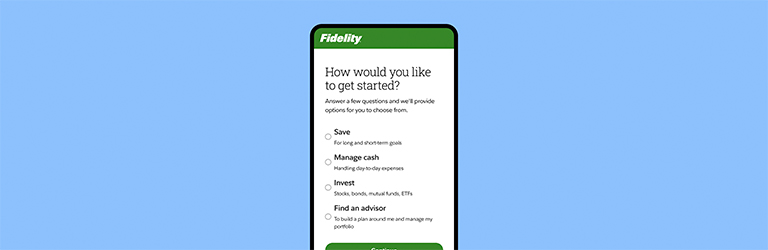

Select your own investments

Manage your own portfolio using our free planning tools.3

- No account-opening fees or minimums2—invest with as little as $1

- Choose from a broad range of investment options, including those designed for retirement, such as target date funds