Description

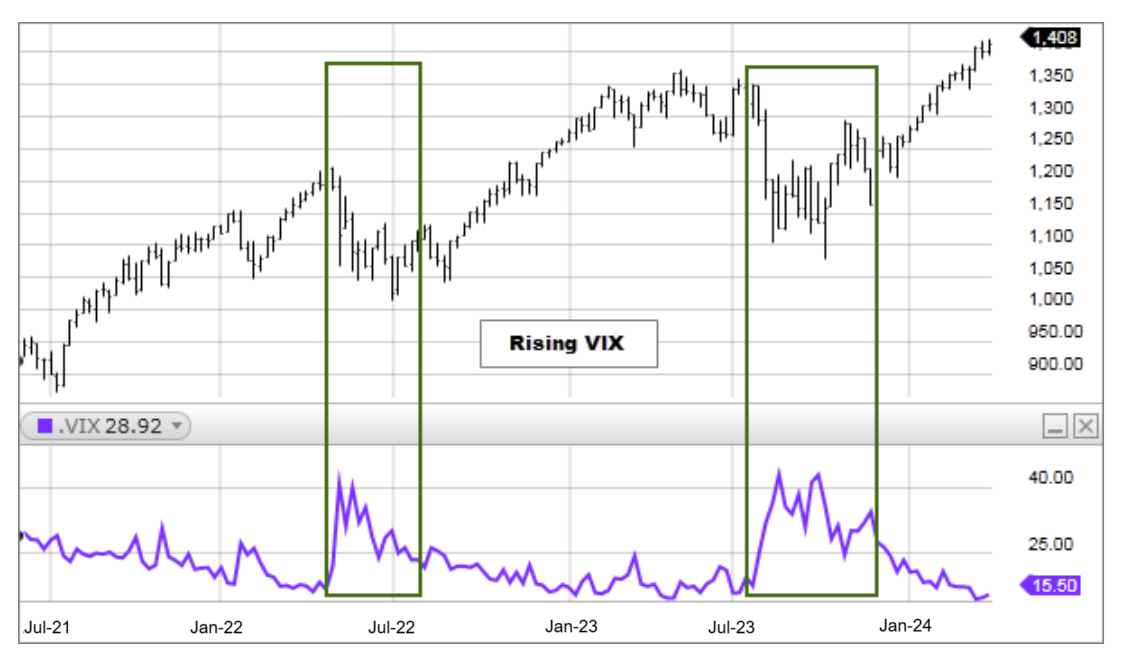

The Chicago Board of Options Exchange Market Volatility Index (VIX) is a measure of implied volatility, based on the prices of a basket of S&P 500 Index options with 30 days to expiration.

How this indicator works

A rising VIX indicates that traders expect the S&P 500 Index to become more volatile. The higher the VIX, the higher the fear, which, according to market contrarians, is considered a buy signal. A falling VIX indicates that traders in the options market expect the S&P 500 Index to trade more quietly. In the same respect, the lower the VIX, the lower the fear – indicating a more complacent market.

Calculation

n/a