Why your credit score is important

Why your credit score is important.

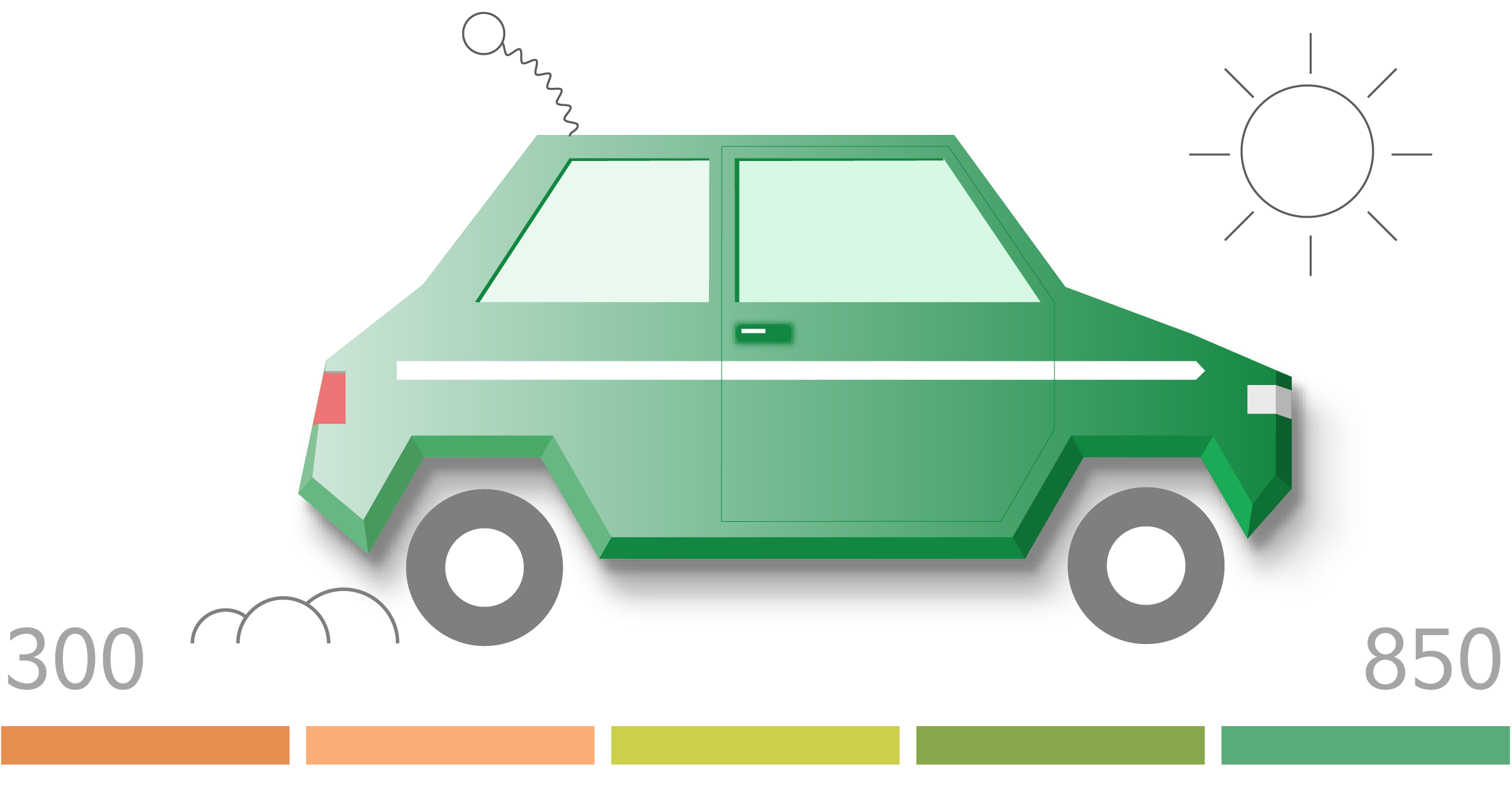

You're constantly surrounded with info about how important your credit score is. Fact—your credit score has a big impact on your money. Let's test drive this with auto loans.

Serena and Justin

Serena and Justin are best friends and both 24 years old. They want to buy the same car (in different colors).

Serena and Justin want to finance their cars. Here are the details:

- Both saved $15,000 for their down payments

- Each car has an MSRP (sticker price) of $35,000

- Both will need to borrow $20,000 for 5 years

Did you know?

The average new car loan amount is $35,163.1

Why is a credit score important?

A good credit score is important because it can mean the difference between getting a low or high interest rate.

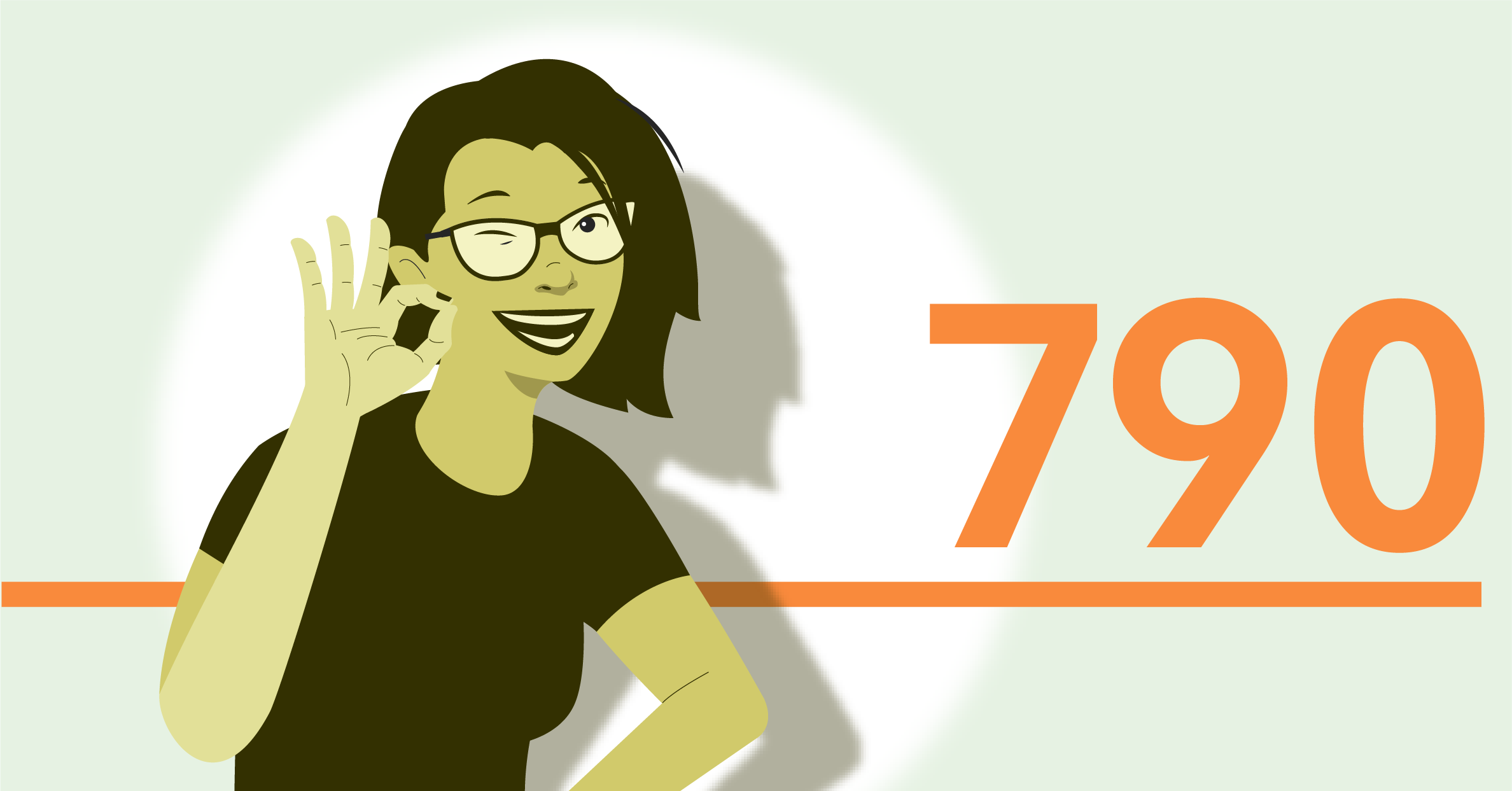

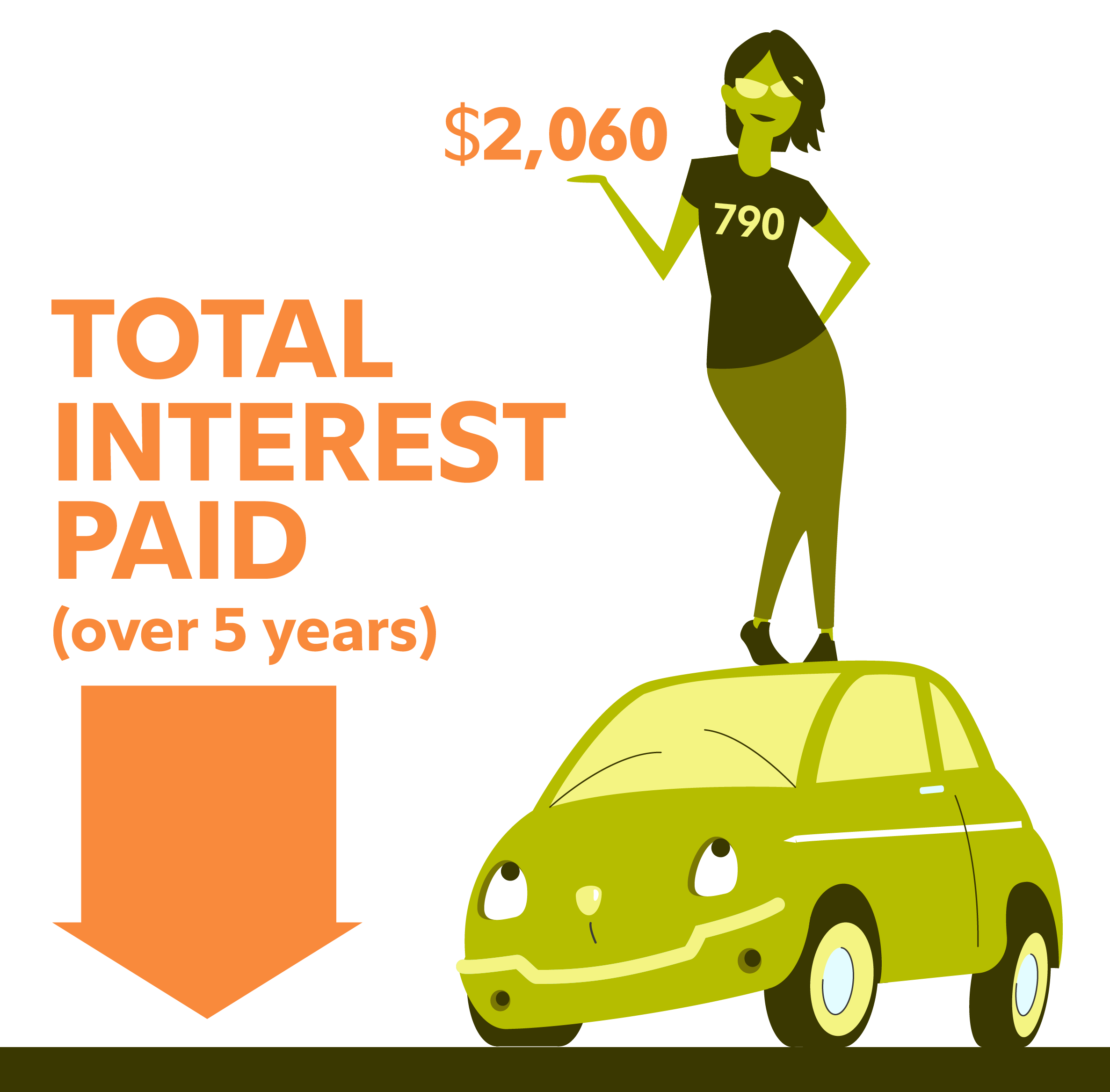

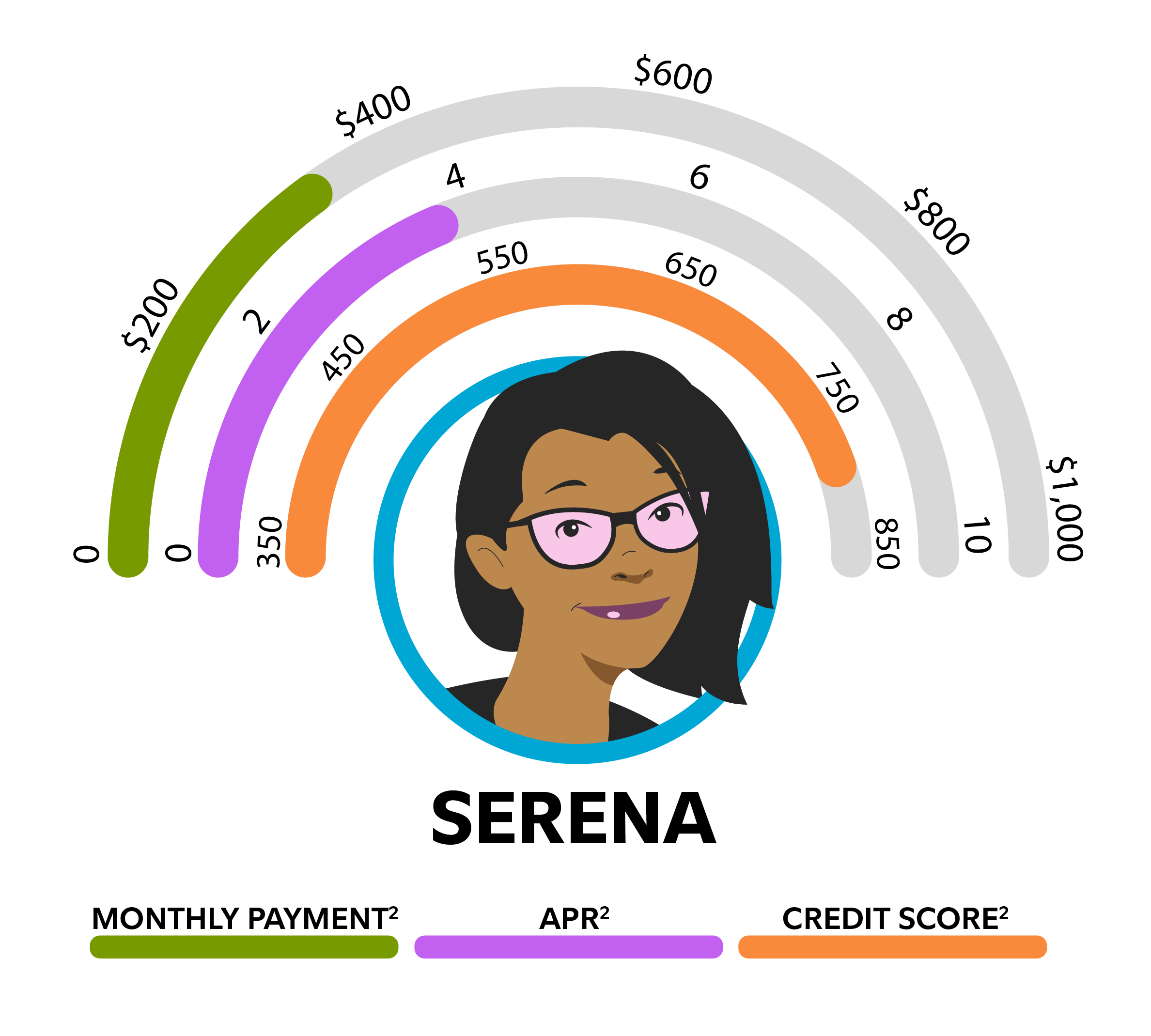

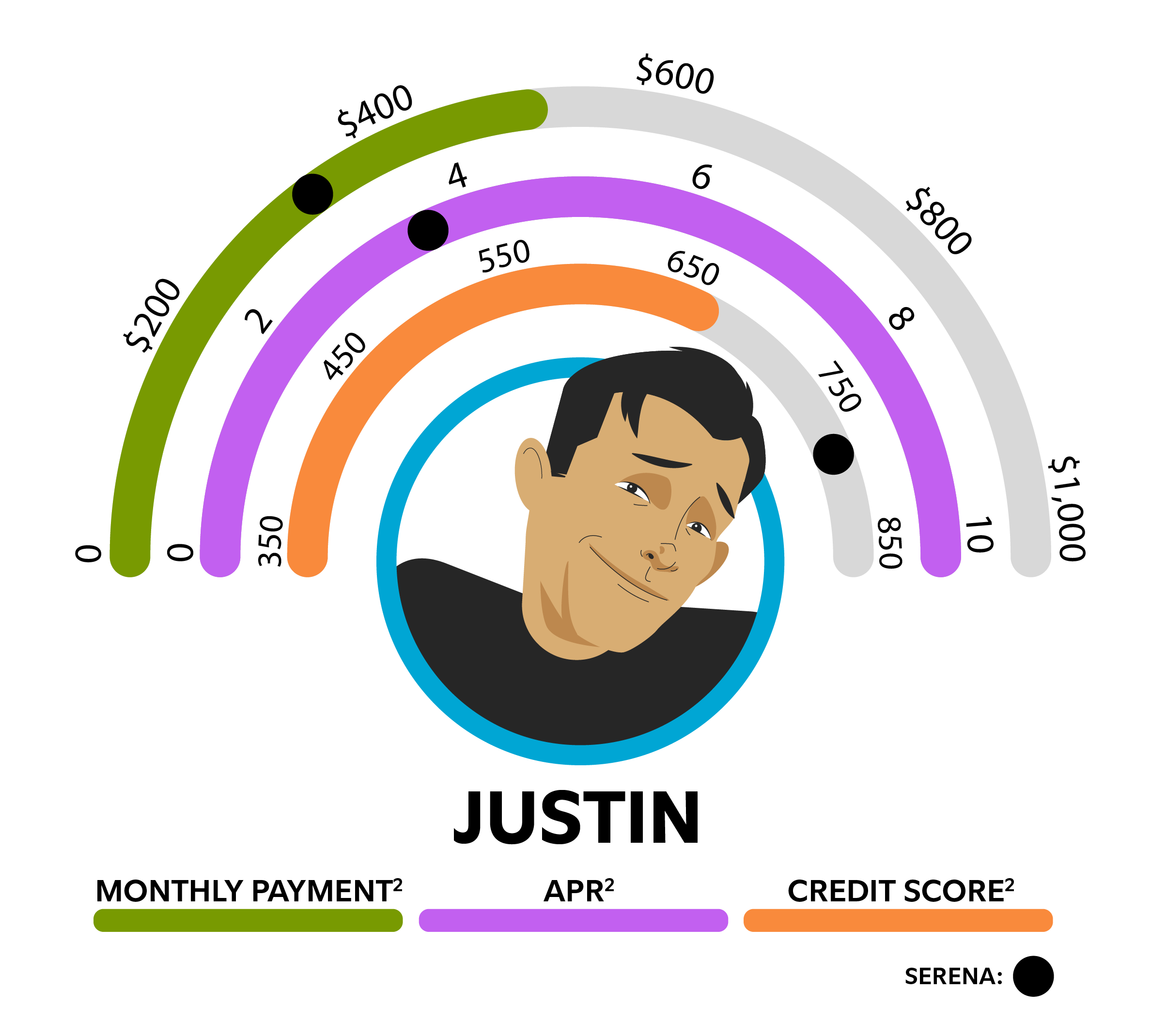

Serena's credit score of 790 gets her a low interest rate and monthly payment.

She will pay just over $2,000 in interest to borrow $20,000 over the next 5 years.

Did you know?

The average monthly car payment is $575.1

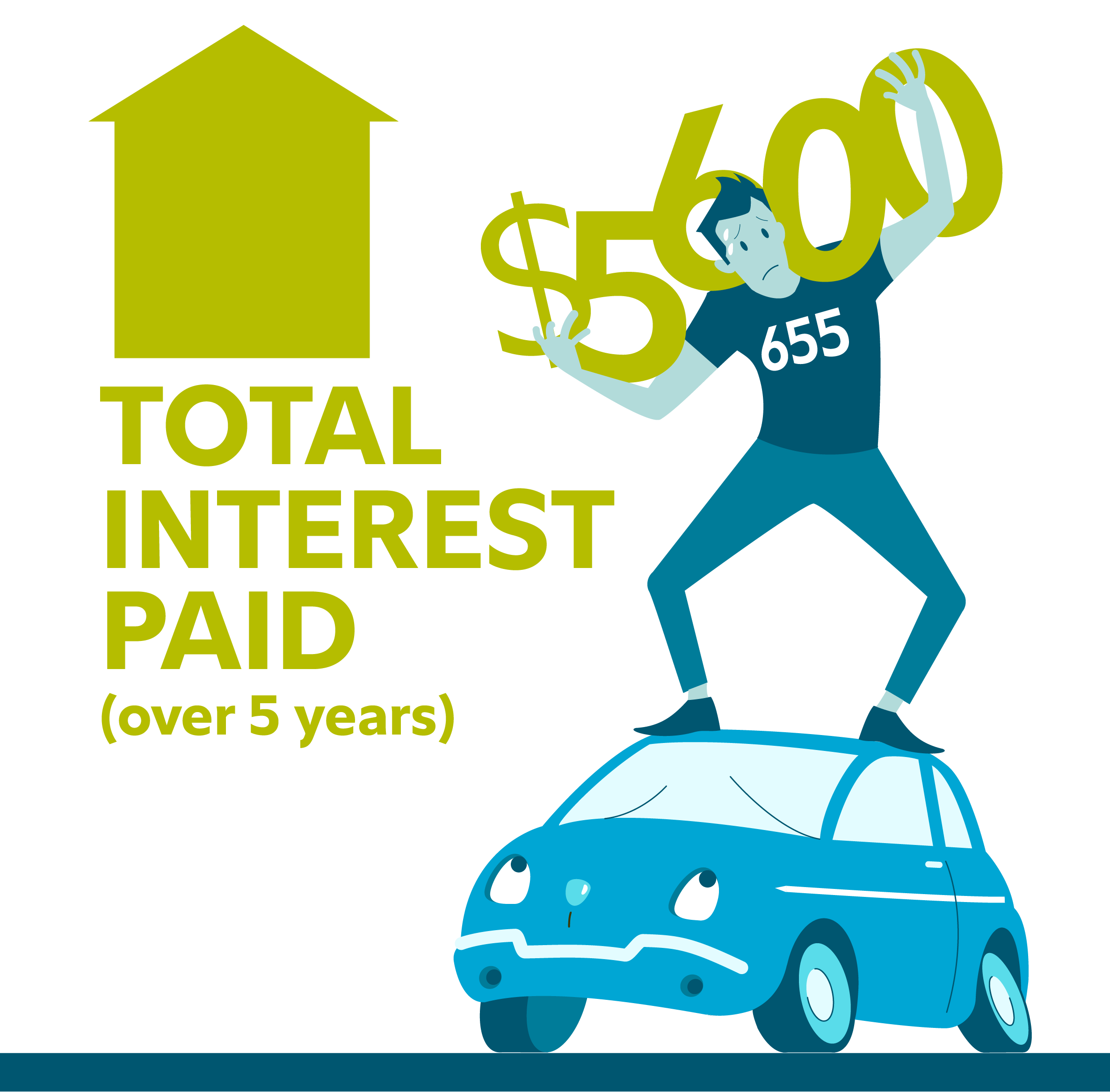

The impact 135 points can make.

What's standing in the way of these two besties getting the same loan for the same car? 135 points.

Justin has a credit score of 655. Not too bad, right?

Wrong—Justin’s credit score gets him a higher annual percentage rate (APR) and monthly payment than Serena. He will pay more than $5,6002 in interest to borrow $20,000 over the next 5 years.

This 135-point credit score difference will cost Justin $3,600 more in interest than Serena. Seems unreal!

Did you know?

Currently, the average car loan length is just under 70 months.1

Your credit score matters.

Being in control of your credit score can save you big money when it comes to loans.

This savings allows you to focus on what’s important to you—just ask Justin.

How your credit score may save you big money

How your credit score may save you big money