Some people don't have the time or availability to frequently manage their trades. A butterfly spread is a limited-risk, limited-profit, advanced option strategy that offers the luxury of not having to continuously watch your brokerage account while this trade is in place.

What is a butterfly spread?

Butterfly spreads are designed to profit from different levels of volatility. A long call butterfly spread can help you profit when volatility is low and you think the stock will not move much during the life of the options. A long call butterfly spread could be created by purchasing 1 in-the-money call option contract at a low strike price, buying 1 out-of-the money call option contract at a higher strike price, and selling 2 at-the-money call option contracts with a strike price in the middle.

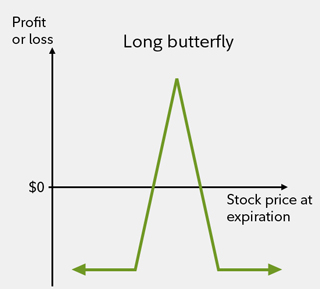

This strategy is called a "butterfly" spread because of the profit/loss diagram, which appears to have a body and wings.

We’ll focus on the long call butterfly spread in this article. A short butterfly spread, which can be constructed by taking the opposite positions of the long butterfly spread, is designed to profit when volatility is expected to increase in the future. It involves selling 1 call option contract at a low strike price, selling 1 call option contract at a higher strike price, and buying 2 call option contracts with a strike price in the middle.

Profit/loss diagram of a long butterfly spread

Keys to the butterfly spread

The objective of a long butterfly spread is to have the price of the underlying security be at or near the middle strike price of the spread at expiration (i.e., you expect the underlying security to have low volatility and to move in a small range). The strike price of the short options is where maximum profit potential would be achieved. The maximum potential loss on this trade is limited to the cost of creating the butterfly spread.

- Maximum profit potential = Strike price of the sold call—strike price of the low strike purchased call—net cost of constructing the butterfly spread.

- Maximum loss = Net cost of constructing the butterfly spread.

The profit potential percentage relative to the funds needed to initiate this trade can be attractive. Also, risk is capped if the market moves sharply in either direction.

The primary disadvantage of the butterfly spread is the possibility that the market could move sharply in either direction to incur a loss on the position, and the potential trading costs versus the limited profit potential (see sidebar).

Potential trading costs

How to trade a butterfly spread

Assume that on November 6 XYZ Company is trading at $50 per share. To construct a butterfly spread, you might buy 1 January 45 call at $7 per contract for a cost of $700 ($7 premium times 100 shares controlled by the 1 contract), sell 2 January 50 calls at $2.50 per contract for a credit of $500 ($2.50 premium times 200 shares controlled by the 2 contracts), and buy 1 January 55 call at $0.50 per contract for a cost of $50 ($0.50 premium times 100 shares controlled by the 1 contract). The risk, or maximum loss, of this trade is $250 ($700 debit plus $500 credit less $50 debit).

First, let's look at how the position might realize a profit. If XYZ closed at $50 at the expiration of the options, the low strike purchased option would be worth $5 for a gain for that option of $500. The 2 XYZ 50 sold call options would expire worthless, as would the purchased $55 call. At a cost of $250 to put the trade on, the $250 potential profit ($500 gain less $250 cost) represents a 100% gain, not including commissions.

Alternatively, if the underlying stock moved below the low strike of $45, all the options would expire worthless and the loss would be the $250 cost of entering into the trade. If the underlying stock moved above the high strike of $55, the loss would still be $250, because any profit from the purchased call would be offset by losses from the sold call.

Since this strategy is the combination of a credit and debit spread, managing the trade has many different outcomes to consider, both during the life of the trade and especially approaching expiration. For example, at expiration, some contracts may be out-of-the-money while other contracts remain in-the-money. It is important to understand what might happen in these situations to ensure the desired position is maintained after expiration. "Exercise" happens if a long option holder chooses to convert the option contract into shares. This is automated if the contract is in-the-money at expiration. "Assignment" happens when a short option seller must deliver the shares the contract represents.

Using the prior example, if XYZ company were to finish between $45 and $50 per share, only the 45 calls would be automatically exercised at expiration, resulting in a long share position after expiration. Conversely, if price were to finish between $50 and $55 per share, you may have only 1 contract exercised while 2 contracts are assigned. The result is a net short share position after expiration. In the case where all contracts are in-the-money, the exercise and assignment process would leave no shares after expiration. To avoid exercise or assignment, the butterfly can be closed prior to expiration, provided there are traders willing to trade the option contracts.

Spread your wings

Variations of this strategy include the short butterfly spread mentioned above, which is designed to profit from high volatility, and it is also possible to create a butterfly spread with put options, instead of call options. The long call butterfly spread is another way to take advantage of your forecast in a low volatility environment.