Description

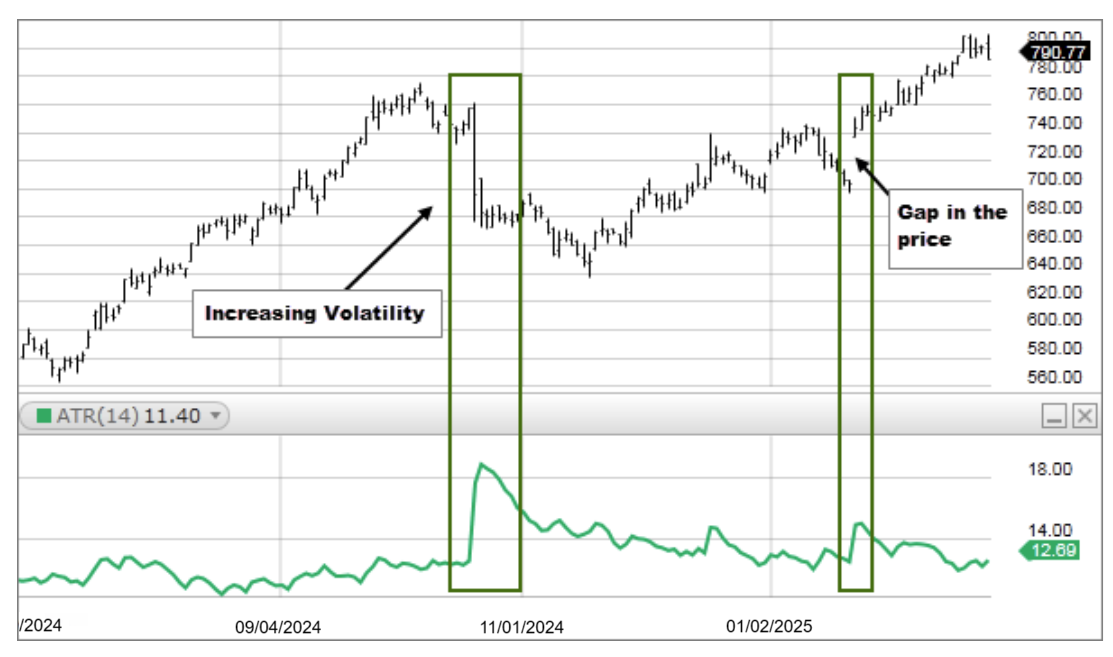

Average True Range (ATR) is the average of true ranges over the specified period. ATR measures volatility, taking into account any gaps in the price movement. Typically, the ATR calculation is based on 14 periods, which can be intraday, daily, weekly, or monthly. To measure recent volatility, use a shorter average, such as 2 to 10 periods. For longer-term volatility, use 20 to 50 periods.

How this indicator works

- An expanding ATR indicates increased volatility in the market, with the range of each bar getting larger. A reversal in price with an increase in ATR would indicate strength behind that move. ATR is not directional so an expanding ATR can indicate selling pressure or buying pressure. High ATR values usually result from a sharp advance or decline and are unlikely to be sustained for extended periods.

- A low ATR value indicates a series of periods with small ranges (quiet days). These low ATR values are found during extended sideways price action, thus the lower volatility. A prolonged period of low ATR values may indicate a consolidation area and the possibility of a continuation move or reversal.

- ATR is very useful for stops or entry triggers, signaling changes in volatility. Whereas fixed dollar- point or percentage stops will not allow for volatility, the ATR stop will adapt to sharp price moves or consolidation areas, which can trigger an abnormal price movement in either direction. Use a multiple of ATR, such as 1.5 x ATR, to catch these abnormal price moves.

Calculation

ATR = (Previous ATR * (n - 1) + TR) / n

Where: ATR = Average True Range n = number of periods or bars TR = True Range

The True Range for today is the greatest of the following:

- Today's high minus today's low

- The absolute value of today's high minus yesterday's close

- The absolute value of today's low minus yesterday's close