Generally, there are no tax implications if you complete a direct rollover and the assets go directly from your employer-sponsored plan into a Rollover, traditional, or Roth IRA (as applicable) via a trustee-to-trustee transfer.

However, if you choose to convert some or all of your savings in your employer-sponsored retirement plan directly to a Roth IRA, the conversion would be subject to ordinary income tax. Contact your tax advisor for more information.

If you withdraw the assets from your former employer‑sponsored retirement plan, the check is made payable to you, and taxes are withheld, you may still be able to complete a 60-day rollover. Within 60 days of receiving the distribution check, you must deposit the money into a Rollover IRA to avoid current income taxes.

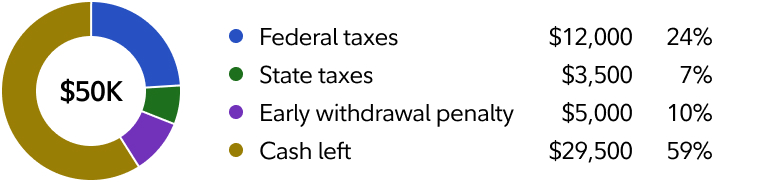

If taxes were withheld from the distribution, you would have to replace that amount if you want to roll over your entire distribution to your Fidelity IRA. If you hold the assets for more than 60 days, your distribution will be subject to current income taxes and a 10% early withdrawal penalty if you are under age 59½.