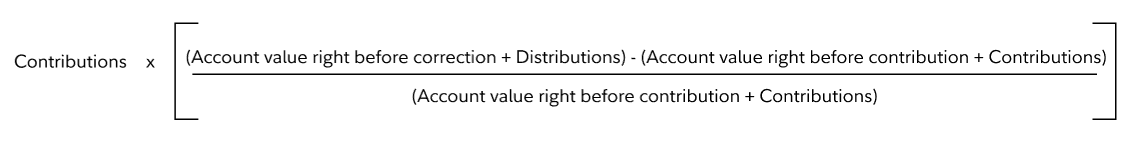

Earnings calculation

How to calculate earnings

Example

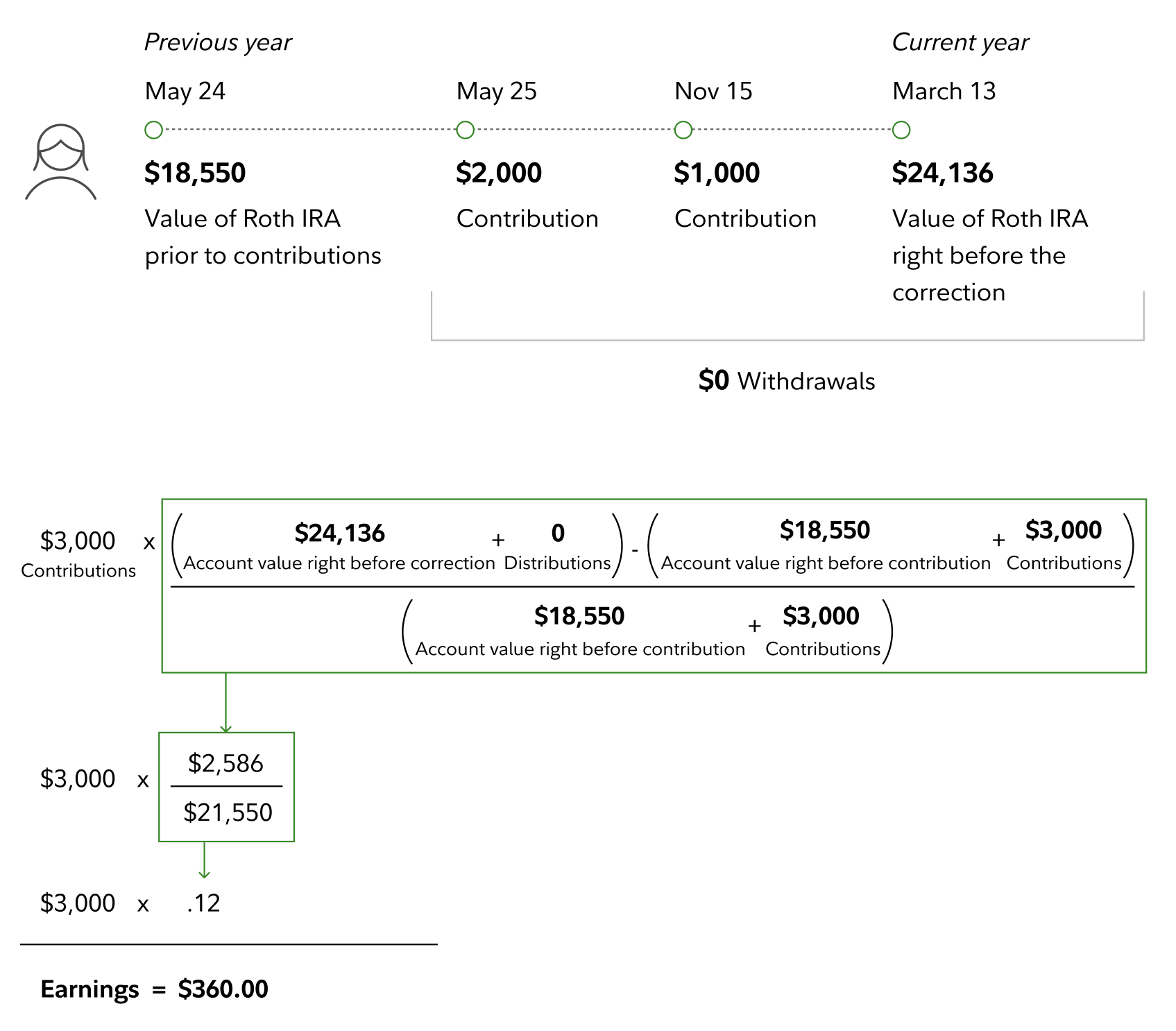

Emily has a Roth IRA that was valued at $18,550 at the end of the day on May 24. On May 25, she made a $2,000 contribution and an additional $1,000 contribution on November 15.

After completing her taxes for the prior year on March 10, she realized her income was too high to make a Roth IRA contribution, and on March 14 she requested to return her $3,000 as an excess contribution. The market value of her Roth IRA at the end of the day on March 13 was $24,136.

Emily did not make any distributions—which includes transfers or recharacterizations—from her Roth IRA while her contributions remained in her account.

Because Emily's Roth IRA increased in value while her excess contribution remained in her account, she will be required to remove her original contribution of $3,000 and earnings of $360.00.