Energy stocks helped power a stock market rally while oil prices have edged higher after the recent US actions in Venezuela. Here’s what investors need to know about this development and how they may impact oil prices and stocks.

Venezuela and oil prices

Oil prices rose nearly 2% on Monday, January 5, climbing above $58 per barrel, but remain near post-pandemic lows. Much uncertainty remains as to how the situation in Venezuela will unfold in the coming days and weeks, including how oil markets will be impacted in the near term.

Venezuela has the world’s largest proven oil reserves (roughly 17% of global reserves), but it accounts for less than 1% of global production at roughly 800,000 barrels of oil a day—of which it exports about 500,000 barrels. That might be why there was initially a muted market response to the recent events in Venezuela.

Some fears of a disruption to global energy production that helped drive oil prices up are occurring amid a bearish period for oil prices. In addition to the first several months of the year typically being a strong supply and low demand period, more US shale source development and increasing efficiencies procuring those resources have helped put a ceiling on oil prices in recent years. That has led to oil trading near multiyear lows.

What’s next for oil prices? Kristen Dougherty, manager of the Fidelity® Select Energy Portfolio (

“Given the abruptness of the political transition in Venezuela, and the country’s long history of underinvestment in its energy infrastructure, I expect any material changes in Venezuela’s oil exports will take an extended amount of time before they can affect global oil supply, and thus affect oil prices,” Dougherty notes. "And I still think oil prices are likely to remain range-bound in 2026, as phased output increases from the Organization of the Petroleum Exporting Companies (OPEC) are gradually absorbed by steady global demand."

Why oil prices matter

While the full impact of recent events on oil prices and the broad market may be uncertain, investors may want to monitor the situation. That’s because oil prices have been a critical factor impacting inflation, interest rates, and stock markets.

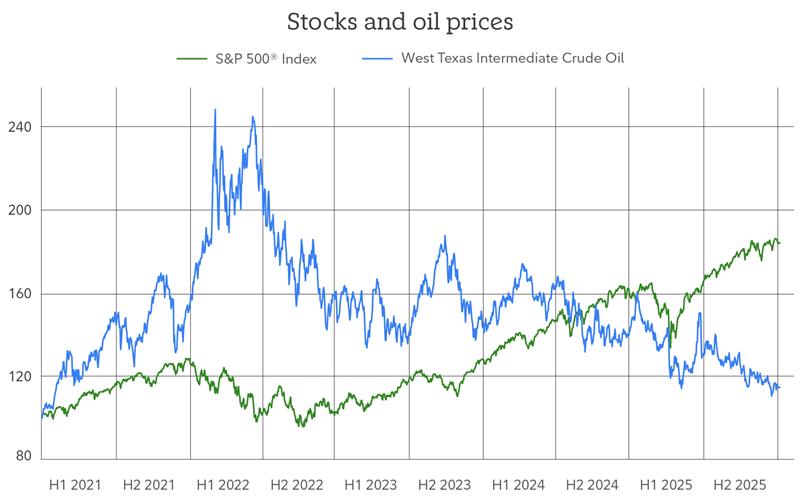

Consider the chart below, which shows the somewhat inverse relationship between the S&P 500 and oil over the past 5 years. When oil prices have been falling and/or are relatively low, stocks have tended to rally. Conversely, when oil prices are rising and/or are relatively high, stocks have generally not performed as well.

Last year is a good example of this dynamic, when the S&P 500 gained 17% as crude oil lost nearly 20%—the largest annual decline in oil prices in 5 years.

At the sector level, rising oil prices tend to be bullish historically for energy stocks and bearish for most other sectors. Alternatively, falling oil prices tend to be bearish historically for the energy sector and bullish for most other sectors. That's because energy costs, which are a ubiquitous operating cost for most businesses to varying degrees, can impact the profitability of a business. Oil prices can be a particularly significant factor for industries like airlines and transportation.

Additionally, prices for gasoline and heating oil—which are derivative products of crude oil—can influence consumer spending. Higher prices can limit discretionary spending, while lower prices can enable more spending. Higher prices can also impact the Fed’s willingness to cut interest rates.

Energy stocks power up

Last year, the energy sector gained 5.5%, well below the S&P 500’s 17% price return. The energy sector was among the biggest movers in reaction to the Venezuela developments.

The bullish sentiment for energy stocks appears to be based on the idea that US oil companies may play a role in rebuilding Venezuela’s oil infrastructure.

“There has been a worsening disconnect between the quality of a country’s reserves and their ability to produce those reserves in ways that contribute to the global market,” Dougherty notes. “The prospect of reversing that is an exciting opportunity for oil and gas producers with historic in-country expertise and to oilfield services companies whose technology would be needed to reverse years of decline over the medium term.”

To that point, the energy equipment and services industry surged 7% in the immediate aftermath.

Investing considerations

Investors seemed to initially sidestep market risks that may have arisen from the recent actions in Venezuela as stocks reached fresh all-time highs. However, markets can move rapidly—especially if there are new developments.

Much like other recent geopolitical tensions that have flared up around the globe, this can serve as a valuable reminder that, while monitoring markets and having a plan to adapt to changing market conditions as needed makes for smart strategy, investors should remain calm during such times. If the recent tensions in Venezuela lead to some market volatility, stay balanced and diversified amid any short-term fluctuations.