What a chicken and egg can teach you about saving and investing

What a chicken and egg can teach you about saving and investing.

Here’s an easy way to understand the difference between saving and investing.

An egg is like money.

You stash a bunch of eggs in the fridge until you need one. Occasionally you’ll add more, and use those as you need them.

That’s kind of how a savings account works … but your money won’t go bad if you don’t use it. Oh, and you might make a small amount of interest, which won’t happen with eggs.

Investing is a little different.

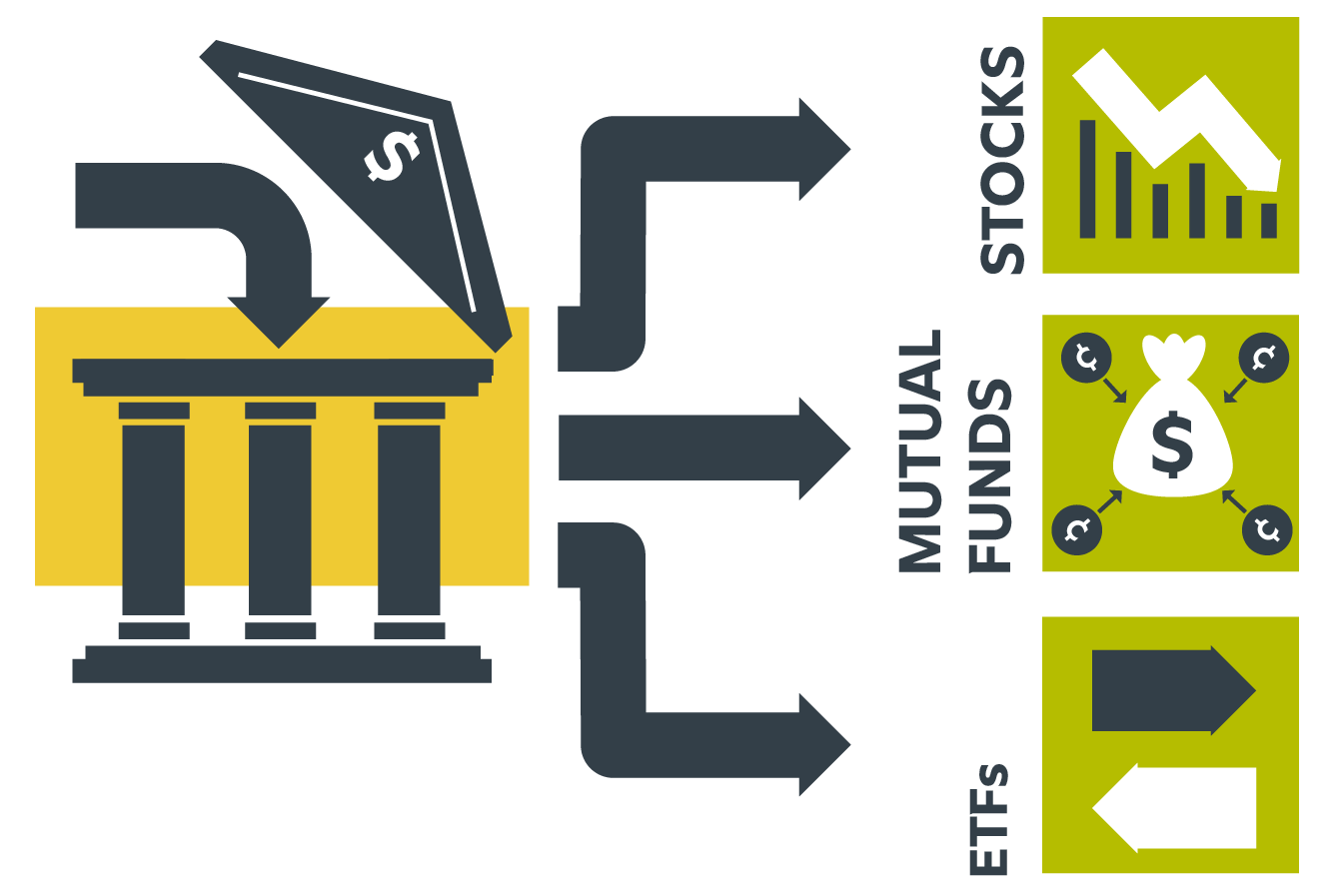

Investing is a little different. It starts by putting money into an account. Then this account is used to buy things like stocks, mutual funds, or exchange-traded funds (ETFs).

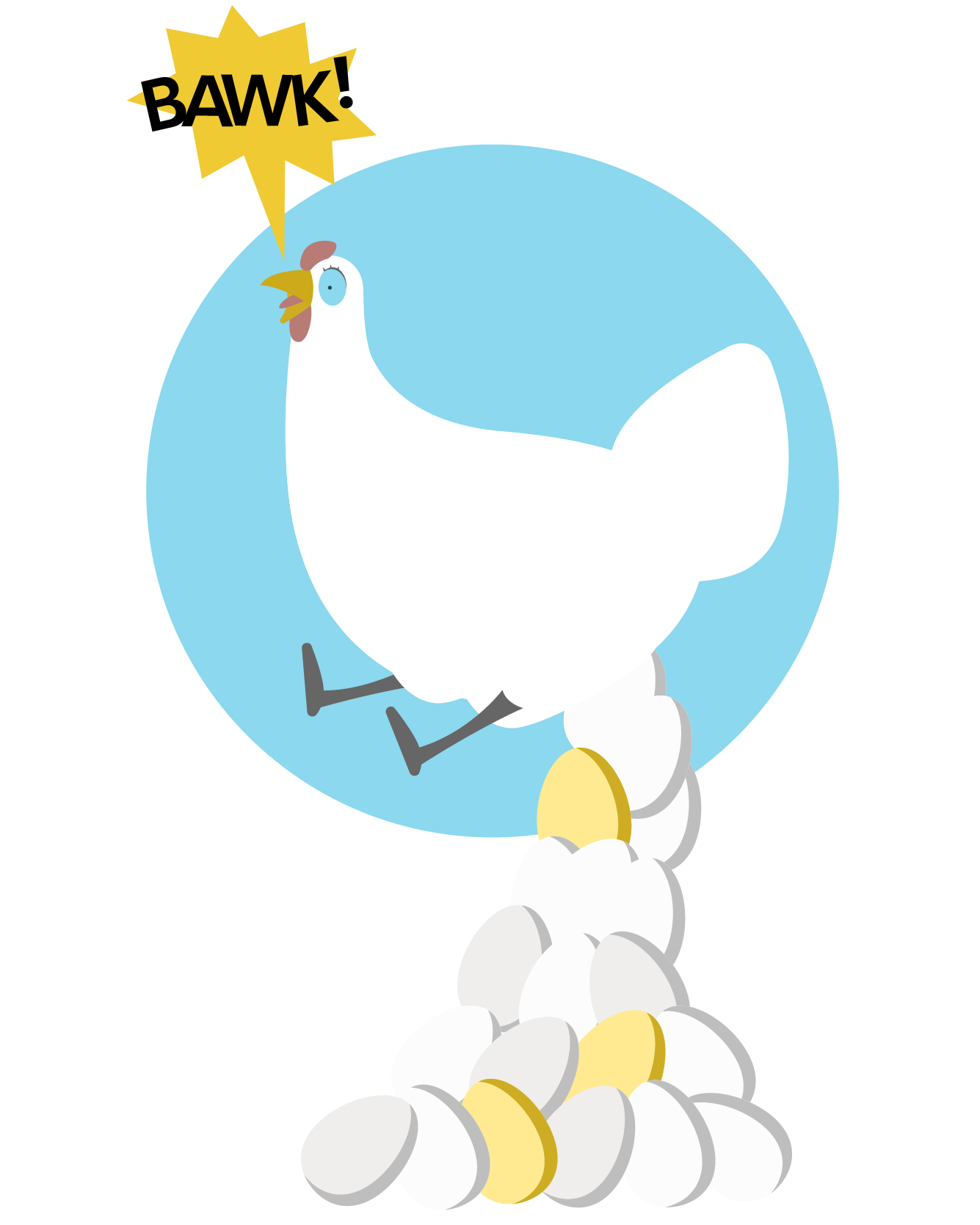

So let’s say investing is more like buying a chicken. A real, live one. It takes care and attention to raise a chicken. And there are some risks involved. Maybe there's a fox in your neighborhood, for instance.

But if things go well, your chicken will lay eggs—and hopefully lots of them. So you’ll reap the rewards of investing in a chicken.

Chicken or egg: what’s your time frame?

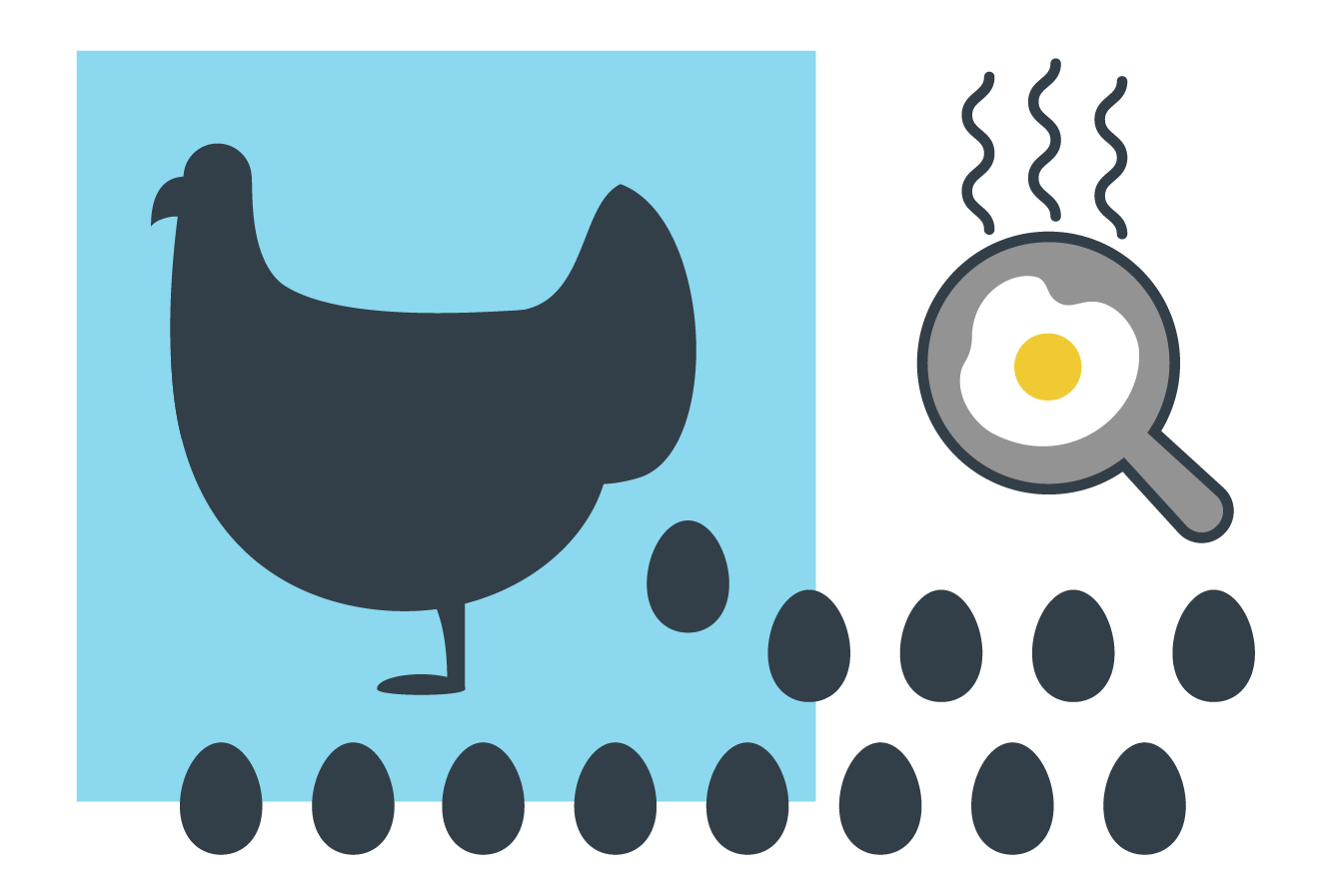

Now, when deciding to either save or invest, your time frame is key. When saving for something in the short term or for an emergency, you might want immediate access to your money. That’s when a savings or cash management account makes sense.

If you have a longer time frame, you could consider investing your money to take advantage of the power of compounding.

You don’t have to pick just one.

Both saving and investing can help you achieve your money goals—and they work really well together, so you don’t have to pick one or the other.

But remember: If you’re not ready to take care of a chicken, start with the eggs. Then once you have enough eggs to cover your short-term needs, time to get yourself a chicken.