The partial government shutdown that began on January 31 has now ended after President Trump signed a new funding bill into law. Most federal agencies are now fully funded through September 2026, with the exception of the Department of Homeland Security, which received temporary funding.

The most recent shutdown may be receding from headlines, but with another deadline already on the horizon, more funding debates are likely ahead. Here’s what to know about shutdowns and markets.

How common are government shutdowns?

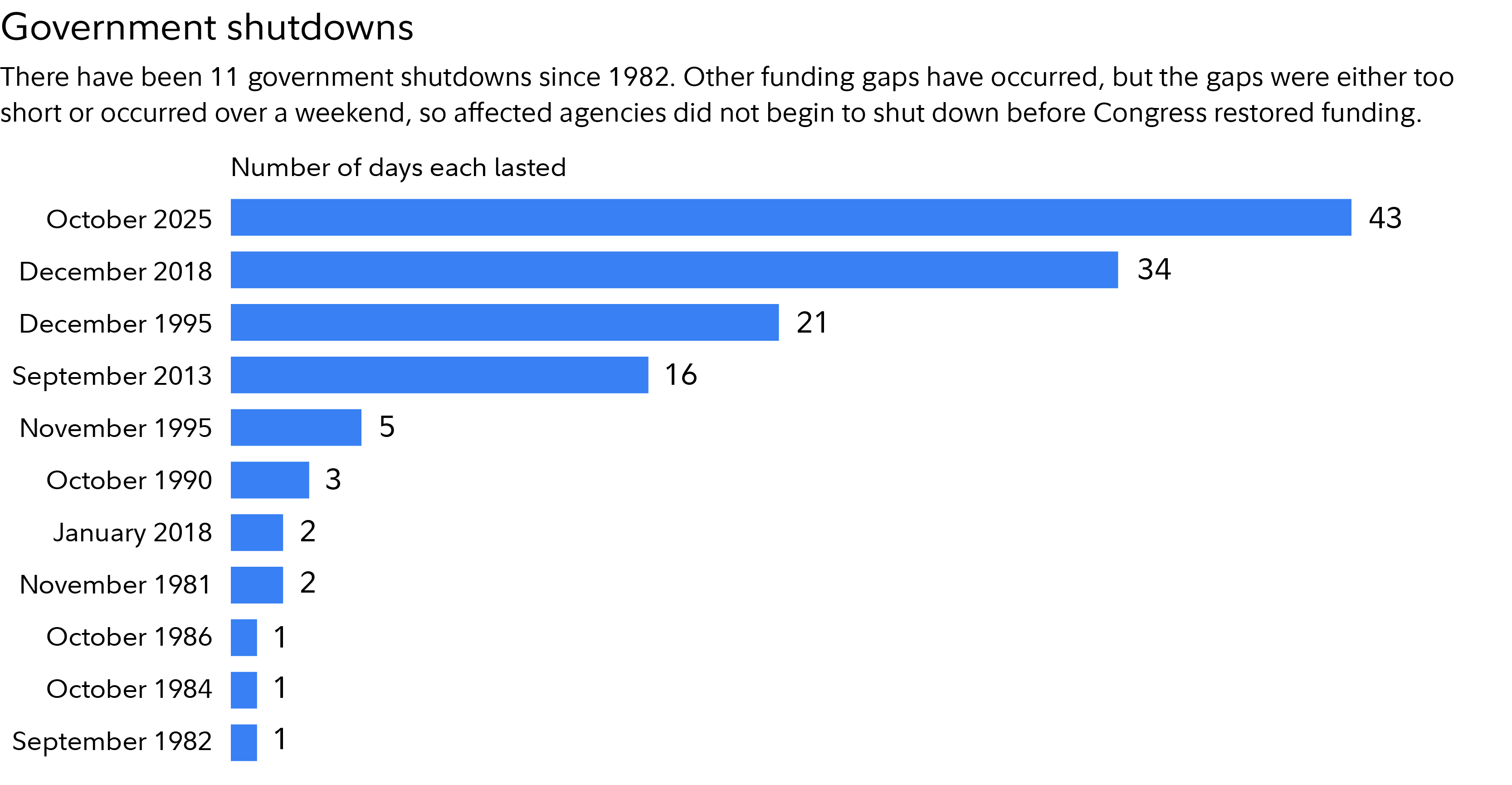

Shutdowns are hardly a rarity. As of the end of 2025 the government had faced a total of 11 shutdowns, starting with the first shutdowns in the early 1980s. History shows these shutdowns have ranged from very brief to more prolonged, but even the longer ones have had limited market impact.

How can government shutdowns affect stocks?

Past shutdowns have had little impact on investors, consumers, or financial markets. “Even longer historical shutdowns, which were disruptive and costly, did not move the stock market,” says Jurrien Timmer, Fidelity's director of global macro.

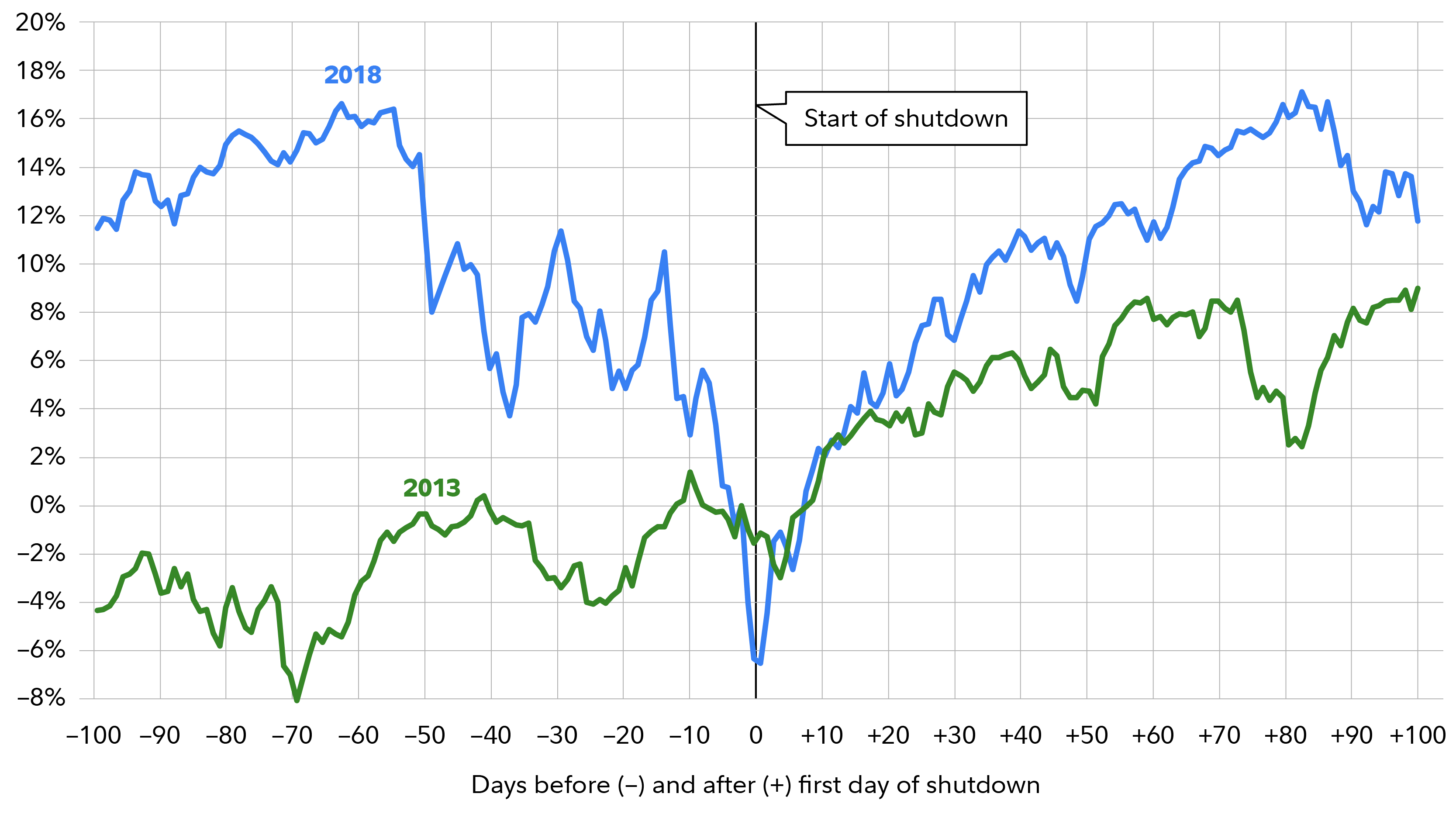

Timmer’s belief that shutdowns are not significant events for stocks is based on analyzing historical data about the performance of the S&P 500® Index during the 100 days before and after the 2013 and 2018 shutdowns. In both cases, stocks rose strongly in the 100 days following the shutdowns of nonessential government services.

Timmer also points out that the 2018 shutdown took place when stocks were nearing the tail end of what he calls an “unrelated 20% drawdown” and began a strong rally while the government was still on hiatus. And though past performance is never a guarantee of future results, US stocks generally rose over the course of the October to November 2025 shutdown.

What this history shows is that market participants understand that short-lived political maneuvering may make headlines, but typically does not have a meaningful impact on corporate earnings, which are the primary drivers of stock prices. That's especially true for news events such as a shutdown where the eventual outcome is predictable. As Timmer puts it, "We've all seen this movie before and it always ends the same way."

S&P 500 performance around 2013 and 2018 shutdowns

Can government shutdowns affect the economy?

While history shows that government shutdowns have had little long-term effect on stock prices—or on the size and functioning of the federal government—they can have a potential economic impact if they drag on.

The federal government spends enormous amounts of money buying goods, providing services, and otherwise generating economic activity. If a shutdown lasts for more than a short period, it can temporarily weigh on economic activity—primarily through reduced government spending and lower confidence among consumers and businesses.

For example, the 2025 government shutdown likely reduced US economic activity in the fourth quarter of 2025, though most estimates indicate that growth in gross domestic product (GDP) stayed positive despite the temporary drag.

How can a shutdown affect government services?

A shutdown can cause an interruption of some government services but not all. Social Security, Medicaid, and Medicare payments to recipients generally are not affected. Neither are what are called essential services such as federal law enforcement, air traffic control, and disaster relief. The US Postal Service also generally is not affected.

Should you worry about your investments when there is a shutdown?

While uncertainty about government shutdowns can generate worrisome headlines, the biggest risk for most investors may be the temptation to overreact to those headlines and make personal finance decisions based on fear and uncertainty.

If you already have an investment strategy built around your goals, financial situation, time horizon, and risk tolerance, you likely don't need to make any changes in response to headlines. If you don't, learn more about how we can work together to help you create one.