Overview

Investment Choices

Lend your securities. Earn income.

Fidelity’s Fully Paid Lending Program lets you earn incremental income on securities that you already own, just by lending them out.

What is the Fully Paid Lending Program?

Fidelity's Fully Paid Lending Program provides you with the opportunity to lend securities in your portfolio and earn income. If there is demand in the securities lending market, generally due to short selling, scarce lending supply, or corporate events, Fidelity may borrow certain eligible securities until either you or Fidelity elect to close the loan.

How does it work?

![]()

Enroll online

Start here by checking your eligibilityLog In Required. If eligible, enrollment takes just a few minutes.

![]()

Lend your eligible securities

Once enrolled, there are no extra steps. All eligible securities in your account, now or in the future, will be considered for borrowing based on demand in the lending market.

![]()

Start earning

The income for lending your securities will be credited to your Fidelity account.

How am I paid?

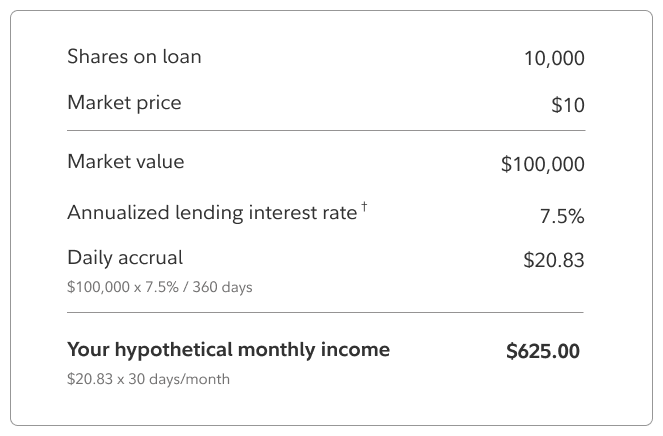

Each month you will be paid lending income that is automatically credited to your Fidelity account. Lending interest rates are variable and may change at any time based on market conditions. Here's a hypothetical example of how interest is calculated, using an annualized lending rate of 7.5%.

†The lending interest rate is based on the relative value of the loaned security, which is determined by several factors including borrowing demand and short selling, and general market conditions.

Important considerations

When deciding whether to participate in Fidelity’s Fully Paid Lending Program it is important that you are aware of these considerations.

ENROLLMENT

Once enrolled, if Fidelity borrows a security, the length of the loan and your ability to earn income will vary depending on short selling demand and available lending supply.

SIPC

Shares on loan are not covered under Securities Investor Protection Corporation (SIPC). However, Fidelity provides collateral at a minimum of 100% of the loan value. In any securities lending transaction, counterparty default is a risk.

DIVIDENDS

Cash distributions paid on securities borrowed over the dividend record date are credited as a "cash-in-lieu" payment, which may have a different tax treatment than the actual dividend from the issuer.

VOTING RIGHTS

When you loan your shares, you relinquish voting rights. However, if you want to vote your shares, you can recall your loan in advance of the record date.