Roth IRA

Save tax-free with access to your contributions

Once you contribute to your Roth, potential growth within the account is tax-free. Contributions you add to your account may be withdrawn at any time, penalty-free.

You have retirement goals; we’ve got the solutions to help you achieve them. And to open most retirement accounts, there are no account fees or minimums.1

Once you contribute to your Roth, potential growth within the account is tax-free. Contributions you add to your account may be withdrawn at any time, penalty-free.

Reduce your taxable income by deducting your contributions, if eligible, and your potential earnings grow tax-deferred.2

If you are looking to move your old 401(k) and workplace accounts into one IRA, you can do so without taxes or penalties.3

We want you to get the most out of your retirement savings. We’ll help you open an account and align your plan to saving and investing goals so you can track your progress and make adjustments as needed.

Feel more prepared to manage your life in retirement. Use our comprehensive collection of tools, education, and educational offerings to help navigate your transition to retirement and make decisions about your money.

From helping you create a plan to calculating income in retirement, we’ve got you covered.

Ready to create a free plan4 for your finances? We’ll show you where you stand and provide guidance on how to reach your goals.

Answer a few quick questions to see which IRA you're eligible for and how much you could add to your account this year.

Using a mix of predictable income and savings, we’ll help you see how much money you could have each month in retirement—make adjustments and see how they affect your potential income.

An income annuity could help provide you with guaranteed income when you’re in retirement. Estimate how these types of annuities could help cover your essential expenses in retirement.5

Whether you're looking for investment strategies or a more collaborative and customized approach, we offer a number of ways to work together.

Remember the 3 A's for retirement saving: amount, account, and asset mix.

An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way.

Understand the risks and know your needs.

No matter the size of your business, we have accounts that can help you and your employees reach your respective retirement goals.

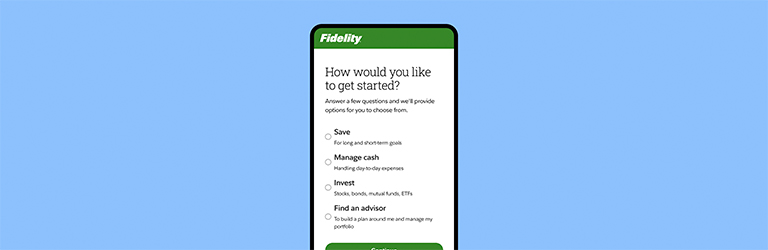

We’ll guide you through some basic questions to help you find accounts that may fit your goals.

We can help you get started.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

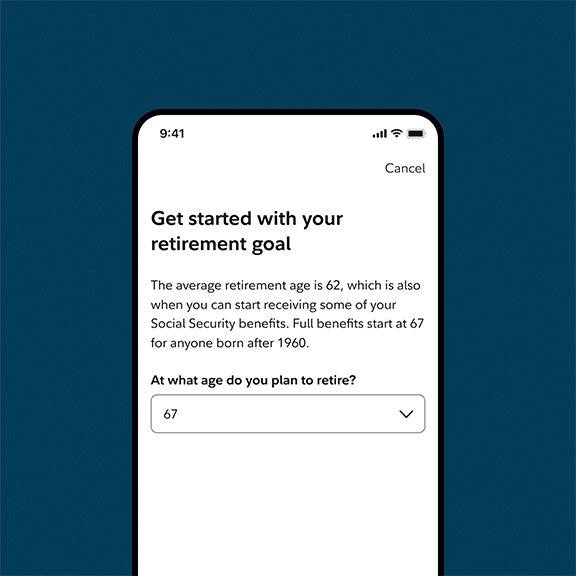

Screenshots are for illustrative purposes only.

IMPORTANT: The projections or other information generated by the Planning & Guidance Center Retirement Analysis and Retirement Income Calculator regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Your results may vary with each use and over time.

1. No account fees or minimums to open Fidelity retail IRA accounts. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs), and commissions, interest charges, and other expenses for transactions, may still apply. See Fidelity.com/commissions for further details.

2. A distribution from a Traditional IRA is penalty-free provided certain conditions or circumstances are applicable: age 59 1/2; qualified first-time homebuyer, up to $10,000; birth or adoption expense (up to $5,000); qualified higher education expense; death or disability; health insurance premiums (if you are unemployed); some unreimbursed medical expenses; substantially equal periodic payments; or tax levy.

3. Generally, there are no tax implications if you complete a direct rollover and the assets go directly from your employer-sponsored plan into a Rollover, Traditional or Roth IRA (as applicable) via a trustee-to-trustee transfer.

4. Fidelity's Planning and Guidance center allows you to create and monitor multiple independent financial goals. While there is no fee to generate a plan, expenses charged by your investments and other fees associated with trading or transacting in your account would still apply. You are responsible for determining whether, and how, to implement any financial planning considerations presented, including asset allocation suggestions, and for paying applicable fees. Financial planning does not constitute an offer to sell, a solicitation of any offer to buy, or a recommendation of any security by Fidelity Investments or any third-party.

5. Annuity guarantees are subject to the claims-paying ability of the issuing insurance company.

Fidelity advisors are licensed with Strategic Advisers LLC (Strategic Advisers), a registered investment adviser, and registered with Fidelity Brokerage Services LLC (FBS), a registered broker-dealer. Whether a Fidelity advisor provides advisory services through Strategic Advisers for a fee or brokerage services through FBS will depend on the products and services you choose.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

1201264.2.0