, and their doctor, and read extensively about their options. What really surprised them was the realization that Medicare would not cover all their health care costs in retirement, including those when traveling abroad.

"We travel a lot and want the security of knowing we can get medical treatment away from home," says Jeff, who with Alison is looking forward to visiting her family in England. So the Ottos decided to buy a Medicare Supplement plan to help reduce their Medicare out-of-pocket costs and obtain coverage in case they have an emergency while traveling internationally.

Medicare and a Medicare Supplement plan

Since its introduction in 1965, Medicare was designed to cover only a portion of a retiree's health care needs. "Original Medicare" includes 2 parts: Part A, hospitalization coverage, and Part B, physicians and outpatient services. Only selected services are covered, and costs are shared between Medicare and you.

When it's time for you to sign up for Medicare, you have 3 primary options: You can choose to pay what Medicare doesn't cover from your own pocket; you can buy supplemental insurance, such as a Medicare Supplement plan (aka "Medigap"); or you can buy an all-in-one policy called a Medicare Advantage Plan.

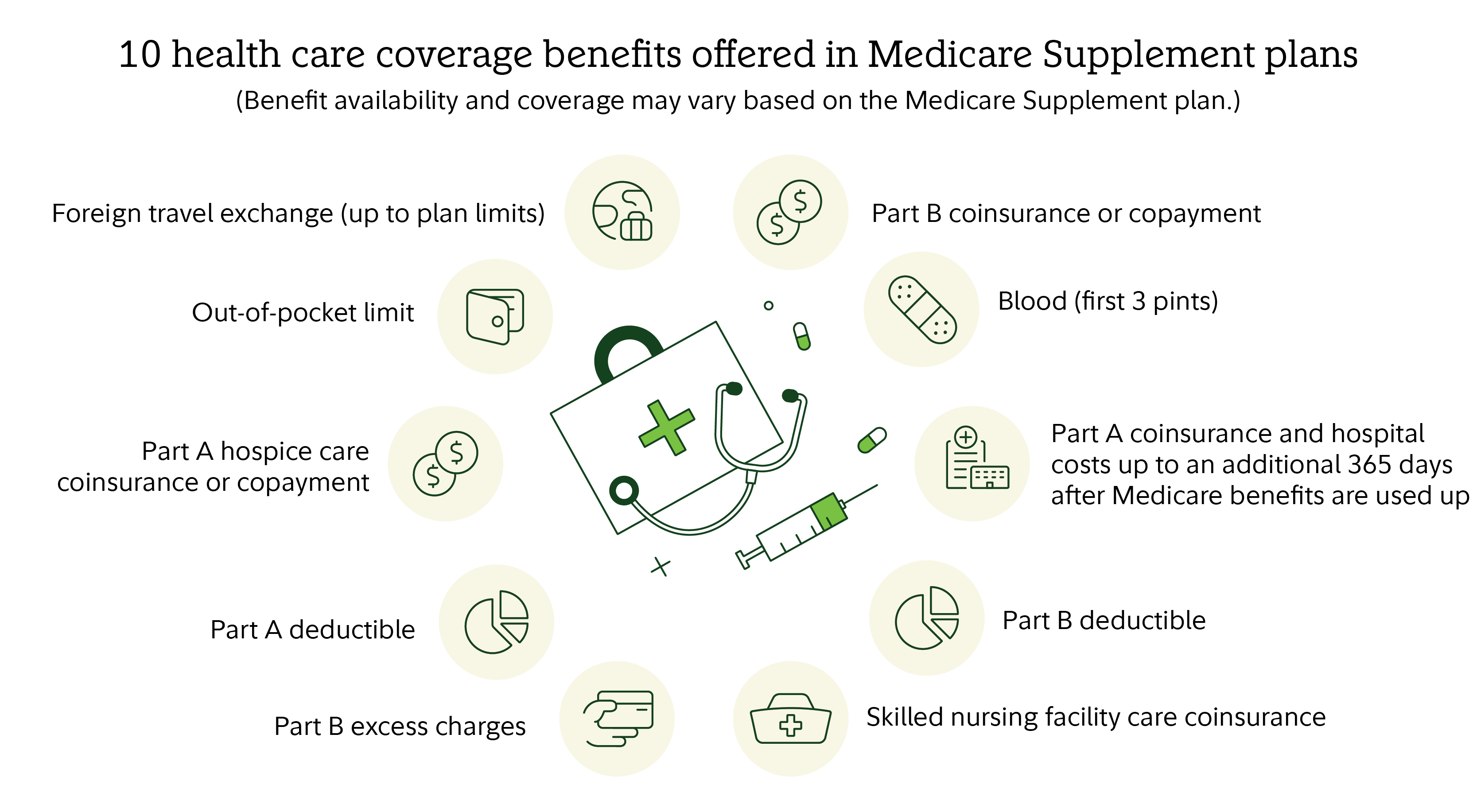

Supplemental insurance plans are sold by private insurance companies and are identified by capital letters: A, B, C, D, F, G, K, L, M, and N.1 Each lettered plan, regardless of the insurance company, must offer the same standardized features. After January 1, 2020, beneficiaries who are newly eligible for Medicare are no longer offered Plan F and Plan C. Beneficiaries who are already in Plan F and Plan C can continue their coverage as it is.

Why buy a Medicare Supplement plan?

Here are 4 common reasons retirees choose to add a Medicare Supplement plan to traditional Medicare.

- A Medicare Supplement plan can eliminate some to most of your Parts A and B out-of-pocket costs. Generally, under Medicare, you are responsible for a portion of the cost after deductibles. A Medicare Supplement plan may pay for your portion of coinsurance, copays, and other costs you owe.

- A Medicare Supplement plan can extend certain qualifying medical services. While a Medicare Supplement plan does not provide long-term care (LTC) insurance, its policies can extend certain qualifying medical services that are received as part of LTC, such short-term stays in a skilled nursing facility or hospice, and, in certain instances, medically necessary home health benefits.

- A Medicare Supplement plan may cover some emergency health care needs when traveling abroad. 2 The Medicare Supplement plan lifetime limit for coverage when traveling abroad is $50,000. If you want more coverage than that, you might want to consider travel insurance, including medical evacuation insurance for emergencies overseas. Pricing will depend on where you are going, your age, and how long you will be traveling. Note: Benefit availability and coverage may vary, based on the Medicare Supplement plan.

- A Medicare Supplement plan generally lets you keep your doctors. Still, it's important to confirm with your doctors, specialists, hospitals, and medical facilities that they accept Medicare and that they accept the exact insurance company and Medicare Supplement plan you are considering.

When should you enroll in a Medicare Supplement plan?

You can enroll in a Medicare Supplement plan after you've enrolled in Medicare Part B. Generally, there are 2 time periods when you'll be eligible without any medical underwriting or worrying about pre-existing conditions:

- You've turned 65 and enrolled in Part B. In this "open enrollment period," you have 6 months to select and enroll in a Medicare Supplement plan.

- You are older than 65 and losing employer coverage. Once you enroll in Medicare Part B, you'll have 6 months to buy a Medicare Supplement plan.

If you miss your initial 6-month enrollment window, insurance companies generally may require medical underwriting and you can be denied coverage, or may have to pay a higher premium for a Medicare Supplement plan, sometimes substantially higher.

As time passes, you can switch plans based on cost or a different level of coverage, but do so cautiously. Do not stop paying premiums on your existing plan before you find a new plan that will accept you. Switching by choice usually means you'll be subject to medical underwriting. Higher costs or outright denial may be the outcome.

Note: Depending on your state, you may not be allowed to purchase a Medicare Supplement plan before age 65. Check with your state's insurance department about what your state's law says regarding your rights. Also note that some states have exceptions as to when individuals can change Medicare Supplement plans.

How much Medicare Supplement plan coverage?

When deciding how much gap coverage you'll need, it's important to think about your health situation at age 65 and how healthy you might be at 75, 85, and 95. Steve Feinschreiber, senior vice president at Fidelity Financial Solutions, offers 4 guidelines to consider as you shop for a Medicare Supplement plan:

- Don't overestimate the status or durability of your good health. "Consider the practical reality of needing more insurance as you age," advises Feinschreiber. "Even elite athletes run into health problems as they move through the decades."

- Use your family health history as a guide. "Talk to your doctor about aging and take a look at your family history," says Feinschreiber. "It could be a good guide to help decide the kind of coverage you might want to plan for."

- Choose the insurance coverage that best meets your individual needs. Since there is no "joint" or "family" coverage under Medicare, it may be more cost-effective for you and your spouse to choose different coverage options from separate insurance companies. For spouses with similar coverage needs, insurance companies may offer discounts for members of the same household who enroll with the same insurer and meet certain conditions.

- Weigh costs vs. coverage. Medicare Supplement plans can be quite costly. "If you find the costs for gap insurance are hurting the overall health of your retirement income plan, think about where you might be able to make trade-offs," says Feinschreiber. "It's about finding the right balance so you have sufficient coverage and don't run out of money over the course of your retirement."

Countdown to Medicare

Because choosing a Medicare Supplement plan can be rather time-consuming and complicated, it's a good idea to get started early, perhaps by age 64, or at least 6 months before you retire. To simplify the process, use our checklist.

Checklist: Medicare and Medicare Supplement plan steps to take before you turn 65

(or at least 6 months before losing your employer health insurance)

Age 64

- Download your "Medicare and You" book from the Medicare website.

- Talk to your employer about coverage options if retiring or if continuing to work.

- Use Medicare Plan finder to search and compare various Medicare Supplement plan options in your area.

- Schedule any medical appointments needed, including vision and dental (to maximize your existing coverage).

1–3 months before turning age 65

- Apply online for Medicare Parts A & B. Note: If you plan on working and remaining on a creditable employer group plan, you could consider delaying Part A and/or Part B while you continue to work, then use a Special Enrollment Period to enroll when you retire.

- Make final decision for a Medicare Supplement plan.

- Finalize any details with your employer.

- Look for your Medicare cards to arrive in the mail. Once you have your Medicare ID number, apply for your Medicare Supplement plan so your Medicare and Medicare Supplement plan go into effect at the same time.

65th birthday month

- Confirm that your coverage is in place for the first day of your birthday month. People born on the first of the month may receive Medicare coverage as early as the first day of the month before their 65th birthday.

Hopefully for you, like the Ottos, the transition into Medicare and a Medicare Supplement plan will be quite seamless. The Ottos realize that their needs may change over time, especially as they curtail travel plans as they get older. "Although we've seen costs increase over the last 2 years since we enrolled in a Medicare Supplement plan, we have the right level of supplemental coverage for now and think we're getting good value at $800+ per month for the both of us, including dental coverage," said Alison.