Potential goals

- To profit from neutral stock price action near the strike price of the short call with limited risk on the downside and limited profit potential on the upside.

- To profit from a bullish stock price move to the strike price of the short call with lower risk than a simple long call but also with limited profit potential if the stock price rises beyond the strike price of the short call.

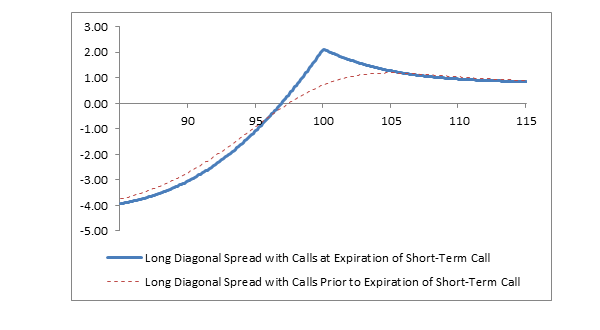

A long diagonal spread with calls is created by buying one “longer-term” call with a lower strike price and selling one “shorter-term” call with a higher strike price. In the example a two-month (56 days to expiration) 95 Call is purchased and a one-month (28 days to expiration) 100 Call is sold. This strategy is established for a net debit, and both the profit potential and risk are limited. The maximum profit is realized if the stock price is equal to the strike price of the short call on the expiration date of the short call, and the maximum risk is realized if the stock price falls sharply below the strike price of the long call.

Example of long diagonal spread with calls

| Sell 1 28-day XYZ 100 call at | 3.35 |

| Buy 1 56-day XYZ 95 call at | (7.60) |

| Net cost = | (4.25) |

The maximum profit is realized if the stock price is equal to the strike price of the short call on the expiration date of the short call. With the stock price at the strike price of the short call at expiration of the short call, the profit equals the price of the long call minus the net cost of the spread including commissions. This is the point of maximum profit because the long call has its maximum difference in price with the expiring short call. It is impossible to know for sure what the maximum profit potential is, because it depends of the price of long call, and that price is subject to the level of volatility which can change.

The maximum risk of a long diagonal spread with calls is equal to the net cost of the spread including commissions. If the stock price falls sharply below the strike price of the long call, then the value of the spread approaches zero; and the full amount paid for the spread is lost.

There is one breakeven point, which is below the strike price of the short call. Conceptually, the breakeven point at expiration of the short call is the stock price at which the price of the long call equals the net cost of the spread. It is impossible to know for sure what the breakeven stock price will be, however, because it depends of the price of the long call which depends on the level of volatility.

| Sell 1 28-day XYZ 100 call at | 3.35 |

| Buy 1 56-day XYZ 95 call at | (7.60) |

| Net cost = | (4.25) |

| Stock Price at Expiration of the 28-day Call | Short 1 28-day 100 Call Profit/(Loss) at Expiration | Long 1 56-day 95 Call Profit/(Loss) at Expiration of the 28-day Call* | Net Profit/(Loss) at Expiration of the 28-day Call |

|---|---|---|---|

| 115 | (11.65) | +12.60 | +0.95 |

| 110 | (6.65) | +7.70 | +1.05 |

| 105 | (1.65) | +3.20 | +1.55 |

| 100 | +3.35 | (0.65) | +2.70 |

| 95 | +3.35 | (4.00) | (0.65) |

| 90 | +3.35 | (6.10) | (2.75) |

| 85 | +3.35 | (7.10) | (3.75) |

*Profit or loss of the long call is based on its estimated value on the expiration date of the short call. This value was calculated using a standard Black-Scholes options pricing formula with the following assumptions: 28 days to expiration, volatility of 30%, interest rate of 1% and no dividend.

A long diagonal spread with calls realizes its maximum profit if the stock price equals the strike price of the short call on the expiration date of the short call. The forecast, therefore, can either be “neutral” or “modestly bullish,” depending on the relationship of the stock price to the strike price of the short call when the position is established.

If the stock price is at or near the strike price of the short call when the position is established, then the forecast must be for unchanged, or neutral, price action.

If the stock price is below the strike price of the call when the position is established, then the forecast must be for the stock price to rise to the strike price at expiration (modestly bullish).

While one can imagine a scenario in which the stock price is above the strike price of the short call and a diagonal spread with calls would profit from bearish stock price action, it is most likely that another strategy would be a more profitable choice for a bearish forecast.

A long diagonal spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the short call, because the strategy profits from time decay of the short call. However, unlike a long calendar spread with calls, a long diagonal spread can still earn a profit if the stock rises sharply above the strike price of the short call. The tradeoff is that a long diagonal spread costs more than a long calendar spread, so the risk is greater if the stock price falls.

Long diagonal spreads with calls are frequently compared to simple vertical spreads in which both calls have the same expiration date. The differences between the two strategies are the initial investment, the risk, the profit potential and the available courses of action at expiration. Long diagonal spreads cost more to establish, because the longer-dated long call has a higher price than the same-strike, shorter-dated call in a comparable vertical spread. As a result, the risk is greater. Also, the profit potential of a long diagonal spread is less if one considers only the expiration date of the short call. The potential benefit of a long diagonal spread, however, is that, after the short call expires, the long call remains open and has unlimited profit potential. One should not forget, however, that the risk of a long diagonal spread is still 100% of the cost of the position. Therefore, even if the short call in a diagonal spread expires worthless, the remaining open long call can still incur a loss if the stock price does not rise.

Patience and trading discipline are required when trading long diagonal spreads. Patience is required because this strategy profits from time decay, and stock price action can be unsettling as it rises and falls around the strike price of the short call as expiration approaches. Trading discipline is required, because “small” changes in stock price can have a high percentage impact on the price of a diagonal spread. Traders must, therefore, be disciplined in taking partial profits if possible and also in taking “small” losses before the losses become “big.”

“Delta” estimates how much a position will change in price as the stock price changes. Long calls have positive deltas, and short calls have negative deltas. When the position is first established, the net delta of a long diagonal spread with calls is positive. With changes in stock price and passing time, however, the net delta varies from slightly negative to approximately +0.90, depending on the relationship of the stock price to the strike prices of the calls and on the time to expiration of the short call.

If the stock price equals the strike price of the short call at expiration of the short call, the position delta approaches +0.90. In this case, the delta of the in-the-money long call approaches +0.90 (depending on volatility and on the time to expiration), and the delta of the expiring short call goes to zero.

When the stock price is above the strike price of the short call at expiration of the short call, the position delta is slightly negative, because the delta of the long call approaches +0.90 and the delta of the in-the-money expiring short call approaches −1.00.

The position delta approaches zero if the stock price falls sharply below the strike price of the long call, because the deltas of both calls approach zero.

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. When volatility falls, the opposite happens; long options lose money and short options make money. “Vega” is a measure of how much changing volatility affects the net price of a position.

Since vegas decrease as expiration approaches, a long diagonal spread with calls generally has a net positive vega when the position is first established. Consequently, rising volatility generally helps the position and falling volatility generally hurts. The vega is highest when the stock price is equal to the strike price of the long call, and it is lowest when the stock price is equal to the strike price of the short call.

The net vega approaches zero if the stock price falls sharply below the strike price of the long call or rises sharply above the strike price of the short call. In both cases, with the options both far out of the money or both deep in the money, both vegas approach zero.

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion. “Theta” is a measure of how much time erosion affects the net price of a position. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion.

Long diagonal spreads with calls generally have a net negative theta when first established, because the negative theta of the long call more than offsets the positive theta of the short call. However, the theta can vary from negative to positive depending on the relationship of the stock price to the strike prices of the calls and on the time to expiration of the shorter-dated short call.

The theta is most negative when the stock price is close to the strike price of the long call, and it is the least negative or possibly positive when the stock price is close to the strike price of the short call.

Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

While the long call in a long diagonal spread with calls has no risk of early assignment, the short call does have such risk. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned.

If the short call is assigned, then 100 shares of stock are sold short and the long call remains open. If a short stock position is not wanted, it can be closed in one of two ways. First, 100 shares can be purchased in the market place. Second, the short 100-share position can be closed by exercising the long call. Remember, however, that exercising a long call will forfeit the time value of that call. Therefore, it is generally preferable to buy shares to close the short stock position and then sell the long call. This two-part action recovers the time value of the long call. One caveat is commissions. Buying shares to cover the short stock position and then selling the long call is only advantageous if the commissions are less than the time value of the long call.

Note, however, that whichever method is used, buying stock or exercising the long call, the date of the stock purchase will be one day later than the date of the short sale. This difference will result in additional fees, including interest charges and commissions. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position.

The position at expiration of the short call depends on the relationship of the stock price to the strike price of the short call. If the stock price is at or below the strike price of the short call, then the short call expires worthless and long call remains open.

If the stock price is above the strike price of the short call, then the short call is assigned. The result is a two-part position consisting of a long call and short 100 shares of stock. If the stock price is above the strike price of the short call immediately prior to its expiration, and if a position of short 100 shares is not wanted, then the short call must be closed.

The term “diagonal” in the strategy name originated when options prices were listed in newspapers in a tabular format. Strike prices were listed vertically in rows, and expirations were listed horizontally in columns. Therefore a “diagonal spread” involved options in different rows and different columns of the table; i.e., they had different strike prices and different expiration dates.