Fidelity Digital Assets®

Fidelity Crypto® is offered by Fidelity Digital Assets® which prioritizes both security and accessibility by using an omnibus storage structure. Traditional capital markets, like stocks and bonds, as well as many other digital asset custodians use a similar structure.

What is an omnibus structure?

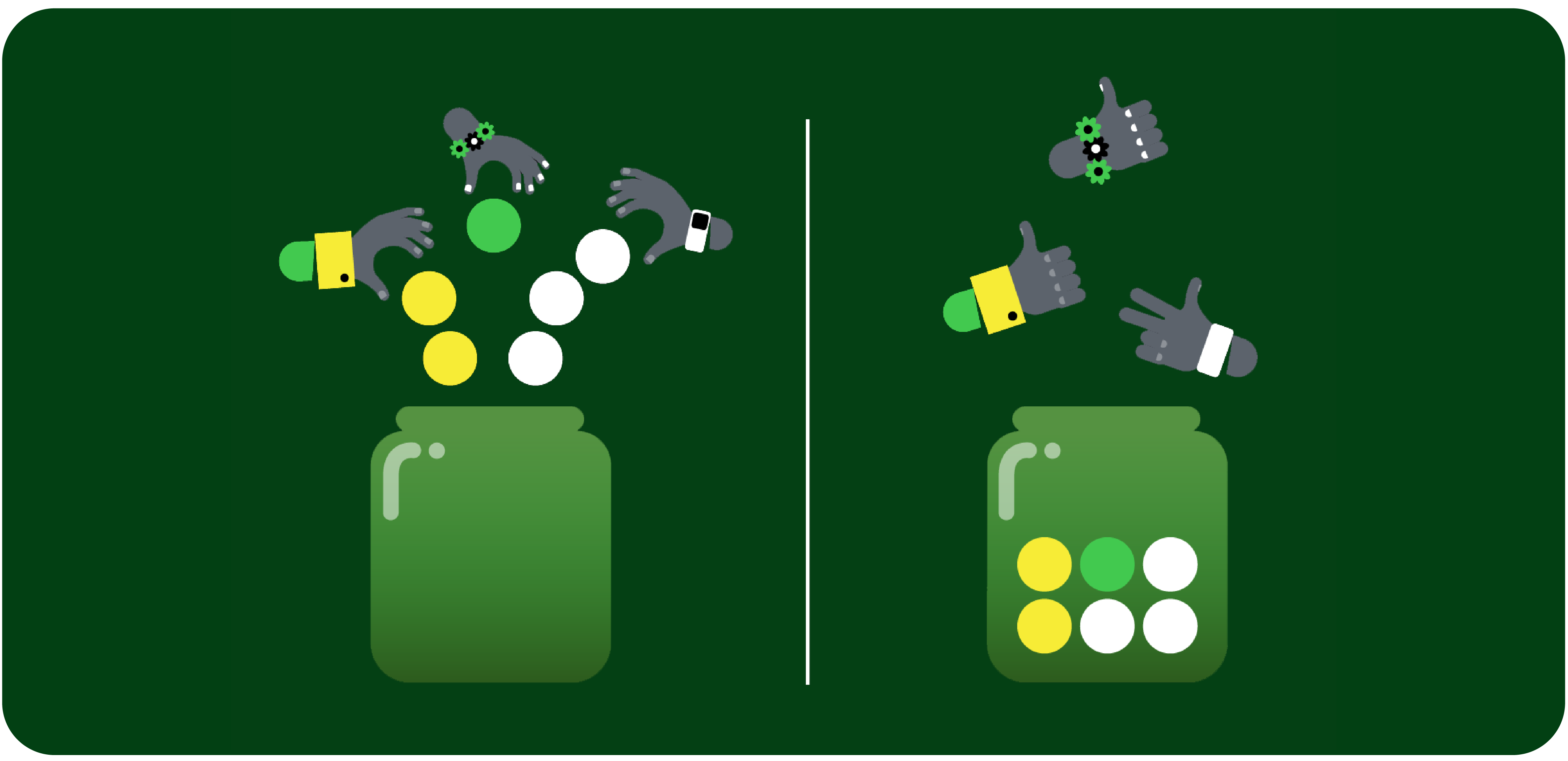

Simply put, an omnibus structure means all client assets are stored together but recorded individually. An omnibus structure allows Fidelity Digital Assets to pull assets from a single source vs. multiple accounts. For example, let s use quarters to represent bitcoin. The idea of an omnibus structure is to have a communal jar of quarters vs. a separate jar for each person.

Say you buy 2 quarters, then someone buys 1, and someone else buys 3. All 6 quarters would be placed in the same jar, but your account would only show your 2 quarters.

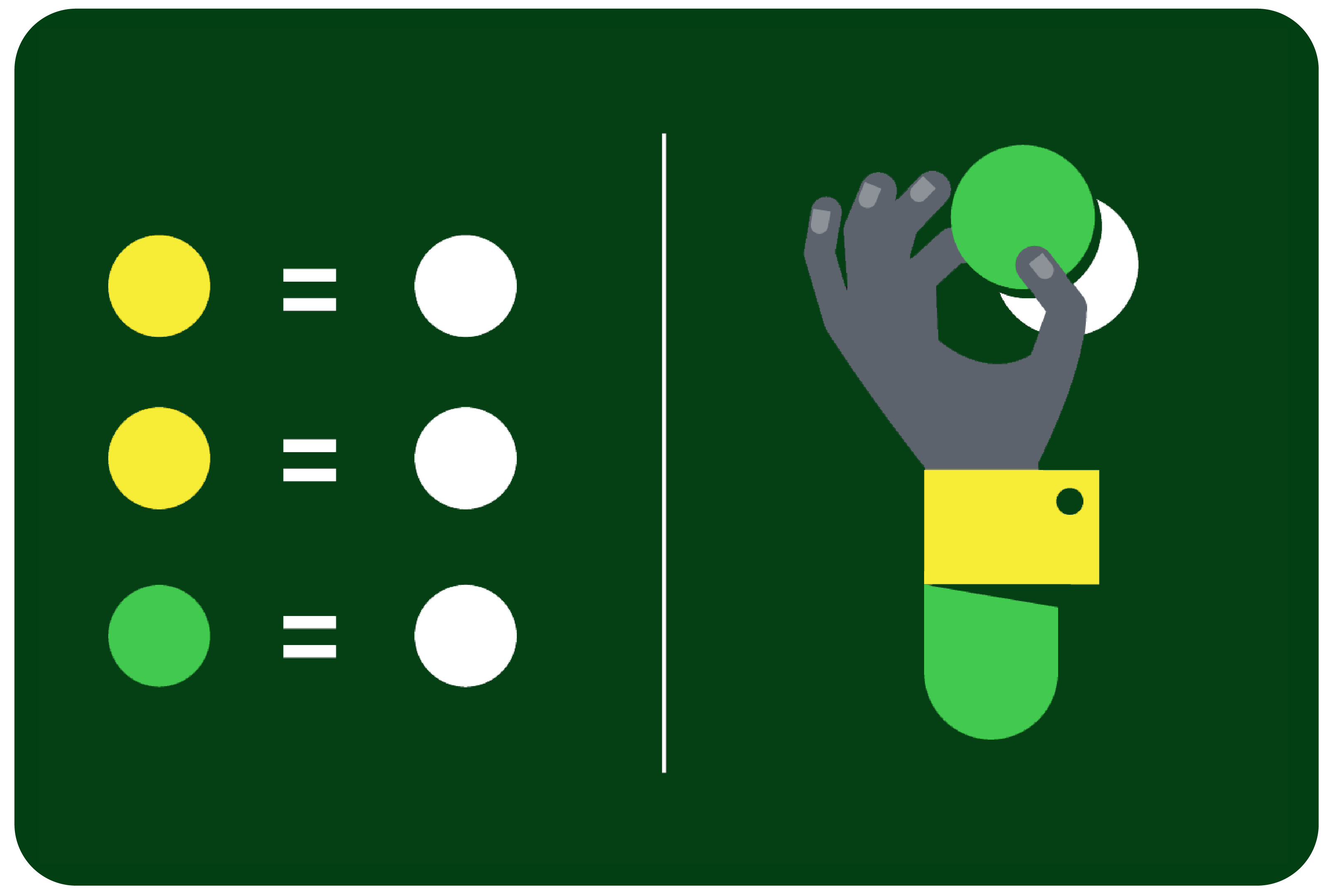

If you withdraw your quarters, they would be taken from the jar with 6 quarters. When you receive your quarters, they might not be the same exact 2 quarters you put in the jar—but they hold the same value—aka a fungible asset.

Did you know?

How does Fidelity Digital Assets use an omnibus structure?

Fidelity Digital Assets combines both hot and cold storage to provide an optimized balance of security and accessibility.

A small portion of all assets are stored online in hot wallets making them easily accessible for trades and transfers.

The remaining assets are stored offline in secure cold storage.

How does Fidelity Digital Assets keep crypto safe?

Cold storage

Your assets are held offline in cold storage in a hardened room structure that's TEMPEST shielded and radio frequency blocked.

Secure facilities

All facilities and systems are fully redundant with backups in case any site becomes unavailable due to unforeseen circumstances, like a natural disaster. All sites also have 24/7 alarms, security, and remote monitoring.

On-chain privacy

Blockchains are public, which means transactions can be seen by all users in real time. With our omnibus structure, your personal holdings and transactions are kept off-chain to help ensure privacy.

Multi-everything

There is no single point of failure. Every security measure is a multistep process at multiple locations.

Did you know?

Fidelity Crypto® standards

Digital assets are not rehypothecated

Rehypothecate means lending out an asset on behalf of a client and potentially lending that asset more than once. This can be risky if everyone wants their assets at the same time, so we don't and have no intention to.

We do not sell client data

We've seen some of this throughout the crypto industry but not here. Your personal information is confidential and will not be shared or sold under any circumstance.

No third-party custodians

Everything is done in house, which is not true for all crypto custodians or exchanges. Any BTC or ETH you may purchase is stored by Fidelity Digital Assets using all the safety and security measures previously outlined.

The bottom line

With Fidelity Crypto, we prioritize the safety and security of your assets and personal information. We also prioritize crypto education, giving you resources and tools to grow your crypto confidence.