The new tax bill signed into law in July has changed the landscape for many taxpayers by making permanent, or expanding, numerous tax cuts from earlier tax-cut legislation. Among the most significant changes, the new act temporarily increases the cap on the state and local taxes, or SALT, deduction—a move that could make itemizing worth a second look, particularly if you live in a high-tax state.

How has the SALT deduction changed?

Under the 2017 Tax Cuts and Jobs Act (TCJA), the SALT deduction was capped at $10,000, making it more beneficial for many middle- and upper-income earners to take the standard deduction since it also doubled under that act.

The new tax legislation raises the SALT deduction cap to $40,000 for single and joint filers—but with several caveats: The full deduction phases out for filers with modified adjusted gross income above $500,000 ($250,000 in the case of a married individual filing separately), and reverts to $10,000 for incomes of $600,000 and above. While the deduction and the phase-out levels will increase by 1% a year, these changes are in effect through 2029, after which point the cap reverts to $10,000. For married couples who file separately, the deduction increases to $20,000 and returns to its previous level of $5,000 in 2030. Good to know: Starting in 2026, the value of itemized deductions for those in the 37% tax bracket will be capped at 35%, or approximately 35 cents for every dollar they deduct.

Although the new deduction is likely to help wealthier taxpayers in high-tax states the most, particularly if they have a lot to itemize in addition to high state income and property taxes, these changes may also make it worthwhile for more people who used to take the standard deduction to consider itemizing.

What are state and local taxes anyway?

As a refresher, state and local taxes can include taxes on earned income from your salary or other wages, sales tax (if itemized and elected as a deduction in place of wages), and property tax, among others.

While 9 states have no income tax, no state is entirely free of state and local taxes. Depending on where you live, the average person pays between $4,722 for the lowest SALT in Alabama to $14,974 annually in the District of Columbia. After District of Columbia, states with the highest SALT include New York with an average per capita SALT of $12,685; California, with an average of $10,319; and Connecticut with an average $9,718.1 Regardless of state, however, those who are most likely to take the SALT deduction are higher earners with proportionately higher property taxes and more expensive homes.

While it’s likely they’ve already been itemizing to take advantage of the mortgage interest deduction, the higher SALT cap may also open the door for others to begin itemizing.

How itemizers could save more

Generally speaking, there are 4 categories of deductions in addition to SALT that someone can consider claiming: medical expenses, home mortgage interest, charitable contributions, and theft and casualty losses due to a federally declared disaster. Some of these, like health care costs, come with annual limits. For example, you cannot deduct health care costs that are less than 7.5% of your adjusted gross income (AGI), nor those paid for with a flexible spending account (FSA) or health savings account (HSA).

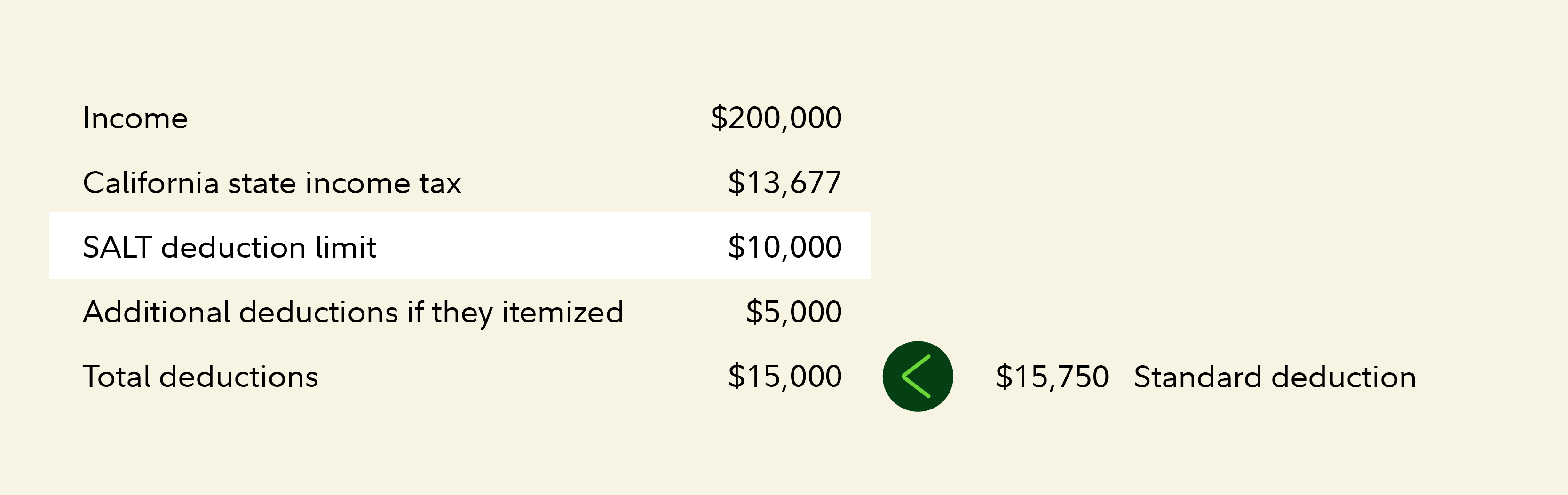

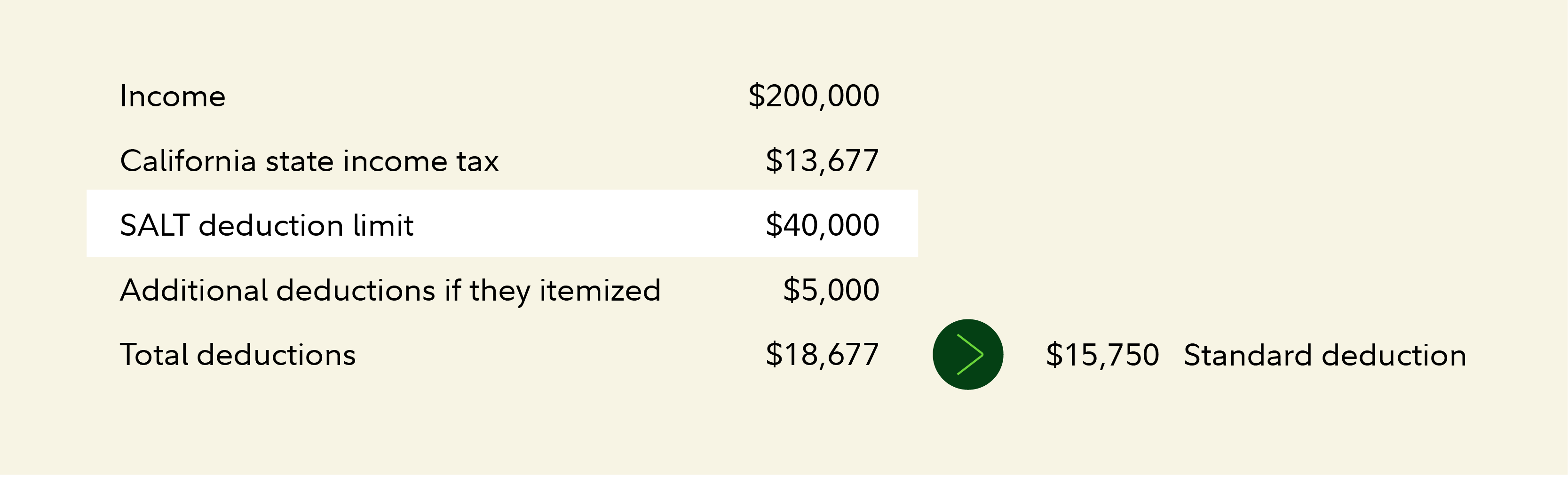

Let’s consider a hypothetical single filer who lives in high-tax California, earns $200,000 annually, and does not own a home. In the past, the $10,000 SALT deduction cap would have made taking the standard deduction—$15,750 for a single filer for the 2025 tax year—a smarter move.

Now, with the higher SALT deduction, they might realize more tax savings by itemizing.

The hypothetical person could potentially reduce their taxable income by an additional $2,927 if they itemized.

Married filers face different choices

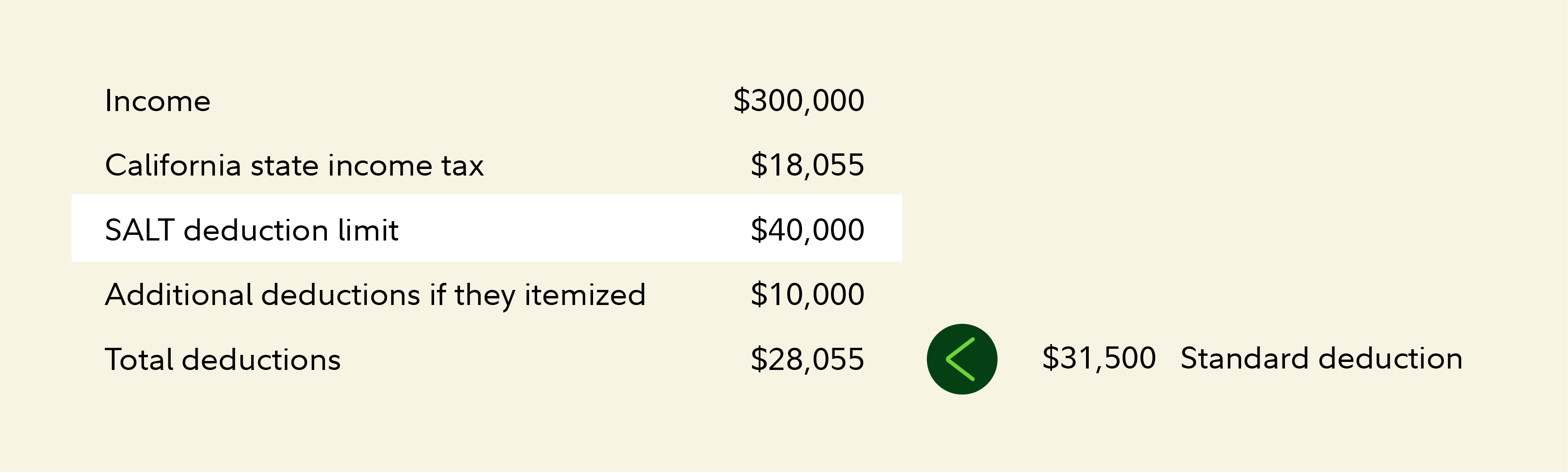

The math is less compelling for a hypothetical married couple who files jointly and who also don’t own their home. That’s because single filers can claim the full $40,000 SALT deduction. In contrast, married couples filing jointly would share that amount between both spouses. Additionally, unlike federal tax brackets and deductions that generally double for married filers, state tax brackets may not double for married filers compared to single filers.

Unless they had more itemizable deductions, the hypothetical couple would be better off continuing to take the $31,500 standard deduction. However, if they were already itemizing—for example, because they owned a home—they’d potentially benefit from the higher SALT cap like the single filer above.

This is true across all scenarios since itemizing increases opportunities for other deductions, such as property tax, the mortgage interest deduction, and charitable contributions.

Additional ways to reduce income

Whether you decide to itemize or not, it’s important to consider other ways you could reduce your taxable income, such as through contributions to tax-advantaged accounts including workplace retirement plans or a traditional IRA, if you qualify for a deduction. A health savings account associated with a high-deductible health plan lets you make pre-tax deferrals through your employer, or deduct your contributions outside of salary deferrals from your taxable income, depending on your situation, and distributions are tax-free if they are used for qualified medical expenses.

If you’re a higher earner and your employer offers a nonqualified deferred compensation (NQDC) plan, you might want to explore this option. NQDC plans are sometimes known as deferred compensation programs (DCPs) or elective deferral programs (EDPs). These plans allow eligible executives to defer a much larger portion of their compensation and to defer taxes on the money until the deferral is paid.

Also, for tax years 2025 through 2028, people who are age 65 and older can claim an additional $6,000 deduction per qualified individual whether they itemize or not. The additional deduction begins to phase out at incomes of $75,000 for single filers and $150,000 for joint filers. Note: The additional senior deduction would be in addition to the $2,000 single filers and $3,200 joint filers are currently able to deduct if they are 65 or older and they are not itemizing.

Bottom line

While the math may still favor taking the standard deduction for many, the higher SALT cap could make itemizing an important consideration for more tax filers. It could also mean more tax savings for people who already itemize. So this year as you’re sitting down to do your tax work, it’s worth consulting a tax or financial professional to find out how the new SALT deduction could work in your favor.