529 plan investment options

Fidelity-managed 529 plan accounts offer a range of investment options, letting you choose an investment type that makes sense for your situation.

What are your investment choices?

Different investors have their own goals, risk-tolerance levels, and time horizons. Whether you select a Fidelity-managed 529 plan for your state of residency or you select our national plan, you have multiple types of investment options to choose from.

The following questions will help you decide the option that works best for you:

Ready to get started?

Per IRS rules, you can change current investments twice in a calendar year, and when you change the beneficiary. You can change the investment instructions for future deposits at any time.

Where do you live?

Depending on your state of residence, a Fidelity-managed, state-specific plan may be a good option for you. If Fidelity does not manage a plan for your state, you may want to consider our national plan, the UNIQUE College Investing Plan (sponsored by the state of New Hampshire). Be sure to consider your own or the beneficiary's home state 529 plan as some states offer favorable tax treatment or other benefits to their residents only if they invest in their own state's 529 plan.3

How do you want your 529 investments managed?

When was the child born?

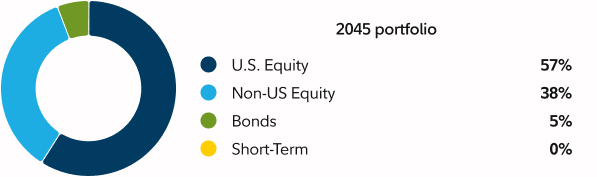

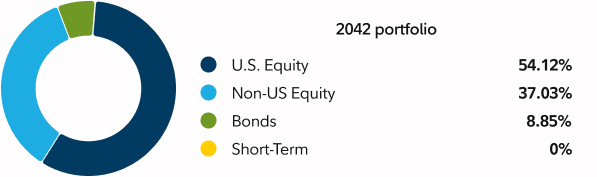

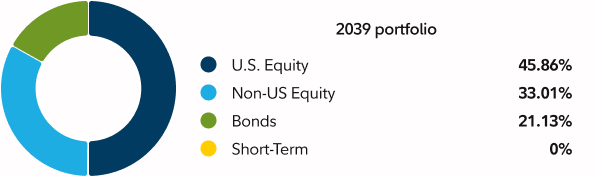

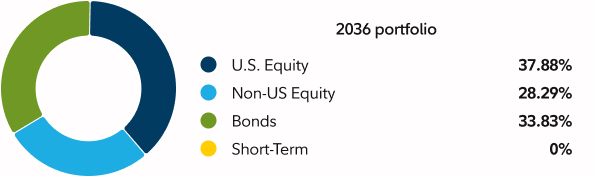

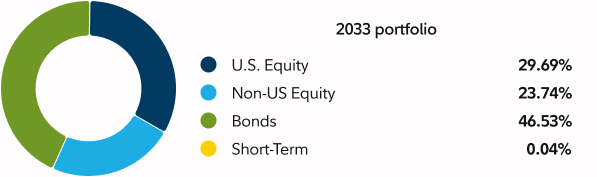

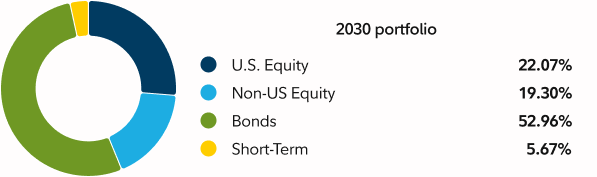

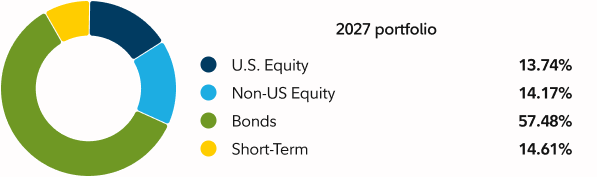

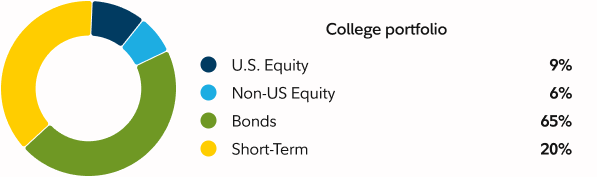

Age-Based Portfolios are mapped to a beneficiary's year of birth and the approximate year the beneficiary is anticipated to start college. Each portfolio is managed with the asset allocation automatically becoming more conservative as the beneficiary nears college age. Select your beneficiary's birth year below to learn more about your Age-Based portfolio investment options.

Select from 3 portfolio types

A custom strategy allows you to build your own investment mix from the 3 portfolio types shown below. You may allocate money to any number of funds you'd like, in 5% increments that total 100%.

To view current portfolio performance, asset allocation, expense ratios, and other fund research, expand a portfolio type below, then select a portfolio name from the list.

View information on the funds' short-term performance, or average annual total returns by month or by quarter.

Please review the 529 plan Fact Kit for more detailed information.

Ready to get started?

Learn more

Access a library of courses, articles, and videos to learn more about planning and saving for college.

Get started with college savings

Understand what it's like to have an account, from choosing a plan to withdrawing funds.

Anyone can use our college savings calculator to figure out how much to save each month. Login or become a member to create a personalized savings plan and track your progress.