Overview

- Types of new issue municipal bond offerings

- Viewing available new issue offerings

- Purchasing a new issue offering

- How a typical negotiated deal might work

- Setting up muni new issue alerts

- Placing a new issue muni

- Tracking open orders, final pricing, and allocation order

There are several advantages to purchasing municipal bonds as new issues. For instance, retail investors can get the same price as institutional investors by buying new issue municipal bonds. A new issue municipal offering also comes to market with current disclosure documents and recently reviewed credit ratings by agencies such as S&P, Moody's and/or Fitch.1

Nevertheless, investing in a new issue municipal bond is not without its challenges. For example, the way a new issue deal comes to market can determine the speed at which your bonds are allocated, and whether or not they'll be repriced. In this article, we'll walk you through the new issue muni purchasing process, discuss a few of the scenarios you may encounter, and highlight the nuances in the process.

Types of new issue municipal bond offerings

The first concept to understand is the way municipalities issue debt and why. Municipalities such as a city, state, township, or government entities issue bonds to finance various public projects such as the construction of a new school, improvement in infrastructure and transportation, water and sewer systems, and highways, to name a few. Municipalities typically offer either general obligation bonds (GOs) or revenue bonds.

Next is the process, or type of offering that issuers (the municipality) engage in to come to market. Municipal bonds come to market issuing debt in one of two ways, negotiated or competitive offerings. In competitive offerings, various broker-dealers compete to buy the debt being issued by the municipality and then distribute it to investors. In negotiated offerings, the issuer usually selects a syndicate (a group of underwriters) to sell the bonds with one firm leading the transaction. At Fidelity, we offer both competitive and negotiated offerings.

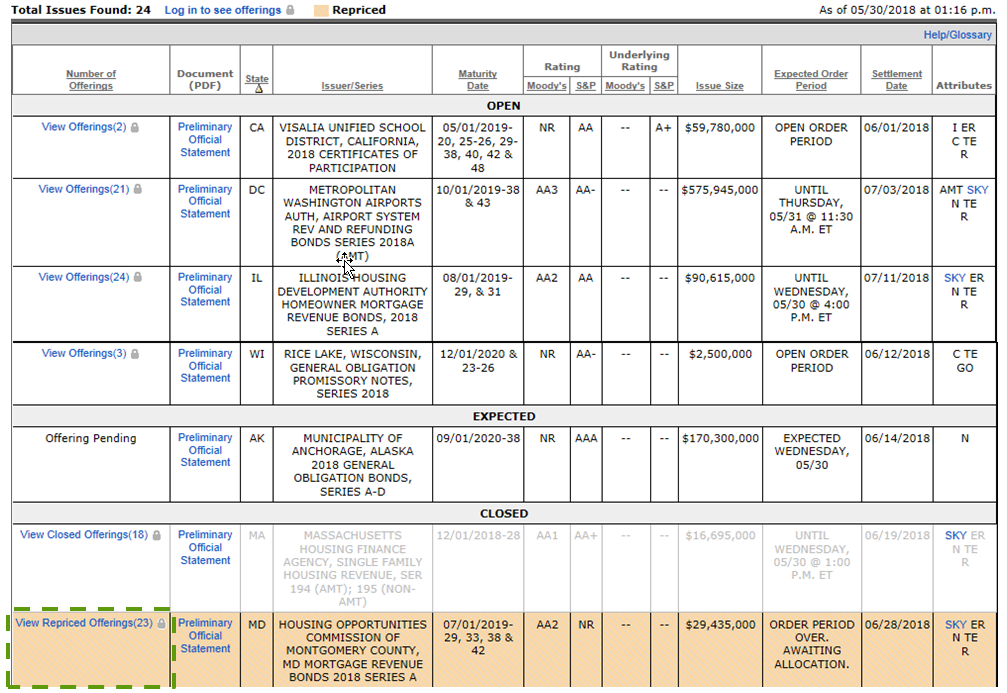

Viewing available new issue offerings

You can view a list of Fidelity's new issue municipal bonds anytime by visiting the new issue municipal bond offerings page. The page is separated into three distinct sections (Open, Expected, and Closed), enabling you to quickly and easily view what you want to see. This is the first step in seeing what bond deals are available and when issuers may be coming to market in your specific state, city, or town. Once you narrow down a search of new issues, you can learn more about the municipal issuer by looking at the "Preliminary Official Statement (POS)." Here you will get a good idea of who is issuing the debt, as well as its structure, credit ratings (when available), and related risks.

Purchasing a new issue offering

The process for purchasing a new offering can vary depending on whether the issuance comes to market as a competitive or negotiated offering. In a competitive transaction there is more of a straightforward timeline; the issuers ask underwriters to submit a firm offer (a competitive bid) to purchase the new issue of municipal securities at a given time. If Fidelity's underwriting desk is part of the bid that "wins," we offer available bonds to investors. In this process you will see what's available and at what price. This inventory is updated as orders are filled on a first-come first-served basis, so only the inventory available is shown.

However, the process differs for a negotiated offering. When a municipality comes to market in a negotiated transaction, there tends to be more time for customers to become aware of an upcoming deal and for investors to review the offering. Negotiated transactions often have Retail Order Periods (ROPs) during which individual investors can place orders before institutional investors. The duration and structure of the ROP can vary from transaction to transaction. For example:

- The ROP may last anywhere from a few hours to several days.

- Some maturities may not be available for the entire duration of the ROP due to over-subscription. ROPs generally open around mid-morning, e.g., 10:00 a.m. ET.

- The ROP may be delayed by hours or rescheduled in a volatile market. As a result, customers may experience a delay when attempting to place an order.

Regardless of how the new issue municipal bond comes to market, there is no separate transaction2 charge applied to new issue municipal bond purchases.

How a typical negotiated deal might work

-

Deal announced

Municipal negotiated transactions are usually announced a week or so in advance to give investors an opportunity to review the offering and POS, although, transactions are occasionally accelerated. Generally you may want to sign up for new issue municipal alerts. -

Preliminary pricing

The underwriter, with the consent of the issuer, will set up a scale, or yield/coupon price for the series of bonds being offered. Here you can look at various maturities you may be interested in and the underwriter's initial assessment of where the bonds will come to market. And, if you have alerts, then you get a notice that this price information is available for you to review.

The underwriter, with the consent of the issuer, will set up a scale, or yield/coupon price for the series of bonds being offered. Here you can look at various maturities you may be interested in and the underwriter's initial assessment of where the bonds will come to market. And, if you have alerts, then you get a notice that this price information is available for you to review.

-

Retail Order Period

The Retail Order Period is when an order is eligible to be placed and can last anywhere from a few hours to several days. It is important for you to monitor your alerts, as you will receive emails for upcoming offerings related to order period timelines. When placing an order it is important to note two things: 1) The pricing can change if there is market volatility, and 2) specific maturities, if popular, can be oversubscribed and you could get a smaller quantity than your original order. ROPs can close early, if an issue becomes oversubscribed, or can be delayed in the event of a volatile market. -

Institutional Order Period

The Institutional Order Period (IOP) generally occurs after the ROP and lasts one day. -

Final Pricing

Final Pricing is generally available the day after the IOP and is typically available either late morning or early afternoon. Final pricing levels may differ from preliminary pricing levels. We'll review the specific scenarios in Tracking open orders, final pricing and allocation . -

Allocation

Allocation generally occurs the day following final pricing. Often, customers will receive full allocation, meaning if the order is, for example, 25 bonds, the customer will receive all 25. On occasion however, an order will be oversubscribed. In these cases, customers might receive a partial or possibly even no allocation. -

Balances

If a deal is undersubscribed (i.e., there are fewer orders than bonds available), Fidelity may post balances of new issues to its website. Details for negotiated offerings are initially displayed prior to final pricing. Similarly, if a transaction is oversubscribed (i.e., more orders than there are bonds available), Fidelity might not receive an allotment that meets the demand for all outstanding orders. As pricing and yield information is subject to change when the deal's final pricing is announced, there may be additional steps the buyer must take. An email alert informs you of a change in the structure of the offering, such as a change in price, or coupon, or in rare cases the maturity date. If the change is not in your favor, you are provided with a short window with which you can choose to cancel your order.

Setting up muni new issue alerts

Municipal alerts are vital to helping you keep track of upcoming offerings. They allow you to stay up to date on changes such as delays with orders you may have already placed or pricing changes. This is especially important given how quickly bond prices can change.

Municipal alerts are vital to helping you keep track of upcoming offerings. They allow you to stay up to date on changes such as delays with orders you may have already placed or pricing changes. This is especially important given how quickly bond prices can change.

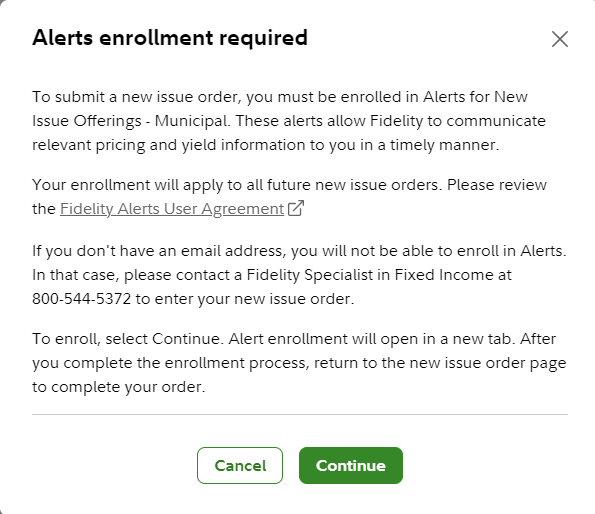

If you are placing an order for the first time on Fidelity.com, you'll be prompted to set up an alert. Once you've set up the alert, you'll be directed back to complete your trading.

You can also set up an alert prior to placing a new issue order. It's quick and easy.

You can also set up an alert prior to placing a new issue order. It's quick and easy.

- From your portfolio summary page, navigate to the green omnipresent navigation bar at the top and select Research, then Alerts.

- Select Fixed Income New Issues and Secondary Products in the Products and Offerings section.

- In the Alert Setup tab, select New Issue Offerings – Municipal.

- Choose View/Select States link to specify the states you'd like to receive alerts about. Be sure to add or edit your email address using the link at the bottom of the page.

- From there, follow the on-screen prompts to complete the process. It'll take just a few minutes.

- If you are redirected from the trading process to set up muni alerts, follow the on-screen prompts to complete the alert setup process, then return to the order entry page to complete the trading process.

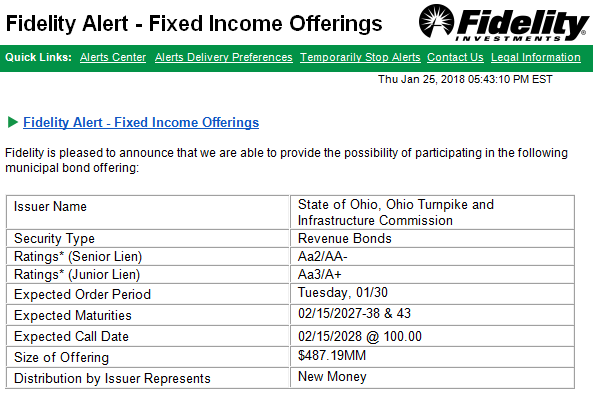

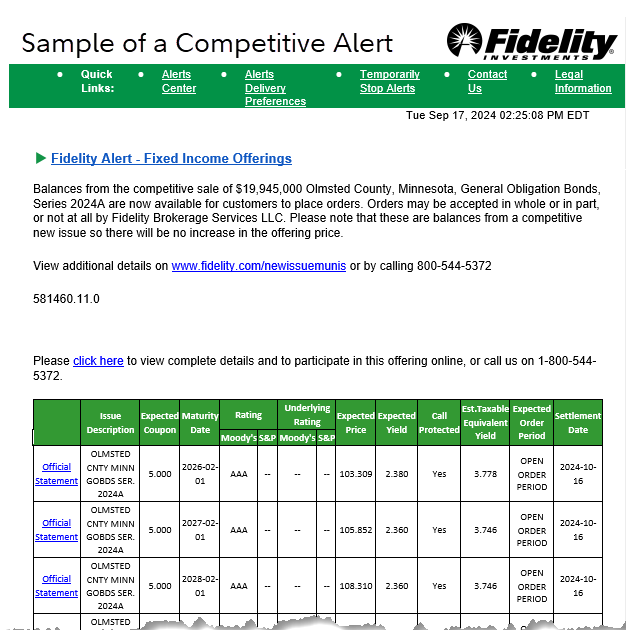

After setting up New Issue Municipal alerts, you can generally expect one or two alerts per offering, depending on whether the issue is a competitive deal or a negotiated deal. For negotiated deals, the first alert informs you that a new issue is available, allowing you to conduct further research.

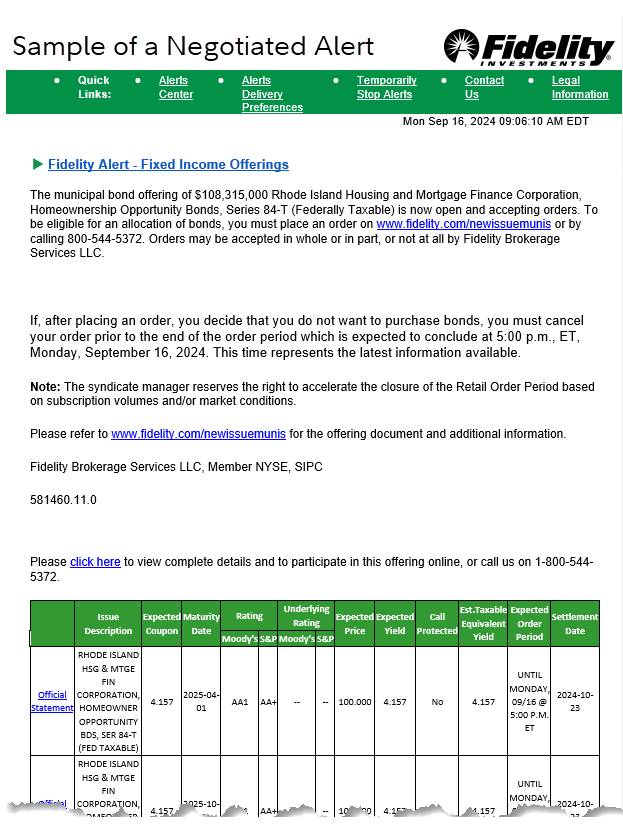

Once the issue is negotiated, you receive a second alert, providing relevant details that the bond has been priced and is ready to receive orders.

Once the issue is negotiated, you receive a second alert, providing relevant details that the bond has been priced and is ready to receive orders.

If the deal is a competitive offering, you will receive only the pricing alert.

For more information on alerts, please watch Establishing & interpreting fixed income alerts (3:15).

Placing a new issue muni order

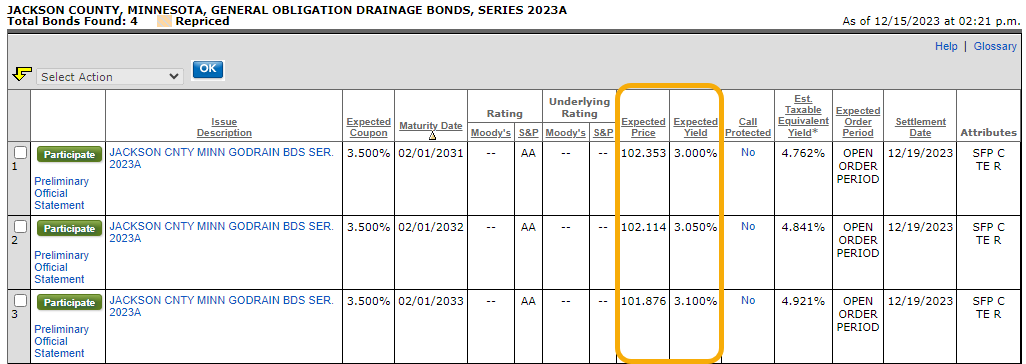

Once you're ready to place the order, select the Participate link on the Search Results page for the relevant new issue muni offering, and follow the on-screen prompts.

Once you're ready to place the order, select the Participate link on the Search Results page for the relevant new issue muni offering, and follow the on-screen prompts.

Remember, there is no separate transaction charge applied to new issue municipal bond purchases.2

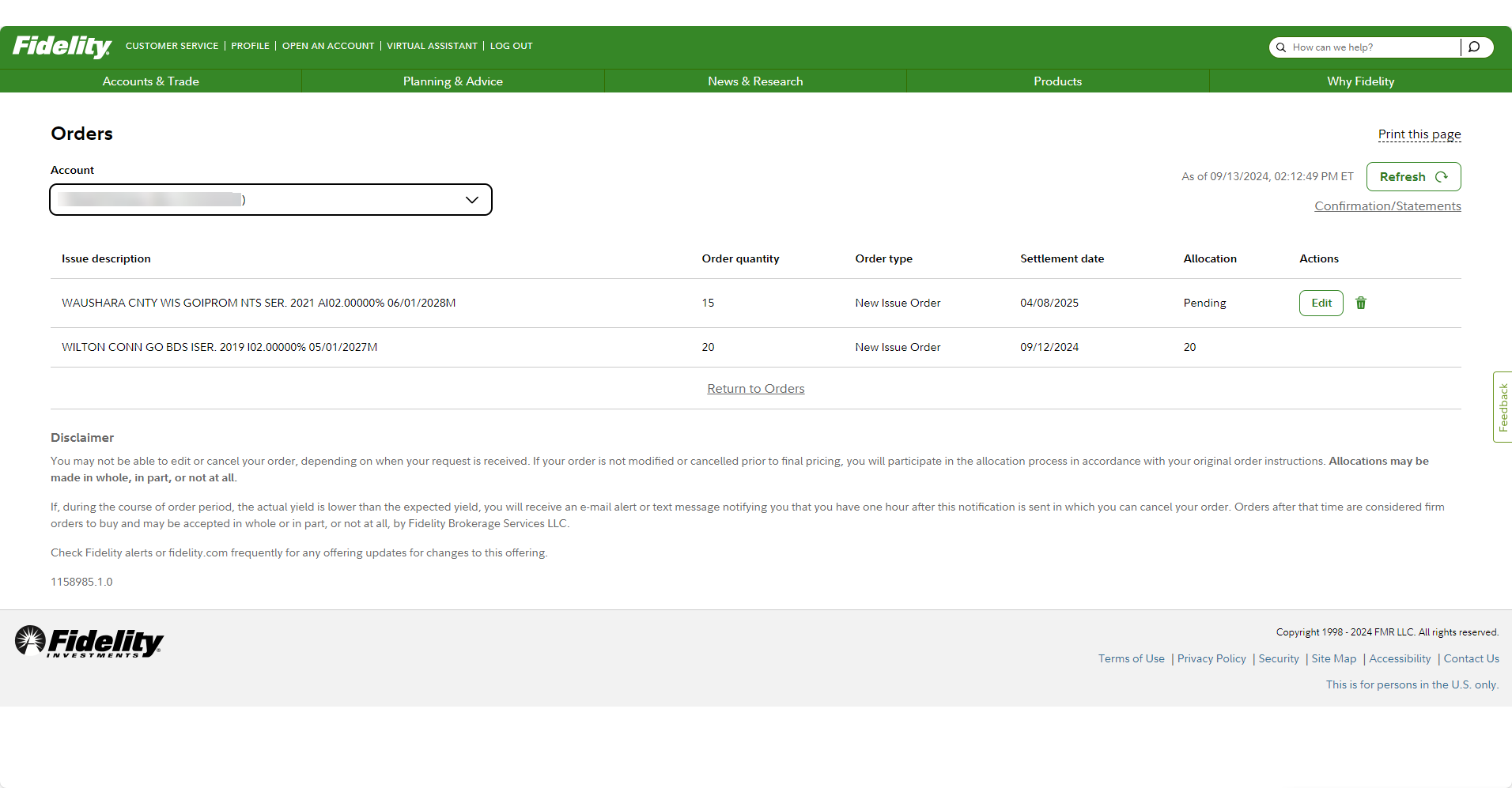

To view an open order for your new issue muni, please follow these steps:

- From your portfolio summary page, navigate to the green omnipresent navigation bar at the top and select the Accounts & Trade tab and select the Account Positions option.

- Select the account and select the Activity & Orders menu. On the bottom section of the page under "Don't see the activity you're looking for?" select view orders for new issue bonds. From this page, you can edit or cancel your new issue muni order for the selected account.

If you no longer want to purchase the bonds, you must delete any order prior to the final pricing of bonds. Any attempts to edit or cancel new issue orders are performed on a best efforts basis. There is no guarantee that orders can be changed or deleted, in whole or in part. After final pricing, the deal closes and you will participate in the allocation process. Allocations may be made in whole, in part, or not at all.

Tracking open orders, final pricing, and allocation

Competitive deals are relatively simple to track and purchase. As Fidelity already owns these bonds, the orders are available while supplies last and filled promptly after an order is received.

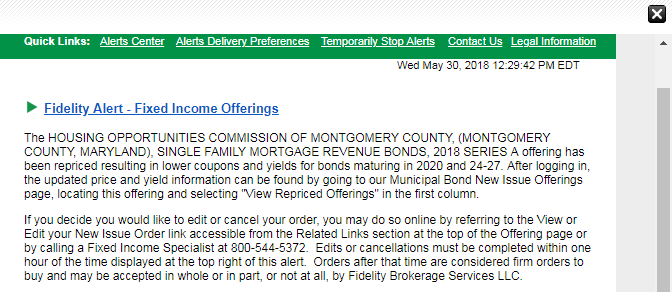

Negotiated deals follow a different trajectory. After you place your order, you'll receive a notification detailing the final price and size of the offering. This process frequently takes some time as the notification is only sent after all orders have been collected. The most common scenario causing a repricing alert notification is when the final price differs from the initial price. For example, at the time of your order, the particular CUSIP you placed an order for may have been priced at 101.5, with a yield of 2%. After the underwriters have reviewed demand for the offering and taken other market factors into consideration, some of the maturities within the offering may be repriced. If the price of the security remains unchanged or becomes lower, you will not need to take any action, and your order will proceed to the allocation process. On the other hand, if the pricing of the security moves higher, you will receive a Repricing alert that requires you to take further action if you wish to cancel or edit your new issue muni order. Other reasons that would generate a repricing alert requiring further action if you wish to cancel would be a Series Change ("new money" to "refunding"), Maturity Change (from the year 2033 to 2034), or Coupon Change (5% to 4%).

Negotiated deals follow a different trajectory. After you place your order, you'll receive a notification detailing the final price and size of the offering. This process frequently takes some time as the notification is only sent after all orders have been collected. The most common scenario causing a repricing alert notification is when the final price differs from the initial price. For example, at the time of your order, the particular CUSIP you placed an order for may have been priced at 101.5, with a yield of 2%. After the underwriters have reviewed demand for the offering and taken other market factors into consideration, some of the maturities within the offering may be repriced. If the price of the security remains unchanged or becomes lower, you will not need to take any action, and your order will proceed to the allocation process. On the other hand, if the pricing of the security moves higher, you will receive a Repricing alert that requires you to take further action if you wish to cancel or edit your new issue muni order. Other reasons that would generate a repricing alert requiring further action if you wish to cancel would be a Series Change ("new money" to "refunding"), Maturity Change (from the year 2033 to 2034), or Coupon Change (5% to 4%).

The alert provides a link to the new issue muni page, where you can easily identify which recently closed offerings were repriced. Click "View Repriced Offerings" to learn the most recent price and yield details. If you fail to contact Fidelity to cancel or edit the order prior to final pricing, you will participate in the allocation process. It's important to note that the window of time that the underwriting group accepts edits or cancellation orders is small, and as a result you have only one hour from receipt of the repricing alert to cancel or adjust your order.

The alert provides a link to the new issue muni page, where you can easily identify which recently closed offerings were repriced. Click "View Repriced Offerings" to learn the most recent price and yield details. If you fail to contact Fidelity to cancel or edit the order prior to final pricing, you will participate in the allocation process. It's important to note that the window of time that the underwriting group accepts edits or cancellation orders is small, and as a result you have only one hour from receipt of the repricing alert to cancel or adjust your order.

To view an open order for your new issue muni, simply:

- From your portfolio summary page, navigate to the green omnipresent navigation bar at the top and select the Accounts & Trade tab and select the Trade option.

- Select the account and select the Activity & Orders menu. On the bottom section of the page under "Don't see the activity you're looking for?" select view orders for new issue bonds. From this page, you can edit or cancel your new issue muni order for the selected account.

Entering an order makes you eligible for but does not guarantee an allocation of bonds. If the offering is oversubscribed (more bonds were requested than available for purchase) and you did not withdraw your order, you may receive the quantity of bonds you requested, a portion of the bonds you requested, or none at all. Fidelity allocates bonds as fairly and equitably as possible.

Entering an order makes you eligible for but does not guarantee an allocation of bonds. If the offering is oversubscribed (more bonds were requested than available for purchase) and you did not withdraw your order, you may receive the quantity of bonds you requested, a portion of the bonds you requested, or none at all. Fidelity allocates bonds as fairly and equitably as possible.

Once an offering has been allocated, the securities are placed in your account and you'll receive a written confirmation. You can check your account history or positions on Fidelity.com to see if you received an allocation of securities.

From our experts

Learn how general obligation muni bonds are created and how they work.