Companies delivering disruptive technological advancements in factory automation – through artificial intelligence, the industrial Internet of Things, factory simulation or robotics – represent compelling investments today, according to Fidelity Portfolio Manager Clayton Pfannenstiel.

“Automation is a significant global trend that our research team is closely monitoring,” says Pfannenstiel, who co-manages Fidelity® Disruptive Automation ETF (FBOT). “Factory automation is helping shift supply chains back home by offsetting geographic cost discrepancies,” Pfannenstiel says. “Automation technology also enhances the value added by manufacturing employees and reduces some of the labor cost advantages that previously drove offshoring.”

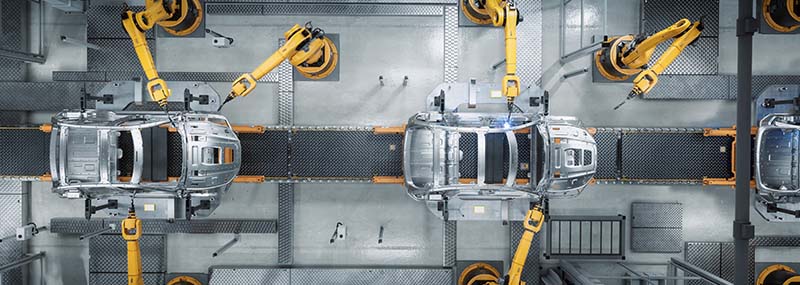

The fund seeks companies at the forefront of automation – from industrial robotics to artificial intelligence and autonomous driving. Disruptive businesses are those that introduce radical change in a market or industry. Think of the printing press in 1440. The steam engine in 1698. The telephone in 1876. And, more recently, the computer, the internet and the smartphone.

“The stocks of disruptive firms are a good fit for my long-term portfolio strategy, as it often takes time for the products, technologies and business models to gain mainstream adoption,” says Pfannenstiel. “My goal is to invest in these companies early in their growth trajectory, so the fund can potentially benefit over time.”

Pfannenstiel believes catalysts for automation-related names include the focus on improved worker safety, increased reliance on e-commerce and enabling logistics, changes in the way people work, and the trend of protecting supply chains through reshoring or diversifying manufacturing locations.

Learn More

The portfolio targets firms driving disruptive technological advances in artificial intelligence, which improves decision-making and can predict equipment failure; the industrial Internet of Things, where sensor connectivity is allowing for real-time monitoring; digital twin technology, which simulates factory decision-making, timelines and costs; and robotics, which augments worker capabilities and boosts productivity.

As a play on these themes, Pfannenstiel cites Emerson Electric (EMR), Siemens (SIEGY) and PTC (PTC) among notable fund holdings at the end of November.

He notes that Emerson Electric spent the past several years simplifying its portfolio and can now go on offense in the industrial automation market. Its virtual programmable logic controller allows customers to utilize Emerson’s technology on legacy/competitor hardware, lowering the switching costs inherent in automation, he explains.

Germany-based Siemens is similarly positioned, but with a greater emphasis on Europe, according to Pfannenstiel. “Europe is at the start of an investment cycle in infrastructure, which I believe could lead to more industrial growth,” he says. “These new factories will require greater automation than the prior generation, and Siemens is in the prime position to drive this automation.”

Pfannenstiel considers PTC a software-native beneficiary of the industrial buildout. He says the company is rolling out AI-backed products to its existing base of customers, helping to accelerate productivity in digital design and supply-chain management.

“These three companies are disrupting their respective industries and are early in their development and maturation,” says Pfannenstiel. “I plan to monitor their growth journeys because I believe they have the potential to become the automation leaders of tomorrow.”

For specific fund information, including full holdings, please click on the fund trading symbol above.

Clayton Pfannenstiel is a sector leader and portfolio manager in the Equity division at Fidelity Investments.

In this role, Mr. Pfannenstiel is the global industrials sector leader and portfolio manager on Fidelity Select Industrials Portfolio, Fidelity Advisor Industrials Fund, VIP Industrials Portfolio, Fidelity Disruptive Automative ETF, and Fidelity Select Aerospace and Defense Portfolio. Additionally, he covers the global multi-industrials companies within the industrials sectors along with aerospace and defense industries.

Prior to assuming his current position in 2021, Mr. Pfannenstiel was a research analyst in Fidelity’s High Income and Alternatives division covering the airline, aerospace and defense, ground transports, maritime shipping, and packaging industries.

Before joining Fidelity in 2018, Mr. Pfannenstiel was a research associate at Sirios Capital Management. Prior to that, he held equity research roles at Credit Suisse and Bank of America/Merrill Lynch. He has been in the financial industry since 2009.

Mr. Pfannenstiel earned his Bachelor of Arts in economics and Asian studies from the University of North Carolina – Chapel Hill and his Master of Business Administration from the Massachusetts Institute of Technology – Sloan School of Management. He is also a CFA® charterholder.