What We Offer

Learn More

Dedicated health savings funds

Investing in Fidelity's health savings funds can help you be better prepared for the unpredictability of health care expenses.

2 dedicated HSA funds

Fidelity understands that saving for medical expenses is different than other savings goals. It's hard to predict whether you'll need the money soon or in retirement. So our investment team has created 2 health savings funds specifically for HSA investing.

Makes investing easier

Helps take the guesswork out of choosing and managing your savings by providing you with a diversified portfolio to save for health care expenses.

Balances growth while seeking to minimize risk

Seeks to strike the right balance to address the uncertain time horizon of future medical expenses to help you save through different market environments.

Makes savings work harder

Offers greater growth potential than cash with a blended fund or an all-index fund created to provide choice, innovation, and value to help you pay for future health care costs.

Fidelity® Health Savings Fund (

Invests in a mix of active and index funds.

Fidelity® Health Savings Index Fund (

Invests in index funds only

*If you have a Fidelity HSA® in connection with your employee benefits program, you may be able to take advantage of a lower price. To learn more, go to NetBenefits.comLog In Required.

Since 1985, health care inflation has risen more than twice as fast as core inflation.†

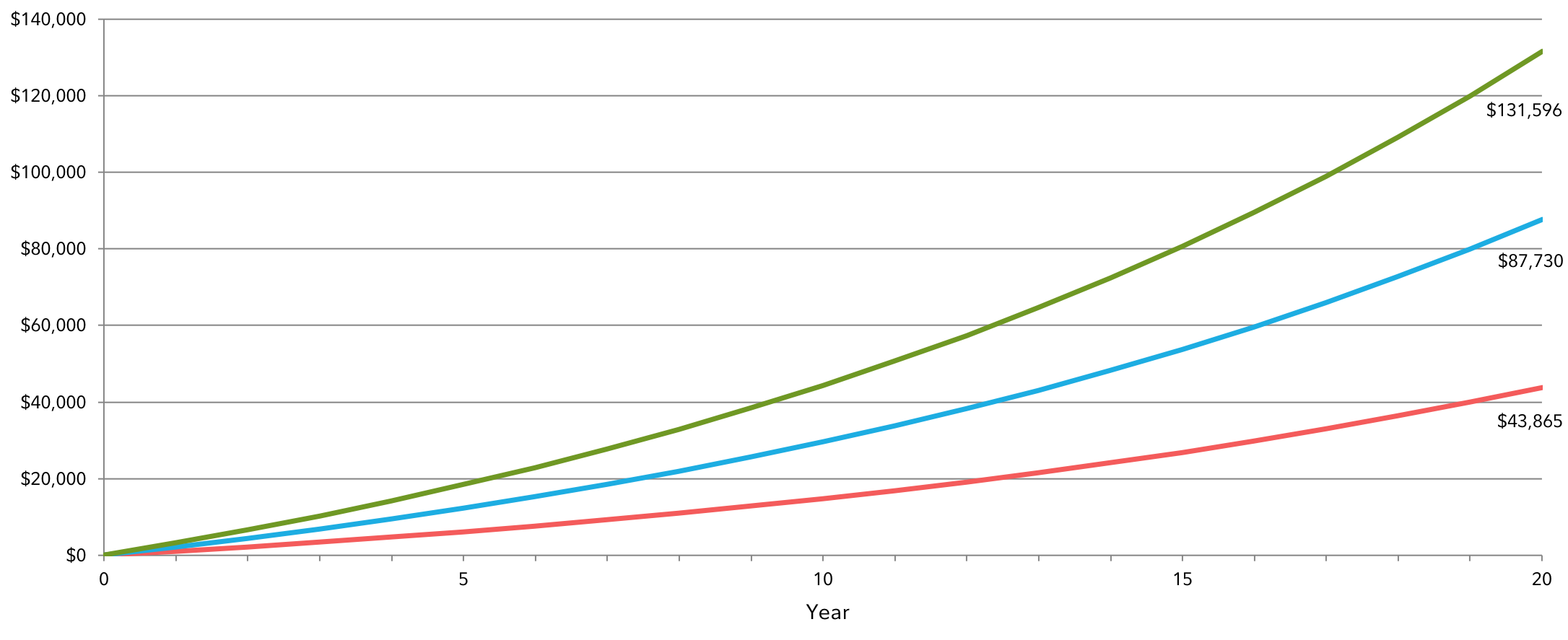

How can investing impact your HSA?

Investing $3,000 of unused HSA money per year for 20 years, for example, can help take the sting out of health care costs in retirement.

If you're looking for help investing, we also offer the Fidelity Go® HSA—it's an easy, affordable way to enjoy the benefits or professional money management. Learn more

Next steps

Get fund picks from Fidelity and independent experts.

Get investment help, or consider Fidelity's Health Savings funds, designed for HSA investing.

![]()

Ways to invest in your health savings account

Know the type of HSA user you are, then see how to make your money work harder.