Roth IRAs can unlock tax-free retirement income, and they come with flexible withdrawal rules. Unlike traditional IRAs, Roth IRA withdrawal rules allow you to access your contributions at any time without taxes or penalties. However, withdrawals from earnings can result in penalties and taxes if withdrawn before the 5-year aging rule is met or before age 59½.

Roth IRA basics

A Roth IRA is a type of retirement account you can set up on your own, apart from your employer. As long as you’re eligible, you can contribute up to the annual IRA contribution limit across all your IRAs. Note that you may only contribute to a Roth IRA if your modified adjusted gross income (MAGI), your annual earnings minus certain adjustments, is under the annual Roth IRA income limits.

The annual contribution limit for IRAs, including Roth and traditional IRAs, is $7,000 for tax year 2025 and $7,500 for tax year 2026. If you’re age 50 or older, you can contribute an additional $1,000 for tax year 2025 and $1,100 for tax year 2026. You can generally contribute for the prior tax year up until the tax filing deadline of the current year.

Roth accounts are funded with money you’ve already paid taxes on, and you can’t deduct Roth IRA contributions from your taxable income. Your earnings could then potentially grow tax-free, and qualified distributions during retirement are federal tax- and penalty-free.

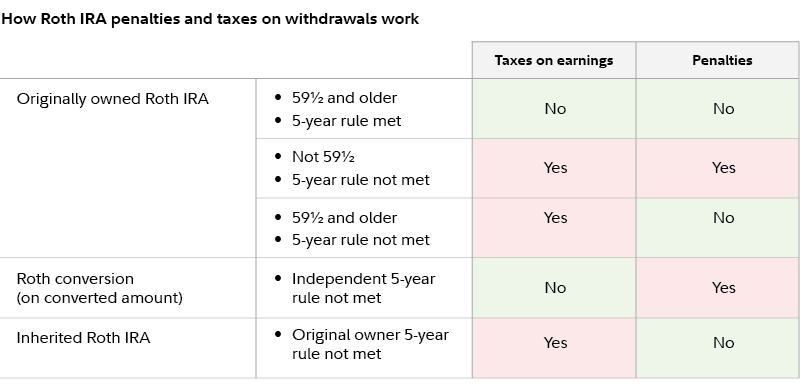

Roth IRA withdrawal rules

Roth IRAs have particular withdrawal rules like other tax-advantaged accounts. So when can you take distributions from a Roth IRA? The answer depends on a few different factors. Again, you can withdraw contributions at any time, even before retirement, without owing taxes or penalties—withdrawals of gains, however, are more restricted.

Here’s what you can expect based on your age.

If you are younger than age 59½

- You can withdraw investment earnings without incurring penalties or taxes if your account meets the 5-year aging rule, as in, 5 years have elapsed between the beginning of the tax year of your first contribution to a Roth account and withdrawal of earnings. Your distribution must also be for a “qualified” reason, such as:

- You’re buying a home for the first time (you can withdraw up to $10,000 penalty-free)

- You’ve become disabled

You may be able to avoid penalties (but not taxes) if:

- You withdraw gains to pay for:

- Adoption or birth expenses (up to $5,000 per child)

- Health insurance premiums while unemployed

- Qualified education expenses, like tuition at an eligible school

- Certain unreimbursed medical expenses exceeding 7.5% of adjusted gross income

Note that this list is not exhaustive. For additional information, refer to the IRS’ full list of exceptions to tax on early distributions.

If you don’t meet one of these, any gains you withdraw will likely be subject to a 10% early withdrawal penalty and income tax.

Let’s say you’re 42 and have contributed a total of $35,000 to a Roth IRA. Your current account value is $50,000, thanks to years of investment growth. While you can withdraw up to $35,000 tax- and penalty-free whenever you’d like, you’d have to clear one of the previously mentioned criteria to access the other $15,000 in your account without paying taxes or penalties.

If you are age 59½ or older

Roth IRA distributions are less complex if you’re age 59½ or older, especially if your account meets the criteria for the IRS’ 5-year rule. In this case, you can withdraw contributions and gains tax- and penalty-free. If you have not had the account open for at least 5 years, gains are taxable but not subject to the 10% penalty.

Roth IRA withdrawal FAQs

Go deeper with answers to more Roth IRA withdrawal questions.

Do you pay taxes on Roth IRA withdrawals?

You generally don’t pay taxes on Roth IRA withdrawals of contributions or even earnings if your account meets the 5-year aging rule and you are age 59½ or older. You could also avoid paying taxes on Roth IRA withdrawals if you’re making qualified withdrawals. You’ll only pay taxes if you withdraw earnings, have not met the 5-year aging rule, and the withdrawal is not a qualified distribution.1

What tax forms do you need for Roth IRA withdrawals?

If you take a Roth IRA distribution during the tax year—no matter your age—you should receive Form 1099-R. This form shows the amount withdrawn from your Roth IRA, which you’ll need to report on your W-2 when you file your tax return. If you owe additional penalties on earnings, you will need to complete Form 5329 to determine the amount owned.

What are the withdrawal rules for Roth IRA conversions?

If you converted a pre-tax retirement account, like a traditional IRA or 401(k), into a Roth IRA, converted Roth balances can be withdrawn penalty-free as long as the withdrawal is 5 or more years after the start of the tax year in which the conversion took place. Keep in mind that if you have done more than one Roth conversion, each conversion has to satisfy its own 5-year aging period. Note, too, that income taxes would not be owed on the converted balances even in the event of a non-qualified withdrawal, as you had already paid the tax at the time of the conversion. Income tax may still be owed on the withdrawal of any earnings.

What are the withdrawal rules for required minimum distributions (RMDs) from Roth IRAs?

Original Roth IRA account owners don’t have to take RMDs. You can leave your money in the account as long as you’d like. If you inherit a Roth IRA, you may have to take RMDs. The amount and cadence of these depend on whether you were married to the deceased and their age when they died, among other factors.

What are the withdrawal rules for inherited Roth IRAs?

As with your own Roth IRA, the withdrawal rules for inherited Roths allow you to access contributions at any time, tax- and penalty-free. The same goes for investment earnings if the account meets the 5-year aging rule; you do not need to be age 59½ to take penalty-free earnings withdrawals on an inherited Roth IRA. If the account does not meet the 5-year aging rule for the original owner, taxes may still be due on withdrawals of earnings. In fact, you may be expected to take RMDs, unless you inherit the account from your spouse. Failing to do so could result in a 25% penalty reducible to 10% if you take the missed distributions within the correction window. Understanding complex inherited IRA RMD and withdrawal rules could prevent unwelcome surprises.2

How do non-qualified Roth withdrawals work?

Your Roth money is withdrawn from your account in the following order:

- contributions

- conversions (taxable portion first, then non-taxable; on a first-in, first-out basis by year)

- earnings