Before investing, consider the investment objectives, risks, charges, and expenses of the annuity and its investment options. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Investing in a variable annuity involves risk of loss - investment returns and contract value are not guaranteed and will fluctuate.

1.

Fidelity Personal Retirement Annuity (Policy Form No. DVA-2005, et al.) is issued by Fidelity Investments Life Insurance Company and, for New York residents, Personal Retirement Annuity (Policy Form No. EDVA-2005, et al.) is issued by Empire Fidelity Investments Life Insurance Company®, New York, N.Y. Fidelity Brokerage Services, Member NYSE, SIPC, and Fidelity Insurance Agency, Inc., are the distributors.

2. Taxes are not incurred when exchanging annuities, as long as the exchange is in compliance with section 1035 of the Internal Revenue Code.

3.

Clients are eligible for an annual fee of 0.10% if (1) the contract is purchased with an initial purchase payment of $1,000,000 or more on or after September 7, 2010, or (2) the contract value has accumulated to $1,000,000 or more on or after September 7, 2010 and at that time we are offering the contract to new applicants for 0.10%. See prospectus for additional details.

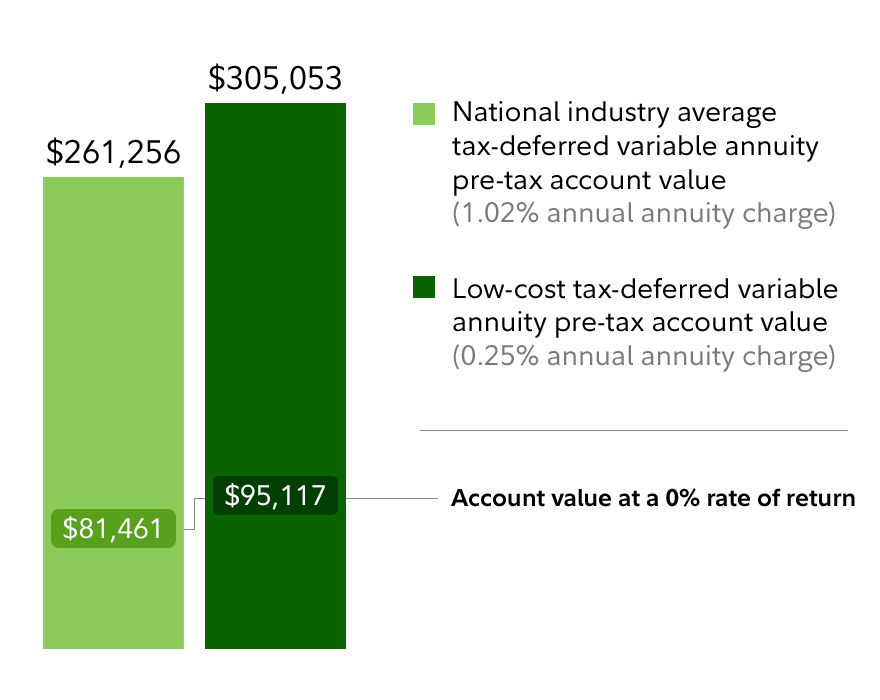

4. The year-by-year pre-tax account values for the low-cost VA at the 5.74% and -0.25% (0% less 0.25% annual annuity charge) net annual rates of return shown above are: $105,735/$99,750 for year 1, $111,799/$99,501 for year 2, $118,211/$99,252 for year 3, $124,990/$99,004 for year 4, $132,158/$98,756 for year 5, $139,737/$98,509 for year 6, $147,751/$98,263 for year 7, $156,225/$98,017 for year 8, $165,184/$97,772 for year 9, $174,658/$97,528 for year 10, $184,674/$97,284 for year 11, $195,265/$97,041 for year 12, $206,464/$96,798 for year 13, $218,305/$96,556 for year 14, $230,824/$96,315 for year 15, $244,062/$96,074 for year 16, $258,059/$95,834 for year 17, $272,859/$95,594 for year 18, $288,507/$95,355 for year 19, and $305,053/$95,117 for year 20. ($305,053 comes to $239,436 after federal income taxes of 32% have been deducted; since there is no gain at a 0% rate of return, income taxes are not applicable).

The year-by-year pre-tax account value for the industry average VA at the 4.92% net annual rate of return is: $104,919 for year 1, $110,080 for year 2, $115,494 for year 3, $121,175 for year 4, $127,135 for year 5, $133,389 for year 6, $139,950 for year 7, $146,834 for year 8, $154,056 for year 9, $161,634 for year 10, $169,585 for year 11, $177,926 for year 12, $186,678 for year 13, $195,860 for year 14, $205,494 for year 15, $215,602 for year 16, $226,207 for year 17, $237,334 for year 18, $249,008 for year 19, $261,256 for year 20.

Withdrawals of taxable amounts from an annuity are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty.

Fidelity insurance and annuity products are issued by Fidelity Investments Life Insurance Company (“FILI”), 900 Salem Street, Smithfield, RI 02917 and, in New York, by Empire Fidelity Investments Life Insurance Company® (“EFILI”), New York, N.Y. FILI is licensed in all states except New York; EFILI is licensed only in New York. Fidelity Insurance Agency, Inc. and, in the case of variable annuities, Fidelity Brokerage Services, Member NYSE, , are the distributors. A contract's financial guarantees are subject to the claims-paying ability of the issuing insurance company.