CALCULATORS & TOOLS BY TOPIC

ADDITIONAL RESOURCES

Search & Compare Investments

Our custom screeners and analysis can help you generate investing ideas and then research and compare investments to help you make more-informed decisions.

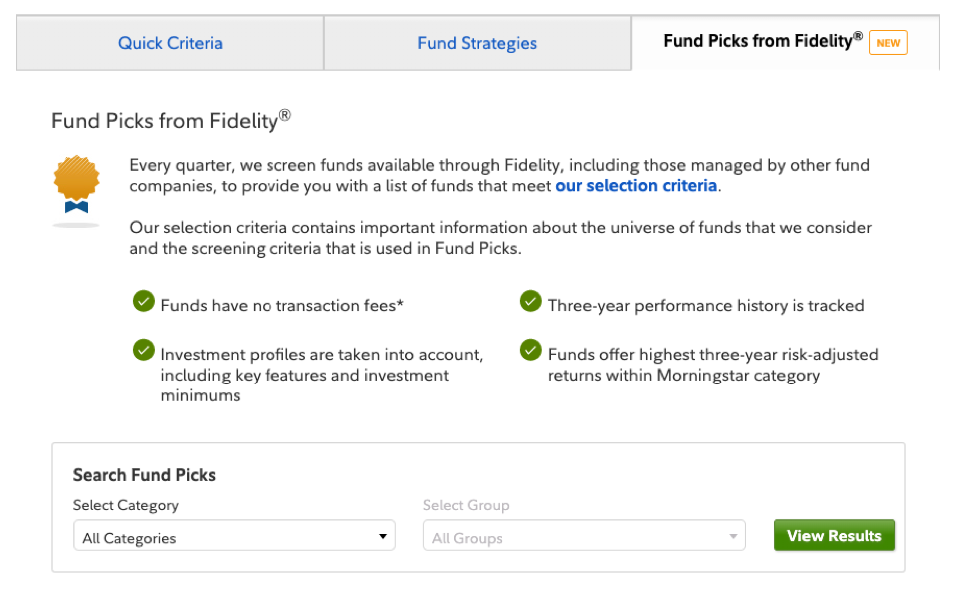

Browse and compare funds based on our selection criteria

We screen the mutual fund universe quarterly and select funds based on criteria such as no transaction fees or loads, risk-adjusted performance, and investment profile.

Fund Picks From Fidelity®

View up to 10 funds per investment category.

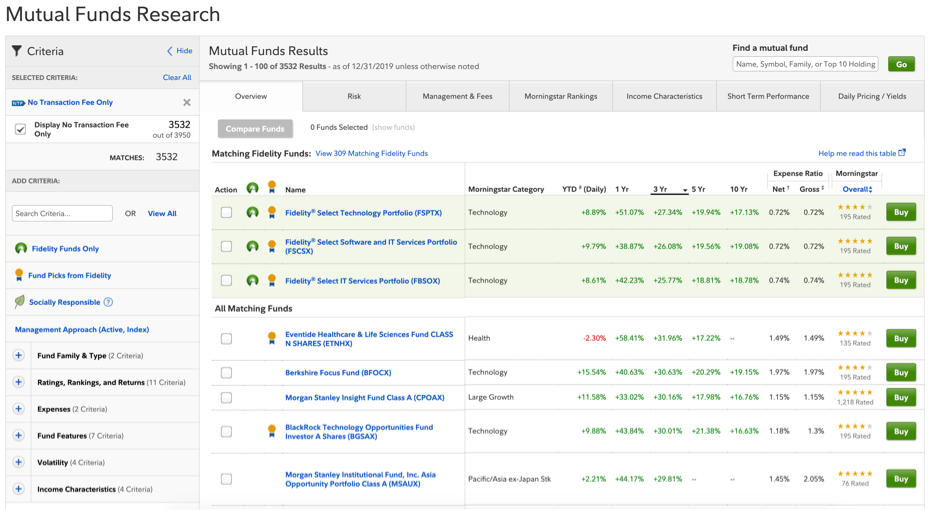

Search and evaluate mutual funds according to your criteria

Our mutual fund screener can help you search, filter, and sort through all 10,000 funds available through Fidelity.

Mutual Fund Evaluator

Search by type, performance, expense ratio, or rating.

Search the universe of publicly traded stocks according to your criteria

Our stock screener lets you explore the universe of publicly traded stocks using preselected or custom criteria.

Stock Screener

Filter by more than 140 criteria with customizable values.

Questions?

- 800-343-3548 800-343-3548

- Chat with a representative