Trading options using Fidelity Trader+™ Web

It’s easy to research, execute, and monitor your options trades using Fidelity Trader+™ Web. Quickly scan the options analysis tools for powerful insights, all in one screen.

Since options can be more complex than traditional investments (like stocks), make sure you apply for options trading. If approved, your brokerage account will be enabled to trade 1 of 3 options strategy tiers, or approval levels, which classify the strategies investors can use based on their experience, financial situation, and risk tolerance.

Follow our step-by-step guide to efficiently place an options trade in Fidelity Trader+™ Web.

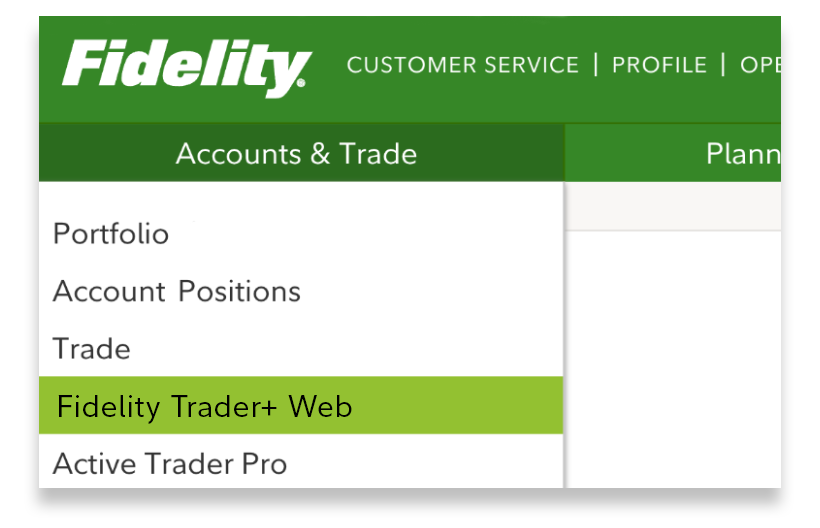

1. Log in to your Fidelity brokerage account. From Accounts & Trade, select Fidelity Trader+™ Web.

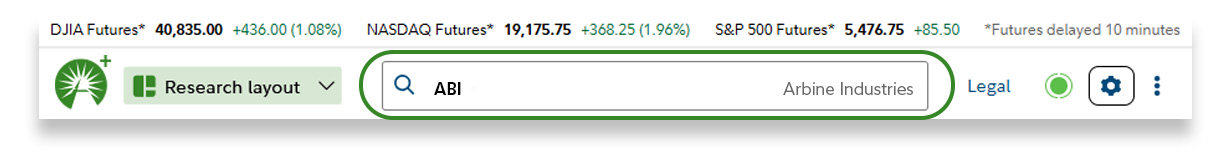

2. Enter the symbol or name of the stock, ETF, or index you want to trade options on.

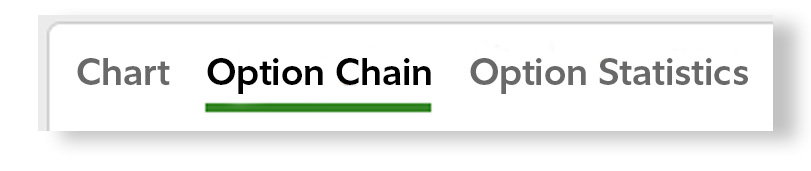

3. Select the Option Chain tool panel, which organizes call and put options by expiration date and strike price.

4. Filter which Option strategy you wish to analyze and trade.

- The Option Chain defaults to displaying both calls and puts.

- For more advanced options strategies, you can configure the Option Chain to “multi-leg” strategies, which have 2 legs or different options contracts in a single strategy.

.jpg)

5. Customize the Option Chain to display your preferred number of Strike prices for each expiration. Additionally, you can set custom strike price ranges to meet your trading needs.

.jpg)

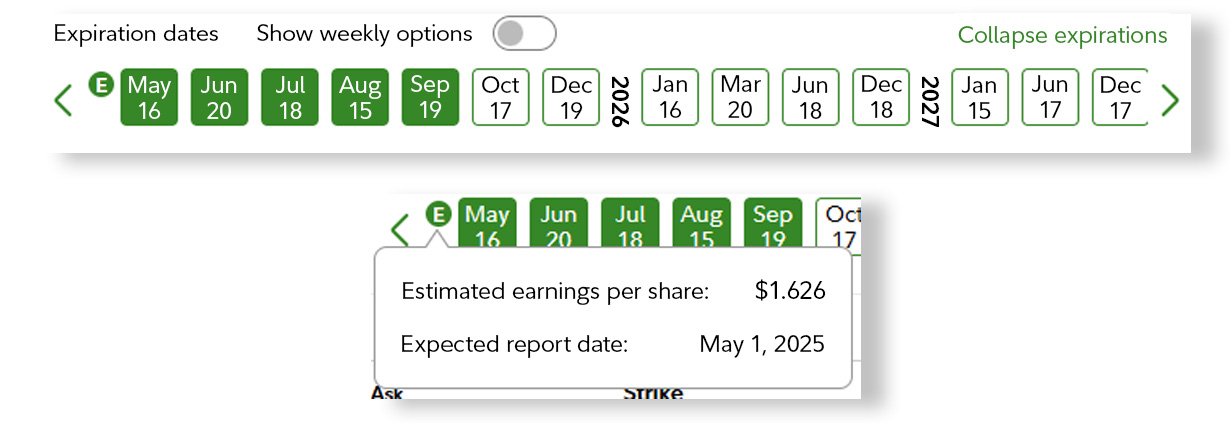

6. Choose the Expiration date that matches your investment time horizon. You can select multiple expirations simultaneously to quickly analyze differences in options pricing across various durations.

- For eligible investments, toggle the weekly options expirations for additional choices and potentially shorter-term trade opportunities.

- To view additional details, hover over the "E" for earnings and the "D" for dividends, where applicable.

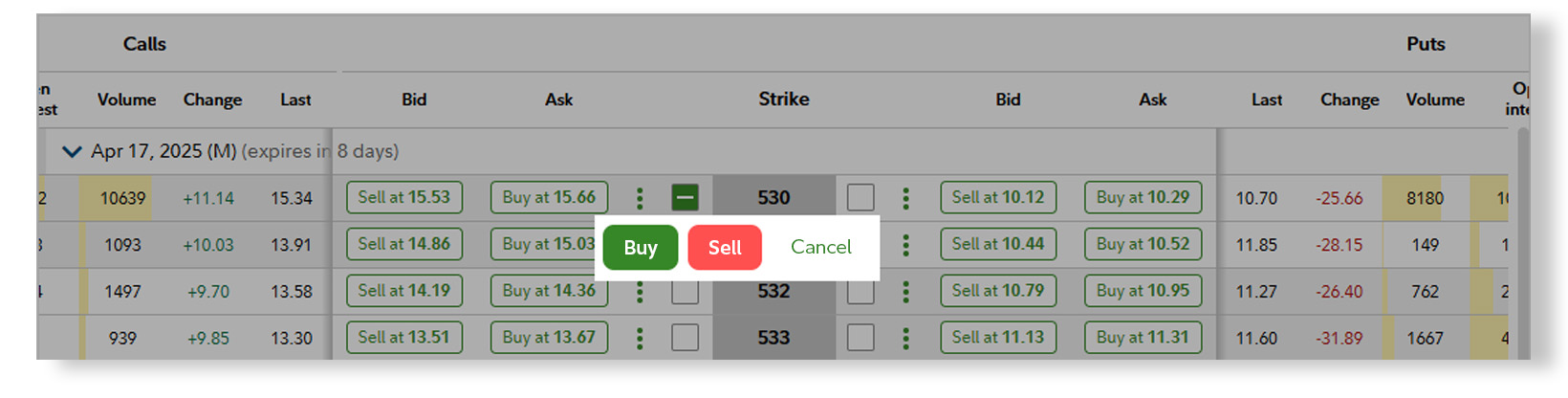

7. Select the check box next to the strike price you wish to trade and choose the appropriate trade action. In this example, we’ll demonstrate buying a call option.

8. Review the Trade Analyzer to quickly understand your trade’s estimated max gains, losses, and probability of profit to help ensure its within your risk tolerance.

- You can adjust order details and the evaluation price to analyze alternative scenarios.

- Select Preview order in trade ticket to move forward with the analyzed trade.

.jpg)

9. Preview your order in the trade ticket. Make any final adjustments to the options contract quantity, order type, and limit price (if you choose a limit order).

.jpg)

10. When ready, select Place Order. You’ll receive confirmation of your order, with an immediate status as to whether it remains open or was filled.

.jpg)

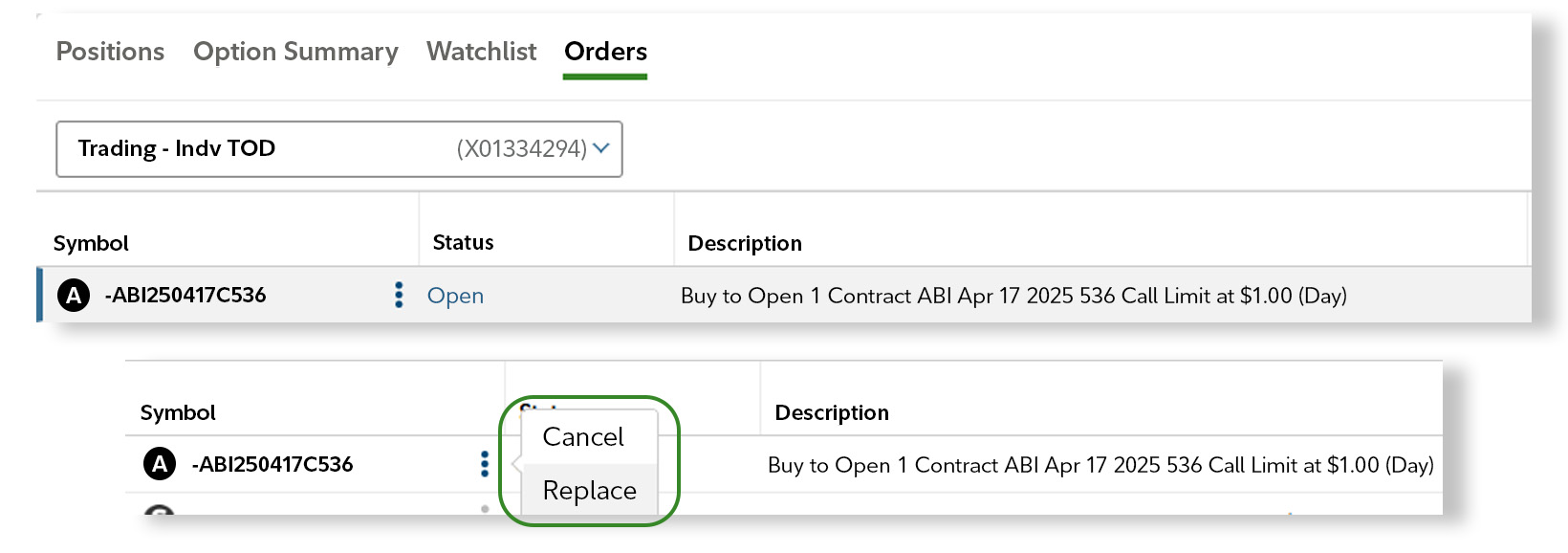

11. After the trade is placed, you can monitor the order status within the Orders tool panel. If market conditions have changed, select the action menu to attempt to cancel or replace your order.

Congratulations—you’re ready to scan, analyze, and trade options with Fidelity Trader+™ Web!

Now you're better equipped with the tools and insights needed to confidently navigate the options markets. Start your trading journey today and take control of your financial future.